Understanding CCFlow Loans

CCFlow loans, a relatively new entrant in the lending landscape, represent a departure from traditional lending models. They leverage technology and alternative data sources to assess creditworthiness, offering a potential lifeline for individuals who might struggle to qualify for conventional loans. Unlike traditional loans that primarily rely on credit scores and FICO ratings, CCFlow loans often consider a broader range of financial indicators, making them potentially more accessible to a wider pool of borrowers. This approach, however, also introduces unique considerations regarding eligibility, benefits, and potential drawbacks.

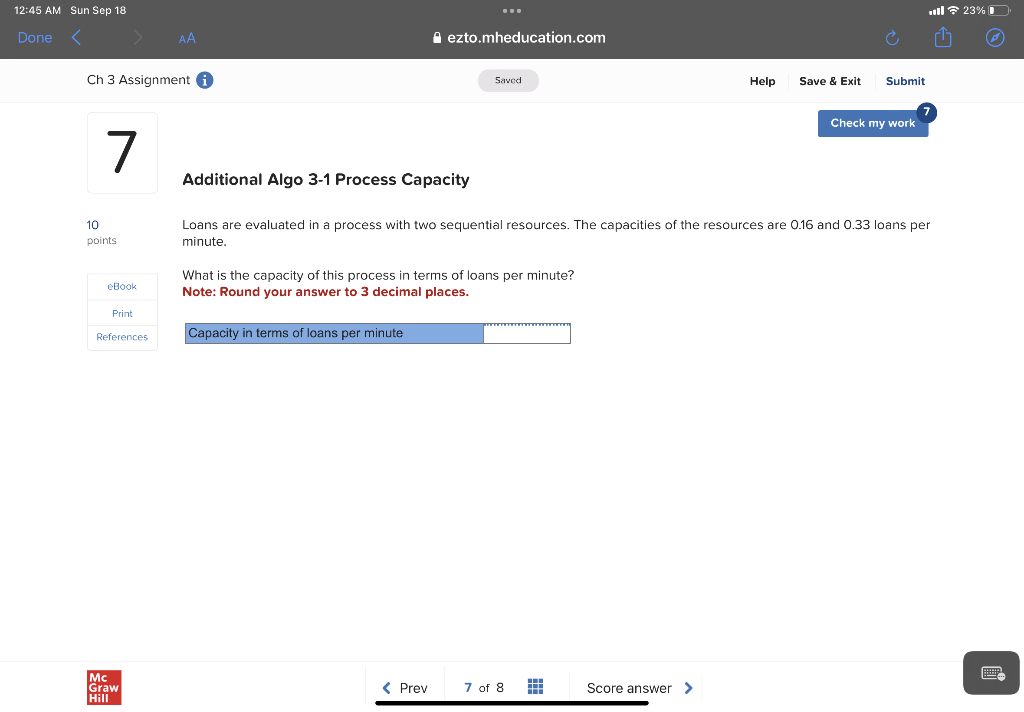

CCFlow Loan Mechanics

CCFlow loans, often facilitated through online platforms, utilize advanced algorithms and machine learning to analyze various data points beyond traditional credit reports. This might include bank account transactions, employment history verified through payroll data, and even social media activity (though the extent of this varies widely between lenders). The process typically involves submitting an application online, providing access to relevant financial accounts (with appropriate security measures in place), and awaiting a decision. The loan amount, interest rate, and repayment terms are then determined based on the algorithm’s assessment of the applicant’s financial profile. This contrasts sharply with traditional loans, which rely heavily on a borrower’s credit score and a manual review process.

CCFlow Loan Eligibility Criteria

Eligibility for a CCFlow loan varies depending on the lender and their specific algorithms. However, common factors considered include consistent income demonstrated through bank statements, a history of responsible financial behavior (such as timely bill payments), and a low debt-to-income ratio. Lenders may also consider factors like employment stability and the length of time the applicant has maintained their bank accounts. Unlike traditional loans, a lower credit score might not automatically disqualify an applicant, provided other financial indicators suggest responsible financial management. A robust and verifiable income stream is typically a key requirement.

