Understanding Loan IQ Basics: Loan Iq Tutorial

Loan IQ, from S&P Global, is a powerful loan management system used by financial institutions worldwide to streamline their lending processes. It’s a comprehensive solution offering a suite of functionalities designed to improve efficiency, reduce risk, and enhance overall profitability in loan origination, servicing, and portfolio management. Understanding its core features is crucial for anyone involved in the financial industry’s lending operations.

Loan IQ’s core functionalities revolve around providing a centralized platform for managing the entire loan lifecycle. This includes everything from initial loan application and underwriting to ongoing servicing, reporting, and analysis. Its strength lies in its ability to automate many manual processes, reducing errors and freeing up staff for more strategic tasks. The system provides a single source of truth for all loan-related data, ensuring consistency and accuracy across the organization.

Loan IQ Modules

Loan IQ is comprised of several interconnected modules, each designed to address a specific aspect of the loan lifecycle. These modules work together seamlessly to provide a holistic view of the loan portfolio. Understanding the functionality of each module is key to effectively utilizing the system. A typical implementation might include, but is not limited to, modules for origination, underwriting, closing, servicing, collections, and reporting. The specific modules implemented will vary depending on the institution’s needs and the complexity of its lending operations. For example, a large commercial bank will likely utilize a broader range of modules compared to a smaller community bank.

Navigating the Loan IQ Interface

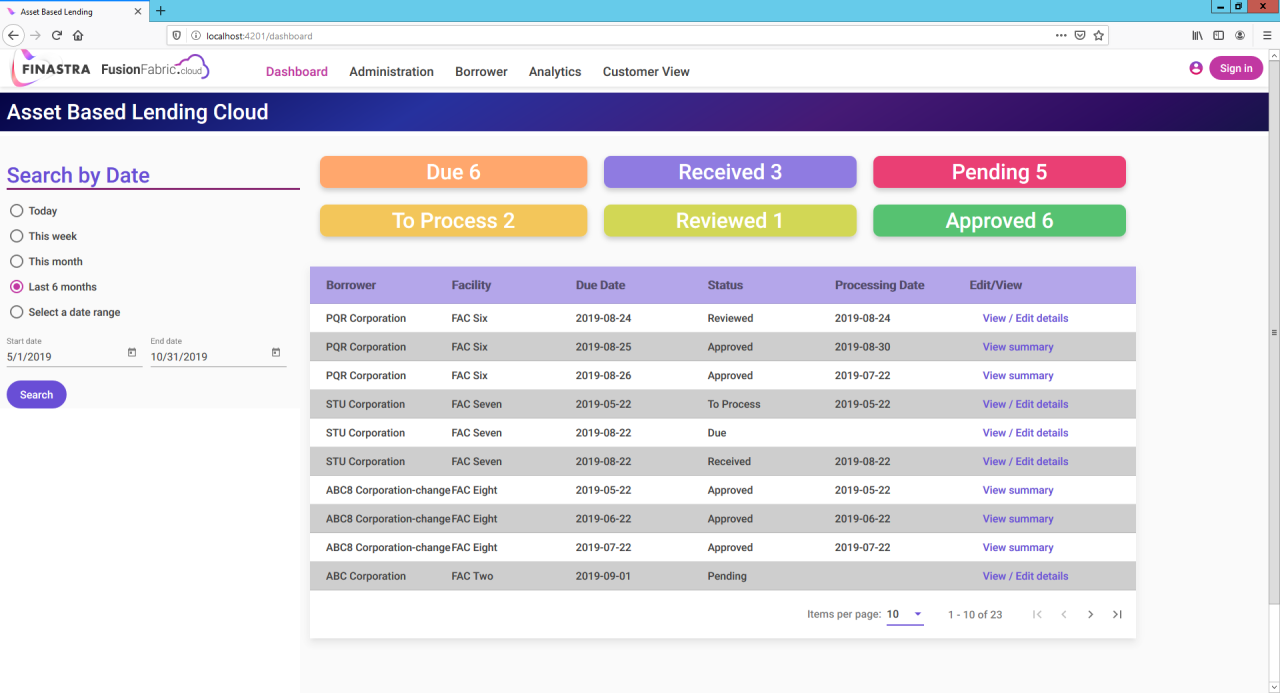

The Loan IQ interface, while feature-rich, is generally intuitive and user-friendly once the basic navigation is understood. Users typically begin on a dashboard providing a high-level overview of key metrics and alerts. From the dashboard, users can access various modules and functionalities through a clearly defined menu system. Data is presented in a clear and concise manner, utilizing tables, charts, and other visual aids to facilitate analysis. The system often incorporates robust search and filtering capabilities to quickly locate specific loans or data points. For example, a loan officer might use the search function to find all loans with a specific borrower or maturity date. Advanced users can leverage more sophisticated query tools to extract customized reports and analyses.

