Understanding Loan Officer Commissions

Loan officer commissions are a crucial aspect of the mortgage industry, representing a significant portion of their income. Understanding the various commission structures and factors influencing them is essential for both loan officers and borrowers. This section will delve into the complexities of loan officer compensation, providing a clear picture of how these commissions are determined.

Loan Officer Commission Structures

Loan officers are compensated in various ways, each with its own set of advantages and disadvantages. The most common structures include a salary plus commission, a straight commission, and a tiered commission system. A salary plus commission provides a base salary, offering income stability, with additional earnings based on the volume of loans closed. Straight commission, on the other hand, ties income directly to performance, motivating higher output but carrying greater risk. Tiered commission systems offer increasing commission rates as the loan officer surpasses predetermined targets, incentivizing higher achievement levels. The specific structure employed varies widely depending on the employer and the individual officer’s experience and performance.

Factors Influencing Commission Rates

Several key factors influence the commission rates a loan officer receives. The type of loan significantly impacts the commission; complex loans, such as jumbo loans or commercial loans, often command higher commission rates due to the increased time and expertise required. The lender also plays a crucial role; different lenders have different commission structures and rates reflecting their profit margins and risk assessments. Finally, the loan amount directly influences commission; larger loan amounts generally result in higher commissions, reflecting the increased revenue generated for the lender.

Examples of Commission Structures

The following table illustrates how different loan types, lenders, and loan amounts impact commission rates. These are examples and actual rates may vary significantly based on numerous factors not included in this simplified illustration.

| Loan Type | Lender | Loan Amount | Commission Rate |

|---|---|---|---|

| Conventional Loan | National Lender A | $300,000 | 0.75% |

| FHA Loan | Regional Lender B | $250,000 | 0.50% |

| Jumbo Loan | National Lender C | $750,000 | 1.25% |

| VA Loan | Local Credit Union | $400,000 | 0.60% |

Functionality of a Loan Officer Commission Calculator

A loan officer commission calculator is a powerful tool that streamlines the process of determining compensation. It eliminates manual calculations, saving valuable time and reducing the risk of errors, allowing loan officers to focus on building client relationships and closing deals. This calculator provides a clear and accurate picture of potential earnings, fostering transparency and improving efficiency within the lending process.

A robust loan officer commission calculator offers a range of features designed to handle the complexities of commission structures. It goes beyond simple calculations, providing insights into various scenarios and helping loan officers make informed decisions. Understanding its functionality is crucial for maximizing its benefits and achieving accurate commission projections.

Key Features of a Loan Officer Commission Calculator

A user-friendly loan officer commission calculator should include several key features to ensure accuracy and efficiency. These features are designed to accommodate the nuances of different compensation plans and provide a comprehensive view of potential earnings.

Essential features typically include:

- Loan Amount Input: The calculator must allow the user to input the total loan amount. This is the foundational data point for all subsequent calculations.

- Interest Rate Input: The ability to input the interest rate is crucial, as it directly impacts the lender’s profit and, consequently, the loan officer’s commission.

- Loan Term Input: The loan term (e.g., 15 years, 30 years) significantly influences the overall commission. The calculator needs to accurately account for this variable.

- Commission Structure Input: This is arguably the most important feature. The calculator should be able to handle various commission structures, including tiered commissions (where the commission rate changes based on loan amount), flat-fee commissions, and percentage-based commissions.

- Commission Rate Input: For percentage-based commissions, the user needs to input the applicable commission rate.

- Bonus Structures Input: Many compensation plans incorporate bonuses for exceeding targets or achieving specific milestones. The calculator should allow for the inclusion of these bonus structures.

- Results Display: The calculator should clearly display the calculated commission, broken down into its constituent components (base commission, bonuses, etc.) for transparency.

- Multiple Scenario Analysis: The ability to run multiple scenarios (e.g., different loan amounts, interest rates, or commission structures) is invaluable for planning and decision-making.

