Understanding “Covantage Loan Calculator” Functionality

A Covantage loan calculator is a powerful tool that simplifies the complex process of loan estimation. It allows you to quickly assess potential loan payments and overall costs, empowering you to make informed financial decisions before committing to a loan. Understanding its functionality is crucial for leveraging its full potential and achieving your financial goals.

Covantage loan calculators, like many others, utilize fundamental financial formulas to compute key loan parameters. The core function involves calculating the monthly payment based on the principal loan amount, the interest rate, and the loan term. These variables are intricately linked, and altering one impacts the others significantly. For example, a higher interest rate will naturally result in larger monthly payments, while a longer loan term will lower monthly payments but increase the total interest paid over the life of the loan.

Interest Rate, Loan Term, and Principal Amount Calculations

The calculator incorporates these variables using standardized financial formulas. The most common is the amortization formula, which calculates the monthly payment. This formula considers the present value (principal loan amount), the interest rate (expressed as a monthly rate), and the number of payments (loan term in months). The output is the monthly payment amount, which remains consistent throughout the loan term (assuming a fixed-rate loan). The calculator then further breaks down the monthly payment into the principal portion and the interest portion for each payment period, allowing you to visualize how your payments are applied over time. For example, in the early stages of a loan, a larger portion of the payment goes towards interest, while in later stages, more goes towards principal repayment.

Loan Types Handled by a Covantage Loan Calculator

A comprehensive Covantage loan calculator would likely handle various loan types catering to diverse business needs. These might include:

- Business Loans: These could range from term loans used for equipment purchases to lines of credit for working capital management. The calculator would adjust calculations based on the specific loan type, potentially incorporating features like variable interest rates for lines of credit.

- Commercial Real Estate Loans: These loans are typically used to finance the purchase or development of commercial properties. The calculator would account for the unique aspects of commercial real estate financing, such as longer loan terms and potentially higher loan-to-value ratios.

- Small Business Administration (SBA) Loans: These government-backed loans often have specific interest rate and term structures, which the calculator would incorporate to accurately reflect the terms available through the SBA loan program.

The specific loan types available will depend on the features offered by the Covantage platform.

Using a Hypothetical Covantage Loan Calculator: A Step-by-Step Guide

Let’s imagine a Covantage loan calculator with the following input fields:

- Loan Amount: This field allows you to enter the principal amount you wish to borrow (e.g., $100,000).

- Interest Rate: Enter the annual interest rate offered (e.g., 7%). The calculator will usually automatically convert this to a monthly rate.

- Loan Term: Specify the loan’s duration in years (e.g., 5 years). The calculator will convert this to months for its calculations.

- Loan Type: Select the appropriate loan type from a dropdown menu (e.g., Term Loan, Line of Credit, SBA Loan).

Upon entering these values and selecting the loan type, the calculator would generate the following output:

- Monthly Payment: The calculated amount you’ll pay each month.

- Total Interest Paid: The total amount of interest you’ll pay over the loan’s lifetime.

- Amortization Schedule (optional): A detailed table showing the principal and interest portions of each monthly payment throughout the loan term.

This information provides a clear picture of the financial implications of the loan, allowing for informed decision-making. For example, if the monthly payment is too high, you can adjust the loan amount, loan term, or explore alternative loan options with lower interest rates.

Comparison with Competitor Loan Calculators

Choosing the right loan calculator can significantly impact your financial planning. A robust tool provides accurate, easily understandable results, saving you time and potential errors. This section compares Covantage’s loan calculator with other popular options to highlight its strengths and weaknesses. We’ll examine key features, user-friendliness, and the clarity of the output provided.

Covantage loan calculator – Direct comparison is crucial when evaluating tools. Many calculators exist, each with unique features and limitations. Understanding these differences allows you to select the best option for your specific needs. This analysis focuses on functionality, ease of use, and the presentation of results.

Covantage Loan Calculator Compared to Competitors

The following table compares Covantage’s loan calculator to two leading competitors, highlighting key differences in functionality, user experience, and output clarity. Note that features and interfaces can change, so always verify directly with the providers for the most up-to-date information.

