Makwa Finance Loans

Makwa Finance is a rapidly growing financial institution providing accessible lending solutions to a specific demographic. Understanding their business model, loan offerings, and application process is crucial for potential borrowers. This overview provides a clear picture of what Makwa Finance offers and how it compares to competitors in the market.

Makwa Finance’s Business Model and Target Market

Makwa Finance operates on a digital-first lending model, focusing on speed and convenience. Their target market typically consists of individuals and small businesses with limited access to traditional banking services or those seeking quick loan solutions. This often includes self-employed individuals, gig workers, and entrepreneurs who may not meet the stringent requirements of larger financial institutions. The company leverages technology to streamline the application and approval process, making loans readily available to a wider range of borrowers.

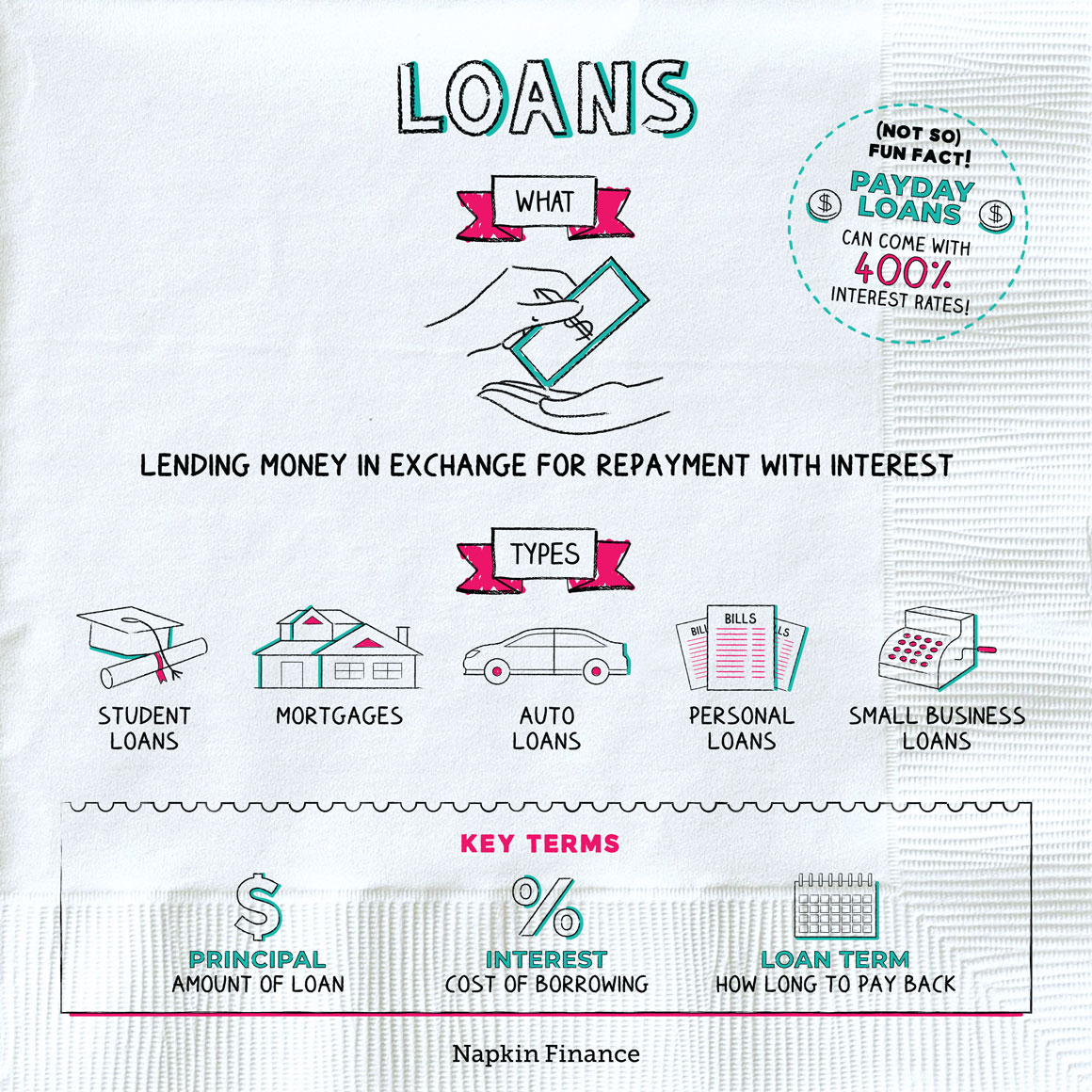

Types of Loans Offered by Makwa Finance

Makwa Finance offers a variety of loan products tailored to different needs and financial situations. These typically include short-term personal loans, small business loans, and potentially lines of credit. The specific loan types and their features might vary depending on regional regulations and market demands. The focus is on providing quick access to funds for immediate needs, such as covering unexpected expenses or funding small business ventures.

Makwa Finance’s Loan Application Process

The application process is designed for simplicity and efficiency. Borrowers typically submit their application online, providing necessary documentation such as proof of income and identification. Makwa Finance utilizes advanced algorithms and credit scoring models to assess creditworthiness and determine loan eligibility quickly. Once approved, funds are usually disbursed electronically within a short timeframe, highlighting the company’s commitment to fast and convenient service.

Comparison of Makwa Finance’s Interest Rates with Competitors

Interest rates offered by Makwa Finance are competitive within the alternative lending market. However, they are generally higher than those offered by traditional banks due to the higher risk associated with lending to borrowers with less-than-perfect credit histories. A direct comparison requires analyzing specific loan terms, credit scores, and market conditions. It’s important for potential borrowers to compare offers from multiple lenders before making a decision. While Makwa Finance might offer faster processing, the overall cost should be carefully weighed against the convenience.

Makwa Finance Loan Products Comparison