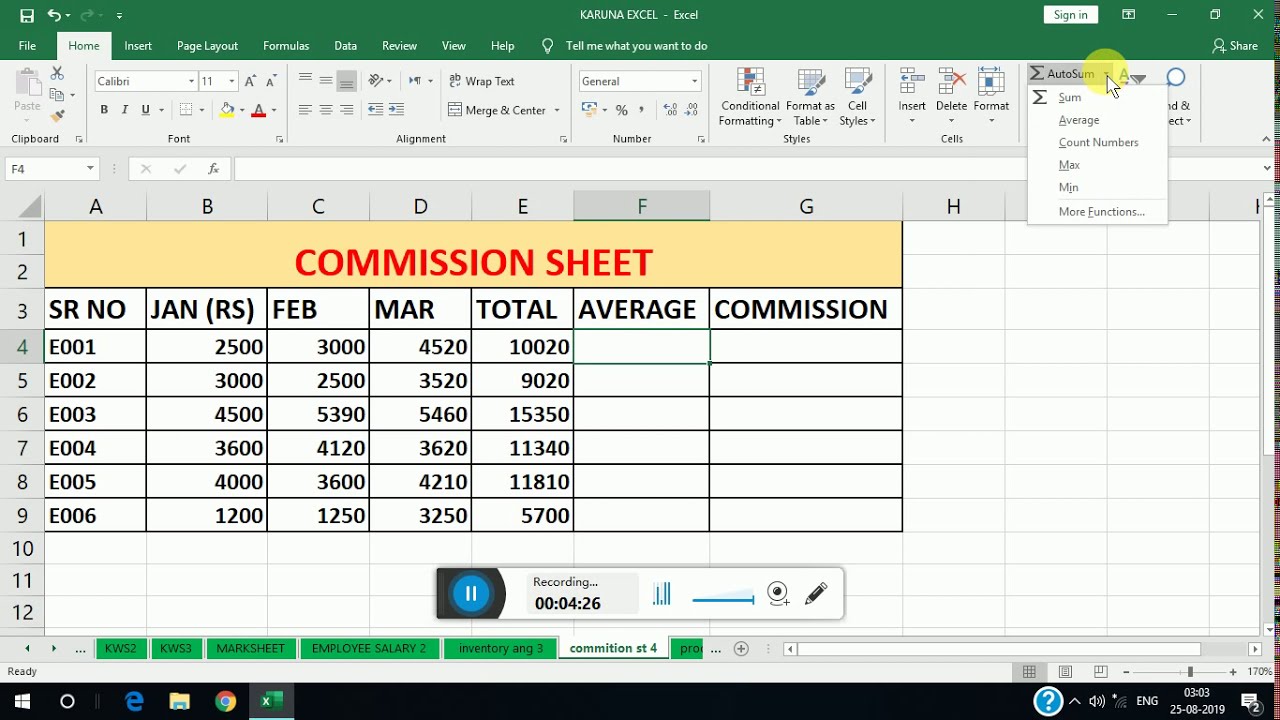

Step-by-Step Data Input and Result Acquisition

The process of using a loan officer commission calculator is designed to be intuitive and straightforward. Let’s Artikel a typical workflow:

- Input Loan Details: Begin by entering the loan amount, interest rate, and loan term into the designated fields.

- Specify Commission Structure: Select the relevant commission structure from the available options (e.g., tiered, flat-fee, percentage-based). If necessary, input the specific commission rate or tiers.

- Add Bonus Information (if applicable): If your compensation includes bonuses, enter the relevant details according to the calculator’s prompts.

- Calculate Commission: Click the “Calculate” button or equivalent to initiate the computation.

- Review Results: The calculator will display the total commission, along with a breakdown of the individual components (base commission, bonuses, etc.).

User Interface Flowchart

Imagine a flowchart. It begins with a rectangular box labeled “Input Loan Details” (loan amount, interest rate, loan term). An arrow leads to a diamond-shaped decision box: “Commission Structure?”. From this, arrows branch to different rectangular boxes representing different commission structures (e.g., “Percentage-Based Commission,” “Tiered Commission,” “Flat Fee Commission”). Each structure box leads to a rectangular box for inputting the specifics of that structure (rate, tiers, or fee amount). All structure-specific input boxes then converge to a rectangular box labeled “Input Bonuses (if applicable)”. This box leads to a rectangular box labeled “Calculate Commission”. Finally, an arrow leads to a terminal box labeled “Display Results” (total commission and breakdown). This visual representation clearly Artikels the logical flow of the calculator’s functionality.

Calculating Commissions with Different Scenarios

Understanding how loan officer commissions are calculated is crucial for both loan officers and lenders. This section will illustrate commission calculations using three distinct loan scenarios, showcasing the impact of varying loan parameters on the final payout. We’ll use a simplified commission structure for clarity, but the principles apply to more complex models.