| Calculator Name | Key Features | Ease of Use | Output Clarity |

|---|---|---|---|

| Covantage Loan Calculator | Loan amount, interest rate, loan term, extra payment options, amortization schedule, detailed cost breakdown. Potentially integrates with Covantage’s other financial tools. | Intuitive interface, clear input fields, minimal steps to generate results. Assumes a moderate level of financial literacy. | Provides a comprehensive amortization schedule, clearly showing monthly payments, principal and interest breakdown for each payment, and total interest paid. |

| Calculator A (Example: Bankrate.com) | Loan amount, interest rate, loan term, loan type selection (mortgage, auto, personal). May offer additional features like debt consolidation calculations. | Generally user-friendly, but might require navigating multiple pages or sections for detailed information. | Presents key results clearly but might lack the detailed amortization schedule provided by Covantage. Focuses on high-level summaries. |

| Calculator B (Example: NerdWallet) | Loan amount, interest rate, loan term, loan type selection. May include comparison tools for different loan offers. | Simple interface, suitable for users with limited financial experience. However, advanced features might be less accessible. | Provides clear summaries of monthly payments and total costs. May prioritize visualization over detailed numerical breakdowns. |

Unique Selling Points of the Covantage Loan Calculator

While many loan calculators offer similar basic functionalities, Covantage’s calculator may differentiate itself through integration with its broader financial platform. This integration could streamline the loan application process and provide a more holistic view of the user’s financial situation. For example, it might directly link to credit score information or pre-approved loan offers, making the entire process smoother. Furthermore, a highly detailed amortization schedule offers a granular level of financial insight not always available with competitors.

Advantages and Disadvantages of Using the Covantage Calculator

Using the Covantage calculator offers several advantages. The detailed amortization schedule allows for precise financial planning and budgeting. Potential integration with other Covantage services can streamline the loan process. However, a disadvantage might be a steeper learning curve if the interface is more complex than competitor calculators, or if it requires a Covantage account for full functionality. The lack of broad loan type support (if applicable) could also be a limitation compared to more general-purpose calculators.

User Interface and User Experience (UI/UX) Design

A superior loan calculator isn’t just about accurate calculations; it’s about providing a seamless and intuitive user experience. The Covantage loan calculator has the potential to be a market leader, but its current UI/UX could benefit from a significant overhaul to boost user engagement and satisfaction. A well-designed interface translates complex financial data into easily digestible information, empowering users to make informed decisions.

The current design, while functional, lacks the visual appeal and intuitive flow necessary to capture and retain users. An improved design should prioritize clarity, efficiency, and a user-friendly experience, making the process of calculating loan payments straightforward and enjoyable. This involves a strategic use of visual elements and interactive features to enhance user comprehension and engagement.

