Definition and Mechanics of C2P Loans

Consumer-to-producer (C2P) loans represent a relatively new financing model that directly connects individual lenders with businesses needing capital. Unlike traditional bank loans, C2P loans bypass intermediaries, often leveraging online platforms to facilitate the lending process. This direct approach can potentially offer advantages for both borrowers and lenders, streamlining access to capital and potentially offering better terms.

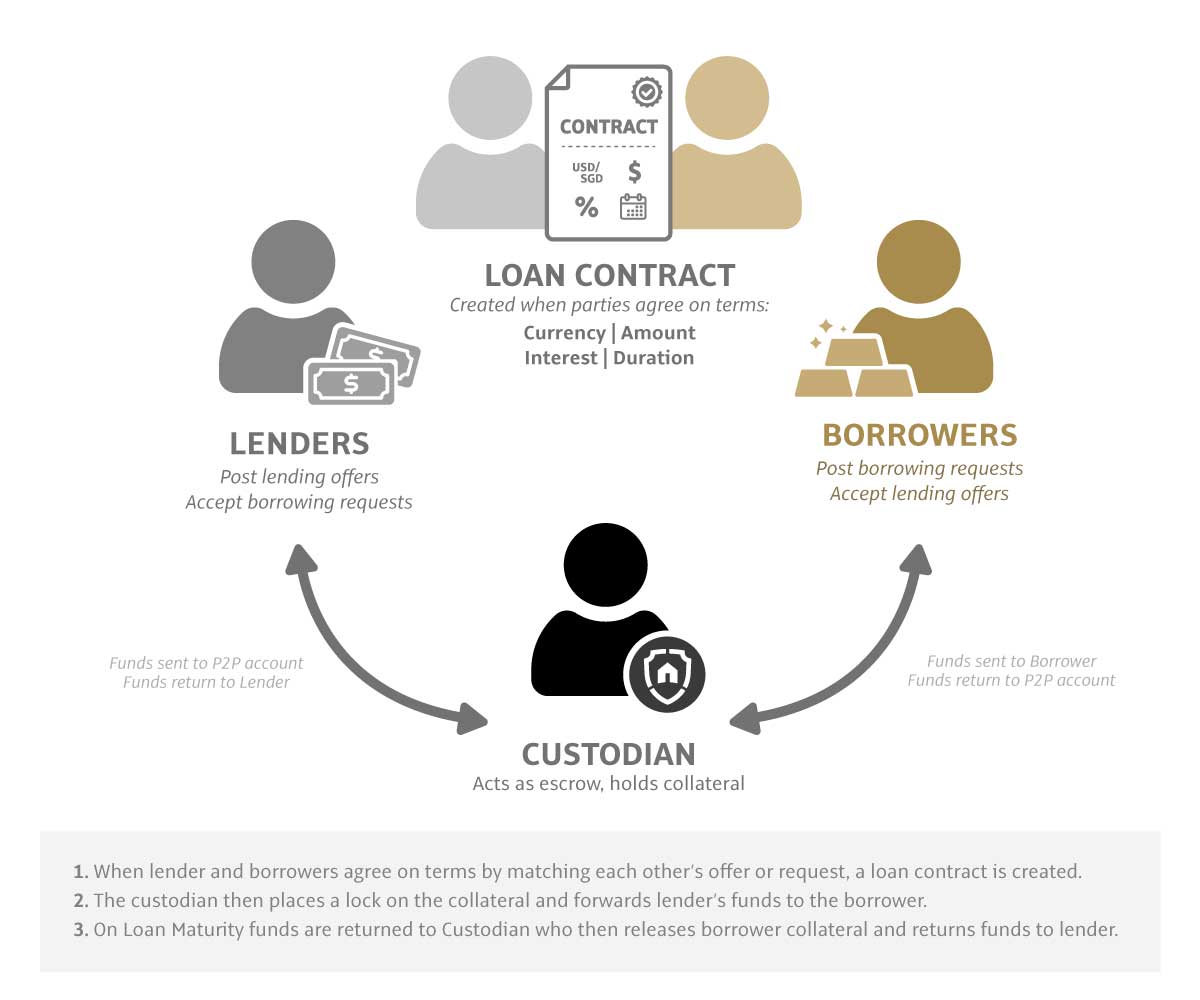

C2P loans function on the principle of peer-to-peer lending, but with a specific focus on connecting consumers with businesses. The mechanics involve individuals investing their savings in business loans through an online platform. These platforms vet both borrowers and lenders, providing a level of security and risk mitigation not always present in informal lending arrangements. The platform then facilitates the loan disbursement and repayment process, acting as an intermediary to ensure compliance and protect the interests of all parties involved. This model offers a viable alternative to traditional bank financing, especially for small businesses that may find it difficult to secure loans through conventional channels.

The C2P Loan Application Process

Securing a C2P loan typically involves a straightforward process. First, the borrower creates a profile on a chosen lending platform, providing detailed information about their business, including financial statements, business plan, and credit history. The platform then assesses the borrower’s creditworthiness and the viability of their business. Once approved, the borrower’s loan listing is made visible to potential lenders. Lenders review the details of the loan request and decide whether to invest. Upon reaching the funding goal, the loan is disbursed to the borrower. Regular repayments are then made through the platform, with interest accruing to the lenders.

Step-by-Step Guide to C2P Loan Application and Approval

- Registration and Profile Creation: The borrower registers on the C2P lending platform and completes a comprehensive profile, including business details and financial information.

- Loan Application Submission: The borrower submits a detailed loan application, outlining the purpose of the loan, the amount needed, and the proposed repayment schedule.

- Platform Review and Credit Assessment: The platform assesses the borrower’s creditworthiness, business viability, and the risk associated with the loan request.

- Loan Listing and Funding: If approved, the loan request is listed on the platform, allowing potential lenders to review and invest.

- Loan Disbursement: Once the funding goal is reached, the loan amount is disbursed to the borrower.

