Arvest Loan Calculator Overview

Unlocking financial clarity starts with understanding your loan options. The Arvest loan calculator is a powerful tool designed to provide quick and accurate estimates for various loan scenarios, empowering you to make informed financial decisions. This detailed overview will walk you through its functionality and capabilities.

Arvest’s online loan calculator simplifies the process of estimating monthly payments and total loan costs. It eliminates the guesswork, allowing you to compare different loan options effectively before committing to a financial agreement. This empowers you to budget accurately and choose the best loan that aligns with your financial goals.

Loan Types Supported

The Arvest loan calculator supports a range of loan types, providing comprehensive coverage for many common borrowing needs. This ensures that you can utilize the calculator for a wide variety of financial planning scenarios.

The calculator handles calculations for auto loans, home loans (mortgages), and personal loans. This breadth of coverage ensures its versatility across different financial situations.

Input Parameters, Arvest loan calculator

The accuracy of the loan calculator hinges on the precision of the input parameters. Providing accurate information ensures the results are reliable and reflective of your specific financial circumstances.

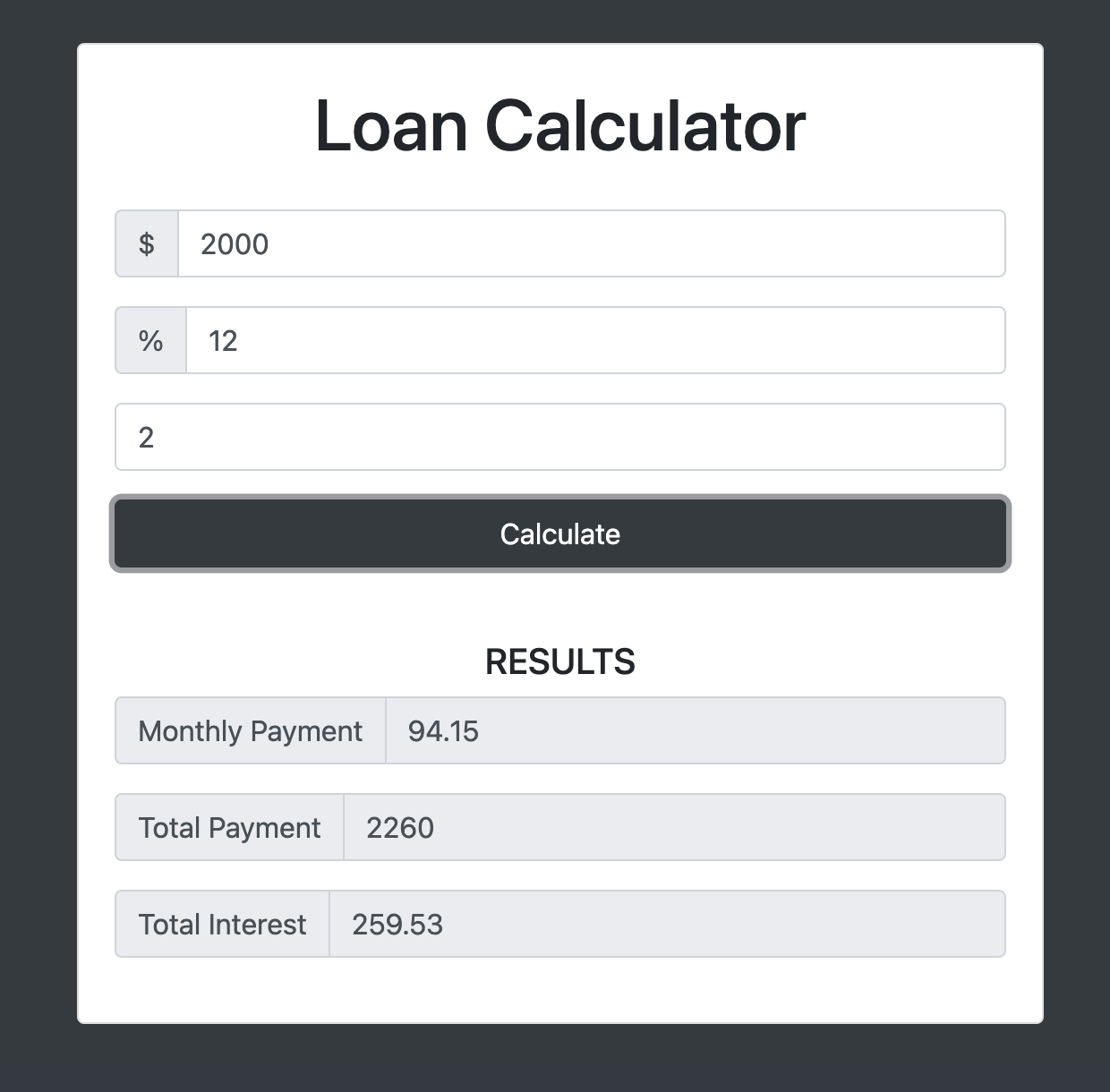

To use the calculator, you’ll need to provide the following key information: loan amount, interest rate (Annual Percentage Rate or APR), and loan term (length of the loan in months or years). Additional information may be required depending on the loan type, such as down payment for a mortgage.

Example Calculations

