USDA Home Loan Eligibility in Vancouver, WA

Securing a USDA home loan in Vancouver, WA, can be a fantastic way to achieve homeownership, especially for those who meet the specific eligibility criteria. Understanding these requirements is crucial for a smooth and successful application process. This section details the key aspects of USDA loan eligibility in Vancouver, focusing on income limits, property location, and the verification process.

Income Limits for USDA Home Loans in Vancouver, WA

Income limits for USDA loans are not set at a city level but rather at a county level. Therefore, to determine your eligibility, you’ll need to check the income limits established for Clark County, WA, where Vancouver is located. These limits are adjusted periodically by the USDA, so it’s essential to consult the most recent data available on the USDA Rural Development website or through a local USDA-approved lender. The income limits vary depending on household size and are typically expressed as a maximum annual income. For example, a family of four might have a higher income limit than a single individual. Exceeding this limit would disqualify you from the program. Always check the official USDA website for the most up-to-date figures.

Property Location Requirements for USDA Loans in Vancouver, WA

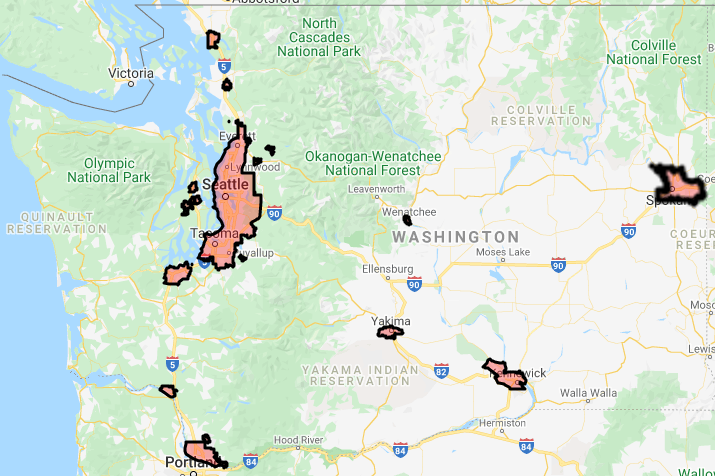

Not all properties in Vancouver, WA, qualify for USDA loans. The USDA defines eligible areas as those within designated rural areas or eligible census tracts. Vancouver has a mix of urban and rural areas, and only properties located within the USDA-defined eligible areas will qualify. You can determine a property’s eligibility by using the USDA’s online eligibility map tool. This tool uses the property’s address to check if it falls within an eligible area. Properties located in densely populated urban centers within Vancouver are typically ineligible.

USDA Loan Eligibility Verification Process

The verification process involves several steps to confirm your eligibility for a USDA home loan. This is a crucial step that ensures you meet all the requirements before proceeding with the loan application.

- Initial Pre-qualification: Contact a USDA-approved lender to get pre-qualified. This involves providing basic financial information, allowing the lender to assess your initial eligibility.

- Income Verification: You will need to provide documentation to verify your income, such as pay stubs, tax returns, and W-2 forms. The lender will verify this information to ensure it aligns with the USDA income limits.

- Credit Report Review: Your credit report will be reviewed to assess your creditworthiness. A good credit score is essential for approval.

- Property Appraisal: An appraisal will be conducted to determine the property’s market value and ensure it meets USDA standards.

- Property Eligibility Verification: The lender will verify that the property is located in an eligible rural area using the USDA’s online map tool.

- Final Loan Approval: Once all documentation is reviewed and verified, and the property meets the requirements, the lender will issue a final loan approval.

Acceptable and Unacceptable Property Types for USDA Loans in Vancouver, WA

The USDA has specific guidelines regarding acceptable property types. Generally, single-family homes are eligible. However, there are some exceptions and limitations.

- Acceptable Properties: Single-family homes, including townhouses and condos in eligible areas, typically qualify. The property must be your primary residence.

- Unacceptable Properties: Properties that are not your primary residence, commercial properties, multi-family dwellings (unless specifically allowed under certain circumstances), and properties in ineligible areas are typically not eligible for USDA loans. Additionally, properties in poor condition or requiring extensive repairs might also be rejected.

