Understanding Mr. Cooper’s Loan Modification Process

Navigating the loan modification process with Mr. Cooper can be complex, but understanding the steps involved and the common pitfalls can significantly improve your chances of success. This guide Artikels the typical process, required documentation, reasons for denial, and common misconceptions to help you better prepare.

Steps Involved in a Loan Modification Request

The loan modification process with Mr. Cooper typically involves several key stages. First, you’ll need to initiate contact and submit a formal application, providing comprehensive financial documentation. Mr. Cooper will then review your application, potentially requesting additional information. Following the review, they’ll make a decision, which may involve negotiation if your initial application isn’t approved. If approved, you’ll need to sign the modified loan agreement. Finally, the modification will be implemented, altering your monthly payment terms. This entire process can take several months.

Required Documentation for Loan Modification Applications

A successful loan modification application requires meticulous documentation. Borrowers should be prepared to provide extensive financial information, including pay stubs, bank statements, tax returns, and proof of income. Documentation showcasing your hardship, such as medical bills or proof of job loss, is also crucial. The more complete and accurate your documentation, the smoother the process will be. Failure to provide all the necessary documentation can lead to delays or denial. Consider gathering all documentation well in advance of submitting your application.

Reasons for Loan Modification Denial by Mr. Cooper

Mr. Cooper, like other lenders, evaluates loan modification requests based on specific criteria. Denials often stem from insufficient documentation, inconsistent financial information, or an inability to demonstrate a sustainable ability to make future payments under the modified terms. For example, a borrower with a history of late payments or a high debt-to-income ratio may be deemed ineligible. Similarly, a lack of verifiable proof of hardship, or providing inaccurate information, can result in denial. The lender’s assessment of your long-term financial prospects is paramount.

Common Misconceptions about Loan Modifications

Many borrowers harbor misconceptions about loan modifications. One common misconception is that a loan modification guarantees a lower monthly payment. The terms of a modification are dependent on the lender’s assessment of your financial situation and their risk tolerance. Another misconception is that the process is quick and easy. The process is often lengthy and requires significant documentation and patience. Finally, some borrowers believe that simply requesting a modification guarantees approval. Approval depends on meeting specific financial criteria and providing sufficient documentation to support your request. Managing expectations is key.

Reasons for Loan Modification Denial

Securing a loan modification can be a lifeline for homeowners facing financial hardship, but the process isn’t guaranteed. Mr. Cooper, like other mortgage servicers, has specific criteria that must be met. Understanding the common reasons for denial is crucial for borrowers to navigate this complex process effectively and potentially improve their chances of success. This section will Artikel the most frequent causes of loan modification denials and explore strategies to overcome these obstacles.

Mr cooper denied loan modification – Loan modification denials from Mr. Cooper, or any lender, often stem from a combination of factors related to the borrower’s financial situation and the loan itself. The most common reasons boil down to insufficient income to support the modified payment, a high debt-to-income ratio (DTI), and issues with the documentation provided during the application process. Let’s delve into these key areas.

Insufficient Income

Insufficient income is a primary reason for loan modification denials. Mr. Cooper assesses your ability to make the modified monthly payments. This involves a thorough review of your income documentation, including pay stubs, tax returns, and bank statements. If your income doesn’t meet their minimum requirements after factoring in the proposed new payment, the modification will likely be denied. For example, if your proposed monthly payment is $1500 and your verifiable monthly income is only $1200, the lender will likely see a significant shortfall. This situation highlights the importance of providing complete and accurate income documentation. Any discrepancies or missing information can lead to a denial.

High Debt-to-Income Ratio

A high debt-to-income ratio (DTI) is another major hurdle. Your DTI is calculated by dividing your total monthly debt payments (including the proposed modified mortgage payment) by your gross monthly income. Mr. Cooper typically prefers a DTI below a certain threshold, often around 43%. A high DTI indicates that a significant portion of your income is already committed to debt repayment, leaving little room for the modified mortgage payment. If your DTI exceeds this threshold, the lender may view the modified payment as unsustainable, resulting in a denial. For instance, if your total monthly debt payments are $4000 and your gross monthly income is $7000, your DTI is 57%, significantly higher than the preferred threshold.