Loan IQ Feature Comparison

The following table compares Loan IQ’s key features against two other commonly used loan management systems, System A and System B (Note: System A and System B are placeholder names; specific systems would need to be identified for a true comparison). This comparison highlights Loan IQ’s strengths and weaknesses relative to other solutions available in the market. The specific features and functionalities offered by each system will vary based on the version and customization.

| Feature | Loan IQ | System A | System B |

|---|---|---|---|

| Automated Underwriting | Yes, with advanced rules engine | Yes, limited rules engine | No |

| Real-time Reporting | Yes, customizable dashboards | Yes, limited customization | Yes, basic reporting only |

| Integration Capabilities | Extensive API and third-party integrations | Limited integration capabilities | Proprietary integrations only |

| Workflow Automation | Highly configurable workflows | Basic workflow automation | Manual processes primarily |

| Security | Robust security features, including encryption and access controls | Standard security features | Standard security features |

Loan IQ Data Management

Mastering Loan IQ isn’t just about understanding its functionalities; it’s about effectively managing the lifeblood of your lending operations: your data. Efficient data management in Loan IQ directly translates to streamlined workflows, reduced errors, and ultimately, improved decision-making. This section will equip you with the strategies and techniques to become a data management powerhouse within the Loan IQ environment.

Importing and Exporting Data in Loan IQ

Importing and exporting data is fundamental to any robust data management strategy. Loan IQ offers several methods for seamlessly integrating with external systems and transferring data. Common import methods include using flat files (like CSV or TXT), database connections (such as SQL Server or Oracle), and even through specialized APIs. The specific method chosen depends on the source system and the volume of data being transferred. Export functionalities are equally versatile, allowing you to extract data for reporting, analysis, or integration with other applications. Careful planning of data formats and mapping is crucial to ensure a smooth and error-free transfer process. Consider factors like data transformation needs, data cleansing requirements, and the frequency of data transfers when designing your import/export processes. For example, a large bank might use a scheduled nightly batch process to import loan application data from their core banking system, while a smaller institution might opt for manual uploads.

Data Validation and Cleansing Techniques

Data quality is paramount. Inaccurate or incomplete data leads to flawed analysis and poor decision-making. Loan IQ provides built-in validation rules and tools to ensure data integrity. These checks can be configured to identify inconsistencies, missing values, and data type errors during the import process. For instance, you might set a rule to flag loan applications with missing interest rates or incorrect loan amounts. Beyond these built-in features, implementing custom validation scripts or using external data cleansing tools can significantly enhance data quality. A common technique involves comparing imported data against a reference dataset to identify discrepancies and outliers. Consider employing regular data profiling and cleansing procedures to maintain the accuracy and reliability of your loan data over time.

Best Practices for Organizing and Managing Loan Data

Effective organization is key to efficient data management. Establish a clear data governance framework, defining data ownership, access rights, and data quality standards. Employ a consistent naming convention for your data fields and attributes to avoid ambiguity. Consider using Loan IQ’s metadata capabilities to document data definitions and relationships. Regularly review and update your data dictionary to ensure it reflects the current state of your data. Furthermore, leverage Loan IQ’s reporting and analytics features to monitor data quality and identify potential issues proactively. Implementing a robust data archiving strategy is also crucial for long-term data management and regulatory compliance.

Workflow for Handling Data Updates and Changes

Managing data updates requires a structured approach. Establish a clear change management process that includes steps for requesting changes, reviewing and approving changes, and implementing changes in a controlled manner. Consider using a version control system to track changes and revert to previous versions if necessary. Implement robust audit trails to document all data modifications and track who made the changes. This ensures accountability and allows for easy troubleshooting in case of errors. Regularly communicate changes to relevant stakeholders and provide training to users on the updated data structures and processes. For instance, a well-defined workflow might involve submitting change requests through a ticketing system, followed by review and approval by designated personnel before the changes are implemented in the Loan IQ system. This minimizes errors and maintains data consistency.

