GMFS Specialized Loan Servicing

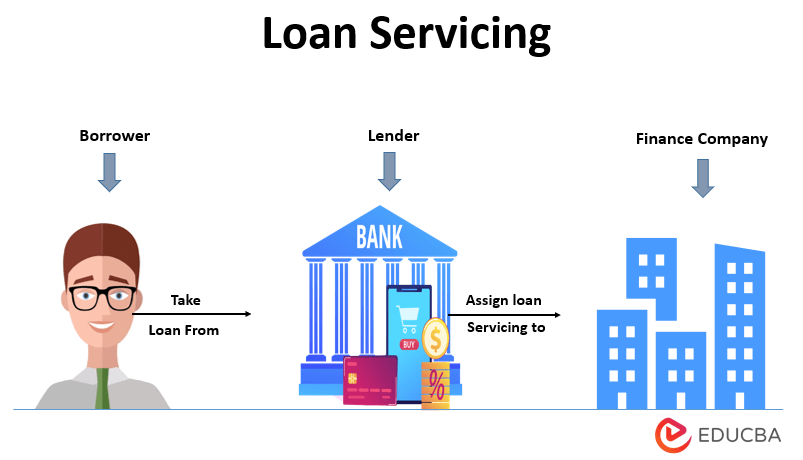

GMFS Specialized Loan Servicing represents a niche within the broader financial services industry, focusing on the unique needs of specific loan types and borrowers. It’s a high-touch, specialized approach that goes beyond the typical automated servicing models employed by larger institutions. This focus allows for a deeper understanding of individual client situations and more tailored solutions.

Definition and Scope of GMFS Specialized Loan Servicing

GMFS Specialized Loan Servicing encompasses the administration and management of loans requiring a higher degree of expertise and personalized attention. Key characteristics include detailed portfolio analysis, proactive risk management, and customized communication strategies. This differs from standard loan servicing which often relies on automated systems and generic communication templates. The specialization allows for more efficient and effective management of complex loan portfolios.

Types of Loans Serviced by GMFS

GMFS typically services loans that demand specialized knowledge and hands-on management. This often includes commercial real estate loans, construction loans, and other asset-based lending products. The complexity of these loan types requires a deep understanding of the underlying assets, market conditions, and borrower circumstances. GMFS’s expertise lies in navigating the intricacies of these complex financial instruments.

Geographical Reach and Client Base of GMFS Loan Servicing

The geographical reach and client base of GMFS will vary depending on the specific company. However, many such firms operate nationally or regionally, serving a diverse clientele including banks, credit unions, and other financial institutions. Their clients often value the specialized expertise and personalized service that GMFS offers, especially for portfolios that are too complex or specialized for larger, more generalized servicing firms.

Specific Services Offered within GMFS Specialized Loan Servicing

GMFS offers a comprehensive suite of services tailored to the specific needs of its clients. These services typically include loan boarding, payment processing, delinquency management, reporting and analytics, and regulatory compliance. In addition, GMFS often provides specialized services such as asset valuation, due diligence, and workout strategies. This proactive approach minimizes risk and maximizes the return on investment for its clients.

Comparison of GMFS to Other Major Loan Servicers

The following table compares GMFS to other major loan servicers. It’s important to note that the specific services and geographic reach can vary significantly between companies. This is a generalized comparison and should not be considered exhaustive.

| Servicer Name | Loan Types | Geographic Reach | Key Features |

|---|---|---|---|

| GMFS (Example) | Commercial Real Estate, Construction, Asset-Based Lending | National/Regional (varies by firm) | Specialized Expertise, High-Touch Service, Proactive Risk Management |

| Company A (Example) | Residential Mortgages, Auto Loans | National | Automated Systems, High Volume Processing |

| Company B (Example) | Student Loans, Personal Loans | National | Technology-Driven, Customer Self-Service Portal |

| Company C (Example) | Commercial & Industrial Loans, SBA Loans | Regional | Industry Expertise, Relationship-Based Service |

GMFS Loan Servicing Processes and Procedures

GMFS Specialized Loan Servicing operates with a streamlined, technology-driven approach to ensure efficient and compliant loan management. Our processes are designed for accuracy, transparency, and adherence to the highest industry standards, minimizing risk and maximizing customer satisfaction. This section details the key aspects of our operational framework.