Situations Where CCFlow Loans Are Suitable

CCFlow loans can be a suitable solution in several scenarios. For example, individuals with limited credit history, such as recent graduates or immigrants, might find them more accessible than traditional loans. Entrepreneurs with promising businesses but lacking extensive credit history could leverage CCFlow loans for startup capital. Furthermore, individuals needing a smaller, short-term loan for unexpected expenses, like medical bills or car repairs, may find the application process and approval speed more advantageous compared to traditional lenders. The speed and convenience offered by online platforms are significant advantages in time-sensitive situations.

Advantages and Disadvantages of CCFlow Loans

CCFlow loans offer several advantages. The speed of application and approval is often significantly faster than traditional loans. They can be more accessible to individuals with limited or imperfect credit histories. The online application process is typically more convenient. However, CCFlow loans also have potential disadvantages. Interest rates can be higher than those offered by traditional lenders, particularly for borrowers deemed higher risk. The reliance on algorithmic assessments may lead to unfair or biased outcomes in some cases. Finally, the use of alternative data sources raises privacy concerns for some borrowers. Thorough research and comparison of different lenders are crucial before committing to a CCFlow loan.

CCFlow Loan Providers and Marketplaces

Navigating the world of CCFlow loans requires understanding not just the loan itself, but also the landscape of providers and marketplaces offering them. Choosing the right lender is crucial for securing favorable terms and ensuring a smooth borrowing experience. This section will delve into the key players, comparing their offerings to help you make an informed decision.

Ccflow loans – The CCFlow loan market, while relatively niche, is populated by a variety of lenders, ranging from large financial institutions to smaller, specialized companies. Each provider offers a unique set of terms, fees, and loan amounts, making careful comparison essential. Understanding the reputation and trustworthiness of these providers is equally vital to avoid potential pitfalls.

Key Players in the CCFlow Loan Market

Several companies specialize in offering CCFlow loans, each with its own strengths and weaknesses. Direct comparisons are difficult due to the dynamic nature of interest rates and loan offerings, which fluctuate based on market conditions and individual borrower profiles. However, we can examine some general characteristics. Larger institutions may offer lower interest rates due to economies of scale, but they might also have stricter eligibility requirements. Smaller companies might offer more flexible terms but potentially higher interest rates.

CCFlow Loan Provider Comparison

The following table provides a comparison of four hypothetical CCFlow loan providers. Remember that these are examples, and actual rates and terms can vary significantly. Always check the lender’s website for the most up-to-date information.

| Provider Name | Interest Rate (APR) | Loan Amount Limits | Repayment Terms (Months) |

|---|---|---|---|

| Lender A | 7.5% – 12% | $5,000 – $50,000 | 12 – 60 |

| Lender B | 9% – 15% | $2,000 – $30,000 | 6 – 36 |

| Lender C | 6.9% – 11% | $10,000 – $75,000 | 24 – 72 |

| Lender D | 8% – 14% | $3,000 – $40,000 | 12 – 48 |

Reputation and Trustworthiness of CCFlow Loan Providers

Assessing the reputation and trustworthiness of a CCFlow loan provider is paramount. Look for lenders with established track records, positive customer reviews, and transparent lending practices. Check independent review sites and the Better Business Bureau (BBB) for any complaints or negative feedback. Be wary of lenders who promise unrealistically low interest rates or require upfront fees. A trustworthy lender will be upfront about all fees and charges associated with the loan.

Finding and Selecting a Suitable CCFlow Loan Provider

The process of finding a suitable CCFlow loan provider involves careful research and comparison. Begin by identifying several potential lenders, comparing their interest rates, fees, and loan terms. Consider your credit score and financial situation when evaluating your eligibility for different loans. It’s advisable to obtain multiple quotes before making a decision. Remember to carefully review the loan agreement before signing, ensuring you understand all the terms and conditions. Don’t hesitate to ask questions and seek clarification if anything is unclear. Choosing the right provider is a crucial step in securing a CCFlow loan that meets your needs and financial circumstances.