Incomplete or Inaccurate Documentation

Providing complete and accurate documentation is paramount. Missing documents, discrepancies in information, or inaccuracies in the submitted materials can easily lead to a denial. Mr. Cooper requires a comprehensive set of documents to verify your income, assets, expenses, and the overall financial picture. Failure to provide all the necessary documentation, or providing documentation that contains inconsistencies or errors, significantly weakens your application. For example, discrepancies between stated income on your application and the information shown on your tax returns will raise red flags and potentially lead to a denial.

Financial Implications of a Denied Loan Modification

A denied loan modification carries significant financial implications. The most immediate consequence is the continuation of the existing, potentially unaffordable, mortgage payments. This can lead to further financial strain, increasing the risk of foreclosure. A denied modification can also negatively impact your credit score, making it more difficult to secure future loans or credit. Furthermore, the stress and emotional toll of navigating the modification process, only to be denied, can be substantial.

Strategies to Improve Chances of Approval

Borrowers can take proactive steps to improve their chances of approval. This includes meticulously gathering and organizing all necessary documentation, demonstrating a clear understanding of your financial situation, and proactively addressing any potential issues before applying. Exploring options such as debt consolidation or seeking financial counseling can help improve your DTI. Engaging a qualified housing counselor can provide invaluable guidance and assistance throughout the process. A well-prepared and thoroughly documented application significantly increases the likelihood of a successful loan modification.

Alternatives to Loan Modification

Facing loan modification denial from Mr. Cooper can be disheartening, but it’s crucial to remember that several other options exist to help you avoid foreclosure. Understanding these alternatives and strategically choosing the best path forward is vital to protecting your financial future. This section Artikels viable alternatives, their comparative advantages and disadvantages, and guides you through a decision-making process.

Comparison of Alternatives to Loan Modification

Choosing the right path requires careful consideration of your individual financial situation. The following table compares and contrasts several key alternatives, highlighting their strengths and weaknesses. Remember to consult with a housing counselor or financial advisor for personalized guidance.

| Alternative | Benefits | Drawbacks | Suitability |

|---|---|---|---|

| Short Sale | Avoids foreclosure, improves credit score faster than foreclosure, potentially reduces tax liabilities. | You’ll likely lose some equity, may affect your ability to buy a home again for several years, impacts credit score initially. | Best for homeowners with significant negative equity and facing imminent foreclosure. |

| Deed in Lieu of Foreclosure | Avoids foreclosure proceedings, avoids negative credit impact associated with foreclosure. | You lose your home and any equity, may still face tax liabilities. | Suitable for homeowners who want to avoid the legal and financial costs of foreclosure but are willing to surrender their home. |

| Forbearance | Provides temporary relief from mortgage payments, prevents immediate foreclosure. | Payments will eventually need to be repaid, often with added interest or fees, may not solve underlying financial issues. | Suitable for homeowners experiencing temporary financial hardship. |

| Refinancing | Lower monthly payments, potentially lower interest rate. | Requires good credit score and sufficient equity, closing costs apply, may involve fees and refinancing fees. | Suitable for homeowners with good credit and sufficient equity who can qualify for a new loan. |

Decision-Making Flowchart for Choosing an Alternative

The decision of which path to take is complex and depends on your specific circumstances. The following flowchart provides a visual guide to aid in the process. Remember, this is a general guide; professional advice is essential.

(Imagine a flowchart here. The flowchart would begin with “Loan Modification Denied.” Branching paths would lead to “Significant Negative Equity?” (Yes/No). “Yes” would lead to “Consider Short Sale or Deed in Lieu.” “No” would lead to “Temporary Financial Hardship?” (Yes/No). “Yes” would lead to “Consider Forbearance.” “No” would lead to “Good Credit & Equity?” (Yes/No). “Yes” would lead to “Consider Refinancing.” “No” would lead to “Seek Professional Advice.”)