The following table provides a general comparison of Makwa Finance loan products. Note that actual interest rates and terms can vary based on individual creditworthiness and loan amount. This is illustrative data and should not be considered a definitive offer.

| Loan Type | Interest Rate (APR) | Loan Amount | Repayment Terms |

|---|---|---|---|

| Short-Term Personal Loan | 18% – 36% | $500 – $5,000 | 3 – 12 Months |

| Small Business Loan | 24% – 48% | $1,000 – $10,000 | 6 – 24 Months |

| Line of Credit | 20% – 40% | $1,000 – $15,000 | Variable |

Makwa Finance Loans

Securing a loan can be a pivotal moment in achieving your financial goals, whether it’s for home improvements, starting a business, or consolidating debt. Understanding the eligibility criteria is crucial before you even begin the application process. This section clarifies the requirements for Makwa Finance Loans, ensuring you’re well-informed and prepared.

Eligibility Requirements for Makwa Finance Loans

Makwa Finance employs a robust yet transparent eligibility process. Several factors determine your suitability for a loan, encompassing your financial history, income stability, and the purpose of the loan itself. Meeting these criteria significantly increases your chances of approval.

Required Documentation for Loan Applications

Providing the correct documentation is essential for a smooth and efficient application process. Incomplete or inaccurate information can lead to delays or rejection. Makwa Finance typically requires specific documents to verify your identity, income, and assets. This often includes government-issued identification, proof of income (pay stubs, tax returns), and bank statements. Additional documents may be requested depending on the loan type and amount.

Credit Score Requirements for Loan Approval

Your credit score plays a significant role in the loan approval process. A higher credit score generally indicates a lower risk to the lender, resulting in better loan terms and a higher likelihood of approval. While Makwa Finance’s specific credit score requirements aren’t publicly listed, it’s safe to assume that a higher credit score will improve your chances. A strong credit history demonstrates responsible financial management, making you a more attractive borrower. Consider improving your credit score before applying if you have concerns.

Comparison of Eligibility Criteria Across Loan Types

Makwa Finance likely offers various loan types, each with its own set of eligibility criteria. For instance, a personal loan might have less stringent requirements compared to a business loan, which usually requires more detailed financial information and projections. Similarly, a home equity loan will necessitate proof of homeownership and property appraisal. Contacting Makwa Finance directly for specifics on individual loan products is highly recommended.