The Application and Approval Process: Ccflow Loans

Securing a CCFlow loan involves a streamlined yet rigorous process. Understanding each step is crucial for a successful application. This section will detail the application process, highlighting key factors influencing approval and offering practical advice to navigate potential challenges. Remember, while CCFlow loans offer speed and convenience, thorough preparation is key to a smooth and efficient experience.

The application process typically begins online, although some lenders may offer alternative methods. The entire process, from application to funding, can often be completed within a few business days, a significant advantage over traditional loans. However, the speed depends heavily on the applicant’s preparedness and the lender’s internal processes.

Required Documentation and Information

Applicants should gather necessary documentation beforehand to expedite the application. This preparation minimizes delays and improves the chances of a swift approval. Missing documents often lead to processing delays.

Generally, lenders require proof of identity (such as a driver’s license or passport), proof of income (pay stubs, bank statements, or tax returns), and information about existing debts. Some lenders may also request information about your employment history and residential address. The specific requirements vary depending on the lender and the loan amount.

Step-by-Step Application Guide

The application process generally follows these steps:

- Online Application: Complete the online application form, providing accurate and complete information. Inaccurate information can lead to immediate rejection or delays.

- Document Upload: Upload the required documents as digital copies. Ensure the documents are clear, legible, and in the correct format specified by the lender.

- Credit Check: The lender will perform a credit check to assess your creditworthiness. A higher credit score generally increases your chances of approval and securing a better interest rate. A lower score may require additional documentation or lead to a higher interest rate.

- Income Verification: The lender will verify your income to ensure you have the capacity to repay the loan. This may involve reviewing pay stubs, bank statements, or tax returns.

- Loan Offer: If approved, you’ll receive a loan offer outlining the terms and conditions, including the interest rate, repayment schedule, and any associated fees. Carefully review the offer before accepting.

- Loan Agreement: Once you accept the offer, you’ll need to sign the loan agreement electronically. This legally binds you to the loan terms.

- Funds Disbursement: After signing the agreement, the funds are typically disbursed to your bank account within a few business days. The timeframe depends on the lender’s internal processes and banking procedures.

Factors Influencing Loan Approval

Several key factors influence a lender’s decision to approve or deny a CCFlow loan application. Understanding these factors allows applicants to better prepare and increase their chances of approval.

Credit score is a paramount factor. A higher credit score demonstrates a history of responsible borrowing and repayment, making you a lower-risk borrower. Income verification is equally crucial, ensuring you have sufficient income to comfortably repay the loan. The loan amount requested relative to your income is also considered; requesting a loan amount significantly exceeding your income capacity can lead to rejection. Finally, the lender’s risk assessment model, which may incorporate other factors, plays a significant role in the final decision.

Addressing Potential Challenges, Ccflow loans

Challenges can arise during the application process. For example, incomplete applications or missing documents can cause delays. Addressing these proactively is crucial. If your application is denied, inquire about the reasons for the denial and consider addressing any underlying issues, such as improving your credit score or providing additional documentation to support your income. Remember, preparation and accurate information are key to a successful application.

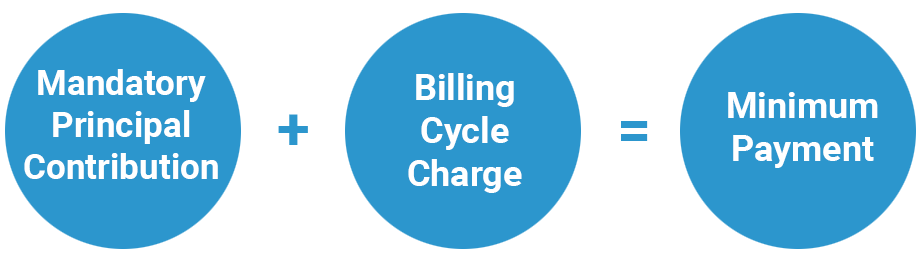

Managing and Repaying CCFlow Loans

Successfully navigating the repayment of a CCFlow loan requires careful planning and proactive management. Understanding your repayment schedule, budgeting effectively, and knowing your options in case of hardship are crucial to avoiding late payments and potential damage to your credit score. This section will provide you with the tools and knowledge to manage your CCFlow loan responsibly.