Commission Calculation Scenarios

Let’s examine three different loan scenarios, each with unique characteristics impacting the final commission earned. We will assume a simplified commission structure where the loan officer receives a percentage of the loan’s total interest earned over the loan’s lifetime. This percentage will be consistent across all scenarios for easy comparison. In reality, commission structures are far more complex, often involving tiered structures, bonuses, and other incentives.

| Scenario | Loan Amount | Interest Rate | Loan Term (Years) | Loan Type | Total Interest Earned (Estimate) | Commission Rate | Commission Earned |

|---|---|---|---|---|---|---|---|

| Scenario 1 | $200,000 | 6% | 30 | Conventional Mortgage | $216,000 | 1% | $2,160 |

| Scenario 2 | $350,000 | 4.5% | 15 | Jumbo Loan | $157,500 | 1% | $1,575 |

| Scenario 3 | $150,000 | 7% | 20 | FHA Loan | $175,000 | 1% | $1,750 |

Impact of Loan Parameters on Commission

The above table demonstrates how different loan parameters significantly influence the final commission amount. Notice that even with a consistent commission rate of 1%, the commission earned varies greatly. A larger loan amount (Scenario 2 vs. Scenario 3) directly translates to a higher commission, even with a lower interest rate and shorter loan term. Conversely, a higher interest rate (Scenario 3 vs. Scenario 1) can result in a higher commission, even if the loan amount is lower. The loan term also plays a crucial role; a longer term (Scenario 1) generally leads to a higher total interest earned and therefore a higher commission, all else being equal. It’s vital for loan officers to understand these relationships to effectively manage their sales strategies and maximize their earnings. Understanding these dynamics allows for more strategic targeting of loan opportunities. For example, focusing on higher loan amounts or longer-term loans can significantly increase overall commission potential.

Comparison of Commission Calculators

Choosing the right loan officer commission calculator can significantly impact your efficiency and accuracy. Two calculators, while both aiming to streamline commission calculations, may differ substantially in their approach and features. Understanding these differences is crucial for selecting the tool best suited to your specific needs.

This comparison highlights the key features and functionalities of two hypothetical loan officer commission calculators: “CommissionPro” and “LoanCalc.” We’ll analyze their strengths and weaknesses to help you make an informed decision.

CommissionPro and LoanCalc Feature Comparison

The following bullet points compare and contrast the core features of CommissionPro and LoanCalc, focusing on their design, functionality, and ease of use. This analysis considers factors like data input methods, calculation speed, reporting capabilities, and overall user experience.

- Data Input: CommissionPro utilizes a streamlined interface with drop-down menus and pre-populated fields for loan types, reducing manual data entry and minimizing errors. LoanCalc, on the other hand, requires more manual input, potentially increasing the risk of human error. This makes CommissionPro more efficient for high-volume users.

- Calculation Speed and Accuracy: CommissionPro boasts a faster calculation engine, delivering results almost instantaneously, even with complex commission structures. LoanCalc’s calculations are slower, particularly with larger datasets, potentially causing delays in processing. Both calculators, however, claim high accuracy, verified through rigorous internal testing.

- Reporting and Visualization: CommissionPro offers comprehensive reporting features, including customizable charts and graphs that visualize commission trends over time. This allows for better data analysis and informed decision-making. LoanCalc provides basic reports, but lacks the advanced visualization capabilities of CommissionPro. This makes CommissionPro more suitable for strategic planning and performance tracking.

- User Interface and Experience: CommissionPro features an intuitive and user-friendly interface, designed to minimize the learning curve. LoanCalc’s interface is more complex and requires a steeper learning curve, potentially leading to frustration for new users. The simpler design of CommissionPro leads to higher user satisfaction and productivity.

- Integration Capabilities: CommissionPro seamlessly integrates with popular CRM and loan origination systems, streamlining the workflow and eliminating the need for manual data transfer. LoanCalc lacks robust integration capabilities, requiring manual data entry from other systems. This makes CommissionPro more suitable for businesses using integrated systems.

Advantages and Disadvantages of Each Calculator

Summarizing the key advantages and disadvantages of each calculator helps to solidify the understanding of their respective strengths and weaknesses. This provides a clear overview for informed decision-making based on individual needs and priorities.

- CommissionPro Advantages: Fast calculation speed, intuitive interface, comprehensive reporting, seamless integration, reduced error rate due to automated data entry.