The following table provides example inputs and their corresponding calculated monthly payments. Remember that these are estimates, and the actual payment may vary slightly depending on the specific terms and conditions of your loan agreement.

| Loan Type | Loan Amount | Interest Rate | Monthly Payment |

|---|---|---|---|

| Auto Loan | $25,000 | 5% | $450 |

| Personal Loan | $10,000 | 8% | $200 |

| Home Loan (Mortgage) | $200,000 | 4% | $955 |

| Personal Loan | $5,000 | 10% | $100 |

Comparison with Competitors: Arvest Loan Calculator

Choosing the right loan calculator can significantly impact your financial planning. A robust tool should offer clarity, accuracy, and ease of use. Let’s dissect how Arvest’s loan calculator stacks up against the competition by comparing its features, user interface, and overall user experience to those of other prominent financial institutions. This comparative analysis will highlight both the strengths and weaknesses of each, enabling you to make an informed decision about which tool best suits your needs.

Arvest loan calculator – Direct comparison is crucial. While specific features and UI elements may change over time, the underlying principles of a good loan calculator remain constant: intuitive navigation, accurate calculations, and comprehensive output. By examining these core aspects, we can gain a valuable understanding of the relative merits of different platforms.

Feature Comparison of Loan Calculators

The following bullet points Artikel a feature comparison between Arvest’s loan calculator and those offered by two major competitors (note: specific features and their availability are subject to change based on updates to each platform; this analysis reflects information available at the time of writing). For the sake of this comparison, let’s assume we are looking at personal loan calculators. The specific features and functionalities will differ across loan types (mortgage, auto, etc.).