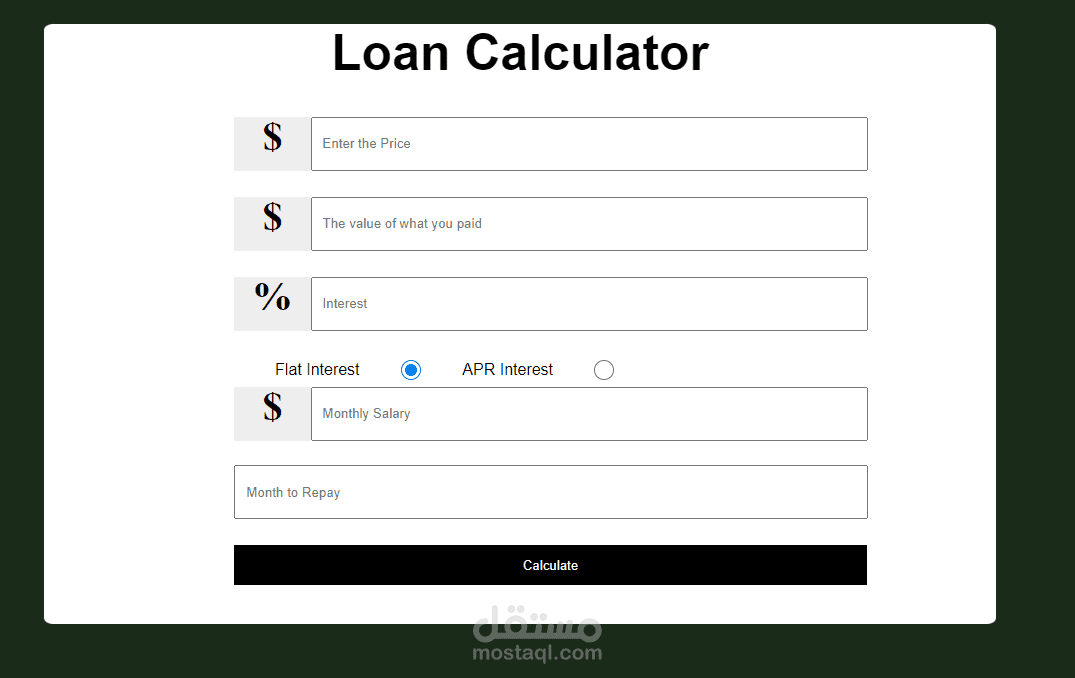

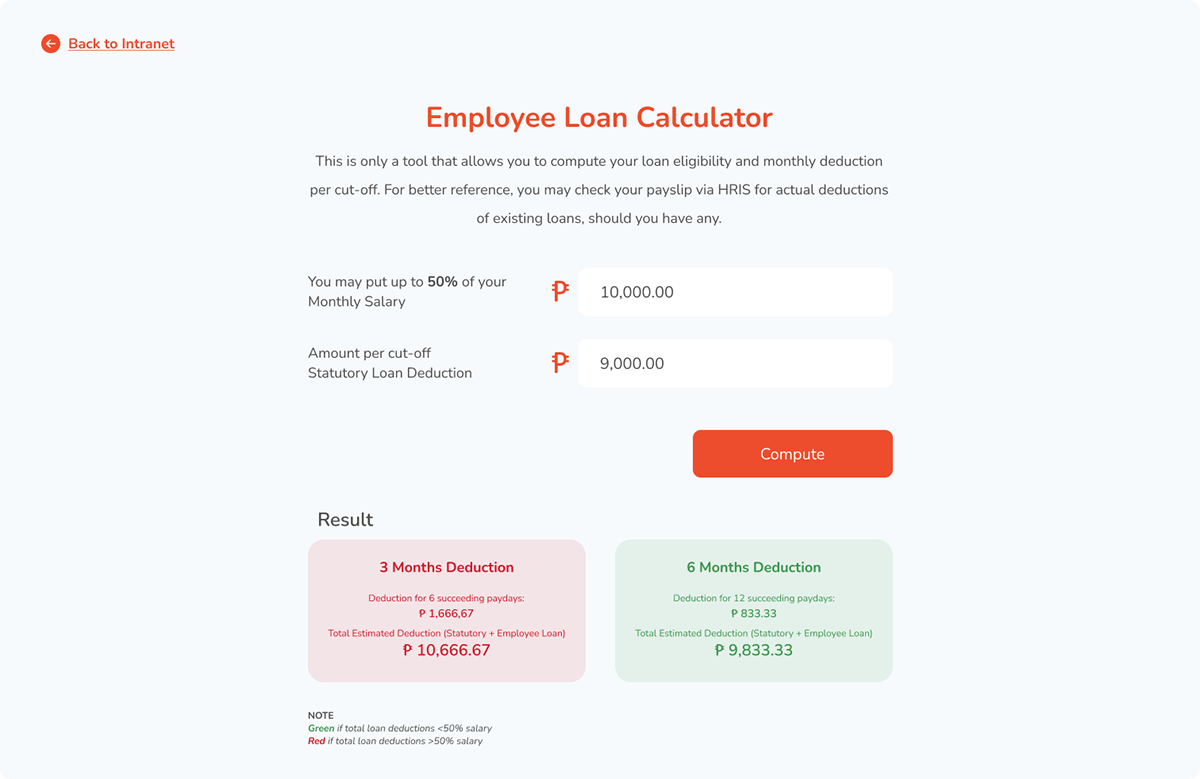

Improved Covantage Loan Calculator Interface Mock-up

Imagine a clean, modern interface dominated by a clear, uncluttered input form. Instead of a dense block of text fields, group related inputs logically. For example, “Loan Details” could house fields for loan amount, interest rate, and loan term. A separate section labeled “Personal Details” could collect information like credit score (optional) for more accurate estimations. Each input field should be clearly labeled and include helpful placeholders. The submit button should be prominently displayed, with clear visual cues indicating its function. Below the input form, a dedicated area displays the calculated results, presented in a visually appealing and easily understandable manner. This section should include a summary of key figures, such as monthly payment, total interest paid, and amortization schedule.

Visual Elements for Enhanced Understanding

The use of visual elements is crucial for improving user understanding. A simple bar chart comparing monthly payments across different loan terms could quickly illustrate the impact of loan duration on affordability. A pie chart visualizing the distribution of principal and interest payments over the life of the loan provides another clear visual representation of financial commitment. Furthermore, an interactive amortization schedule, presented as a line graph or table, allows users to see how their principal and interest payments change over time. This dynamic visualization helps users grasp the long-term financial implications of their loan choice. Consider adding a feature that allows users to adjust loan parameters in real-time, immediately seeing the impact on the charts and graphs. This interactive experience significantly enhances user engagement and comprehension.