Loan Application and Approval Process Flowchart

Imagine a flowchart starting with “Loan Application Submission.” This leads to “Document Verification,” where all provided documents are checked for completeness and accuracy. Successful verification flows to “Credit Score Assessment,” where the applicant’s creditworthiness is evaluated. A positive assessment proceeds to “Loan Approval/Denial.” If approved, the process moves to “Loan Disbursement,” and finally, “Loan Repayment.” If denied, there’s an option for “Application Reconsideration” or “Alternative Loan Options.” This visual representation simplifies the complex process, highlighting key stages and potential outcomes.

Makwa Finance Loans

Understanding your loan repayment options is crucial for responsible borrowing and maintaining a healthy financial standing. Makwa Finance Loans offers flexible repayment plans designed to suit individual circumstances, but failing to adhere to these agreements can have significant consequences. This section details the various repayment methods, potential repercussions of late payments, and answers common questions regarding the repayment process.

Loan Repayment Options

Makwa Finance Loans provides borrowers with several convenient repayment options. These options are designed to maximize flexibility and accommodate diverse financial situations. Borrowers can choose from monthly installments, bi-weekly payments, or even accelerated repayment plans, depending on the loan amount and term. The specific options available will be clearly Artikeld in your loan agreement. Contacting a Makwa Finance representative can clarify which options best suit your needs and budget.

Consequences of Late or Missed Payments

Late or missed loan payments can lead to several negative consequences, impacting your credit score and overall financial well-being. These consequences can include late fees, increased interest rates, and potential damage to your credit rating, making it harder to secure loans or credit in the future. In severe cases, repeated late payments may result in loan default, leading to collection actions and potential legal repercussions. Understanding the importance of timely payments is essential for maintaining a positive financial history.

Loan Payment Methods

Makwa Finance offers multiple convenient methods for making loan payments. Borrowers can make payments online through the Makwa Finance website, via mobile app, by phone, or through traditional methods such as mail or in-person at designated locations. Each method is secure and designed to streamline the payment process. The specific payment methods available and instructions for each are clearly Artikeld in your loan agreement and on the Makwa Finance website.

Repayment Schedule Examples

To illustrate potential repayment schedules, let’s consider two hypothetical examples. A $5,000 loan with a 12-month term at a 10% annual interest rate might have monthly payments of approximately $445. Conversely, a $10,000 loan with a 24-month term at the same interest rate might have monthly payments of approximately $465. These are illustrative examples, and the actual payment amount will depend on the specific loan terms and interest rate. Your personalized repayment schedule will be clearly detailed in your loan agreement. Remember that these are just examples and your individual repayment schedule will vary.

Frequently Asked Questions Regarding Loan Repayment

Understanding the repayment process is vital for successful loan management. Here are answers to frequently asked questions:

- What happens if I miss a payment? Missing a payment will result in late fees and potentially increased interest rates. Consistent missed payments can severely damage your credit score and lead to collection efforts.

- Can I make extra payments? Yes, Makwa Finance generally allows for extra payments, which can reduce the overall interest paid and shorten the loan term. Contact your loan officer to confirm the procedure.

- How can I access my repayment schedule? Your personalized repayment schedule is available online through your account on the Makwa Finance website, and a copy will be included in your loan agreement.

- What are the accepted payment methods? Makwa Finance accepts payments via online banking, mobile app, phone, mail, and in-person at designated locations. Details are available on the website and in your loan agreement.

- What if I experience financial hardship? If you anticipate difficulty making payments, contact Makwa Finance immediately. They may offer options to help you manage your debt, such as a repayment plan modification.

Makwa Finance Loans

Makwa Finance Loans presents itself as a viable option for individuals seeking financial assistance. Understanding the customer experience is crucial for assessing its true value proposition. This section delves into customer reviews and feedback to provide a balanced perspective on the company’s performance.