Sample Repayment Schedules

A CCFlow loan’s repayment schedule depends on the loan amount, interest rate, and loan term agreed upon. Let’s illustrate with a few examples. Assume a $5,000 loan with a 10% annual interest rate.

| Scenario | Loan Term (Months) | Monthly Payment (approx.) |

|---|---|---|

| Scenario 1: Short-Term | 12 | $445 |

| Scenario 2: Medium-Term | 24 | $235 |

| Scenario 3: Long-Term | 36 | $165 |

*Note: These are simplified examples and do not include any potential fees.* Actual payments will vary depending on the lender and specific loan terms. Always review your loan agreement carefully for the precise details of your repayment schedule.

Strategies for Effective Debt Management

Effective CCFlow loan management hinges on proactive budgeting and financial planning. Creating a detailed budget that accounts for all income and expenses is paramount. This allows you to identify areas where you can reduce spending and allocate funds towards loan repayment. Prioritizing loan payments and setting up automatic payments can prevent missed payments and associated fees. Consider exploring options like debt consolidation if you have multiple loans to simplify repayment and potentially lower interest rates. Regularly reviewing your credit report can help you track your progress and identify any potential issues.

Consequences of Late Payments or Defaults

Late payments on a CCFlow loan will likely result in late fees, impacting your overall cost of borrowing. Repeated late payments can severely damage your credit score, making it difficult to obtain credit in the future. In cases of default, the lender may pursue collection actions, which can include wage garnishment, legal action, and negative impacts on your credit history. The consequences can be far-reaching and financially damaging.

Resources for Borrowers Experiencing Repayment Difficulties

If you anticipate difficulty in making your CCFlow loan payments, it’s crucial to contact your lender immediately. Many lenders offer hardship programs that can provide temporary relief, such as reduced payments or extended loan terms. Non-profit credit counseling agencies can provide free or low-cost guidance on managing debt and creating a budget. They can help you explore options like debt management plans and negotiate with creditors. Government agencies also offer resources and programs to assist borrowers facing financial hardship. Proactive communication with your lender and seeking help from these resources is crucial to avoiding serious financial consequences.

CCFlow Loans vs. Traditional Loans

Navigating the world of financing can feel like traversing a minefield. Understanding the nuances between different loan types is crucial for making informed decisions that align with your financial goals. This section will dissect the key differences between CCFlow loans and traditional bank loans, empowering you to choose the best option for your specific circumstances. We’ll examine eligibility criteria, associated fees, repayment terms, and the inherent risks involved in each.

CCFlow loans and traditional bank loans represent distinct approaches to borrowing money. While both aim to provide capital, they differ significantly in their structure, accessibility, and overall cost. Traditional bank loans, typically secured by collateral, often involve a more rigorous application process and stricter eligibility requirements. CCFlow loans, on the other hand, frequently operate with a less stringent approval process, making them potentially more accessible to individuals with less-than-perfect credit histories. However, this increased accessibility often comes with higher interest rates and fees.

Eligibility Criteria and Application Process

Traditional bank loans typically require extensive documentation, including proof of income, credit history checks, and collateral assessment. The application process can be lengthy, involving multiple interviews and verifications. In contrast, CCFlow loans often rely on alternative data points, such as bank transactions and online activity, leading to a potentially faster and simpler application process. However, this streamlined approach can result in higher interest rates for borrowers deemed higher risk. For example, a small business owner seeking a significant loan for expansion might find the stringent requirements of a bank loan preferable to the higher interest rates of a CCFlow loan, even if the application process is quicker. Conversely, an individual needing a small, short-term loan might find the ease of access of a CCFlow loan more beneficial, despite the higher cost.

Interest Rates and Fees

Interest rates and fees are critical factors differentiating CCFlow loans and traditional loans. Traditional bank loans usually offer lower interest rates, particularly for borrowers with strong credit scores and substantial collateral. However, these loans often involve various fees, such as origination fees, appraisal fees, and potentially prepayment penalties. CCFlow loans frequently carry significantly higher interest rates to compensate for the higher risk associated with lending to borrowers with less robust credit histories. While fees might be lower upfront, the cumulative cost over the loan’s lifetime could exceed that of a traditional bank loan, especially if the borrower is unable to pay off the loan quickly. For instance, a borrower with excellent credit securing a mortgage through a bank might pay a lower overall interest amount compared to someone with poor credit taking out a similar-sized loan through a CCFlow platform.