Loan Lifecycle Management with Loan IQ

Loan IQ isn’t just a database; it’s a comprehensive platform designed to streamline and optimize the entire loan lifecycle. From the initial application to final loan closure, Loan IQ provides the tools and insights necessary for efficient loan management, minimizing risk and maximizing profitability. This section will delve into how Loan IQ supports each stage of this process, highlighting key performance indicators and reporting capabilities.

Loan iq tutorial – Loan IQ’s strength lies in its ability to manage the entire loan journey, offering a centralized system for tracking and analyzing data at every stage. This holistic approach provides a single source of truth, eliminating data silos and improving collaboration across teams. This unified view allows for better decision-making, enhanced risk management, and ultimately, improved operational efficiency.

Loan Origination and Underwriting

Loan IQ supports the origination process by providing tools for managing applications, conducting credit checks, and assessing risk. Key data points, such as borrower information, collateral details, and credit scores, are captured and analyzed within the system to streamline the underwriting process. Automated workflows can be configured to expedite approvals and reduce processing time, leading to faster loan disbursements. For example, automated checks against internal and external databases for fraud detection can be implemented, reducing the risk of non-performing loans.

Loan Booking and Funding

Once a loan is approved, Loan IQ facilitates the booking and funding process. The system automatically generates necessary documentation, tracks funding disbursements, and updates loan status information. This ensures accuracy and reduces the risk of errors. Real-time tracking of funds ensures timely disbursement and reduces delays in the loan process. For instance, integration with payment systems allows for immediate confirmation of loan disbursement.

Loan Servicing and Monitoring

Loan IQ provides robust tools for monitoring loan performance throughout its lifecycle. Key metrics such as outstanding principal balance, interest payments, and delinquency rates are tracked and analyzed. Automated alerts can be configured to notify relevant personnel of potential issues, allowing for proactive intervention. This real-time monitoring minimizes losses and ensures compliance with regulatory requirements. A loan portfolio might be flagged if a significant percentage of loans show signs of delinquency, prompting a deeper investigation and potentially adjustments to lending criteria.

Loan Portfolio Reporting and Analysis

Loan IQ offers a range of reporting and analytics capabilities to provide insights into loan portfolio performance. Pre-built reports provide a summary of key metrics, while custom reports can be created to address specific needs. These reports help identify trends, assess risk, and inform strategic decision-making. Examples include reports showing delinquency rates by loan type, geographic location, or credit score, which allows for targeted interventions and risk mitigation strategies. For example, a report might reveal a high delinquency rate among loans issued in a specific region, prompting a review of lending practices in that area.

Loan Modification and Workout

Loan IQ assists in managing loan modifications and workouts for loans experiencing financial distress. The system tracks modifications, such as interest rate changes or payment deferrals, and updates loan status accordingly. This ensures accurate reporting and facilitates the workout process. By providing a centralized record of all modifications, Loan IQ helps maintain compliance and transparency. For instance, a detailed audit trail of all loan modifications allows for easy tracking and reporting to regulatory bodies.

Loan Closure and Archiving

Finally, Loan IQ facilitates the closure and archiving of loans. The system tracks the final payment, updates loan status, and archives relevant documentation. This ensures compliance and provides a historical record of loan performance. The archived data can be used for future analysis and reporting. Automated processes for generating final statements and closing documentation further streamline this final stage of the loan lifecycle. This reduces manual effort and minimizes the risk of errors in the final stages of loan management.

Managing Different Loan Types

Loan IQ is designed to handle a variety of loan types, including mortgages, commercial loans, consumer loans, and more. The system’s flexible configuration allows for the customization of workflows and reporting to meet the specific requirements of each loan type. For example, the system can be configured to track different metrics for mortgages compared to commercial loans, reflecting the unique characteristics of each loan type. This ensures that the system effectively supports the specific needs of each loan product offered by the financial institution.

Loan IQ Reporting and Analytics

Loan IQ’s robust reporting and analytics capabilities are a game-changer for loan portfolio management. Unlocking the power of this functionality allows financial institutions to move beyond simple data aggregation and delve into insightful analysis that drives strategic decision-making, risk mitigation, and ultimately, profitability. This section will dissect the key aspects of Loan IQ reporting, showcasing its power and versatility.

