Understanding Home Equity Loan Rates in Rochester, NY

Securing a home equity loan can be a powerful financial tool, allowing homeowners in Rochester, NY, to tap into their home’s equity for various needs, from home improvements to debt consolidation. However, understanding the intricacies of home equity loan rates is crucial for making informed decisions and securing the best possible terms. This section will dissect the key factors influencing these rates, compare fixed versus variable options, detail associated fees, and illustrate the impact of different loan terms on overall borrowing costs.

Factors Influencing Home Equity Loan Rates in Rochester, NY

Several interconnected factors determine the interest rate you’ll receive on a home equity loan in Rochester. Your credit score is paramount; a higher score typically translates to a lower rate. The loan-to-value ratio (LTV), calculated by dividing the loan amount by your home’s value, also plays a significant role. A lower LTV generally results in a better rate because it represents less risk for the lender. Prevailing market interest rates, influenced by broader economic conditions, directly impact the rates offered. Finally, the terms of the loan itself, including the loan amount and repayment period, will affect the final interest rate. Lenders often offer more competitive rates for larger loans with shorter repayment terms.

Fixed vs. Variable Interest Rates for Home Equity Loans in Rochester, NY

Home equity loans in Rochester typically offer two primary interest rate structures: fixed and variable. A fixed-rate loan provides predictable monthly payments throughout the loan’s term, shielding you from interest rate fluctuations. This predictability offers financial stability, allowing for better budgeting. Conversely, a variable-rate loan’s interest rate adjusts periodically based on an underlying index, such as the prime rate. While initially, a variable rate might be lower than a fixed rate, it carries the risk of increasing significantly over time, leading to higher monthly payments. The choice between fixed and variable hinges on your risk tolerance and long-term financial outlook. For instance, someone prioritizing stability might opt for a fixed rate, while someone comfortable with some risk and anticipating potentially lower rates in the future might prefer a variable rate.

Typical Fees Associated with Obtaining a Home Equity Loan in Rochester, NY

Obtaining a home equity loan in Rochester usually involves several fees. These can include an appraisal fee to assess your home’s value, an origination fee charged by the lender to process the loan, and potentially title insurance and recording fees. Some lenders may also charge prepayment penalties if you pay off the loan early. It’s crucial to understand all associated fees upfront to accurately assess the total cost of borrowing. For example, an appraisal fee might range from $300 to $500, while origination fees can vary significantly depending on the lender and loan amount, potentially reaching several hundred or even thousands of dollars. These fees should be factored into your overall budget and compared across different lenders to find the most cost-effective option.

Examples of Different Loan Terms and Their Impact on the Total Cost of Borrowing

Consider two hypothetical scenarios: a $50,000 home equity loan with a 10-year term at a 6% fixed interest rate versus the same loan amount with a 15-year term at the same interest rate. The shorter-term loan will have higher monthly payments but result in significantly less interest paid over the life of the loan. Conversely, the longer-term loan will have lower monthly payments, but you’ll pay considerably more in interest over time. For the 10-year loan, the total interest paid might be approximately $10,000, while for the 15-year loan, this figure could exceed $18,000. This illustrates how loan term significantly impacts the total cost of borrowing, requiring careful consideration of your financial capacity and long-term goals. A longer repayment period offers lower monthly payments but increases the overall interest expense. A shorter term provides higher monthly payments but reduces the total interest paid.

Finding Lenders in Rochester, NY

Securing a home equity loan requires careful consideration of lenders. The right lender can significantly impact your interest rate, fees, and overall loan experience. Understanding the different types of lenders and their respective processes is crucial for making an informed decision.

Finding the best home equity loan lender in Rochester, NY, involves comparing options across various institutions. This process necessitates examining not only interest rates but also the nuances of each lender’s application procedures and associated fees. Let’s delve into the key players in the Rochester, NY lending landscape.

Types of Lenders Offering Home Equity Loans in Rochester, NY

Rochester, NY, offers a diverse range of lenders for home equity loans. Borrowers typically have three primary options: banks, credit unions, and online lenders. Each presents unique advantages and disadvantages. Banks generally offer a wide array of financial products, including home equity loans, and often have extensive branch networks. Credit unions, being member-owned cooperatives, often provide more personalized service and potentially lower rates to their members. Online lenders leverage technology to streamline the application process, often resulting in quicker approvals, but may lack the personalized touch of traditional institutions.