- Repayment Schedule: The borrower adheres to the agreed-upon repayment schedule, making regular payments through the platform.

Comparison of C2P Loans with Traditional Lending Models

C2P loans differ significantly from traditional bank loans in several key aspects. Traditional bank loans often involve lengthy application processes, stringent eligibility criteria, and higher fees. C2P loans, on the other hand, can offer faster approval times, more flexible terms, and potentially lower interest rates, particularly for businesses that may struggle to meet traditional bank lending requirements. However, C2P loans may carry higher risks for lenders due to the inherent uncertainties associated with small business financing.

Interest Rates, Loan Terms, and Eligibility Criteria for Different C2P Loan Providers

| Provider | Interest Rate Range | Typical Loan Term | Eligibility Criteria |

|---|---|---|---|

| Provider A | 5% – 15% | 12-36 months | Good credit score, established business history |

| Provider B | 7% – 20% | 6-24 months | Minimum revenue requirements, positive cash flow |

| Provider C | 8% – 18% | 12-48 months | Detailed business plan, strong management team |

Types and Variations of C2P Loans

The world of consumer-to-peer (C2P) lending is surprisingly diverse. While the core concept remains the same – individuals lending money to other individuals – the specific structures and features of these loans vary considerably, impacting both borrowers and lenders. Understanding these variations is crucial for making informed decisions, whether you’re seeking funding or looking for alternative investment opportunities. This section will break down the key types of C2P loans, highlighting their nuances and practical applications.

Secured vs. Unsecured C2P Loans

The most fundamental distinction in C2P loans lies in whether they are secured or unsecured. Secured loans require collateral – an asset the borrower pledges to the lender as security. If the borrower defaults, the lender can seize and sell the collateral to recoup their losses. Unsecured loans, on the other hand, rely solely on the borrower’s creditworthiness and promise to repay.

Secured C2P loans often come with lower interest rates because the lender assumes less risk. Think of it like this: if you’re lending money to someone who’s put their car up as collateral, you’re much more comfortable with the risk than if they’re offering nothing but a promise. Examples of collateral could include real estate, vehicles, or valuable personal property. Conversely, unsecured C2P loans typically carry higher interest rates to compensate for the increased risk of default. Borrowers with poor credit histories often find themselves needing to accept these higher rates.