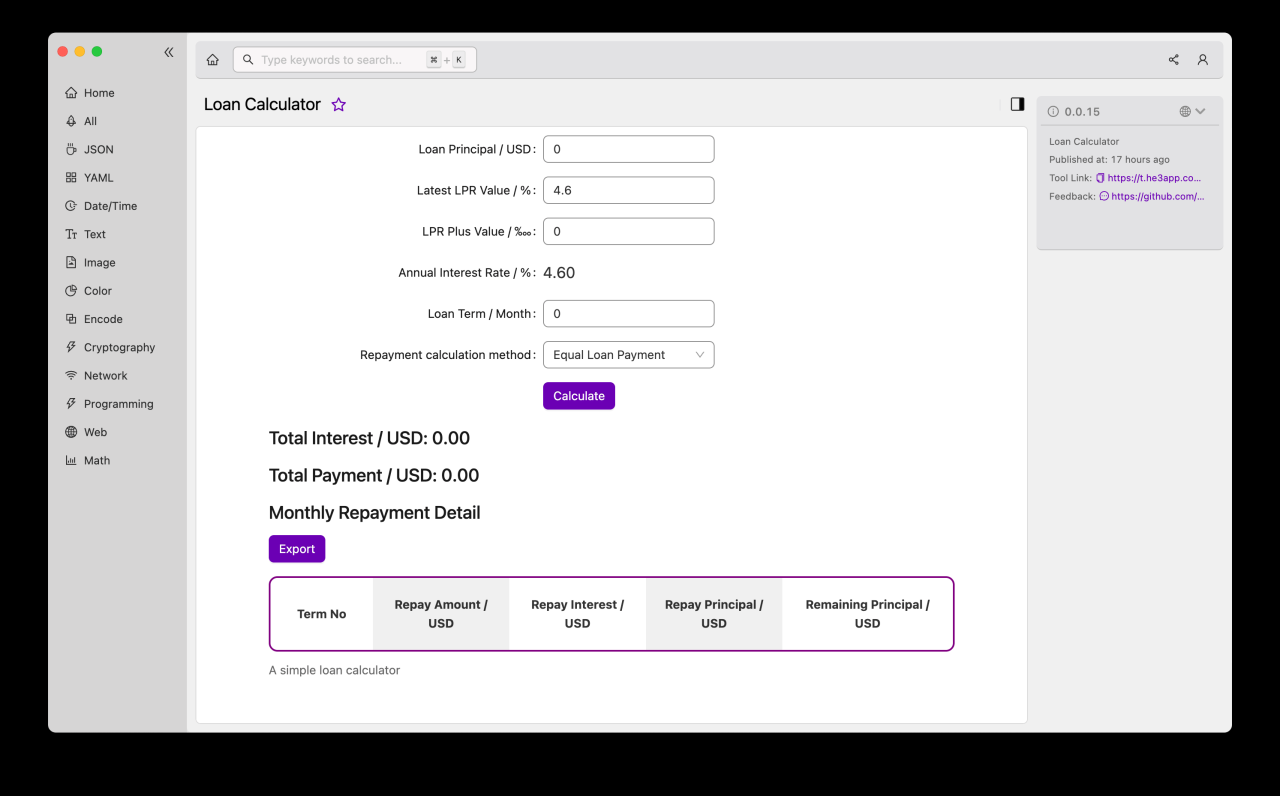

- Arvest: Typically includes options for loan amount, interest rate, loan term, and displays monthly payment, total interest paid, and amortization schedule. May offer additional features such as extra payment options or the ability to adjust payment frequency.

- Competitor A (e.g., Bank of America): Similar core features to Arvest, often including a more detailed breakdown of fees and charges associated with the loan. Might offer more advanced features, such as the ability to compare loan offers from different lenders.

- Competitor B (e.g., Wells Fargo): Likely includes the standard loan amount, interest rate, and loan term inputs. May also offer features to factor in potential tax implications or allow for variable interest rates, offering a more comprehensive calculation.

User Interface and User Experience

The user interface (UI) and user experience (UX) are critical components influencing a calculator’s effectiveness. A well-designed UI simplifies the input process, while a positive UX ensures the user finds the information they need easily and understands the results.

- Arvest: The Arvest calculator’s UI and UX will vary depending on its specific design. Generally, a clean, straightforward design with clear labels and intuitive input fields is preferable. A well-organized display of results is also key. A cluttered or confusing interface detracts from the user experience.

- Competitor A (e.g., Bank of America): Bank of America often prioritizes a visually appealing and modern design. However, excessive visual elements can sometimes detract from usability. A balance between aesthetics and functionality is essential for a positive UX.

- Competitor B (e.g., Wells Fargo): Wells Fargo typically focuses on simplicity and clarity in their UI design. A straightforward approach can lead to a more efficient and user-friendly experience, particularly for users who are not comfortable with complex financial tools.

Strengths and Weaknesses

A balanced perspective requires acknowledging both the strengths and limitations of each calculator. This analysis helps determine which tool best aligns with individual needs and preferences.

- Arvest Strengths: May offer strong integration with other Arvest financial tools and services. A user-friendly interface could be a key strength. The accuracy of its calculations is paramount.

- Arvest Weaknesses: May lack advanced features found in competitors’ calculators. The level of customization might be limited compared to some alternatives.

- Competitor A Strengths: Advanced features and comprehensive loan comparison tools can provide a more holistic view of loan options.

- Competitor A Weaknesses: A visually complex UI might confuse some users. Too much information can overwhelm less financially savvy users.

- Competitor B Strengths: Simplicity and ease of use are attractive to users seeking a straightforward calculation.

- Competitor B Weaknesses: May lack advanced features or customization options.

User Experience and Design

Arvest’s loan calculator presents a critical opportunity: to empower users with financial clarity and control. A well-designed calculator can significantly impact the user’s perception of the brand, influencing their likelihood of choosing Arvest for their financial needs. However, even a slightly clunky interface can deter potential customers and create a negative impression. Let’s analyze the user experience and explore avenues for improvement.

The current Arvest loan calculator’s usability hinges on its intuitive navigation and clear presentation of information. A user should be able to input their data seamlessly, understand the calculations performed, and receive the results in a readily comprehensible format. Any friction in this process – whether it’s confusing terminology, unclear instructions, or a slow response time – directly impacts user satisfaction and ultimately, business outcomes.