Step-by-Step Loan Servicing Task

A typical loan servicing task, such as a payment processing, follows a well-defined workflow. First, the payment is received through various channels (online portal, ACH transfer, mail). The payment is then validated against the borrower’s account information. Next, the payment is posted to the borrower’s account, updating the principal, interest, and any applicable fees. Finally, the system generates an updated statement reflecting the transaction, and the borrower receives confirmation. This entire process is automated to minimize manual intervention and potential errors. Real-time updates are provided to the borrower via their online account or email, depending on their preference.

Technology and Systems Utilized

GMFS leverages a sophisticated suite of integrated systems to manage the entire loan servicing lifecycle. Our core system is a robust, secure, and scalable platform that handles all aspects of loan management, from origination to payoff. This system includes modules for payment processing, escrow management, reporting, and customer relationship management (CRM). We utilize advanced data analytics to identify trends, predict potential issues, and proactively address them. For example, our system can identify borrowers at risk of delinquency based on their payment history and other relevant data points, allowing us to intervene early and prevent defaults. The system is regularly updated with the latest security patches and compliance enhancements.

Compliance Procedures and Regulatory Adherence

GMFS maintains meticulous compliance with all applicable federal and state regulations governing loan servicing. We adhere strictly to the Real Estate Settlement Procedures Act (RESPA), the Truth in Lending Act (TILA), and other relevant legislation. Regular internal audits and external reviews ensure our continued compliance. Our compliance team is highly trained and knowledgeable in all aspects of regulatory requirements. We maintain detailed records of all compliance activities, including training records, audit reports, and regulatory correspondence. Any identified non-compliance issues are addressed immediately and thoroughly documented. This rigorous approach ensures we consistently meet or exceed all regulatory expectations.

Internal Controls and Risk Management, Gmfs specialized loan servicing

GMFS employs a comprehensive system of internal controls to mitigate operational, financial, and compliance risks. These controls include segregation of duties, regular reconciliation of accounts, and robust access controls to sensitive data. We conduct regular risk assessments to identify and address potential vulnerabilities. Our risk management framework is aligned with industry best practices and incorporates a proactive approach to risk mitigation. For example, we use fraud detection systems to identify and prevent fraudulent activities, and we implement business continuity plans to ensure uninterrupted service in the event of unforeseen circumstances. Our internal audit function provides independent oversight of our controls and processes.

Loan Payment Processing Workflow

[Imagine a flowchart here. The flowchart would begin with “Payment Received” branching to various input methods (online, mail, ACH). Each branch would converge at “Payment Validation,” leading to “Payment Posting.” From there, it branches to “Account Update” and “Statement Generation,” both leading to “Confirmation to Borrower.” Finally, there’s a feedback loop from “Confirmation to Borrower” back to “Payment Received,” completing the cycle. Error handling would be incorporated throughout the process, with branches leading to “Error Resolution” for issues like insufficient funds or incorrect information.]

GMFS Client Interaction and Communication

GMFS prioritizes clear, efficient, and empathetic communication with its borrowers throughout the loan servicing process. This approach minimizes misunderstandings, fosters trust, and ensures a positive customer experience, ultimately contributing to higher borrower satisfaction and reduced delinquency rates. Effective communication is a cornerstone of our operational success.

Gmfs specialized loan servicing – GMFS employs a multi-channel approach to interact with borrowers, recognizing that individuals have varying communication preferences. This ensures accessibility and convenience for all clients. The strategic use of these channels allows us to deliver timely and relevant information, fostering a proactive and responsive customer service model.

Communication Channels

GMFS utilizes a combination of communication channels to reach borrowers effectively. These include secure online portals providing 24/7 access to account information, personalized email updates regarding payments, due dates, and important account changes, and a dedicated telephone support line staffed by knowledgeable representatives available during extended business hours. This layered approach allows for efficient communication tailored to individual borrower needs and preferences. The online portal offers self-service options, empowering borrowers to manage their accounts independently while telephone support provides personalized assistance when needed.