Short-Term vs. Long-Term C2P Loans

C2P loans also differ significantly in their repayment terms. Short-term loans are designed for quick financing needs, often with repayment periods ranging from a few weeks to a year. These loans might be used for emergency expenses, unexpected bills, or bridging short-term financial gaps. Long-term C2P loans, on the other hand, offer longer repayment periods, sometimes stretching several years. These are more suitable for larger purchases or projects requiring sustained financial support, such as home renovations or business expansions. The interest rates and associated fees will naturally vary depending on the loan’s duration. A short-term loan will typically have a higher interest rate per year, but the overall cost might be less than a longer-term loan with a lower annual interest rate.

Peer-to-Peer Lending Platforms and Their Loan Variations

Many online platforms facilitate C2P lending, each with its own set of loan products and variations. Some platforms specialize in specific niches, such as student loans, small business loans, or even loans for specific types of purchases. For example, one platform might offer unsecured personal loans with flexible repayment options, while another focuses on secured loans for larger amounts. These variations allow borrowers to find loans tailored to their unique circumstances and financial needs. The differences in loan structures across platforms often reflect their risk assessment models and target borrower demographics.

Characteristics of Different C2P Loan Types

The following table summarizes the key characteristics of different C2P loan types:

| Loan Type | Secured/Unsecured | Typical Use Case | Interest Rate | Repayment Term |

|---|---|---|---|---|

| Secured Personal Loan | Secured | Home improvements, debt consolidation | Lower | Medium to Long-term |

| Unsecured Personal Loan | Unsecured | Emergency expenses, smaller purchases | Higher | Short to Medium-term |

| Business Loan | Secured or Unsecured | Business expansion, equipment purchase | Variable | Long-term |

| Student Loan | Unsecured | Tuition fees, educational expenses | Variable, often government-subsidized | Long-term |

Eligibility Criteria and Risk Assessment

Securing a C2P (customer-to-peer) loan hinges on a lender’s thorough assessment of your creditworthiness and the inherent risks involved. This process isn’t just about your ability to repay; it’s a comprehensive evaluation of your financial health and the likelihood of you meeting your obligations. Understanding this process is crucial for both borrowers aiming for approval and lenders seeking to minimize potential losses.

Typical Eligibility Requirements for C2P Loans

Lenders employ various criteria to determine your eligibility for a C2P loan. These often include a minimum credit score, demonstrating sufficient income to cover repayments, a verifiable employment history, and a clean credit report free of significant delinquencies. The specific requirements, however, can vary significantly depending on the lender and the loan amount. Some lenders might prioritize factors like your debt-to-income ratio (DTI), the value of the collateral offered (if any), and the length of your residency at your current address. Meeting these requirements significantly increases your chances of loan approval.

Methods of Risk Assessment for C2P Loans

Risk assessment for C2P loans is a multi-faceted process. Lenders utilize a combination of quantitative and qualitative methods. Quantitative methods involve analyzing hard data like your credit score, income, debt levels, and loan-to-value ratio (LTV) if collateral is involved. Qualitative methods delve into your repayment history, employment stability, and the overall financial health of your business, if the loan is for business purposes. Sophisticated algorithms and statistical models are frequently employed to process this data and assign a risk score, which directly influences the interest rate and loan terms offered. A higher risk score often translates to a higher interest rate.

Factors Considered in Creditworthiness Evaluation

Several key factors are meticulously evaluated during the creditworthiness assessment. These include your credit history, demonstrating a consistent record of timely payments; your income stability, showcasing a reliable source of funds to service the loan; your debt levels, indicating your capacity to manage existing financial obligations; your loan-to-value ratio (LTV), if using collateral, showing the relationship between the loan amount and the asset’s value; and your collateral, offering additional security to the lender. A thorough review of these factors provides a comprehensive picture of your ability to repay the loan. For example, a borrower with a high credit score, stable income, low debt, and substantial collateral will typically present a lower risk profile compared to a borrower with a poor credit history, unstable income, high debt, and little to no collateral.