Key Features Differentiating CCFlow Loans from Traditional Loans

The following points highlight the core differences between CCFlow and traditional loan options:

- Eligibility Requirements: Traditional loans often require a strong credit score and collateral; CCFlow loans may have less stringent requirements but higher interest rates.

- Application Process: Traditional loans involve a more rigorous and time-consuming application; CCFlow loans often offer a faster and simpler process.

- Interest Rates: Traditional loans generally offer lower interest rates for qualified borrowers; CCFlow loans typically have higher interest rates.

- Fees: Traditional loans may involve various fees (origination, appraisal, etc.); CCFlow loans might have fewer upfront fees but higher overall costs.

- Loan Amounts: Traditional loans often offer larger loan amounts; CCFlow loans might have lower loan limits.

- Loan Terms: Both loan types offer varying terms, but CCFlow loans might offer shorter terms.

Potential Risks Associated with CCFlow and Traditional Loans

Both CCFlow and traditional loans present inherent risks. Traditional loans carry the risk of collateral seizure in case of default. High fees and lengthy application processes are also potential drawbacks. CCFlow loans, while often easier to obtain, pose the risk of high interest rates and potentially predatory lending practices. Careful consideration of the terms and conditions is crucial before committing to either type of loan. For example, failing to make timely payments on a traditional mortgage could lead to foreclosure, while neglecting payments on a high-interest CCFlow loan could rapidly lead to a significant debt burden. Understanding these risks and choosing the loan type that best aligns with your financial capabilities is essential.

Legal and Regulatory Aspects of CCFlow Loans

Navigating the world of CCFlow loans requires a keen understanding of the legal landscape. These loans, often operating in a relatively new and rapidly evolving financial sector, are subject to a complex web of regulations that vary significantly depending on the jurisdiction. Ignoring these legal frameworks can lead to significant financial and legal risks for both borrowers and lenders.

The legal and regulatory environment surrounding CCFlow loans is a critical factor influencing their accessibility, cost, and overall safety. Understanding these aspects empowers borrowers to make informed decisions and protects them from potential exploitation. Conversely, lenders must operate within these boundaries to maintain compliance and avoid legal repercussions.

Relevant Legal and Regulatory Frameworks

CCFlow loans fall under various legal and regulatory umbrellas, depending on the specific type of loan and the jurisdiction. In many jurisdictions, consumer protection laws, such as those regulating interest rates, disclosure requirements, and debt collection practices, directly apply. Additionally, laws governing electronic transactions, data privacy, and contract law all play crucial roles. For instance, in the United States, state laws often dictate aspects of lending practices, while federal laws, like the Truth in Lending Act (TILA), govern disclosure requirements. The European Union, on the other hand, has its own comprehensive set of consumer protection directives and regulations that impact the CCFlow lending landscape. Specific regulatory bodies, such as the Financial Conduct Authority (FCA) in the UK or similar agencies in other countries, may also have specific guidelines and oversight for online lending platforms. The lack of a universally standardized regulatory framework necessitates careful consideration of the specific legal context in which a CCFlow loan is offered and accepted.

Borrower Protections in Case of Disputes

Several legal avenues are typically available to borrowers facing disputes with CCFlow lenders. These include the right to file complaints with consumer protection agencies, engage in mediation or arbitration, or pursue legal action in civil court. Many jurisdictions offer legal aid or pro bono services to assist consumers in navigating legal disputes, especially those involving financial matters. Furthermore, depending on the jurisdiction and the specifics of the loan agreement, borrowers may be protected by laws limiting interest rates, prohibiting unfair debt collection practices, or allowing for the cancellation or modification of contracts under certain circumstances. The strength of these protections, however, varies greatly by location and the specifics of the loan agreement. For example, laws concerning predatory lending practices are rigorously enforced in some regions, while others may have weaker regulatory frameworks.