Customer Service Protocols and Best Practices

GMFS adheres to strict customer service protocols designed to ensure consistency and quality in all interactions. These protocols emphasize empathy, active listening, and clear, concise communication. Representatives are trained to handle sensitive information with discretion and professionalism, resolving issues promptly and efficiently. Best practices include providing clear explanations of loan terms and conditions, actively seeking feedback from borrowers, and documenting all interactions thoroughly. This systematic approach contributes to a positive customer experience and ensures that all inquiries are addressed effectively and efficiently. Regular training sessions for customer service representatives focus on conflict resolution techniques and effective communication strategies, further enhancing the quality of service provided.

Managing Borrower Inquiries and Complaints

GMFS employs a robust system for managing borrower inquiries and complaints. All inquiries are logged and tracked using a centralized system, ensuring that no request falls through the cracks. A tiered approach to complaint resolution is employed, with initial responses provided by trained representatives and escalated to supervisors or managers as needed. This structured approach ensures that issues are addressed promptly and effectively, regardless of complexity. Regular reviews of complaint data identify trends and areas for improvement, allowing GMFS to continuously refine its processes and enhance the borrower experience. The goal is to resolve all issues to the borrower’s satisfaction, promoting loyalty and positive word-of-mouth referrals.

Common Borrower Questions and GMFS Responses

Understanding common borrower questions is crucial for proactive and effective communication. Addressing these questions clearly and promptly enhances the borrower experience and reduces potential frustration.

- Question: “What is my current loan balance?” Response: “Your current loan balance can be found on our secure online portal, or you can call our customer service line to obtain this information.”

- Question: “How do I make a payment?” Response: “You can make payments online through our secure portal, by mail, or by phone. Instructions for each method are available on our website.”

- Question: “I’m experiencing financial hardship; what options are available?” Response: “We understand that unforeseen circumstances can impact your ability to make payments. Please contact our dedicated hardship department immediately to discuss available options such as forbearance or modification.”

- Question: “What are the fees associated with my loan?” Response: “A detailed breakdown of all applicable fees is available in your loan agreement. You can also access this information on our website or by contacting our customer service line.”

GMFS Specialized Loan Servicing

GMFS Specialized Loan Servicing operates in a dynamic and challenging environment. Understanding the hurdles and opportunities is crucial for strategic planning and sustainable growth. This section analyzes the key challenges and opportunities facing GMFS in this specialized sector, focusing on technological disruption, regulatory changes, and potential avenues for expansion. We’ll examine these factors through a data-driven lens, offering insights into how GMFS can navigate this complex landscape and achieve its business objectives.

Technological Advancements and Their Impact on GMFS Operations

The rapid advancement of technology significantly impacts GMFS’s operational efficiency and customer experience. Automation, AI-powered solutions, and blockchain technology present both opportunities and challenges. For instance, robotic process automation (RPA) can streamline repetitive tasks like data entry and payment processing, reducing operational costs and improving accuracy. However, implementing and maintaining these systems requires substantial upfront investment and ongoing technical expertise. Furthermore, the integration of new technologies with existing legacy systems can be complex and time-consuming. The adoption of cloud-based solutions can improve scalability and accessibility, but security concerns and data migration challenges need careful consideration. Failure to adapt to these technological advancements could lead to a competitive disadvantage and hinder GMFS’s ability to provide efficient and cost-effective services. Conversely, strategic investment in technology can significantly enhance operational efficiency, improve customer service, and unlock new revenue streams.

The Evolving Regulatory Landscape and its Implications for GMFS

The regulatory landscape for specialized loan servicing is constantly evolving, presenting both challenges and opportunities for GMFS. Changes in compliance requirements, data privacy regulations (like GDPR and CCPA), and cybersecurity standards necessitate significant investment in compliance infrastructure and expertise. Non-compliance can lead to hefty fines and reputational damage. For example, the increasing scrutiny of consumer protection regulations requires GMFS to implement robust processes to ensure fair lending practices and transparent communication with borrowers. However, proactively adapting to these changes can position GMFS as a leader in compliance and build trust with clients and regulators. Staying ahead of the curve through continuous monitoring of regulatory changes and investing in robust compliance programs is essential for long-term sustainability.