- CommissionPro Disadvantages: Potentially higher initial cost due to advanced features and integrations.

- LoanCalc Advantages: Lower initial cost, potentially more customizable for very niche commission structures (though this requires significant technical expertise).

- LoanCalc Disadvantages: Slower calculations, complex interface, limited reporting and visualization, lack of integration capabilities, higher potential for human error.

Potential Errors and Limitations: Loan Officer Commission Calculator

While loan officer commission calculators offer a convenient way to estimate earnings, it’s crucial to understand their inherent limitations and potential for inaccuracies. Over-reliance on these tools without critical evaluation can lead to significant discrepancies between projected and actual compensation. Understanding these limitations is key to using calculators effectively and avoiding costly misunderstandings.

Even the most sophisticated calculators rely on input data, and inaccuracies in this data directly impact the final calculation. Furthermore, the complexity of loan commission structures often necessitates simplifying assumptions within the calculator’s algorithm, which can introduce further error. Finally, external factors not accounted for in the calculator can drastically alter the final commission amount.

Data Input Errors

Inaccurate data entry is perhaps the most common source of error. A simple typo in the loan amount, interest rate, or points can significantly alter the calculated commission. For instance, entering a loan amount of $250,000 instead of $250,0000 will result in a drastically lower commission calculation. Similarly, misinterpreting the lender’s fee structure or incorrectly inputting the loan-to-value ratio can lead to substantial inaccuracies. Careful double-checking of all input data is paramount.

Limitations of Simplified Models

Many calculators employ simplified models of commission structures. Real-world compensation plans often involve complex tiered structures, bonuses based on volume or performance metrics, and adjustments for specific loan types or risk profiles. A calculator that doesn’t account for these nuances will likely produce an inaccurate result. For example, a calculator might not account for a bonus paid only after closing a certain number of loans in a quarter, leading to an underestimation of total compensation.

Unforeseen Circumstances

External factors not included in the calculator’s algorithm can dramatically affect a loan officer’s commission. These include changes in interest rates, unexpected delays in loan processing, loan defaults, or lender-imposed adjustments. For example, a sudden increase in interest rates could reduce the number of loan applications, directly impacting the commission earned. Similarly, a delay in closing a loan due to unforeseen circumstances can push the commission payment into a later period, affecting the officer’s cash flow. A calculator cannot predict these events and their impact on the final commission.

Scenario: Incorrectly Calculated Points

Let’s say a loan officer is using a calculator to estimate commission on a $300,000 loan with a 2% commission rate and 1 point. The calculator might only factor in the percentage-based commission and omit the points, leading to a significant underestimation of the total compensation. The actual commission should include both the percentage of the loan amount and the value of the points (1% of $300,000 = $3,000).

Scenario: Ignoring Tiered Commission Structures

Consider a tiered commission structure where the commission rate increases with the number of loans closed. A calculator that doesn’t account for this tiered system will likely underestimate the commission for a loan officer who closes a large number of loans. For example, if the commission rate is 1% for the first 10 loans and 1.5% for subsequent loans, a calculator that assumes a flat 1% rate will significantly undervalue the compensation for someone closing 15 loans.

Visual Representation of Commission Calculations

Data visualization is crucial for understanding complex financial information like loan officer commissions. By visually representing the relationship between loan amounts and earned commissions, we can quickly identify trends, patterns, and potential areas for improvement in commission structures. Effective visualizations allow for a more intuitive grasp of the often intricate calculations involved.

Visualizing commission data helps loan officers, managers, and even clients understand the financial incentives and potential earnings associated with different loan products and volumes. This improved understanding fosters better decision-making and enhances transparency within the lending process.

Loan Amount vs. Commission Earned: A Line Graph

Imagine a line graph where the x-axis represents the loan amount (in thousands of dollars, for example, ranging from $100,000 to $1,000,000) and the y-axis represents the commission earned (also in dollars). The line itself would represent the commission structure. A linear relationship would indicate a consistent commission rate regardless of the loan amount. A steeper slope would show a higher commission rate for larger loans, while a flatter slope would suggest a lower rate or a tiered commission structure. For instance, the line might initially increase slowly, then sharply increase after a certain loan amount threshold, reflecting a tiered commission structure where larger loans earn a higher percentage. Data points along the line would clearly illustrate the commission earned for specific loan amounts. This visual representation makes it instantly clear how commission changes with increasing loan size.