Benefits and Drawbacks of Each Alternative

Each alternative offers a unique set of advantages and disadvantages. Carefully weighing these factors is crucial before making a decision. For instance, a short sale might temporarily harm your credit, but it prevents the more severe long-term damage of a foreclosure. Conversely, a deed in lieu of foreclosure avoids legal battles but results in the immediate loss of your home. Refinancing offers lower payments but requires meeting stringent lending criteria.

Resources for Borrowers Facing Foreclosure

Facing foreclosure can be overwhelming, but you’re not alone. Numerous resources are available to provide support and guidance.

The following organizations can provide valuable assistance:

* HUD-approved housing counselors: These counselors offer free or low-cost counseling and can help you navigate your options.

* National Foundation for Credit Counseling (NFCC): The NFCC provides credit counseling and debt management services.

* State and local housing authorities: Many states and localities offer assistance programs for homeowners facing foreclosure.

* Legal aid societies: Legal aid organizations can provide legal representation if you’re facing foreclosure litigation.

Legal Rights and Protections: Mr Cooper Denied Loan Modification

Being denied a loan modification by Mr. Cooper can be frustrating, but it’s crucial to understand your rights and the avenues available to challenge the decision. Knowing your legal options empowers you to navigate this challenging situation effectively and potentially secure a more favorable outcome. Remember, the information below is for general guidance and you should always seek advice from a qualified legal professional for your specific circumstances.

Being denied a loan modification doesn’t automatically mean you’re without recourse. Several legal avenues exist to protect your interests and possibly overturn the denial. Understanding these rights and the processes involved is key to effectively advocating for yourself.

Appealing a Loan Modification Denial

Mr. Cooper, like other mortgage servicers, typically has an internal appeals process. This usually involves submitting a formal request for reconsideration, providing additional documentation to support your case, and clearly outlining why you believe the initial denial was incorrect. This process often involves detailed paperwork, demonstrating your financial hardship and ability to make modified payments. Failure to follow the precise steps Artikeld in Mr. Cooper’s internal appeals process could jeopardize your chances of a successful appeal. Carefully review all documentation provided by Mr. Cooper and follow their instructions precisely. Consider seeking assistance from a housing counselor or legal professional to ensure your appeal is comprehensive and properly submitted.

Legal Recourse Available to Borrowers

If the internal appeal process fails, you may have grounds to pursue legal action. This could involve filing a lawsuit against Mr. Cooper, alleging violations of federal or state consumer protection laws related to mortgage servicing and loan modifications. A successful lawsuit could result in a court-ordered loan modification, compensation for damages, or other remedies. The strength of your case will depend on several factors, including the specific circumstances of your loan, the evidence you can present, and the applicable laws in your jurisdiction. Consulting with an attorney specializing in mortgage foreclosure and consumer rights is crucial to evaluate your legal options and the potential viability of a lawsuit.

Consumer Protection Laws Related to Mortgage Modifications

Several federal and state laws protect borrowers during the loan modification process. The Real Estate Settlement Procedures Act (RESPA) requires mortgage servicers to provide accurate and timely information to borrowers, including about loan modification options. The Fair Debt Collection Practices Act (FDCPA) protects borrowers from abusive or deceptive debt collection practices, including those related to mortgage modifications. State laws also often provide additional protections for borrowers. These laws can vary significantly by state, so it’s essential to understand the specific regulations applicable in your area. Violation of these laws could provide additional grounds for legal action against Mr. Cooper. For example, a failure to properly consider your application or provide timely responses could be considered a violation of RESPA.

