Understanding Volunteer Mortgage Loan Servicing

Volunteer mortgage loan servicing represents a crucial, albeit often overlooked, aspect of community support and financial stability. It involves individuals donating their time and expertise to assist homeowners facing mortgage difficulties, ultimately contributing to preventing foreclosures and maintaining housing stability within communities. This often takes the form of direct assistance to borrowers, or support for non-profit organizations working in this space. Understanding the nuances of this field is critical for both potential volunteers and organizations seeking to leverage this valuable resource.

Volunteer programs in mortgage loan servicing vary considerably depending on the organization’s mission and the needs of the community they serve. Some programs focus on financial literacy and counseling, guiding homeowners through budgeting, debt management, and exploring modification options with their lenders. Others may provide direct assistance with paperwork, helping homeowners navigate complex mortgage documents and communicate effectively with their mortgage servicers. A third type of program might involve volunteers acting as advocates, connecting homeowners with resources and supporting them through the often stressful process of avoiding foreclosure.

Types of Volunteer Programs

The diversity of volunteer mortgage loan servicing programs reflects the complexity of the mortgage landscape and the varied needs of homeowners. Some programs might focus solely on pre-foreclosure intervention, working with homeowners who are already behind on their payments. Others may offer broader financial counseling services, addressing a wider range of financial challenges that could contribute to mortgage delinquency. A further distinction lies between programs run by large non-profit organizations with established infrastructure and those operating on a smaller, more localized scale, often relying heavily on the skills and experience of individual volunteers. For example, a large national non-profit might offer a structured training program for volunteers, while a smaller, local organization may rely on the expertise of retired financial professionals or experienced real estate agents.

Volunteer Roles and Responsibilities

Volunteers in mortgage loan servicing programs assume diverse roles, tailored to their skills and the needs of the program. Some volunteers might focus on client intake and initial assessment, gathering information about a homeowner’s financial situation and mortgage details. Others might specialize in financial counseling, working directly with homeowners to create budgets and explore debt management strategies. Still others might excel in administrative tasks, such as organizing paperwork, scheduling appointments, or managing databases. In some cases, volunteers might even be involved in outreach and community education, promoting financial literacy and raising awareness about available resources. The specific responsibilities of a volunteer often depend on the organization and the volunteer’s background and experience.

Organizations Utilizing Volunteer Mortgage Loan Servicers

Numerous organizations rely on volunteer mortgage loan servicers to expand their reach and impact. These include national non-profits dedicated to housing stability, such as the National Foundation for Credit Counseling (NFCC) and local Habitat for Humanity affiliates. Faith-based organizations often have programs offering financial counseling and support to their congregations. Additionally, some community development corporations (CDCs) integrate volunteer mortgage loan servicing into their broader efforts to improve neighborhood conditions. These organizations often provide training and support to their volunteers, ensuring they possess the necessary knowledge and skills to effectively assist homeowners. The involvement of volunteers significantly enhances the capacity of these organizations, allowing them to serve a greater number of homeowners in need.