Strategies to Improve Chances of Loan Approval

Improving your chances of loan approval involves proactive steps to enhance your financial profile. This includes consistently paying bills on time to improve your credit score; increasing your income to lower your debt-to-income ratio; reducing existing debt to demonstrate better financial management; and saving for a down payment or securing collateral to strengthen your application. By focusing on these areas, borrowers can significantly increase their likelihood of obtaining favorable loan terms. Regularly monitoring your credit report and addressing any inaccuracies is also crucial.

Flowchart Illustrating the Lender’s Risk Assessment Process

The following describes a typical flowchart illustrating the lender’s risk assessment process.

[Start] –> [Application Received] –> [Credit Check & Income Verification] –> [Debt-to-Income Ratio Calculation] –> [Collateral Assessment (if applicable)] –> [Risk Score Calculation] –> [Loan Approval/Rejection] –> [Loan Offer/Rejection Letter] –> [End]

Each stage involves a detailed analysis of the borrower’s financial information. The credit check assesses credit history and score. Income verification confirms the borrower’s ability to repay. The debt-to-income ratio determines the borrower’s capacity to handle additional debt. Collateral assessment (if applicable) evaluates the value and security of the asset pledged. The risk score is calculated based on all factors. Finally, the lender decides whether to approve or reject the loan application.

Benefits and Drawbacks for Borrowers

C2P loans, while offering a potentially attractive solution for bridging financial gaps, aren’t without their complexities. Understanding both the advantages and disadvantages is crucial before committing to this type of financing. This section will dissect the potential benefits and risks, comparing C2P loans to alternatives and exploring their long-term financial implications. Remember, informed decision-making is key to responsible borrowing.

Potential Benefits of C2P Loans

C2P loans can provide several advantages for borrowers, particularly in situations where traditional financing options are unavailable or insufficient. The speed and accessibility of these loans can be game-changers for individuals facing urgent financial needs. However, it’s vital to weigh these benefits against the potential drawbacks.

Potential Drawbacks and Risks Associated with C2P Loans

The convenience of C2P loans comes at a price. High interest rates and short repayment periods can lead to a debt trap if not managed carefully. Furthermore, the reliance on readily available credit can mask underlying financial issues, potentially worsening the borrower’s long-term financial health. Unexpected expenses or job loss can quickly escalate the debt burden.

Comparison of C2P Loans Versus Other Financing Options

Compared to traditional bank loans, C2P loans often offer faster access to funds but at a significantly higher cost. Personal loans from banks typically have lower interest rates and longer repayment terms, making them more manageable for borrowers. Credit cards, while readily accessible, also carry high interest rates and can easily lead to overspending and accumulating debt. Choosing the right option depends on individual circumstances and financial literacy. For example, a borrower needing immediate funds for a crucial car repair might find a C2P loan more suitable than waiting for a bank loan approval. However, someone consolidating debt might find a lower-interest personal loan more beneficial in the long run.

Long-Term Financial Implications of Taking Out a C2P Loan

The long-term implications of a C2P loan can be substantial. The high interest rates can significantly increase the total amount repaid, potentially hindering future financial goals like saving for a down payment on a house or investing. Missed payments can severely damage credit scores, making it harder to obtain loans or credit in the future. Careful budgeting and financial planning are essential to avoid these negative consequences. For instance, failing to repay a C2P loan can result in a significant increase in debt due to late payment fees and penalties, potentially affecting credit scores for years.

Summary of Pros and Cons of C2P Loans

| Pros | Cons |

|---|---|

| Fast access to funds | High interest rates |

| Convenient application process | Short repayment periods |

| May be available to those with poor credit | Risk of debt trap |

| Can address immediate financial needs | Negative impact on credit score if missed payments occur |

Regulations and Legal Aspects

Navigating the legal landscape of C2P (Consumer-to-Peer) lending is crucial for both borrowers and lenders. Understanding the regulations, protections, and responsibilities involved is essential for a successful and legally sound transaction. Failure to comply with these regulations can lead to significant financial and legal consequences.