Building a Stronger Application

Securing a loan modification with Mr. Cooper requires a meticulously prepared application that demonstrates your financial hardship and commitment to repayment. A strong application isn’t just about filling out forms; it’s about crafting a compelling narrative that resonates with the lender and showcases your proactive approach to resolving your financial difficulties. This involves presenting your financial situation clearly, accurately, and persuasively.

A successful loan modification application hinges on several key elements. It’s not simply about providing the requested documents; it’s about presenting a comprehensive picture of your current financial standing and your realistic plan for future repayment. This requires meticulous attention to detail and a clear understanding of Mr. Cooper’s requirements.

Key Elements of a Successful Application, Mr cooper denied loan modification

A successful application goes beyond simply meeting the minimum requirements. It requires a strategic approach that highlights your commitment to repayment and demonstrates your understanding of your financial situation. Crucially, it presents a realistic plan for future payments, addressing the reasons for your current delinquency and outlining steps taken to improve your financial stability. This might include evidence of reduced expenses, increased income, or participation in debt management programs. Supporting documentation should be organized logically and easily accessible for the reviewer.

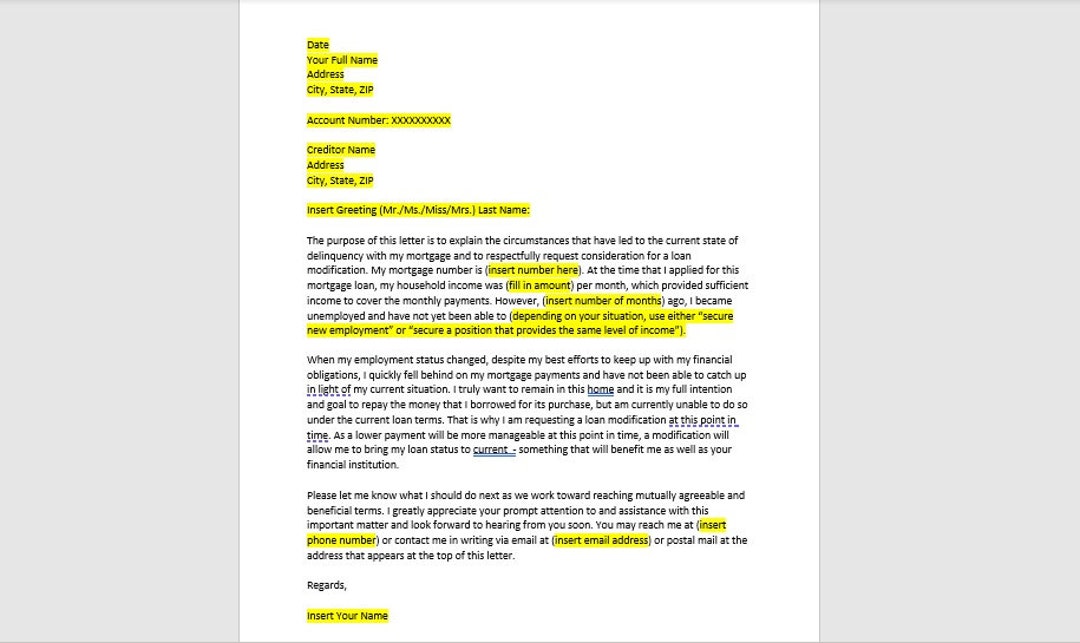

Compelling Narrative Examples

Your application shouldn’t just be a collection of documents; it needs a story. Consider these examples: “Due to unexpected medical expenses exceeding $20,000, I experienced a significant reduction in disposable income, resulting in missed mortgage payments. However, I have since secured a part-time job and am actively reducing unnecessary expenses. My projected income, coupled with the modified payment plan, will allow me to resume consistent mortgage payments.” Another example: “Following a job loss due to company downsizing, I faced immediate financial hardship. I actively sought new employment, successfully securing a new position after three months. While my income is currently lower, I’ve implemented a strict budget, cutting expenses by 25%, and I am confident that a loan modification will allow me to regain financial stability.” These narratives showcase both hardship and proactive solutions.