Payment Processing and Volunteer Involvement

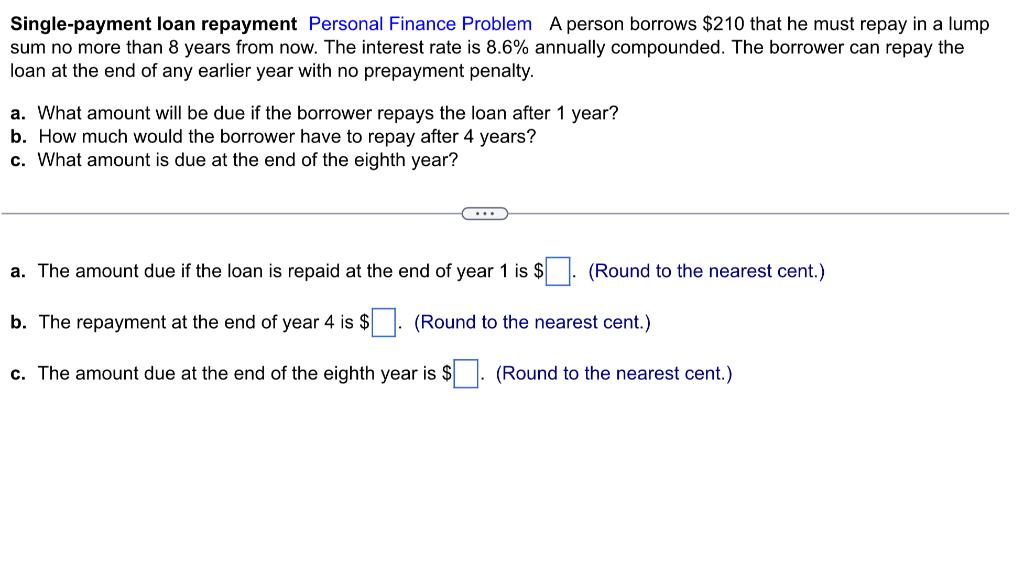

Leveraging volunteers in mortgage loan servicing payment processing offers a unique opportunity to reduce operational costs while potentially enhancing customer service. By strategically integrating volunteer efforts, organizations can streamline their processes and improve efficiency, leading to significant cost savings and a more positive borrower experience. This section details how volunteer assistance can be effectively integrated into the payment processing workflow.

Volunteer mortgage loan servicing payment – Efficient payment processing is critical for any mortgage servicing operation. Delays or errors can lead to late payment fees, damaged borrower relationships, and regulatory issues. Volunteer involvement, when properly managed and supported, can significantly improve processing speed and accuracy, contributing to a smoother and more reliable system.

Payment Processing Workflow with Volunteer Assistance

The following steps Artikel a typical mortgage payment processing workflow incorporating volunteer assistance. Careful planning and training are essential for success. Each step requires clear guidelines and robust quality control measures.

A well-defined workflow ensures transparency and accountability. This allows for easy tracking of payments and identification of any potential bottlenecks. The use of technology plays a crucial role in facilitating this streamlined process.

Imagine a flowchart: The process begins with the borrower submitting their payment (online, mail, or in person). This payment is then received and logged by a paid staff member who performs an initial data entry check for accuracy. The payment then moves to a volunteer team who conduct a second verification of the data and match it against the borrower’s account information. This second check acts as a critical quality control step, reducing errors. After volunteer verification, the payment is routed to the final processing stage handled by paid staff, who update the account status and generate any necessary receipts or confirmations. Finally, the payment is reconciled and reported. Any discrepancies or issues are flagged for immediate attention by the paid staff.

Technology and Tools for Volunteer Involvement

Technology plays a pivotal role in enabling efficient volunteer participation. Secure, user-friendly software is paramount.

The selection of appropriate technology directly impacts the effectiveness of volunteer contributions. Consider factors like ease of use, security features, and scalability when choosing your tools. Robust training and ongoing support are crucial to maximize the volunteers’ contribution.

Examples of helpful tools include secure online payment portals that integrate with the organization’s database, allowing volunteers to access and verify information efficiently. Specialized software for data entry and verification can further enhance accuracy and speed. Collaboration tools, such as shared online spreadsheets or project management software, can facilitate communication and task assignment amongst volunteers and paid staff.

Efficiency Comparison: Volunteer-Based vs. Traditional Methods

Volunteer-based payment processing can offer significant efficiency gains compared to traditional methods.

A direct comparison reveals the potential benefits. Traditional methods often rely solely on paid staff, leading to higher labor costs. A volunteer-based system can significantly reduce these costs, freeing up paid staff to focus on more complex tasks. However, it’s crucial to remember that successful implementation requires proper training, supervision, and quality control measures to maintain accuracy and efficiency. While initial setup and training might involve some upfront investment, the long-term cost savings can be substantial. For example, a non-profit organization might see a 20-30% reduction in processing costs by integrating a well-structured volunteer program, allowing them to serve more borrowers with the same budget. This represents a significant return on investment in terms of both financial savings and social impact.

Challenges and Benefits of Volunteer Mortgage Loan Servicing

Implementing a volunteer-based system for mortgage loan servicing presents a unique set of opportunities and obstacles. While the potential for cost savings and community engagement is significant, careful planning and execution are crucial to ensure the program’s success and maintain the integrity of the financial processes involved. This requires a proactive approach to addressing potential challenges and leveraging the inherent benefits.