Finding USDA-Approved Lenders in Vancouver, WA

Securing a USDA home loan in Vancouver, WA, requires careful selection of a lender. Choosing the right partner can significantly impact your loan process, from application to closing. Understanding the landscape of available lenders and their services is crucial for a smooth and successful home buying experience.

USDA-Approved Lenders in Vancouver, WA

Finding a reputable USDA-approved lender is paramount. The following list provides examples, and it’s vital to independently verify their current status and offerings. Remember that lender availability and specific programs change frequently. Always confirm directly with the lender before making any decisions.

Usda home loans vancouver wa – Please note: The following list is for illustrative purposes only and does not constitute an endorsement. Contact information may change, so it’s crucial to verify details independently before contacting any lender.

- Lender A: (Example Name – replace with actual lender) Contact: (Example Phone Number), (Example Email Address), (Example Website Address)

- Lender B: (Example Name – replace with actual lender) Contact: (Example Phone Number), (Example Email Address), (Example Website Address)

- Lender C: (Example Name – replace with actual lender) Contact: (Example Phone Number), (Example Email Address), (Example Website Address)

- Lender D: (Example Name – replace with actual lender) Contact: (Example Phone Number), (Example Email Address), (Example Website Address)

- Lender E: (Example Name – replace with actual lender) Contact: (Example Phone Number), (Example Email Address), (Example Website Address)

Comparison of Lender Services

Direct comparison helps highlight key differences in lender offerings. This table showcases examples; always confirm current offerings directly with the lenders.

| Lender Name | Contact Info | Loan Products | Special Offers |

|---|---|---|---|

| Lender A (Example) | (Example Contact Info) | USDA Direct Loans, USDA Guaranteed Loans, (List other loan products) | (Example Offer, e.g., Reduced Closing Costs) |

| Lender B (Example) | (Example Contact Info) | USDA Guaranteed Loans, Refinance Options, (List other loan products) | (Example Offer, e.g., Fast Application Processing) |

| Lender C (Example) | (Example Contact Info) | USDA Direct Loans, Construction Loans, (List other loan products) | (Example Offer, e.g., Low Interest Rates) |

Choosing a Suitable Lender: A Process Flowchart

Selecting the right lender involves a systematic approach. The following describes a visual representation (a flowchart would be included here in a visual medium, but textually, it’s represented below).

The process begins by identifying your needs and loan requirements. Next, research and compare multiple lenders, focusing on factors like fees, reputation, and customer service. Then, pre-qualify with several lenders to understand your options and interest rates. Following that, review loan estimates carefully. Finally, select the lender that best meets your needs and proceed with the application process.

Factors to Consider When Selecting a USDA Lender

Several key factors influence the selection of a USDA lender. Careful consideration of these elements is crucial for a positive experience.

Fees: Compare closing costs, origination fees, and other associated charges across lenders. Unexpected fees can significantly impact your overall costs. Transparency in fee structures is a crucial indicator of a reputable lender. For example, one lender might advertise a lower interest rate but have higher closing costs, ultimately making another lender a better option.

Reputation: Research the lender’s reputation through online reviews, Better Business Bureau ratings, and word-of-mouth referrals. A lender with a strong track record of positive customer experiences is more likely to provide a smooth and efficient loan process. Look for consistent positive feedback regarding communication, responsiveness, and problem-solving.

Customer Service: Assess the lender’s responsiveness, communication clarity, and overall helpfulness. A lender with excellent customer service will readily answer your questions, address your concerns, and provide timely updates throughout the loan process. For instance, a lender that consistently fails to return calls or provides unclear information should be avoided.

The USDA Loan Application Process in Vancouver, WA

Securing a USDA loan in Vancouver, WA, to achieve your dream of homeownership can feel like navigating a complex maze. However, understanding the process and gathering the necessary documentation beforehand can significantly streamline the application and increase your chances of approval. This guide provides a clear, step-by-step walkthrough of the application process, highlighting crucial aspects to ensure a smooth journey.