Interface Evaluation

The Arvest loan calculator’s interface needs a thorough evaluation to ensure it meets the needs of its target audience. Factors such as ease of navigation, clarity of instructions, and visual appeal should be assessed. For example, is the input process straightforward? Are the results presented clearly and concisely? Does the design accommodate users with varying levels of financial literacy? A user testing study involving a diverse group of individuals would provide valuable insights into the strengths and weaknesses of the current interface. For instance, testing with visually impaired users could reveal accessibility challenges. Analyzing the user flow, identifying drop-off points, and assessing the overall experience are crucial steps in this evaluation. Analyzing heatmaps of user interactions on the page can provide insights into where users focus their attention and where they might experience confusion.

Suggestions for Improvement

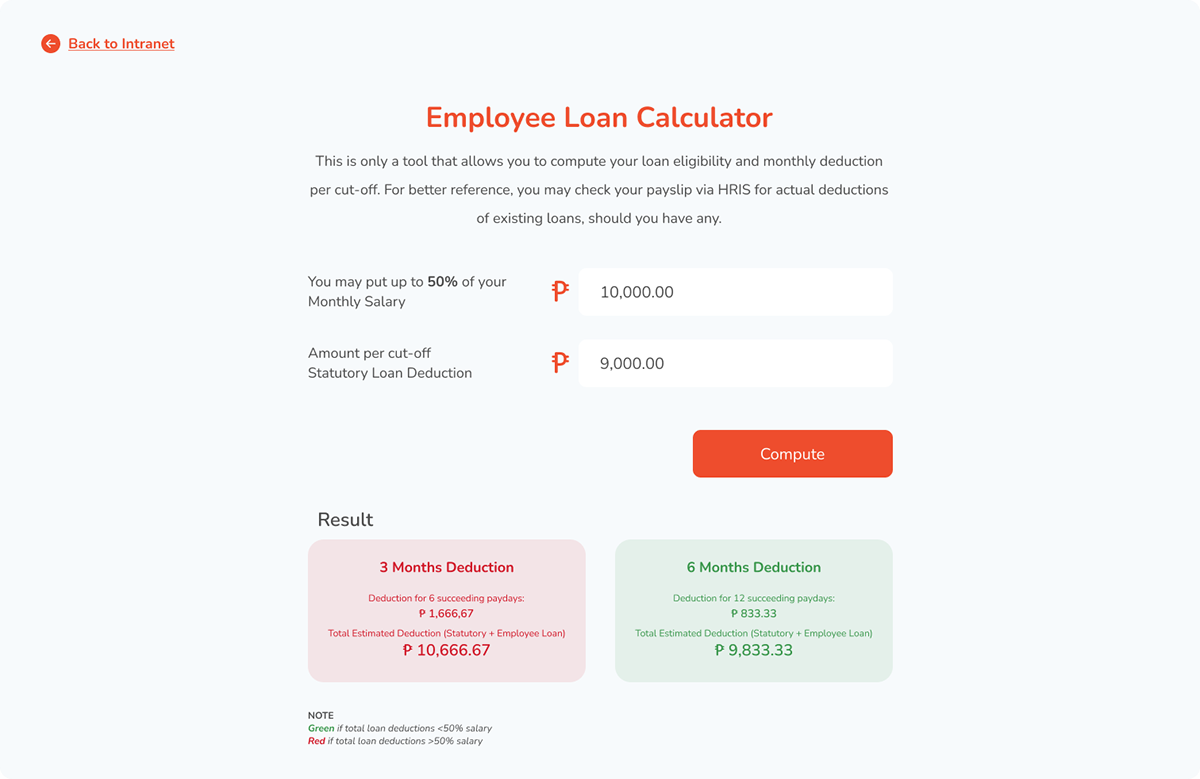

Several key areas can be improved to enhance the user experience. First, simplifying the input fields and using clear, concise labels is crucial. Avoid jargon and ensure the terminology is easily understood by a broad audience. Second, incorporating visual aids like progress bars or clear indicators of completion can significantly improve the user experience. Third, consider adding interactive tooltips or help sections to provide additional information and clarify any ambiguous terms. Fourth, improving the responsiveness of the calculator to ensure it works seamlessly across different devices and browsers is vital for a positive user experience. Finally, implementing a clear and concise summary of the results, highlighting key figures and implications, would improve the overall usability. Consider adding a feature that allows users to easily share or save the results for later reference.