Comparison of Application Processes

Let’s compare the application processes of two prominent lender types in Rochester, NY: a local bank and a credit union. A typical bank application usually involves an in-person meeting, a comprehensive review of your financial documents (income statements, credit reports, etc.), and a formal appraisal of your home. This process can take several weeks. In contrast, a credit union might offer a more streamlined process, possibly allowing for online application submission and potentially faster approval times, particularly for existing members. However, the required documentation will still be similar. The key difference lies in the level of personal interaction and the overall speed of processing. For example, First Niagara Bank (assuming they offer home equity loans in Rochester, NY) might have a more traditional, in-person focused approach, whereas a local credit union like, for instance, Rochester Community Credit Union, might offer a more blended online/in-person experience. These are illustrative examples, and actual processes may vary.

Interest Rates, Fees, and Loan Terms Comparison

The following table provides a hypothetical comparison of interest rates, fees, and loan terms from three different lenders in Rochester, NY. Remember that these are examples only, and actual rates and fees will vary depending on your credit score, loan amount, and the specific lender’s offerings at any given time. It’s crucial to obtain current quotes directly from each lender before making a decision.

| Lender Type | Interest Rate (APR) | Closing Costs | Loan Term (Years) |

|---|---|---|---|

| Local Bank (Example: First Niagara Bank) | 6.5% – 8.5% | $1,500 – $3,000 | 10 – 15 |

| Credit Union (Example: Rochester Community Credit Union) | 6.0% – 7.5% | $1,000 – $2,500 | 10 – 15 |

| Online Lender (Example: Hypothetical Online Lender) | 6.8% – 8.8% | $800 – $2,000 | 5 – 15 |

Assessing Your Financial Eligibility: Home Equity Loan Rates Rochester Ny

Securing a home equity loan in Rochester, NY, hinges on your financial standing. Lenders meticulously assess your creditworthiness to determine your eligibility and the terms they’ll offer. Understanding these key financial aspects is crucial for a smooth application process and securing the best possible interest rate.

Credit Score Requirements

A strong credit score is paramount for obtaining favorable home equity loan terms. Lenders in Rochester, NY, typically prefer applicants with credit scores above 660, though some may consider applicants with scores as low as 620. However, a higher credit score usually translates to lower interest rates and more favorable loan terms. A score below 620 significantly reduces your chances of approval or may result in higher interest rates and stricter loan conditions. Improving your credit score before applying is a proactive step to enhance your eligibility and negotiating power. This might involve paying down existing debts, correcting any errors on your credit report, and consistently making on-time payments.

Debt-to-Income Ratio

Your debt-to-income ratio (DTI) is another critical factor lenders consider. This ratio represents the percentage of your gross monthly income dedicated to debt repayment. It’s calculated by dividing your total monthly debt payments (including mortgage, credit card payments, car loans, student loans, etc.) by your gross monthly income. Lenders generally prefer a DTI below 43%, although this can vary depending on the lender and the specific loan terms. A lower DTI indicates a greater capacity to manage additional debt, making you a less risky borrower. To improve your DTI, you might consider paying down high-interest debts or increasing your income.

Loan-to-Value Ratio

The loan-to-value ratio (LTV) measures the loan amount relative to your home’s value. It’s calculated as follows:

LTV = (Loan Amount / Home Value) x 100

For example, if you have a home valued at $300,000 and you’re seeking a $50,000 home equity loan, your LTV would be (50,000 / 300,000) x 100 = 16.67%. A lower LTV is generally preferred by lenders, as it reduces their risk. A higher LTV might lead to higher interest rates or the requirement for private mortgage insurance (PMI). It’s important to accurately assess your home’s value through a recent appraisal to ensure an accurate LTV calculation.

Required Documents for Application

Preparing the necessary documentation beforehand streamlines the application process. Having these documents readily available demonstrates your preparedness and professionalism. The typical checklist includes:

- Government-issued photo identification (driver’s license or passport)

- Social Security number

- Proof of income (pay stubs, tax returns, W-2 forms)

- Proof of residence (utility bills, bank statements)

- Home appraisal (recent and professionally conducted)

- Details of existing debts (credit card statements, loan agreements)

- Completed loan application

Using a Home Equity Loan

Unlocking the equity in your home through a home equity loan offers significant financial flexibility, but understanding its uses and implications is crucial for successful management. This section explores common applications, potential tax effects, and effective repayment strategies to help you make informed decisions.