The USDA loan application process is multifaceted, involving several key steps and requiring meticulous attention to detail. From initial pre-qualification to final loan closing, each stage plays a crucial role in determining the outcome of your application. Thorough preparation is paramount to a successful application.

Required Documentation for USDA Loan Applications

Submitting a complete application with all the necessary documentation is critical for a timely processing of your USDA loan. Missing or incomplete documents can lead to delays, and in some cases, rejection of your application. Be prepared to provide comprehensive financial information and property details.

- Proof of Income: Pay stubs (typically from the last two months), W-2 forms (from the last two years), tax returns (from the last two years), and self-employment documentation (if applicable) are essential to demonstrate your income stability.

- Credit Report: A copy of your credit report from one of the three major credit bureaus (Equifax, Experian, or TransUnion) is needed to assess your creditworthiness. A higher credit score generally improves your chances of approval.

- Bank Statements: Recent bank statements (typically from the last two months) showing your savings and checking account balances are necessary to verify your financial stability and ability to make loan payments.

- Property Information: Details about the property you intend to purchase, including the address, appraisal report, and purchase agreement, are required. The property must meet USDA eligibility requirements.

- Personal Identification: Valid government-issued identification, such as a driver’s license or passport, is necessary to verify your identity.

Completing the USDA Loan Application Form Accurately and Efficiently

Accuracy is paramount when completing the USDA loan application. Inaccuracies or omissions can delay processing or even lead to application rejection. Taking your time and carefully reviewing each section before submission is crucial. Seek assistance from your lender if you have any questions or uncertainties.

Utilize online resources provided by your lender or the USDA to access the application form. Carefully read all instructions and ensure you understand each question before providing your answer. Maintain organized records of all submitted documents for future reference.

Many lenders offer online application portals that allow you to track your application’s progress. This transparency can help you manage expectations and address any potential issues promptly.

Potential Challenges and Solutions During the USDA Loan Application Process

While the USDA loan program aims to make homeownership accessible, applicants can still encounter challenges. Proactive planning and understanding potential hurdles can help mitigate these issues.

- Credit Score Issues: A low credit score can hinder your approval. Solutions include improving your credit score by paying down debt, addressing any negative items on your report, and maintaining consistent on-time payments.

- Debt-to-Income Ratio (DTI): A high DTI can also affect approval. Reducing debt, increasing income, or exploring lower-priced homes can help improve your DTI.

- Property Eligibility: The property must meet USDA eligibility requirements. Thoroughly researching properties that meet these requirements before applying is crucial. Working with a real estate agent experienced with USDA loans can be beneficial.

- Appraisal Issues: If the appraised value is lower than the purchase price, it can impact your loan approval. Negotiating a lower purchase price or finding a different property may be necessary.

Home Buying Process with USDA Loans in Vancouver, WA

Purchasing a home in Vancouver, WA, using a USDA loan involves a strategic process that requires careful planning and execution. Understanding each step, from finding the right property to closing the deal, is crucial for a smooth and successful home buying experience. This section details the key phases of this process, highlighting the importance of a real estate agent and the specifics of the USDA appraisal.

Finding a Suitable Home

Locating a home that meets your needs and qualifies for a USDA loan requires a focused approach. Begin by defining your must-haves and your budget. Remember that USDA loans have income and property location restrictions, so working with a real estate agent familiar with these guidelines is essential. Your agent will help you navigate the Vancouver, WA, market, identify properties that meet USDA eligibility criteria, and provide insights into comparable sales to help you make informed offers. They can also help you understand the nuances of the local market, including factors like school districts and proximity to amenities. Consider factors such as commute times, neighborhood safety, and proximity to essential services.

The Role of a Real Estate Agent

A real estate agent acts as your advocate throughout the entire home-buying process. Their expertise extends beyond simply finding properties; they’ll negotiate offers, manage paperwork, and coordinate with lenders and inspectors. In the context of a USDA loan, a knowledgeable agent will ensure that the properties you consider are eligible under the program’s guidelines, saving you time and potential frustration. They will also be instrumental in navigating the complexities of the appraisal process. A strong agent-client relationship is paramount to a successful transaction. Expect regular communication and transparent updates throughout the process.