Potential Challenges in Volunteer Mortgage Loan Servicing

Using volunteers for mortgage loan servicing introduces several challenges. Accuracy and efficiency are paramount in financial transactions; human error, lack of specialized knowledge, and inconsistent availability of volunteers can all impact these critical aspects. Furthermore, maintaining data security and complying with relevant regulations requires robust systems and thorough training. The potential for burnout among volunteers, due to the demanding nature of the work, is another important factor to consider. Finally, ensuring adequate supervision and quality control necessitates a well-defined structure and management strategy.

Strategies for Mitigating Challenges and Ensuring Accuracy and Efficiency

Effective mitigation strategies are key to addressing these challenges. Robust training programs, covering all aspects of mortgage loan servicing, including regulatory compliance and data security protocols, are essential. Implementing a clear workflow, with defined roles and responsibilities for each volunteer, will enhance efficiency. Regular quality checks and audits are vital to identify and correct errors. Leveraging technology, such as specialized software and secure online platforms, can streamline processes and minimize human error. Providing ongoing support and mentorship to volunteers will help prevent burnout and maintain morale. Finally, establishing clear communication channels and feedback mechanisms will foster collaboration and problem-solving.

Benefits of Utilizing Volunteers for Mortgage Loan Servicing

The advantages of utilizing volunteers extend beyond cost savings. Volunteer programs can significantly reduce operational expenses, freeing up resources for other crucial initiatives. More importantly, they foster a strong sense of community engagement, empowering volunteers and creating a positive social impact. Volunteers often bring diverse skills and perspectives, enriching the organization and improving service delivery. This community involvement can also enhance the organization’s reputation and build stronger relationships with stakeholders. Furthermore, volunteer programs can be a powerful tool for workforce development and skill-building for the volunteers themselves.

Comparison of Advantages and Disadvantages

| Advantages | Disadvantages |

|---|---|

| Significant cost savings | Potential for errors due to lack of experience |

| Increased community engagement | Inconsistent volunteer availability |

| Enhanced organizational reputation | Need for robust training and supervision |

| Improved service delivery through diverse skills | Risk of volunteer burnout |

| Opportunities for workforce development | Challenges in maintaining data security and regulatory compliance |

Legal and Regulatory Considerations: Volunteer Mortgage Loan Servicing Payment

Volunteer mortgage loan servicing, while noble in its intent, operates within a complex legal and regulatory landscape. Ignoring these frameworks can lead to significant legal liabilities and jeopardize the entire operation. Understanding and adhering to these rules is paramount for the success and sustainability of any volunteer program. This section details the crucial legal considerations and best practices for ensuring compliance.

Navigating the legal and regulatory environment of volunteer mortgage loan servicing requires a meticulous approach. Failure to comply with relevant laws can result in severe consequences, including financial penalties, legal action, and reputational damage for both the volunteers and the organizations they represent. Understanding the intricacies of consumer protection laws, data privacy regulations, and fair lending practices is essential for responsible operation.

Applicable Laws and Regulations

Federal and state laws significantly impact volunteer mortgage loan servicing. These include, but are not limited to, the Fair Debt Collection Practices Act (FDCPA), the Real Estate Settlement Procedures Act (RESPA), the Truth in Lending Act (TILA), and various state-specific consumer protection laws. The FDCPA, for instance, dictates how debt collectors, even volunteers, can interact with borrowers. RESPA governs the disclosure requirements related to mortgage loan servicing, while TILA mandates accurate disclosure of loan terms. State laws often add further layers of complexity and specific requirements. Organizations should consult legal counsel to ensure full compliance with all applicable laws at the federal and state levels.

Potential Legal Liabilities

Several potential legal liabilities exist for volunteers involved in mortgage loan servicing. For example, volunteers could face lawsuits for violations of the FDCPA if they engage in harassing or deceptive debt collection practices. Incorrect or incomplete disclosures could lead to violations of RESPA and TILA, resulting in fines and legal action. Failure to protect borrower data could trigger violations of privacy laws, leading to significant penalties. Furthermore, volunteers could face accusations of negligence or malpractice if their actions cause financial harm to borrowers. A thorough understanding of the legal risks is crucial to mitigating potential liabilities.