C2P loans, while offering innovative financing solutions, are subject to a complex web of regulations designed to protect consumers from predatory lending practices and ensure fair market operations. These regulations vary significantly depending on the jurisdiction, but common threads exist across many regions. Key areas of focus often include interest rate caps, disclosure requirements, and debt collection practices. The specific laws governing C2P lending often overlap with broader consumer protection laws and regulations related to personal loans or online lending platforms.

Relevant Regulations and Laws, C2p loan

The legal framework governing C2P loans is multifaceted. National and state-level consumer protection laws frequently dictate aspects like maximum permissible interest rates, the transparency of loan terms, and the permissible collection methods employed by lenders. For instance, the Truth in Lending Act (TILA) in the United States mandates clear disclosure of loan terms, including the annual percentage rate (APR) and all fees associated with the loan. Similar regulations exist in other countries, often tailored to their specific financial contexts. Additionally, laws addressing unfair or deceptive business practices may apply, preventing lenders from employing misleading tactics to secure loans. Failure to adhere to these regulations can result in hefty fines and legal action.

Legal Protections for Borrowers

Borrowers benefit from several legal protections designed to prevent exploitation. Many jurisdictions mandate that lenders provide clear and concise loan agreements, outlining all terms and conditions. These agreements must be readily understandable, avoiding complex jargon that could confuse borrowers. Furthermore, laws often limit the amount of interest a lender can charge, preventing exorbitant rates that could trap borrowers in a cycle of debt. Borrowers also have legal recourse if a lender engages in unfair or deceptive practices, such as harassment during debt collection. This protection often includes the ability to file complaints with regulatory bodies and pursue legal action to resolve disputes.

Responsibilities of Lenders and Borrowers

Lenders are responsible for adhering to all applicable regulations, providing accurate and transparent loan agreements, and engaging in ethical debt collection practices. They must ensure borrowers fully understand the terms and conditions before signing the agreement. Borrowers, in turn, are responsible for reviewing the loan agreement carefully, understanding the terms and conditions, and making timely payments as agreed upon. Open communication between lender and borrower is vital to prevent misunderstandings and potential disputes. Failure to meet these responsibilities can lead to legal action against either party.

Consequences of Defaulting on a C2P Loan

Defaulting on a C2P loan can have severe repercussions. Lenders may pursue legal action to recover the outstanding debt, potentially leading to wage garnishment, bank account levies, or even property seizure, depending on the jurisdiction and the loan agreement. A default can also severely damage a borrower’s credit score, making it difficult to secure loans or credit in the future. The impact of a default can extend beyond the financial realm, affecting opportunities such as renting an apartment or obtaining employment. The specific consequences will depend on the loan agreement, the jurisdiction, and the lender’s collection practices.

Common Clauses in C2P Loan Contracts

C2P loan contracts often include standard clauses addressing various aspects of the agreement. These commonly include provisions specifying the loan amount, the interest rate, the repayment schedule, late payment fees, and the consequences of default. Many contracts also include clauses related to prepayment penalties, arbitration agreements, and governing law. Understanding these clauses is crucial for both borrowers and lenders to ensure transparency and prevent future disputes. For example, a clause might specify that disputes will be resolved through binding arbitration rather than through court proceedings. Another might Artikel the specific steps a lender will take if a borrower defaults on their payments.

Impact on the Economy and Society: C2p Loan

The proliferation of C2P (Consumer-to-Producer) loans presents a multifaceted impact on the economy and society, potentially reshaping financial landscapes and influencing social structures. Understanding these effects is crucial for policymakers, lenders, and borrowers alike to navigate the opportunities and challenges this innovative lending model presents. The increased accessibility to capital, while offering significant potential, also necessitates careful consideration of potential downsides and the need for robust regulatory frameworks.