The USDA Home Appraisal Process, Usda home loans vancouver wa

The appraisal is a critical step in the USDA loan process. An independent appraiser, approved by the USDA, will assess the property’s value to ensure it aligns with the loan amount. The appraiser will examine the property’s condition, features, and comparable sales in the area. A crucial aspect is that the property must meet specific USDA requirements for habitability and safety. Any necessary repairs identified during the appraisal might need to be addressed before the loan can be finalized. The appraisal report will determine whether the loan proceeds are sufficient to cover the purchase price and any closing costs. Delays in this process can impact the overall timeline, so timely communication with the appraiser and your lender is key.

Timeline of the Home Buying Process

The following timeline provides a general overview. Actual timelines can vary based on several factors including market conditions, lender processing times, and appraisal scheduling.

| Stage | Timeline (Approximate) | Description |

|---|---|---|

| Loan Application & Pre-approval | 1-4 weeks | Gather financial documents, complete the application, and obtain pre-approval. |

| Home Search & Offer | 2-8 weeks | Work with your real estate agent to find a suitable home and submit an offer. |

| Home Inspection & Appraisal | 2-4 weeks | Conduct a home inspection and obtain a USDA appraisal. |

| Loan Underwriting & Closing | 3-6 weeks | The lender reviews the application and appraisal, and the closing process takes place. |

| Closing & Move-in | 1-2 weeks post-closing | Sign the final documents and move into your new home. |

Illustrative Example: The Miller Family’s Vancouver, WA Home Purchase: Usda Home Loans Vancouver Wa

The Miller family, consisting of two working adults and two children, had long dreamed of owning a home in Vancouver, WA. Their combined annual income was $85,000, and they had diligently saved for a down payment, accumulating approximately $10,000. Finding a suitable home within their budget, however, proved challenging in the competitive Vancouver market. Their search led them to explore USDA loan options, a pathway to homeownership that many overlook.

The Miller Family’s USDA Loan Journey

The Millers initially faced the common hurdle of navigating the complexities of the mortgage application process. They weren’t entirely familiar with the USDA loan program’s requirements and nuances. They discovered that, unlike conventional loans, USDA loans often require less stringent credit score requirements and smaller down payments. This was a significant advantage for the Millers, given their limited savings. They found a USDA-approved lender who guided them through the process, explaining the eligibility criteria and assisting them with the necessary documentation.

Overcoming Challenges in the Home-Buying Process

The Millers encountered some challenges during their home search. Finding a property that met their needs and qualified under the USDA program required patience and persistence. Their initial offers on several properties were unsuccessful due to the competitive bidding environment. However, their lender provided valuable support, offering insights into market trends and suggesting strategies for crafting competitive offers. Ultimately, they found a charming three-bedroom house in a desirable neighborhood listed at $350,000.

Securing the USDA Loan and Purchasing the Home

With their lender’s assistance, the Millers successfully secured a USDA loan for $340,000, requiring only their $10,000 down payment. The low down payment requirement was a significant relief, allowing them to avoid the substantial financial burden of a larger down payment. The closing process, though intricate, went smoothly thanks to the guidance and support of their lender. The low interest rates offered through the USDA loan program significantly reduced their monthly mortgage payments compared to conventional loans, making homeownership a more attainable reality.

Benefits Experienced by the Miller Family

The Millers experienced several key benefits through their USDA loan. The most significant was the ability to purchase a home with a significantly smaller down payment than would have been required with a conventional loan. This reduced their initial financial burden considerably, enabling them to allocate funds towards other essential expenses such as home improvements and furnishings. Furthermore, the low interest rates associated with the USDA loan resulted in lower monthly mortgage payments, freeing up more of their monthly budget for other needs. The USDA loan empowered the Millers to achieve their dream of homeownership in Vancouver, WA, a feat that might have seemed impossible with traditional financing options.