Home equity loan rates rochester ny – Home equity loans provide access to a substantial sum of money, secured by the value of your property. This accessibility makes them a versatile financial tool with a variety of applications, both large and small.

Common Uses of Home Equity Loans

Home equity loans are frequently used for significant home improvements, debt consolidation, or even funding major life events. Borrowers might use the funds to renovate their kitchens or bathrooms, add a new addition, or pay off high-interest credit card debt. The funds can also be used for education expenses, medical bills, or even starting a business. The flexibility of home equity loans makes them an attractive option when other financing options may be less accessible or more expensive.

Tax Implications of Home Equity Loans

The interest you pay on a home equity loan may be tax-deductible, but there are important limitations. The deduction is generally limited to the amount of interest paid on debt up to $750,000 ($375,000 if married filing separately). It’s crucial to consult with a tax professional to determine the deductibility of your specific situation, as rules can be complex and vary depending on your individual circumstances and the loan’s purpose. For example, if the loan is used for home improvements that increase the value of your home, the interest may be fully deductible. However, if the loan proceeds are used for non-home-related expenses, the deductibility may be significantly restricted or eliminated.

Strategies for Effective Home Equity Loan Repayment

Managing your home equity loan repayment effectively requires a proactive approach. Creating a realistic budget that incorporates the monthly payment is paramount. Consider making extra payments whenever possible to reduce the principal balance faster and minimize the total interest paid over the life of the loan. Automating your payments can help ensure on-time payments and avoid late fees. Regularly reviewing your loan statement can also help you stay informed about your progress and identify any potential issues. Furthermore, exploring options like refinancing to a lower interest rate, if available, can save you money in the long run.

Sample Repayment Schedule

This table illustrates a sample repayment schedule for a $50,000 home equity loan at 6% interest over 10 years. Remember, this is a simplified example and actual payments may vary slightly depending on the lender and loan terms.

| Year | Beginning Balance | Payment | Ending Balance |

|---|---|---|---|

| 1 | $50,000.00 | $6,200.00 | $47,627.07 |

| 2 | $47,627.07 | $6,200.00 | $44,976.60 |

| 3 | $44,976.60 | $6,200.00 | $42,144.07 |

| 4 | $42,144.07 | $6,200.00 | $39,125.00 |

| 5 | $39,125.00 | $6,200.00 | $35,914.03 |

| 6 | $35,914.03 | $6,200.00 | $32,506.78 |

| 7 | $32,506.78 | $6,200.00 | $28,900.00 |

| 8 | $28,900.00 | $6,200.00 | $25,089.32 |

| 9 | $25,089.32 | $6,200.00 | $21,071.38 |

| 10 | $21,071.38 | $6,200.00 | $0.00 |

Risks and Considerations

Securing a home equity loan can significantly boost your financial flexibility, but it’s crucial to approach it with a clear understanding of the potential downsides. Failing to do so can lead to serious financial hardship, even jeopardizing your home. Let’s examine the key risks and considerations before you sign on the dotted line.

Home equity loans, while offering attractive interest rates compared to some alternatives, carry inherent risks. The most significant is the risk of foreclosure. If you fail to make your monthly payments consistently, the lender can initiate foreclosure proceedings, ultimately resulting in the loss of your home. This is a devastating outcome, impacting not only your finances but also your personal well-being. Therefore, thorough planning and a realistic assessment of your repayment capabilities are paramount.

Foreclosure Risk and Mitigation Strategies

Foreclosure is the ultimate risk associated with any loan secured by your home. It’s a legal process where the lender takes possession of your property due to your failure to meet the terms of the loan agreement. This process can be lengthy and emotionally taxing. To mitigate this risk, meticulously review your budget to ensure you can comfortably afford the monthly payments, including interest and any associated fees. Consider building an emergency fund to cover unexpected expenses that could otherwise impact your ability to make timely payments. Open communication with your lender is also crucial; if you anticipate difficulties, contact them immediately to explore potential solutions, such as temporary payment modifications or forbearance. Proactive communication often prevents the escalation of a minor financial setback into a full-blown foreclosure crisis.

Understanding Loan Terms and Conditions

Before signing any loan agreement, meticulously review all terms and conditions. Pay close attention to the interest rate (both fixed and variable rates have implications), the loan term (the length of time you have to repay the loan), and any associated fees (origination fees, appraisal fees, etc.). Understanding the annual percentage rate (APR) is crucial; it reflects the total cost of borrowing, including interest and fees. Don’t hesitate to seek clarification from your lender if anything is unclear. A comprehensive understanding of the loan agreement protects you from unforeseen costs and prevents future disputes.