Sample Loan Performance Report

A typical Loan IQ report might analyze a portfolio’s performance across several key metrics. Imagine a report summarizing the performance of a commercial real estate loan portfolio. It would likely include columns for loan ID, borrower name, loan amount, outstanding balance, interest rate, days past due, loan-to-value ratio (LTV), and delinquency status. A summary section at the top might show aggregate statistics such as average LTV, weighted average interest rate, total outstanding balance, and percentage of delinquent loans. Further analysis might segment the portfolio by geographic location or property type to reveal performance variations. Visualizations like charts and graphs would enhance understanding, for example, a bar chart showing delinquency rates by property type or a line graph tracking the portfolio’s overall outstanding balance over time. This detailed view provides a clear picture of the portfolio’s health and identifies areas needing attention.

Types of Loan IQ Reports and Their Uses

Loan IQ offers a diverse range of reports catering to various needs. Standard reports include portfolio summaries, individual loan details, aging reports, and delinquency reports. These provide a snapshot of the overall portfolio health and individual loan performance. More advanced reports can delve into credit risk analysis, including probability of default calculations and stress testing scenarios. Regulatory reports ensure compliance with various financial regulations. Customizable dashboards allow users to track key performance indicators (KPIs) in real-time, providing a dynamic view of the portfolio’s performance. The choice of report depends on the specific analytical needs, ranging from high-level overviews to granular detail for specific loans or borrowers.

Customizing Loan IQ Reports

Loan IQ’s flexibility shines in its report customization options. Users can tailor reports by selecting specific data fields, applying filters to focus on particular segments of the portfolio, and choosing different visualization methods (tables, charts, graphs). For instance, a user might create a custom report focusing solely on loans with LTV ratios above 80%, filtering by specific geographic regions, and displaying the data in a bar chart to easily compare risk levels across different areas. This allows for in-depth analysis tailored to specific business needs and regulatory requirements. The ability to create custom reports is crucial for efficient portfolio management and informed decision-making.

Comparison of Loan IQ Reporting with Other Systems

While other loan management systems offer reporting capabilities, Loan IQ often distinguishes itself through its depth, flexibility, and integration with the core loan management functions. Many competing systems may lack the same level of customization or the ability to seamlessly integrate data from various sources within the system. This integrated approach minimizes data discrepancies and enhances the accuracy and reliability of the reports. While some systems might excel in specific areas, such as regulatory reporting, Loan IQ’s comprehensive suite of reporting tools and its ability to adapt to evolving business needs often positions it as a leading solution for sophisticated financial institutions. The specific advantages will depend on the individual needs and priorities of the institution.

Advanced Loan IQ Features

Unlocking the true power of Loan IQ goes beyond the basics. Mastering its advanced features is crucial for maximizing efficiency, ensuring regulatory compliance, and gaining a competitive edge in the financial landscape. This section delves into the sophisticated capabilities that transform Loan IQ from a simple loan management system into a strategic asset.

Loan IQ for Regulatory Compliance

Loan IQ offers robust tools to streamline regulatory compliance. Its comprehensive data management capabilities allow for easy tracking and reporting of critical information required by various regulatory bodies, such as Basel III, Dodd-Frank, and others. Automated workflows ensure consistent adherence to regulatory guidelines, minimizing the risk of errors and penalties. For example, the system can automatically generate reports demonstrating compliance with loan-to-value ratio (LTV) requirements, providing an auditable trail for regulatory scrutiny. This reduces manual effort and significantly lowers the likelihood of non-compliance. The system’s configuration options allow for customization based on specific jurisdictional regulations, ensuring ongoing compliance as rules evolve.

Loan IQ Integration Capabilities

Seamless integration with other core banking systems, CRM platforms, and data warehouses is a cornerstone of effective Loan IQ deployment. This interoperability eliminates data silos and ensures a holistic view of the loan portfolio. For instance, integrating Loan IQ with a core banking system allows for real-time updates on loan balances, payments, and other critical data points. Integration with a CRM system provides a unified view of customer interactions and loan performance, improving customer service and risk management. The potential for customized integrations extends to specialized systems, such as fraud detection platforms or credit scoring models, enriching the overall functionality of Loan IQ and enabling proactive risk management strategies. The specific integration methods may vary (e.g., APIs, ETL processes), but the objective remains consistent: enhanced data flow and operational efficiency.