Customer Review Summary

Analyzing numerous online reviews and testimonials regarding Makwa Finance Loans reveals a mixed bag of experiences. While some borrowers praise the ease of application and relatively quick processing times, others express dissatisfaction with customer service responsiveness and perceived high interest rates. A significant portion of the feedback centers around the transparency of fees and the overall clarity of the loan agreement. This necessitates a closer examination of both positive and negative aspects to paint a complete picture.

Positive and Negative Aspects of the Customer Experience

Positive feedback frequently highlights the streamlined application process, often cited as user-friendly and efficient. Many borrowers appreciate the speed at which they received loan approvals and disbursements. Conversely, negative feedback consistently points to issues with customer service. Delayed responses to inquiries, difficulty reaching representatives, and a lack of personalized support are common complaints. Furthermore, several reviews mention concerns about the overall cost of the loans, suggesting that interest rates and fees may be higher than advertised or compared to competitors.

Company Responsiveness to Customer Complaints

Determining Makwa Finance’s responsiveness to customer complaints requires a nuanced approach. While some reviews indicate prompt and helpful resolutions to issues, others describe frustrating experiences with unresolved problems and unanswered concerns. A lack of readily available contact information or a difficult-to-navigate complaint process may contribute to these negative experiences. Quantifying the company’s response rate and effectiveness in resolving complaints would require further investigation and access to internal data.

Comparison with Competitors

Comparing Makwa Finance’s customer service to competitors requires specific data points on competitor performance. Without direct comparisons using metrics such as average response times, customer satisfaction scores, or complaint resolution rates, a definitive statement is difficult. However, anecdotal evidence from online reviews suggests that some competitors offer more readily accessible and responsive customer support channels. This perceived difference could be due to varying company structures, staffing levels, or customer service strategies.

Key Aspects of Customer Feedback

- Positive: Easy application process, relatively quick loan approval and disbursement.

- Negative: Unresponsive customer service, high interest rates and fees, lack of transparency in loan agreements.

- Responsiveness: Mixed experiences reported; some positive, some negative with unresolved issues.

- Competitor Comparison: Anecdotal evidence suggests some competitors offer superior customer service.

Makwa Finance Loans

Makwa Finance Loans presents a compelling case study in the lending landscape. Understanding its financial health and stability is crucial for both potential borrowers and investors. This analysis delves into key aspects of the company’s performance, regulatory standing, and inherent risks, providing a comprehensive overview for informed decision-making. We will also compare its financial health against industry benchmarks and examine its organizational structure and management team.

Financial Performance and Stability

Assessing Makwa Finance’s financial performance requires a detailed examination of its financial statements, including balance sheets, income statements, and cash flow statements. Key metrics to consider include profitability (net income, return on assets), liquidity (current ratio, quick ratio), and solvency (debt-to-equity ratio). A strong and consistent track record in these areas would indicate a financially stable institution. For example, a consistently high return on equity coupled with a low debt-to-equity ratio would suggest a healthy and well-managed company. Conversely, declining profitability and increasing debt levels would raise concerns about long-term viability. Independent audits and credit ratings can provide further insight into the company’s financial health.

Regulatory Compliance and Licensing

Operating within a strict regulatory environment is paramount for any financial institution. Makwa Finance’s adherence to all relevant laws and regulations is crucial for its credibility and operational stability. This includes licensing from appropriate authorities, compliance with consumer protection laws, and adherence to anti-money laundering (AML) and know-your-customer (KYC) regulations. Transparency in disclosing its licensing and regulatory approvals builds trust with clients and investors. Any instances of non-compliance can lead to significant penalties and reputational damage, potentially impacting the company’s long-term sustainability.

Potential Risks Associated with Borrowing

Borrowing from any financial institution carries inherent risks. With Makwa Finance, potential risks might include high interest rates, stringent lending criteria, and potential difficulties in repayment. Borrowers should carefully assess their ability to meet repayment obligations before taking out a loan. Understanding the terms and conditions of the loan agreement is also critical, including any fees, penalties for late payments, and the overall cost of borrowing. A thorough comparison of loan offers from different lenders is recommended to ensure the borrower is obtaining the most favorable terms.