Best Practices for Legal Compliance

To minimize legal risks, volunteer organizations should implement robust compliance measures. This includes:

- Comprehensive Training: Volunteers should receive thorough training on all relevant laws and regulations, including the FDCPA, RESPA, and TILA. This training should cover proper communication techniques, data privacy protocols, and ethical considerations.

- Clear Written Procedures: Establish clear written procedures outlining how volunteers should handle all aspects of mortgage loan servicing, including communication with borrowers, data handling, and record-keeping. These procedures should be regularly reviewed and updated.

- Robust Data Security Measures: Implement strong data security measures to protect borrower information from unauthorized access, use, or disclosure. This includes secure data storage, access controls, and encryption.

- Regular Compliance Audits: Conduct regular compliance audits to identify and address any potential legal or regulatory violations. These audits should be conducted by qualified individuals with expertise in mortgage lending and compliance.

- Legal Counsel Consultation: Regularly consult with legal counsel to ensure compliance with all applicable laws and regulations and to obtain guidance on complex legal issues.

Training and Support for Volunteers

Effective volunteer mortgage loan servicing hinges on comprehensive training and ongoing support. Without properly prepared volunteers, the program risks errors, legal issues, and ultimately, failure to assist those in need. A robust training program, coupled with consistent support mechanisms, is crucial for maximizing volunteer effectiveness and ensuring the long-term success of the initiative.

The training must go beyond basic procedures; it needs to instill a deep understanding of the ethical and legal responsibilities involved in handling sensitive financial information. Volunteers must be equipped to handle difficult situations with empathy and professionalism, while adhering to strict regulatory guidelines. Ongoing support is essential to address emerging challenges, update knowledge on changing regulations, and maintain a high standard of service.

Essential Training Components, Volunteer mortgage loan servicing payment

A well-structured training program should cover several key areas to equip volunteers with the necessary skills and knowledge. This includes both theoretical understanding and practical application of learned concepts.

- Mortgage Loan Servicing Fundamentals: This module covers the basics of mortgage loans, including different loan types, amortization schedules, and common loan servicing activities. Volunteers will learn to understand loan documents and identify potential issues.

- Payment Processing Procedures: This section details the step-by-step process of receiving, recording, and allocating payments. It emphasizes accuracy and the importance of maintaining detailed records. Volunteers will learn to use the designated software and handle various payment methods.

- Communication and Client Interaction: Effective communication is vital. This module focuses on developing strong interpersonal skills, active listening, and techniques for handling difficult conversations with borrowers. Role-playing scenarios will help volunteers practice handling various situations.

- Legal and Regulatory Compliance: This crucial section covers relevant laws and regulations, including Fair Housing Act provisions, privacy laws (like HIPAA if applicable), and state-specific regulations. Volunteers will learn to identify potential compliance risks and take appropriate action.

- Data Security and Confidentiality: Protecting borrower information is paramount. This module emphasizes the importance of data security best practices, including password management, secure data storage, and handling sensitive information responsibly. Volunteers will be trained on the organization’s data security protocols.

Sample Training Curriculum

A sample three-day training curriculum could be structured as follows, balancing theoretical learning with practical application and hands-on exercises:

| Day | Module | Activities |

|---|---|---|

| 1 | Mortgage Loan Servicing Fundamentals & Payment Processing Procedures | Lectures, group discussions, hands-on exercises with sample loan documents and payment processing software. |

| 2 | Communication & Client Interaction, Legal & Regulatory Compliance | Role-playing scenarios, case studies, quizzes on relevant laws and regulations. |

| 3 | Data Security & Confidentiality, Practical Application & Q&A | Review of all modules, simulated real-world scenarios, open Q&A session with experienced staff. |

Ongoing Support Mechanisms

Sustaining volunteer effectiveness requires ongoing support beyond initial training. This includes regular updates, mentorship opportunities, and readily available resources.

- Regular Training Refresher Sessions: Quarterly or semi-annual refresher sessions to update volunteers on changes in regulations, software updates, and best practices. These sessions could be webinars, in-person meetings, or a combination of both.