Suggestions for Improving User Experience

Several interactive elements can significantly enhance the user experience. Tooltips explaining the meaning and impact of each input field could greatly assist users, especially those unfamiliar with loan terminology. For example, hovering over the “Interest Rate” field could display a brief explanation of how the interest rate affects the overall cost of the loan. Additionally, a “What-if” scenario tool could allow users to easily adjust loan parameters and see the immediate impact on the calculated results. This interactive feature allows for a more dynamic and engaging user experience, promoting better understanding of the financial implications. Finally, integrating a comparison tool that allows users to simultaneously compare multiple loan scenarios would be invaluable. This feature empowers users to make informed decisions by visually comparing different loan options side-by-side.

Potential Applications and Use Cases: Covantage Loan Calculator

The Covantage loan calculator isn’t just a tool; it’s a strategic asset for anyone navigating the complex world of borrowing. Its versatility extends far beyond simple interest calculations, offering powerful insights that can significantly impact financial decisions across various scenarios. By providing clear, concise, and accurate loan projections, it empowers users to make informed choices, optimizing their financial strategies and mitigating potential risks.

The Covantage loan calculator’s intuitive design and comprehensive features make it invaluable for a wide range of users, from individual consumers planning major purchases to seasoned investors managing complex portfolios. Its adaptability allows it to seamlessly integrate into existing financial workflows, enhancing efficiency and decision-making across the board.

Small Business Loan Planning

A small business owner, say Sarah, who owns a bakery, is considering expanding her operations by purchasing a new oven. Using the Covantage calculator, Sarah can input the cost of the oven, her desired loan term, and various interest rate scenarios. The calculator instantly provides her with projected monthly payments, total interest paid, and the overall cost of the loan. This allows Sarah to compare different loan options and determine which best aligns with her budget and business goals. She can also model different scenarios, such as increasing her down payment to lower her monthly payments or extending the loan term to reduce the monthly burden. This data-driven approach enables her to make a financially sound decision about expanding her business.

Real Estate Investment Analysis

John, a real estate investor, is evaluating a potential property purchase. He uses the Covantage calculator to assess the feasibility of different financing options for a multi-family dwelling. By inputting the property’s purchase price, estimated rental income, and potential operating expenses, along with various loan terms and interest rates, he can generate projections of his potential cash flow and return on investment (ROI). This allows him to compare the profitability of different financing strategies and identify the optimal loan structure to maximize his returns while minimizing risk. He can test different scenarios, like changes in interest rates or occupancy rates, to see how these variables impact his investment’s profitability.

Integration into Financial Planning Platforms

The Covantage loan calculator can be seamlessly integrated into broader financial planning tools and platforms. Imagine a comprehensive financial planning application that includes budgeting tools, investment tracking, and retirement planning modules. The integration of the Covantage calculator would add a crucial layer of functionality, enabling users to accurately assess the impact of loan debt on their overall financial picture. For instance, a user could model different loan scenarios to determine how a mortgage would affect their retirement savings projections or how a small business loan might impact their overall cash flow. This holistic approach allows for more accurate and comprehensive financial planning, empowering users to make informed decisions across all aspects of their financial lives. This integration would significantly enhance the platform’s value proposition, attracting users seeking a complete and powerful financial management solution.

Data Security and Privacy Considerations

In today’s digital landscape, safeguarding user data is paramount, especially for financial applications like online loan calculators. A breach of trust can have devastating consequences, impacting not only user confidence but also the reputation and legal standing of the Covantage brand. Building a secure and privacy-respecting loan calculator is not just a good idea; it’s a business imperative. Ignoring these considerations is a recipe for disaster.

The Covantage loan calculator must prioritize data security and user privacy through robust measures. This goes beyond simply complying with regulations; it’s about building a culture of security within the development and operation of the platform. Transparency and user control over their data are key components of a successful strategy.

Data Encryption and Protection Measures

Protecting user data requires a multi-layered approach. All data transmitted to and from the Covantage loan calculator should be encrypted using industry-standard protocols like HTTPS with TLS 1.3 or higher. This ensures that sensitive information, such as personal details and financial data, remains confidential during transmission. Data at rest, meaning data stored on servers, must also be encrypted using strong encryption algorithms like AES-256. Regular security audits and penetration testing should be conducted to identify and address vulnerabilities proactively. Furthermore, access control measures should be implemented, limiting access to sensitive data to only authorized personnel on a need-to-know basis. Implementing robust logging and monitoring systems will help detect and respond quickly to any suspicious activity. Consider using a Web Application Firewall (WAF) to filter malicious traffic and protect against common web attacks.