Widespread adoption of C2P loans could significantly stimulate economic growth. By providing direct access to capital for small and medium-sized enterprises (SMEs), particularly in underserved communities, C2P lending can unlock entrepreneurial potential and drive job creation. This injection of capital can fuel innovation, increase productivity, and contribute to overall economic expansion. However, this positive impact is contingent on responsible lending practices and effective risk management to prevent potential negative consequences.

Economic Impact of Widespread C2P Loan Adoption

Increased access to credit through C2P loans can revitalize local economies. Consider a scenario where artisans in a rural area gain access to microloans to purchase better equipment or expand their workshops. This leads to increased production, higher incomes, and potentially, the creation of new jobs within the community. The cumulative effect of such localized economic boosts across numerous communities can generate a substantial ripple effect throughout the national economy. Conversely, uncontrolled expansion could lead to over-indebtedness and financial instability within vulnerable populations, necessitating a balanced approach to implementation and regulation.

Social Implications of Increased Access to C2P Loans

C2P loans can empower marginalized communities by providing them with the financial tools to improve their livelihoods. For example, women entrepreneurs in developing countries often lack access to traditional lending channels. C2P loans can bridge this gap, enabling them to start or expand their businesses, improving their financial independence and social standing. This increased financial inclusion can contribute to greater social equity and reduce income inequality. However, it’s crucial to address potential risks such as predatory lending practices that could exacerbate existing social inequalities if not properly regulated.

Role of C2P Loans in Fostering Economic Development

C2P lending plays a pivotal role in fostering economic development, particularly in emerging markets and underserved communities. By providing access to credit for individuals and businesses that lack traditional collateral, C2P loans can stimulate entrepreneurship and create employment opportunities. This is especially relevant in sectors like agriculture, where smallholder farmers often struggle to access formal credit. For example, a farmer might use a C2P loan to invest in improved seeds or irrigation systems, leading to increased crop yields and higher income. This increased productivity directly contributes to economic growth and poverty reduction.

Challenges and Risks Associated with the Expansion of C2P Lending

The rapid expansion of C2P lending presents several challenges. One significant concern is the potential for predatory lending practices, where borrowers are subjected to high interest rates and unfair terms. This can trap individuals in a cycle of debt, undermining the positive social and economic impacts intended by C2P loans. Effective regulation and consumer protection measures are crucial to mitigate this risk. Furthermore, the lack of robust credit scoring systems in some regions can make it difficult to assess borrower risk accurately, potentially leading to higher default rates and instability within the lending market. The development of innovative credit assessment methods is essential to address this challenge.

Potential Effects of C2P Loans on Different Socioeconomic Groups

The impact of C2P loans varies across socioeconomic groups. While it can be a powerful tool for economic empowerment for low-income individuals and SMEs, it’s crucial to ensure that access is equitable and doesn’t disproportionately benefit wealthier groups. Careful design and implementation of C2P lending programs are needed to prevent the creation of new inequalities. For instance, programs targeted specifically at marginalized communities, coupled with financial literacy initiatives, can help ensure that the benefits of C2P loans are shared broadly and contribute to a more inclusive economic landscape. Failure to consider these aspects could widen the gap between the wealthy and the poor, undermining the overall positive potential of C2P lending.

Future Trends and Developments in C2P Lending

The consumer-to-peer (C2P) lending landscape is rapidly evolving, driven by technological advancements, shifting regulatory environments, and changing consumer behaviors. Understanding these trends is crucial for both lenders and borrowers to navigate this dynamic market effectively and capitalize on emerging opportunities. The future of C2P lending promises increased accessibility, enhanced security, and a more refined risk assessment process, but also presents challenges related to regulation and ethical considerations.

Several key factors will shape the future trajectory of C2P lending. Technological innovation will play a significant role, automating processes, improving credit scoring, and enhancing security. Regulatory changes will also be instrumental, balancing the need for consumer protection with the promotion of innovation and competition. Finally, shifts in consumer behavior and preferences will determine the overall adoption and success of different C2P lending models.