Comparison with Industry Benchmarks

Comparing Makwa Finance’s financial health to industry benchmarks provides valuable context. Key performance indicators (KPIs) such as return on equity, net interest margin, and non-performing loan ratios should be compared to those of similar lending institutions. This comparison helps to gauge Makwa Finance’s relative performance and identify any areas of strength or weakness. For example, a higher-than-average non-performing loan ratio might indicate a higher risk profile. Industry reports and financial databases can provide the necessary benchmark data for a meaningful comparison.

Organizational Structure and Management Team

Makwa Finance’s organizational structure and the experience of its management team are vital for its success. A well-defined organizational structure ensures efficient operations and effective risk management. A strong and experienced management team with a proven track record in the financial services industry is crucial for strategic decision-making and navigating market challenges. Transparency in disclosing the organizational structure and the background of key personnel builds confidence and trust among stakeholders. Information on the management team’s experience and qualifications can usually be found on the company’s website or in publicly available financial documents.

Makwa Finance Loans

Securing a loan can be a significant financial decision, impacting your budget and future prospects. Understanding your options is crucial to making the best choice for your specific needs. This section explores alternative loan providers and compares their offerings to those of Makwa Finance Loans, empowering you to make an informed decision.

Alternative Loan Options and Comparisons

Several institutions offer loans, each with varying interest rates, terms, and eligibility criteria. These alternatives include banks, credit unions, online lenders, and peer-to-peer lending platforms. Banks often offer lower interest rates for those with excellent credit scores but may have stricter approval processes and longer application times. Credit unions, typically member-owned, may offer more personalized service and potentially better rates for members, but their loan amounts and offerings might be limited. Online lenders often provide faster approvals and more flexible terms, but interest rates can be higher, especially for borrowers with less-than-perfect credit. Peer-to-peer lending connects borrowers directly with investors, sometimes offering competitive rates, but the process can be more complex.

Comparing Makwa Finance Loans to these alternatives requires considering several factors. While Makwa Finance may offer competitive rates for certain borrowers, other lenders might provide better options depending on individual circumstances. For example, a borrower with a high credit score might find a lower interest rate from a bank, while someone needing a quick loan might prefer the speed of an online lender.

Advantages and Disadvantages of Choosing Makwa Finance

Choosing Makwa Finance Loans presents certain advantages and disadvantages compared to competitors. Potential advantages could include streamlined application processes, competitive interest rates for specific borrower profiles, or flexible repayment options. However, disadvantages might include higher interest rates for borrowers with lower credit scores or less favorable terms compared to other lenders. The overall value proposition of Makwa Finance depends heavily on the individual borrower’s financial situation and loan requirements.

Factors to Consider When Selecting a Loan Provider

Selecting the right loan provider involves careful consideration of several key factors. These include interest rates, loan amounts, repayment terms, fees, eligibility requirements, and the lender’s reputation and customer service. A lower interest rate reduces the overall cost of borrowing, while flexible repayment terms can make managing debt easier. Understanding the fees associated with the loan, such as origination fees or prepayment penalties, is also crucial. Finally, researching the lender’s reputation and customer service history can help avoid potential problems during the loan process.

Comparison Table of Loan Providers

The following table compares Makwa Finance to three hypothetical alternative lenders. Note that actual interest rates, loan amounts, and repayment terms vary depending on individual circumstances and the specific lender. This table serves as an illustrative example.

| Lender | Interest Rate (APR) | Loan Amount (USD) | Repayment Terms (Months) |

|---|---|---|---|

| Makwa Finance | 8.5% – 15% | $5,000 – $50,000 | 12 – 60 |

| Example Bank | 6.0% – 12% | $10,000 – $100,000 | 24 – 72 |

| Online Lender X | 10% – 20% | $1,000 – $25,000 | 6 – 36 |

| Credit Union Y | 7% – 14% | $2,000 – $40,000 | 12 – 48 |