User Experience Description

The overall user experience (UX) of the Arvest loan calculator should be one of ease, clarity, and confidence. Users should feel empowered to explore various loan scenarios and understand the financial implications without feeling overwhelmed or confused. A positive UX fosters trust and encourages users to proceed with their loan application. Conversely, a negative UX, characterized by frustration or confusion, can lead to users abandoning the process. A well-designed calculator can transform a potentially daunting task into a straightforward and empowering experience. Consider incorporating features that allow users to compare different loan options side-by-side, further enhancing the decision-making process.

Alternative Layout

An alternative layout could prioritize a clean, minimalist design. This could involve using a single column layout, organizing input fields logically, and employing clear visual hierarchy to guide the user through the process. The results section should be prominently displayed, using charts or graphs to visually represent the data. The color palette should be consistent with Arvest’s branding, while maintaining high contrast for readability. This design would focus on simplicity and ease of use, making the calculator accessible to a wider audience, including those less familiar with financial terminology. The rationale behind this design is to reduce cognitive load and provide a more intuitive and user-friendly experience. The use of whitespace would help to prevent the page from feeling cluttered, improving readability and overall visual appeal.

Accuracy and Reliability

The Arvest loan calculator aims to provide users with precise estimations of loan payments and total costs. Its accuracy hinges on the quality of the input data and the underlying calculation methods. Understanding these aspects is crucial for leveraging the calculator effectively and interpreting its results with confidence.

The Arvest loan calculator employs standard financial formulas to determine loan payments and total interest accrued. These formulas are widely accepted within the financial industry and are based on established mathematical principles. The calculator’s core functionality relies on accurately computing the present value of a loan, factoring in the loan amount, interest rate, loan term, and payment frequency. This calculation uses established formulas for different interest compounding methods, ensuring consistent and reliable results.

Interest Rate Compounding Methods

The Arvest loan calculator handles both simple and compound interest calculations. Simple interest is calculated only on the principal amount borrowed. The formula is: Simple Interest = Principal x Interest Rate x Time. Compound interest, on the other hand, is calculated on both the principal and accumulated interest. This means interest earned in each period is added to the principal, and subsequent interest calculations are based on this increased amount. The more frequent the compounding (e.g., daily, monthly, annually), the faster the interest grows. The calculator utilizes a standard compound interest formula, adjusted for the specified compounding frequency. For example, for monthly compounding, the effective monthly interest rate is calculated by dividing the annual interest rate by 12, and the number of periods is multiplied by 12.

Sources of Inaccuracy

While the Arvest loan calculator strives for accuracy, several factors can introduce minor discrepancies. Input errors, such as incorrect loan amounts, interest rates, or loan terms, will directly impact the calculated results. Rounding errors, inherent in any computational process, can also contribute to small variations. Furthermore, the calculator assumes a fixed interest rate throughout the loan term. In reality, interest rates can fluctuate, potentially affecting the actual payments and total cost of the loan. Finally, the calculator may not account for all potential fees associated with a loan, such as origination fees or prepayment penalties, which could alter the final cost. Users should always consult with a loan officer for the most precise and comprehensive loan information.

Accuracy of Calculations

The Arvest loan calculator’s accuracy depends heavily on the precision of the input data. Assuming accurate input, the calculator’s algorithms, based on widely accepted financial formulas, produce highly reliable estimations. However, it’s essential to remember that the results are estimations, not precise predictions of future loan payments. External factors, such as interest rate changes or unexpected fees, can influence the actual loan costs. The calculator’s value lies in providing a clear and consistent estimate based on the provided information, allowing users to make informed financial decisions. The inherent limitations due to potential input errors and external factors should be kept in mind when interpreting the results.

Illustrative Examples

The Arvest loan calculator provides a clear and concise way to estimate loan payments. Understanding how the calculator works with different loan types and scenarios is crucial for making informed financial decisions. Let’s explore some real-world examples to illustrate its functionality.