Optimizing Loan IQ Performance and Efficiency

Optimizing Loan IQ involves a multifaceted approach. Regular system maintenance, including database optimization and performance tuning, is paramount. Establishing clear data governance policies, including data quality standards and validation rules, ensures the integrity of the information used for decision-making. Proper user training and the adoption of best practices in data entry and workflow management are also crucial. Consider implementing a robust workflow automation strategy to streamline repetitive tasks, reducing manual intervention and potential for errors. Regular performance monitoring, using built-in tools or third-party monitoring solutions, allows for proactive identification and resolution of bottlenecks. For example, analyzing query performance can identify areas for database optimization, significantly improving response times.

Loan IQ Security Features

Robust security is non-negotiable for any loan management system. Loan IQ employs multiple layers of security, including access controls based on user roles and permissions, encryption of sensitive data both in transit and at rest, and regular security audits. Multi-factor authentication (MFA) further strengthens security by requiring multiple forms of verification before granting access. The system’s audit trails provide a comprehensive record of all user activities, facilitating investigation and accountability. Regular security updates and patching are crucial to protect against emerging threats. Furthermore, adhering to industry best practices for data security, such as PCI DSS compliance (where applicable), ensures the protection of sensitive customer and financial data. This multi-layered approach minimizes the risk of data breaches and unauthorized access.

Troubleshooting and Support in Loan IQ

Mastering Loan IQ isn’t just about understanding its features; it’s about navigating the inevitable bumps in the road. This section will equip you with the troubleshooting skills and support resources necessary to overcome common challenges and maximize your efficiency within the Loan IQ platform. Proactive problem-solving is key to leveraging Loan IQ’s full potential.

Common Loan IQ Issues and Solutions

Many issues stem from data entry errors, incorrect configurations, or a lack of understanding of specific functionalities. Addressing these problems quickly is crucial for maintaining data integrity and operational efficiency. Here’s a breakdown of common problems and their solutions:

- Problem: Incorrect calculation of loan amortization schedules. Solution: Review the input parameters, particularly interest rates, loan terms, and payment frequencies. Double-check for any typos or inconsistencies in the data. Consult the Loan IQ documentation for the correct formula used in amortization calculations. Consider using Loan IQ’s built-in validation tools to identify errors before processing.

- Problem: Data import errors. Solution: Ensure the imported data adheres to Loan IQ’s specified format. Check for data type mismatches, missing values, or inconsistencies in data fields. Use Loan IQ’s data validation features to identify and correct errors before importing. If the problem persists, contact support for assistance.

- Problem: System performance issues (slow processing, freezes). Solution: Check your system’s resources (RAM, CPU). Ensure your Loan IQ instance is up-to-date with the latest patches and updates. Contact your IT department or Loan IQ support if the problem persists, providing details on the system specifications and the actions leading up to the issue. Consider optimizing your queries and reports to reduce processing time.

Accessing Loan IQ Support Resources

Effective troubleshooting often begins with readily available support. Loan IQ offers a range of resources to help you resolve issues quickly and efficiently.

- Loan IQ Documentation: Comprehensive manuals, user guides, and FAQs provide detailed explanations of Loan IQ’s functionalities and troubleshooting steps. This is often the first place to look for answers.

- Online Knowledge Base: A searchable database of solutions to common problems, articles, and tutorials provides quick access to relevant information.

- Dedicated Support Team: For complex issues or those not addressed in the documentation, contacting the Loan IQ support team directly via phone or email is crucial. Be prepared to provide detailed information about the issue, including screenshots and error messages.

- Community Forums: Engaging with other Loan IQ users in online forums can provide valuable insights and solutions to problems you might be facing. This collaborative approach often reveals workarounds or alternative solutions.

Troubleshooting Data Errors in Loan IQ

Data integrity is paramount in Loan IQ. Effective strategies for troubleshooting data errors involve a systematic approach.

- Identify the Error: Pinpoint the specific data error, including the location (e.g., specific deal, field, report), the type of error (e.g., missing data, incorrect data type), and the impact of the error.