Potential Challenges Faced by GMFS in Specialized Loan Servicing

Several challenges hinder GMFS’s operations within the specialized loan servicing market. These include the complexity of specialized loan products, requiring specialized expertise and advanced technological solutions for efficient management. Managing defaults and delinquencies in specialized loan portfolios presents a unique challenge, demanding effective risk management strategies and recovery processes. Competition from larger, more established players with greater resources and technological capabilities is also a significant factor. Furthermore, maintaining high levels of customer satisfaction in a sector often characterized by complex and sensitive financial situations is crucial. Failing to address these challenges can lead to increased operational costs, reduced profitability, and reputational damage.

Potential Opportunities for Growth and Expansion within GMFS

Despite the challenges, significant opportunities exist for GMFS to expand its market share and enhance profitability. The increasing demand for specialized loan products, particularly in niche sectors like renewable energy financing or healthcare lending, presents a significant growth opportunity. Expanding into new geographic markets or offering new specialized loan servicing products can also drive revenue growth. Strategic partnerships with other financial institutions or technology providers can provide access to new markets and technologies. Focusing on enhancing customer experience through personalized service and advanced technology can also attract and retain clients. By strategically addressing these opportunities, GMFS can achieve significant growth and establish itself as a leader in the specialized loan servicing market.

Summary of Key Challenges and Opportunities

| Challenge/Opportunity | Description |

|---|---|

| Technological Advancements | Implementing and integrating new technologies (AI, RPA, Cloud) presents challenges related to cost, expertise, and security, but offers opportunities for increased efficiency and improved customer service. |

| Regulatory Changes | Evolving compliance requirements (data privacy, cybersecurity) necessitate investment in compliance infrastructure, but proactive adaptation builds trust and minimizes risk. |

| Complex Loan Products | Managing the complexities of specialized loan products requires specialized expertise and advanced technology, but successfully navigating this complexity leads to a competitive advantage. |

| Market Competition | Competition from larger players is a challenge, but focusing on niche markets and providing superior customer service can create differentiation. |

| Growth Opportunities | Expanding into new markets, offering new products, and forging strategic partnerships offer significant growth potential. |

GMFS and the Competitive Landscape

The specialized loan servicing market is fiercely competitive, with numerous players vying for market share. Understanding GMFS’s position within this landscape requires a thorough analysis of its strengths, weaknesses, and the overall dynamics of the industry. This examination will highlight key differentiators, competitive pressures, and future trends that will shape the success of GMFS and its competitors.

GMFS’s Competitive Advantages and Disadvantages Compared to Competitors

GMFS’s competitive advantage stems from its specialized focus, likely encompassing niche loan types or specific client demographics. This allows for a deeper understanding of regulatory requirements and client needs within that niche. However, this specialization might also limit GMFS’s market reach compared to larger, more diversified servicing companies offering a broader range of services. Competitors may possess superior technological infrastructure, broader geographic reach, or more established brand recognition, potentially impacting GMFS’s ability to attract and retain clients. A direct comparison requires a detailed analysis of specific competitors and their respective market offerings. For example, a hypothetical competitor, “Apex Loan Solutions,” might excel in automated processes and possess a significantly larger client base, but lack the same level of specialized expertise in GMFS’s niche.

Key Factors Driving Competition in the Specialized Loan Servicing Market

Several key factors are driving competition in the specialized loan servicing market. Technological advancements, such as automation and AI-powered solutions, are lowering operational costs and improving efficiency, forcing companies to invest in modernization to remain competitive. Regulatory changes, particularly those impacting data privacy and security, necessitate significant investments in compliance and risk management. The increasing demand for specialized servicing expertise, driven by the growth of complex loan products, creates opportunities for companies like GMFS but also attracts new entrants and intensifies competition. Finally, pricing pressure from both clients and competitors forces companies to constantly seek ways to optimize their operations and improve their value proposition.