Loan Scenario Examples

The following examples demonstrate the Arvest loan calculator’s ability to handle various loan types and parameters. Each scenario highlights the input values and the resulting calculated monthly payment.

| Loan Type | Loan Amount | Interest Rate | Loan Term (Years) | Calculated Monthly Payment |

|---|---|---|---|---|

| Auto Loan | $25,000 | 6% | 5 | $470.70 (Approximate. Actual amount may vary slightly depending on Arvest’s specific calculations.) |

| Personal Loan | $10,000 | 9% | 3 | $322.67 (Approximate. Actual amount may vary slightly depending on Arvest’s specific calculations.) |

| Home Loan | $300,000 | 7% | 30 | $1,998.79 (Approximate. Actual amount may vary slightly depending on Arvest’s specific calculations and additional fees.) |

Home Loan Calculator User Experience

Imagine you’re planning to buy a house and need to estimate your monthly mortgage payment. You navigate to the Arvest loan calculator and select “Home Loan” as the loan type. You then input the desired loan amount (e.g., $300,000), the interest rate (e.g., 7%), and the loan term (e.g., 30 years). The calculator instantly displays the estimated monthly payment (approximately $1,998.79 in this example). You can then adjust the inputs to see how changes in loan amount, interest rate, or loan term affect your monthly payment. This interactive process allows you to explore different financing options and make a more informed decision. For example, reducing the loan term to 15 years would significantly increase the monthly payment but reduce the total interest paid over the life of the loan.

Handling Additional Fees

The Arvest loan calculator may incorporate the ability to include additional fees, such as origination fees, which are common in mortgage loans. These fees are usually a percentage of the loan amount. Let’s say, for the $300,000 home loan example above, there’s a 1% origination fee, amounting to $3,000. A sophisticated calculator would either add this fee to the loan amount, increasing the principal, or display it separately as an upfront cost, providing a more comprehensive view of the total loan expenses. The displayed monthly payment would then reflect the inclusion of the increased principal (if the fee is added) or provide a separate line item for the fee, making the total cost transparent to the user. This level of detail ensures accurate financial planning.

Accessibility and Inclusivity

Arvest’s loan calculator, like any online financial tool, needs to be accessible to everyone. Failing to prioritize accessibility not only limits your potential customer base but also runs counter to best practices for inclusive design. A truly effective calculator ensures ease of use for individuals with a wide range of abilities, including those using assistive technologies. This section analyzes the current accessibility of Arvest’s loan calculator and suggests concrete improvements.

The success of any online financial tool hinges on its accessibility. A significant portion of the population relies on assistive technologies, and excluding them is not only ethically questionable but also bad for business. By making the Arvest loan calculator accessible, you open your services to a larger market and demonstrate a commitment to inclusivity. This analysis will focus on specific areas for improvement and offer practical solutions.

Screen Reader Compatibility and Keyboard Navigation

Ensuring the loan calculator is fully compatible with screen readers like JAWS and NVDA is crucial. This involves proper semantic HTML markup, clear labeling of all interactive elements (buttons, input fields, etc.), and a logical tab order for keyboard navigation. Without these features, visually impaired users will struggle to understand and interact with the calculator. For example, each input field should have a clear and concise label indicating its purpose (e.g., “Loan Amount,” “Interest Rate”). Furthermore, the calculator’s functionality should be fully operable using only the keyboard, eliminating the need for a mouse. Failure to implement these features can lead to significant usability issues for screen reader users. A well-structured HTML document with appropriate ARIA attributes will significantly enhance accessibility for screen reader users.

Color Contrast and Visual Clarity

Sufficient color contrast between text and background is essential for users with low vision. The World Wide Web Consortium (W3C) provides guidelines on minimum color contrast ratios. Arvest should ensure that all text and interactive elements meet these standards, guaranteeing readability for users with visual impairments. Additionally, the calculator’s design should minimize the use of complex visual elements that could be confusing or difficult to interpret for users with cognitive disabilities. Simple, clean design principles will improve usability for everyone. For instance, a high contrast between the text and background color (e.g., dark text on a light background or vice versa) should be implemented across the entire calculator interface.

Alternative Text for Images and Multimedia

Any images or multimedia elements used within the calculator must include detailed alternative text (alt text) descriptions. This allows screen readers to convey the information to visually impaired users. Alt text should accurately and concisely describe the image’s content and purpose, providing context for understanding the calculator’s functionality. For example, if an image visually represents the loan amortization schedule, the alt text should describe the information presented in the schedule, such as the principal, interest, and remaining balance for each payment period. The absence of alt text renders images inaccessible to screen reader users, depriving them of crucial information.

Support for Diverse Input Methods

The calculator should support various input methods beyond standard keyboard and mouse interaction. This includes compatibility with alternative input devices such as switch controls and eye-tracking systems. This ensures users with motor impairments can still access and use the calculator effectively. Consider implementing features that allow users to customize input methods based on their individual needs. For example, providing options for larger buttons or alternative input mechanisms can make a significant difference in usability for users with limited motor skills. This demonstrates a commitment to inclusivity and caters to a broader range of users.