- Mentorship Program: Pairing experienced volunteers with newer ones to provide guidance and support. This allows for knowledge transfer and fosters a supportive community.

- Access to Resources and Documentation: Providing volunteers with easy access to up-to-date manuals, FAQs, and other relevant documents through a centralized online portal.

- Dedicated Support Line: Establishing a dedicated support line or email address for volunteers to quickly address questions or concerns.

Volunteer Performance Evaluation

A structured system for evaluating volunteer performance is essential for identifying areas for improvement and recognizing outstanding contributions. This should be a combination of quantitative and qualitative measures.

- Quantitative Metrics: Tracking key performance indicators (KPIs) such as accuracy of payment processing, timely completion of tasks, and adherence to deadlines. This provides objective data on performance.

- Qualitative Feedback: Regular feedback sessions with supervisors to discuss performance, identify areas for improvement, and provide constructive criticism. This allows for personalized development plans.

- Peer Reviews: Incorporating peer feedback to gain diverse perspectives on volunteer performance and identify strengths and weaknesses. This fosters a collaborative environment.

- Annual Performance Reviews: Conducting formal annual performance reviews to summarize performance over the year, identify areas for growth, and provide recognition for outstanding contributions. This ensures accountability and promotes continuous improvement.

Impact and Future of Volunteer Mortgage Loan Servicing

Volunteer mortgage loan servicing programs offer a powerful blend of community support and financial stability, significantly impacting both individual borrowers and the wider community. By providing crucial assistance with loan management, these programs alleviate stress, prevent foreclosures, and ultimately contribute to stronger neighborhoods. The positive ripple effects extend beyond the immediate beneficiaries, creating a more resilient and equitable housing landscape.

The success of these programs hinges on the dedication and expertise of volunteers, who provide a human touch often missing in traditional financial institutions. This personalized approach fosters trust and empowers borrowers to navigate complex financial situations effectively. The long-term benefits are substantial, reducing the societal costs associated with housing instability and contributing to improved community well-being.

Positive Impacts on Borrowers and Communities

Volunteer mortgage loan servicing programs demonstrably improve borrowers’ financial health and reduce their stress levels. One example is the “Helping Hands Housing Initiative” in a mid-sized city, where volunteer counselors assisted over 100 families facing foreclosure. Through personalized budgeting advice, loan modification negotiations, and access to other resources, the program helped 85% of participants avoid foreclosure and maintain stable housing. The resulting reduction in homelessness and housing instability contributed to a safer and more vibrant community. Further, the program saw a significant decrease in the number of families relying on emergency shelters or social services for housing assistance. This illustrates the substantial community-wide benefits stemming from efficient and empathetic volunteer loan servicing.

Future Trends in Volunteer Mortgage Loan Servicing

The future of volunteer mortgage loan servicing is likely to see increased integration of technology and a broader range of services. We can anticipate the rise of online platforms connecting volunteers with borrowers, facilitating remote assistance and expanding the reach of these programs. Furthermore, the integration of artificial intelligence (AI) for tasks like initial loan assessment and basic financial counseling could enhance efficiency and allow volunteers to focus on more complex cases requiring human interaction. For instance, a pilot program in California is exploring the use of AI chatbots to answer frequently asked questions, freeing up volunteer time for more in-depth counseling sessions. This allows for a more efficient use of volunteer resources and scalability of the program.

Recommendations for Improving and Expanding Volunteer Programs

To maximize the impact of volunteer mortgage loan servicing, several key improvements are needed. Firstly, comprehensive and ongoing training for volunteers is crucial to ensure they possess the necessary financial literacy and communication skills. Secondly, establishing strong partnerships with local housing agencies, non-profit organizations, and financial institutions is vital for resource sharing and coordinated outreach. Thirdly, increased funding and government support are needed to sustain these programs and expand their reach to underserved communities. A successful model would involve dedicated funding streams, perhaps through government grants or corporate partnerships, ensuring long-term financial stability for these vital services. Finally, robust data collection and analysis are necessary to track program effectiveness and identify areas for improvement. This data can inform future program design and demonstrate the tangible benefits of volunteer loan servicing to potential funders and stakeholders.