Effective Communication with Mr. Cooper

Maintain clear, concise, and respectful communication throughout the process. Respond promptly to all requests for information and clearly articulate your situation and proposed solutions. Document all communication, including dates, times, and the names of individuals you speak with. If you encounter difficulties, escalate your concerns through appropriate channels, always maintaining a professional demeanor. Remember, politeness and professionalism go a long way in securing a favorable outcome.

Organizing Financial Documentation

Organize your financial documentation using a clear and logical system. Create a binder or digital folder with clearly labeled sections for each document type. This could include pay stubs, bank statements, tax returns, and proof of expenses. Ensure all documents are legible and easy to understand. A well-organized application demonstrates your attention to detail and makes the review process smoother and more efficient for Mr. Cooper. Consider using a table to summarize key financial information, such as monthly income and expenses. For instance, a table could clearly display income sources, amounts, and expenses, making it easier for the reviewer to understand your financial picture at a glance.

Illustrative Scenarios

Understanding how loan modification denials occur is crucial for borrowers. Let’s examine specific scenarios to illustrate common reasons for rejection and a successful appeal. These examples highlight the importance of meticulous documentation and a strong understanding of Mr. Cooper’s requirements.

Loan Modification Denial Due to Insufficient Income

Scenario: Sarah, a single mother, applied for a loan modification with Mr. Cooper. Her monthly mortgage payment was $2,000, and her total monthly income, including child support, was $2,500. While she had experienced a temporary job loss impacting her income, she provided documentation of her recent re-employment at a lower salary. However, Mr. Cooper denied her application because her net monthly income, after essential expenses like food, transportation, and childcare, was insufficient to cover the modified mortgage payment they proposed. They deemed her remaining funds inadequate to ensure consistent mortgage payments, even with a modified plan. The proposed modified payment, factoring in a reduced interest rate and extended term, still exceeded her available funds after essential living costs. Her application lacked sufficient evidence demonstrating a realistic path to consistent payments despite the modification.

Loan Modification Denial Due to High Debt-to-Income Ratio

Scenario: John and Mary applied for a loan modification after John experienced a medical emergency resulting in significant medical bills. While their income remained relatively stable, their debt-to-income ratio skyrocketed due to the new medical debt. Even with a proposed loan modification reducing their monthly mortgage payment, their overall debt burden, including credit card debt, medical bills, and the modified mortgage payment, exceeded acceptable limits set by Mr. Cooper. Their debt-to-income ratio, even after the proposed modification, remained too high to demonstrate a sustainable ability to meet their financial obligations. Mr. Cooper’s analysis indicated a high risk of future delinquency, leading to the denial.

Loan Modification Denial Due to Incomplete Documentation

Scenario: David submitted a loan modification application to Mr. Cooper, but his application lacked crucial documentation. He failed to provide complete tax returns for the past two years, pay stubs for the past three months, and bank statements for the past six months. Without this comprehensive financial picture, Mr. Cooper couldn’t accurately assess his financial situation and determine his ability to make consistent modified mortgage payments. The incomplete application prevented a thorough review, leading to an immediate denial. The lack of sufficient supporting documentation made it impossible for Mr. Cooper to verify David’s income, expenses, and overall financial stability.

Successful Loan Modification Appeal

Scenario: After receiving a loan modification denial due to insufficient income, Emily meticulously gathered additional documentation to support her appeal. She provided evidence of a recent salary increase, documented additional income from a part-time job, and detailed her efforts to reduce her living expenses. She presented a revised budget showing a clear path to consistent mortgage payments, even with the modified plan. She also included a letter explaining her extenuating circumstances and demonstrating her commitment to maintaining her home. Mr. Cooper, after reviewing her supplemental documentation and revised budget, reassessed her application and approved the loan modification. Her proactive approach in addressing the initial concerns and providing substantial supporting evidence proved crucial in securing the modification.