Future Trends Impacting the Specialized Loan Servicing Industry

The future of specialized loan servicing will be shaped by several key trends. The increasing adoption of fintech solutions will continue to transform the industry, with a focus on digitalization, automation, and data analytics. The demand for personalized customer experiences will drive the development of more sophisticated client portals and communication channels. Cybersecurity will remain a paramount concern, requiring ongoing investments in robust security measures to protect sensitive client data. Finally, the regulatory landscape will continue to evolve, requiring companies to adapt to new rules and regulations. For example, the increasing focus on ESG (environmental, social, and governance) factors will likely influence the types of loans serviced and the operational practices of servicing companies.

Hypothetical Competitor: Apex Loan Solutions

Apex Loan Solutions is a hypothetical competitor to GMFS, characterized by its large scale and focus on automation. Apex possesses a strong technological infrastructure, allowing for efficient processing of high volumes of loans. Its strengths include advanced data analytics capabilities, enabling better risk assessment and client segmentation. However, Apex’s weakness lies in its less specialized approach; while offering a broader range of services, they may lack the deep expertise in specific loan types that GMFS offers. This could lead to less effective client interaction and potentially higher error rates in handling complex, niche loan products. Apex’s size also presents a potential disadvantage in terms of flexibility and responsiveness to individual client needs.

Illustrative Scenario: Gmfs Specialized Loan Servicing

This case study details how GMFS Specialized Loan Servicing navigated a complex situation involving a distressed borrower, highlighting the effectiveness of their policies and procedures in achieving a positive outcome. The scenario underscores the human element within the financial process, demonstrating GMFS’s commitment to both efficient servicing and compassionate client support.

Sarah Miller, a small business owner, experienced unforeseen financial hardship due to a sudden drop in sales following a major supplier’s bankruptcy. Her loan, a commercial mortgage secured through a regional bank and serviced by GMFS, was nearing default. Overwhelmed and stressed, Sarah initially avoided contact with GMFS, exacerbating the situation. Her emotional state was one of deep anxiety and fear, fueled by the uncertainty of her business’s future and the potential loss of her property.

Initial Contact and Assessment

Upon finally receiving a communication from Sarah, GMFS immediately initiated their established protocol for distressed borrowers. A dedicated case manager, experienced in handling such situations, was assigned. This manager contacted Sarah, not just to discuss the overdue payments, but also to understand the root cause of her financial difficulties. A thorough assessment was conducted, reviewing Sarah’s financial statements, projections, and the overall economic impact on her business. This holistic approach, a core component of GMFS’s policies, aims to identify sustainable solutions rather than simply enforcing immediate repayment.

Development and Implementation of a Remediation Plan

Based on the assessment, a customized remediation plan was developed. This plan included a temporary reduction in monthly payments, a restructuring of the loan terms, and access to financial counseling resources. The plan was meticulously documented, following GMFS’s internal procedures, ensuring transparency and accountability throughout the process. The reduction in payments provided immediate relief, easing Sarah’s immediate financial pressure and allowing her to focus on stabilizing her business. The restructuring provided a longer-term solution, giving her the time needed to recover. The financial counseling offered support and guidance in managing her finances more effectively in the future.

Resolution and Lessons Learned

Sarah’s proactive engagement with the financial counselor, coupled with the flexible approach from GMFS, resulted in a significant improvement in her financial situation. She was able to restructure her business model, secure new suppliers, and gradually increase sales. Within 18 months, she was back on track with her loan payments. The case demonstrates the importance of early intervention, empathetic communication, and the development of tailored solutions. GMFS’s established policies and procedures, emphasizing a client-centric approach, were instrumental in achieving a positive outcome, avoiding foreclosure, and preserving both Sarah’s business and her peace of mind. The emotional impact on Sarah shifted from overwhelming fear and despair to cautious optimism and eventual relief as she regained control of her financial situation.