Comparison with Other Financing Options, Home equity loan rates rochester ny

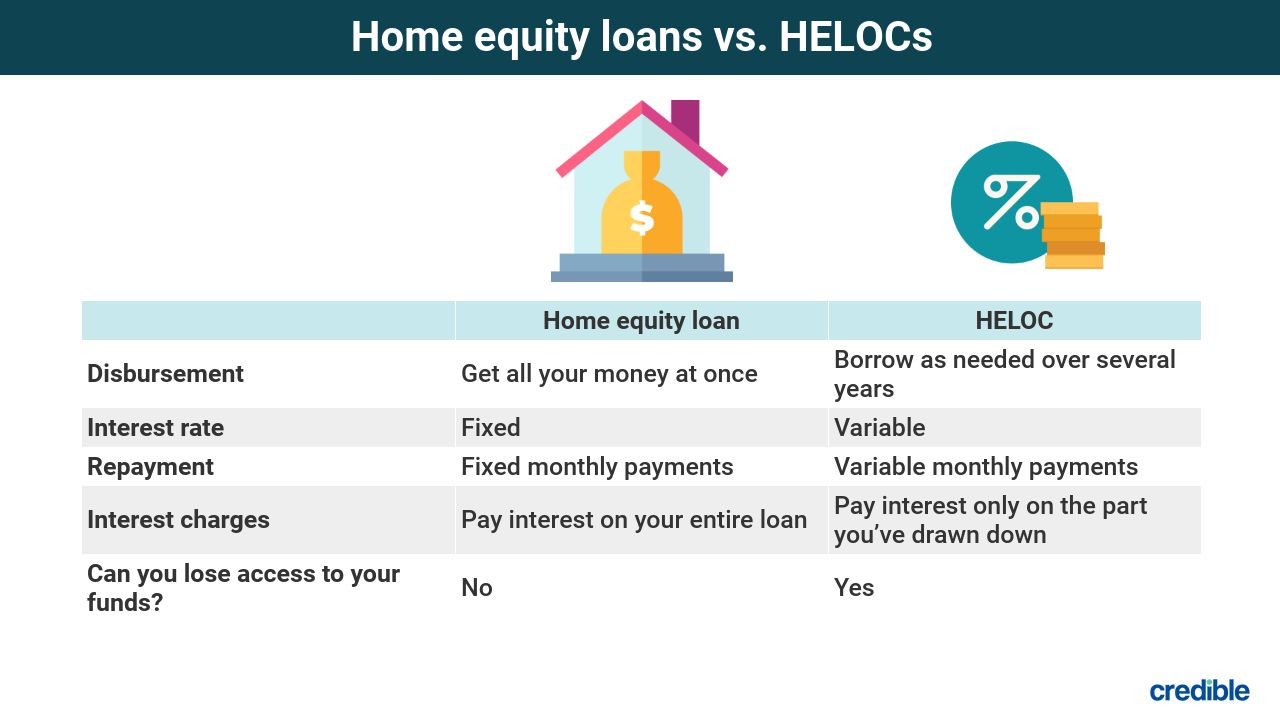

Home equity loans aren’t the only financing option available. Personal loans offer flexibility but typically come with higher interest rates. HELOCs (Home Equity Lines of Credit) provide access to funds as needed, but interest rates can be variable, potentially leading to fluctuating monthly payments. The best option depends on your specific needs and financial situation. A personal loan might be suitable for smaller, short-term needs, while a HELOC offers flexibility for larger, ongoing expenses. A home equity loan is often preferred for larger, one-time expenses with a fixed repayment schedule. Careful comparison of interest rates, fees, and repayment terms is vital to selecting the most appropriate financing solution.

Refinancing a Home Equity Loan

If your financial situation improves, or interest rates drop significantly, you might consider refinancing your home equity loan. Refinancing involves replacing your existing loan with a new one, often with better terms. This could mean securing a lower interest rate, reducing your monthly payments, or shortening the loan term. However, refinancing involves fees, so it’s crucial to weigh the potential benefits against the costs. Shop around and compare offers from multiple lenders before making a decision. A lower interest rate can save you a substantial amount of money over the life of the loan, but the fees associated with refinancing should not outweigh the savings.