- Isolate the Source: Determine the source of the error. Was it due to manual entry, data import, or a system glitch? Trace the data’s journey through the system to identify the point of origin.

- Implement Corrective Actions: Based on the source and type of error, take corrective actions. This may involve correcting data entries, re-importing data, or adjusting system configurations. Utilize Loan IQ’s validation tools to ensure accuracy.

- Document the Process: Maintain a record of the troubleshooting steps, the solution implemented, and the outcome. This documentation helps prevent similar errors in the future and provides valuable information for support if needed.

Frequently Asked Questions Regarding Loan IQ Usage, Loan iq tutorial

Addressing common questions proactively streamlines the learning process and prevents future issues.

- Question: How do I create a new loan in Loan IQ? Answer: The process involves navigating to the “New Loan” section, inputting relevant deal information, and selecting appropriate loan parameters. The specific steps are detailed in the Loan IQ user manual.

- Question: How do I generate reports in Loan IQ? Answer: Loan IQ offers a range of reporting capabilities. You can generate pre-defined reports or create custom reports using the reporting tools. Consult the Loan IQ documentation for detailed instructions on report creation and customization.

- Question: How do I manage user permissions in Loan IQ? Answer: Access control and user permissions are managed through the system’s administrative interface. This allows for granular control over user access and data security. Consult the Loan IQ administrator’s guide for specific instructions.

Illustrative Loan Scenarios in Loan IQ

Loan IQ’s power lies not just in its features, but in its ability to handle complex financial scenarios with ease and precision. Understanding how to apply Loan IQ in real-world situations is crucial for maximizing its potential. The following scenarios illustrate Loan IQ’s capabilities in managing diverse loan structures, performing portfolio analysis, and handling loan modifications.

Complex Loan Structure Processing

This scenario involves a syndicated loan with multiple tranches, each having different interest rates, maturities, and repayment schedules. The borrower is a large corporation needing financing for a major expansion project. In Loan IQ, we would first define the overall loan, specifying the total amount, borrower information, and general terms. Then, we would create separate tranches within the loan, each with its own detailed parameters. This allows for precise tracking of cash flows, interest calculations, and amortization schedules for each tranche. Loan IQ’s functionality allows for the automatic calculation of interest payments based on the specific terms of each tranche, including any applicable fees or adjustments. Furthermore, the system facilitates the management of different lender participation percentages and their corresponding payouts. Reporting features would provide a comprehensive overview of the loan’s performance, broken down by tranche, allowing lenders to monitor their investments effectively. This detailed breakdown of a complex structure demonstrates Loan IQ’s capacity to handle intricate financial instruments with accuracy and transparency.

Loan Portfolio Analysis

A financial institution uses Loan IQ to analyze its commercial loan portfolio to assess risk and identify potential opportunities. The analysis involves creating custom reports that segment the portfolio based on various criteria such as industry, loan type, credit rating, and geographic location. Loan IQ’s reporting tools allow for the generation of detailed summaries, including key metrics like average loan size, delinquency rates, and loan-to-value ratios for each segment. This data visualization provides insights into the overall portfolio health and potential concentration risks. For example, a high concentration of loans in a specific industry facing economic headwinds might highlight a potential area of concern. Furthermore, Loan IQ can generate stress tests simulating different economic scenarios to assess the portfolio’s resilience under various conditions. The results of this analysis inform strategic decision-making, allowing the institution to proactively manage risk and optimize its lending strategies. This scenario highlights Loan IQ’s powerful analytical capabilities for informed risk management and portfolio optimization.

Loan Modification and Amendment Management

Imagine a borrower experiencing financial difficulties requiring a loan modification. Using Loan IQ, the lender can easily amend the existing loan agreement. This might involve adjusting the interest rate, extending the repayment term, or restructuring the payment schedule. Loan IQ automatically recalculates the loan’s amortization schedule, reflecting the changes made. The system generates updated documentation, including amended loan agreements and revised payment schedules, ensuring compliance and accuracy. The entire modification process is tracked within Loan IQ, providing a complete audit trail of all changes made to the loan. This facilitates transparency and ensures regulatory compliance. This streamlined process minimizes manual effort and reduces the risk of errors, demonstrating Loan IQ’s efficiency in managing loan modifications and amendments. The system’s audit trail also ensures regulatory compliance and provides a detailed history of all changes made to the loan.