Common Legal Issues and Their Resolution

Common legal issues surrounding CCFlow loans often involve disputes over interest rates, hidden fees, unauthorized charges, misleading advertising, and violations of data privacy laws. Resolution methods vary depending on the nature of the issue and the jurisdiction. Many disputes can be resolved through negotiation, mediation, or arbitration, avoiding the expense and time commitment of a full-blown court case. However, if these methods fail, borrowers may need to pursue legal action to protect their rights. Successful resolution often hinges on the strength of the evidence, the clarity of the loan agreement, and the applicable laws in the relevant jurisdiction. For example, a borrower who can demonstrate that a lender violated a state’s usury laws might be able to recover excessive interest payments. Similarly, a borrower whose personal data was mishandled might be entitled to compensation under data protection laws.

Importance of Understanding Loan Agreement Terms

Before signing any CCFlow loan agreement, borrowers should carefully review all terms and conditions. This includes understanding the interest rate, fees, repayment schedule, late payment penalties, and any other conditions associated with the loan. Failure to understand these terms can lead to unforeseen financial difficulties and potential legal disputes. Seeking independent legal advice before signing is advisable, especially for complex loan agreements or if there are any ambiguities or concerns about the terms. A thorough understanding of the agreement is paramount to protecting the borrower’s financial well-being and avoiding potential legal pitfalls. Ignoring this crucial step can have significant and long-lasting consequences.

Illustrative Examples of CCFlow Loan Use Cases

CCFlow loans, with their flexible repayment structures and often faster approval processes compared to traditional loans, offer unique advantages in specific financial situations. Understanding these use cases helps illustrate the power and potential limitations of this lending model. Let’s examine three distinct scenarios where a CCFlow loan proves beneficial.

Scenario 1: Bridging a Gap in Seasonal Income

This scenario involves Sarah, a freelance graphic designer whose income fluctuates throughout the year. During the slower months, Sarah experiences a significant drop in earnings, making it difficult to cover her regular expenses, such as rent and utilities. She needs $5,000 to bridge the income gap until her busy season begins in three months. A CCFlow loan with a three-month repayment term, structured to align with her expected income surge, would be ideal. The loan’s flexibility allows Sarah to make smaller payments during the lean months and larger payments when her income increases. A positive outcome is that Sarah avoids accumulating high-interest debt on credit cards or facing late payment penalties on her bills. A potential negative aspect is the higher interest rate compared to a traditional loan, although the short repayment term mitigates this risk. The short-term nature and flexible repayment schedule of the CCFlow loan perfectly suits Sarah’s irregular income stream.

Scenario 2: Funding a Small Business Expansion

John owns a small bakery and needs $10,000 to purchase new ovens and expand his production capacity. Traditional bank loans often require extensive paperwork and lengthy processing times, which could delay John’s expansion plans. A CCFlow loan, with its streamlined application process and faster approval, allows John to access the funds quickly. He chooses a 12-month repayment plan, structuring payments to align with his projected increased revenue from the expanded production. The positive impact is that John can capitalize on increased demand promptly, boosting his business’s growth and profitability. However, the higher interest rate compared to a traditional small business loan needs careful consideration. The speed and efficiency of the CCFlow loan, coupled with its suitability for short-to-medium-term financing, are crucial for John’s timely expansion.

Scenario 3: Unexpected Medical Expenses

Maria unexpectedly faced significant medical expenses of $3,000 after a car accident. Her health insurance covered a portion, but she still had a considerable out-of-pocket cost. She doesn’t have sufficient savings to cover the expense, and applying for a traditional loan would take too long. A CCFlow loan, with its rapid approval process, provides Maria with immediate financial relief. She opts for a six-month repayment plan, managing payments alongside her regular expenses. The positive outcome is that Maria avoids accumulating high-interest debt on credit cards or facing collection agencies. The potential negative is the interest rate, but the immediate financial assistance allows her to focus on her recovery without added financial stress. The speed and ease of access of a CCFlow loan were crucial in this emergency situation.