Emerging Trends in the C2P Loan Market

The C2P lending market is witnessing a surge in demand for alternative financing solutions, particularly among underserved populations. This trend is driven by several factors, including the increasing popularity of digital lending platforms, the growing accessibility of smartphones and internet connectivity, and the desire for faster and more convenient loan processing. We’re also seeing a rise in niche C2P lending platforms focusing on specific borrower segments, such as small businesses, gig workers, and students. For example, platforms specializing in providing loans to renewable energy startups are gaining traction, demonstrating the growing integration of C2P lending with sustainable finance initiatives. This targeted approach allows for more tailored risk assessments and improved loan performance.

Technological Advancements Impacting C2P Lending

Artificial intelligence (AI) and machine learning (ML) are revolutionizing C2P lending by automating credit scoring, fraud detection, and loan underwriting. AI algorithms can analyze vast datasets of borrower information to create more accurate and efficient risk assessments, leading to improved loan approvals and reduced defaults. Blockchain technology offers enhanced security and transparency by providing an immutable record of loan transactions. This reduces the risk of fraud and improves trust between borrowers and lenders. Furthermore, the increasing use of open banking APIs allows for seamless data integration, enabling lenders to access a wider range of financial information to make more informed lending decisions. For instance, a platform leveraging open banking might access a borrower’s transaction history to assess their repayment capacity more accurately than traditional methods.

Predictions for the Future of C2P Loans and Their Role in the Financial Landscape

C2P lending is poised to become an increasingly significant part of the broader financial landscape. We anticipate a continued increase in the volume of C2P loans, driven by the growing demand for accessible and affordable credit. The integration of fintech solutions will lead to a more personalized and efficient lending experience, tailored to individual borrower needs. However, this growth will also require robust regulatory frameworks to ensure consumer protection and prevent market manipulation. We predict that C2P lending will become more integrated with other financial services, such as payment processing and investment platforms, creating a more holistic financial ecosystem. For example, a future scenario could see a C2P platform offering bundled services including loans, savings accounts, and investment options, providing a one-stop shop for financial management.

Evolution of Regulations and Policies Related to C2P Loans

Regulatory bodies worldwide are actively working to establish clear guidelines for C2P lending platforms. The focus is on protecting borrowers from predatory lending practices, ensuring data privacy, and promoting transparency. We expect to see stricter regulations regarding interest rates, loan terms, and data security. Increased scrutiny of lending algorithms and risk assessment models is also likely. These regulatory changes will aim to strike a balance between fostering innovation in the C2P lending sector and safeguarding consumer interests. This could involve the introduction of licensing requirements for C2P platforms, mandatory disclosure of fees and interest rates, and increased oversight of data handling practices. Similar to the evolution of regulations surrounding online marketplaces like eBay and Amazon, C2P lending will likely see a gradual tightening of rules and increased consumer protections over time.

Potential Future Scenarios for C2P Lending

Several potential scenarios could unfold in the C2P lending market in the coming years. These scenarios highlight the diverse possibilities and challenges ahead:

- Scenario 1: Hyper-Personalization and AI-Driven Lending: C2P platforms leverage advanced AI and machine learning to offer highly personalized loan products and risk assessments, catering to individual borrower needs and circumstances with unparalleled accuracy and speed. This leads to increased loan approvals for deserving borrowers and a reduction in defaults.

- Scenario 2: Increased Regulatory Scrutiny and Consolidation: Stricter regulations lead to a consolidation of the C2P lending market, with only larger, well-capitalized platforms surviving. This could lead to reduced competition and potentially higher borrowing costs for consumers.

- Scenario 3: Integration with Decentralized Finance (DeFi): C2P lending platforms integrate with DeFi protocols, offering decentralized and transparent loan processes with reduced reliance on traditional financial intermediaries. This could lead to increased efficiency and lower transaction costs but also introduces new challenges related to security and regulation.

- Scenario 4: Expansion into Underserved Markets: C2P lending platforms successfully expand into underserved markets, providing access to credit for populations traditionally excluded from traditional financial systems. This contributes to financial inclusion and economic empowerment but requires careful consideration of cultural and economic factors.