Compliance with Data Privacy Regulations

Adherence to regulations like the General Data Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act (CCPA) in California is non-negotiable. This means implementing mechanisms for users to access, correct, and delete their data. Covantage needs a clear and concise privacy policy that details how user data is collected, used, and protected. This policy should be easily accessible on the calculator’s website. Consent management tools should be integrated to ensure compliance with consent requirements under GDPR and CCPA. Data minimization should be a core principle; only collect the data absolutely necessary for the calculator’s functionality. Finally, regular internal audits should be conducted to ensure ongoing compliance with all applicable data privacy laws. Failure to comply with these regulations can result in hefty fines and irreparable damage to the company’s reputation.

User Authentication and Authorization

The Covantage loan calculator should employ strong authentication methods to verify user identities. This could involve multi-factor authentication (MFA), requiring users to provide multiple forms of identification before accessing the calculator. Password policies should enforce strong passwords, encouraging users to create complex and unique credentials. Regular password changes should be encouraged. Furthermore, the system should implement robust authorization mechanisms to control access to different functionalities within the calculator based on user roles and permissions. This granular control ensures that only authorized users can access sensitive data and features. A comprehensive system for managing user accounts and permissions is crucial for maintaining data security.

Accessibility and Inclusivity

Creating a truly valuable loan calculator means ensuring it’s accessible to everyone, regardless of their abilities or technological resources. Accessibility isn’t just a matter of compliance; it’s about expanding your reach and empowering a broader audience to achieve their financial goals. A truly inclusive design fosters trust and builds a stronger brand reputation.

Building an accessible and inclusive Covantage loan calculator requires a multifaceted approach, encompassing features that cater to diverse needs and preferences. This goes beyond simple compliance; it’s about designing a user experience that is both efficient and empathetic.

Accessibility Features for Users with Disabilities

The following features are crucial for ensuring the Covantage loan calculator is usable by individuals with various disabilities. These features enhance usability and promote a more equitable experience.

- Keyboard Navigation: The entire calculator should be fully navigable using only a keyboard. Tab order should be logical and intuitive, allowing users to easily move between fields and interactive elements without a mouse. This is vital for users with motor impairments.

- Screen Reader Compatibility: Implement proper ARIA attributes (Accessible Rich Internet Applications) to ensure that screen readers can accurately interpret and convey the calculator’s content and functionality to visually impaired users. This includes providing clear and concise labels for all input fields and buttons.

- Sufficient Color Contrast: Ensure adequate color contrast between text and background elements to meet WCAG (Web Content Accessibility Guidelines) standards. This improves readability for users with low vision.

- Alternative Text for Images: Provide descriptive alternative text for any images used in the calculator. This allows screen readers to convey the image’s meaning to blind users.

- Adjustable Font Sizes: Allow users to adjust the font size to suit their individual needs. This caters to users with visual impairments.

- Support for Assistive Technologies: Thoroughly test the calculator with various assistive technologies, such as screen readers and screen magnifiers, to identify and address any accessibility barriers.

Inclusive Language and Design, Covantage loan calculator

Inclusive design ensures the calculator resonates with a diverse user base, avoiding language or imagery that might alienate or exclude specific groups.

The language used throughout the calculator should be clear, concise, and easy to understand for users with varying levels of financial literacy. Avoid jargon and technical terms whenever possible. Provide definitions or explanations for any necessary technical terms. Furthermore, consider offering the calculator in multiple languages to cater to a global audience. Visual design elements should also be carefully considered; avoid using stereotypes or imagery that could be perceived as offensive or exclusionary. Use culturally sensitive visuals and ensure that the design is accessible to users with diverse cultural backgrounds and preferences. For example, using a diverse range of images representing users of the calculator promotes inclusivity and fosters a sense of belonging for a wider audience.

Cross-Device and Browser Accessibility

Ensuring accessibility across various devices and browsers is critical for maximizing the calculator’s reach.

The calculator should be responsive and adapt seamlessly to different screen sizes and resolutions, from desktops to smartphones and tablets. This ensures a consistent and user-friendly experience regardless of the device used. Furthermore, thorough testing across various popular browsers (Chrome, Firefox, Safari, Edge) is crucial to identify and resolve any compatibility issues. This ensures that the calculator functions correctly and provides a consistent experience across different platforms. Regular updates and maintenance are essential to address any new accessibility issues that might arise with future browser updates or device changes. This proactive approach guarantees long-term accessibility and inclusivity.