Commission Comparison Across Loan Types: A Bar Chart

A bar chart effectively compares commissions across different loan types. The x-axis would list the various loan types (e.g., conventional mortgages, FHA loans, jumbo loans, etc.). The y-axis would represent the commission earned (in dollars) for a standardized loan amount, say $300,000. Each bar would represent a different loan type, with its height corresponding to the commission earned for that type. A legend would clearly identify each bar. For example, a bar representing jumbo loans might be significantly taller than a bar representing FHA loans, reflecting a higher commission structure for jumbo loans. This chart facilitates easy comparison, highlighting which loan types are more lucrative for loan officers. Adding error bars could illustrate the variability in commissions earned for each loan type, based on factors like the borrower’s credit score or the loan’s complexity.

Utilizing Visualizations for Enhanced Understanding, Loan officer commission calculator

Visual representations, such as the line graph and bar chart described above, significantly improve the understanding of loan officer commission structures. They transform complex numerical data into easily digestible visual information. This allows for quicker identification of trends and patterns, enabling loan officers to strategize their efforts to maximize their earnings. Managers can use these visualizations to assess the effectiveness of different commission structures and make data-driven decisions to optimize their compensation plans. Moreover, these visuals aid in explaining the commission structure to clients, fostering greater transparency and trust. The ability to quickly see the relationship between loan size, loan type, and commission earned empowers all stakeholders with a clearer understanding of the financial incentives involved.

Advanced Commission Calculation Scenarios

Calculating loan officer commissions often involves more than just a simple percentage of the loan amount. Many factors influence the final commission, adding layers of complexity. Understanding these nuances is crucial for accurate compensation and effective business management. This section delves into advanced scenarios involving points, rebates, and other compensation components.

Advanced commission structures often incorporate various compensation elements beyond the basic loan amount percentage. These elements can significantly impact the final commission earned, requiring a more sophisticated calculation method. Accurately accounting for these elements is vital for both loan officers and lenders to ensure fair and transparent compensation practices.

Commission Calculations Involving Points

Points, which represent 1% of the loan amount, are frequently used to adjust interest rates. Loan officers might earn additional commission based on the number of points charged.

The commission calculation might include a base percentage plus an additional percentage for each point charged. For example: Commission = (Base Percentage * Loan Amount) + (Points * Point Percentage * Loan Amount)

Example: A loan officer earns a 1% base commission and an additional 0.2% for each point charged. On a $300,000 loan with 2 points, the commission would be: ($300,000 * 0.01) + (2 * 0.002 * $300,000) = $3,000 + $1,200 = $4,200.

Commission Calculations Involving Rebates

Rebates, offered by lenders to borrowers, can impact the loan officer’s commission. Sometimes, a portion of the rebate is shared with the loan officer, while other times it may reduce the overall commission.

The commission might be reduced by a percentage of the rebate amount. For example: Commission = (Base Percentage * Loan Amount) – (Rebate Amount * Rebate Percentage)

Example: A loan officer earns a 1% commission on a $250,000 loan. The lender offers a $1,000 rebate, and 50% of the rebate is deducted from the loan officer’s commission. The commission would be: ($250,000 * 0.01) – ($1,000 * 0.50) = $2,500 – $500 = $2,000.

Commission Calculations Involving Multiple Loan Products

Loan officers often handle multiple loan products with varying commission structures. Calculating the total commission requires summing the commissions from each individual loan.

Total Commission = Σ (Commission from Loan i) where i represents each individual loan.

Example: A loan officer closes three loans: Loan 1: $200,000 loan with 1% commission = $2,000; Loan 2: $350,000 loan with 0.75% commission = $2,625; Loan 3: $150,000 loan with 1.2% commission = $1,800. Total Commission = $2,000 + $2,625 + $1,800 = $6,425.

Commission Calculations with Tiered Commission Structures

Some compensation plans use tiered structures, where the commission rate increases with the loan volume.

The commission is calculated based on the loan amount falling within specific tiers, each with a different commission rate.

Example: A loan officer earns 0.75% on loans up to $250,000, 1% on loans between $250,001 and $500,000, and 1.25% on loans exceeding $500,000. A $400,000 loan would earn a commission of: ($250,000 * 0.0075) + ($150,000 * 0.01) = $1,875 + $1,500 = $3,375.