Understanding “America First” in the Context of Personal Loans

The “America First” philosophy, while primarily associated with foreign policy and trade, has subtle yet significant implications for the domestic financial landscape, particularly in the personal loan market. Understanding these implications requires examining how a prioritization of American interests might affect lending practices, loan availability, and the overall economic well-being of both borrowers and lenders. This isn’t simply about waving flags; it’s about analyzing the practical consequences of potentially discriminatory lending policies.

An “America First” approach to personal loans could manifest in several ways, impacting both the accessibility and terms of loans for various groups. This isn’t a hypothetical scenario; we’ve seen similar nationalistic economic policies implemented in other countries, revealing both benefits and drawbacks. The key is to analyze the potential effects with a critical eye, avoiding both naive optimism and unfounded pessimism.

Impact on Loan Availability and Terms

A strict “America First” policy could lead to lenders prioritizing applications from U.S. citizens or residents. This might involve stricter documentation requirements for non-citizens, potentially leading to loan rejections for individuals who otherwise qualify based on traditional creditworthiness metrics. Furthermore, favorable interest rates and loan terms could be reserved for domestic borrowers, effectively creating a two-tiered system. This could disproportionately affect immigrant communities and those with ties to other nations, limiting their access to crucial financial tools for homeownership, education, or business ventures. Consider the impact on a small business owner who is a legal resident but struggles to secure a loan due to their immigration status under a stricter lending environment. The potential for decreased economic mobility and widening wealth disparity is a serious concern.

Influence on Lending Practices Based on Nationality or Location, America first personal loan calculator

The implementation of an “America First” policy might lead to the development of lending algorithms or scoring models that explicitly factor in a borrower’s nationality or geographic location. This could lead to systematic discrimination, even if unintentional, where certain groups are consistently denied loans or offered less favorable terms solely based on their origin or residence. For example, a lender might assign lower credit scores to applicants from specific regions or countries, regardless of their individual credit history. This creates an uneven playing field and reinforces existing economic inequalities. The lack of transparency in these algorithms could also make it difficult to challenge or rectify such discriminatory practices.

Economic and Social Consequences of Prioritizing Domestic Borrowers

Prioritizing domestic borrowers, while potentially boosting the short-term economic activity within the U.S., could have long-term negative consequences. Restricting access to credit for non-citizens or those residing in specific areas could stifle economic growth and innovation. For example, entrepreneurs from other countries who bring valuable skills and ideas might be deterred from investing in the U.S. if they face significant barriers to accessing capital. Furthermore, limiting access to personal loans could exacerbate existing social inequalities, potentially leading to increased poverty and social unrest. The economic ripple effects of such a policy could be far-reaching and potentially damaging to the overall health of the U.S. economy.

Analyzing Personal Loan Calculator Features: America First Personal Loan Calculator

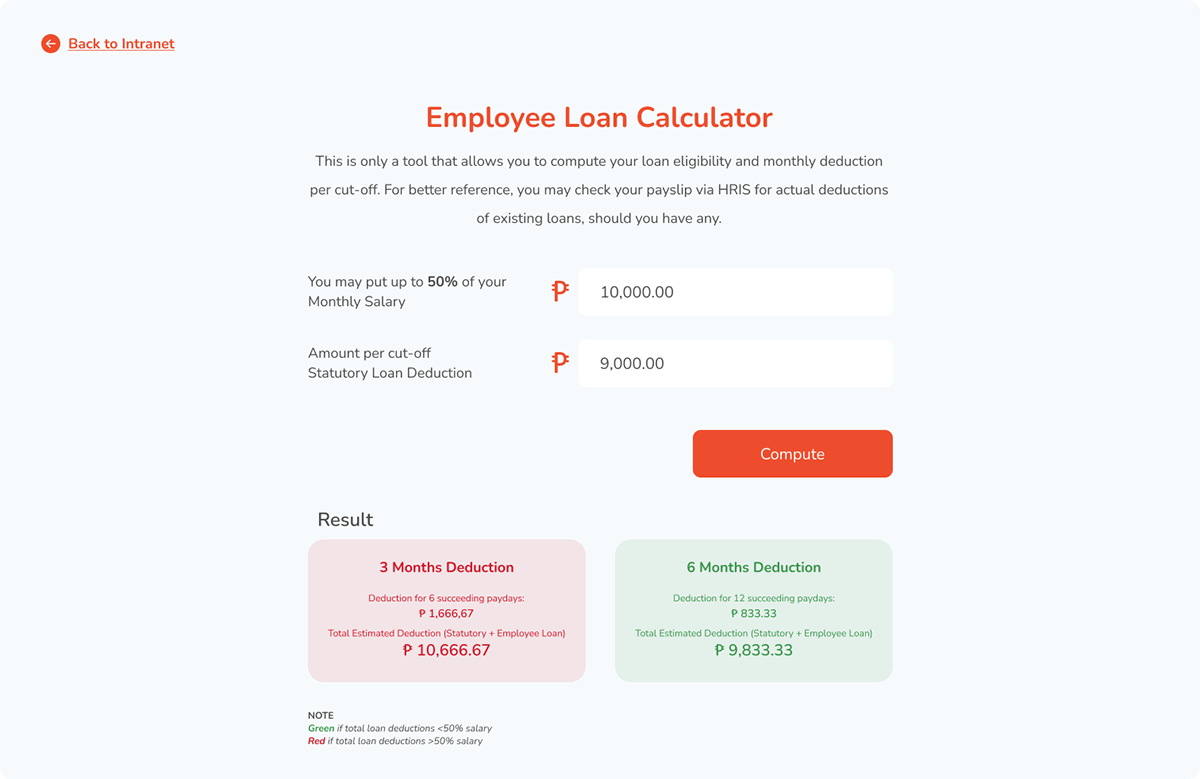

A robust personal loan calculator is more than just a number-crunching tool; it’s a critical piece of software that empowers users to make informed financial decisions. Its effectiveness hinges on a seamless user experience and the accuracy of its calculations. A poorly designed calculator can lead to misunderstandings, miscalculations, and ultimately, poor financial choices. Therefore, understanding the essential features and comparing different interfaces is paramount.

America first personal loan calculator – A well-designed personal loan calculator should provide users with a clear and concise overview of their potential loan terms. This goes beyond simply spitting out a monthly payment; it’s about giving users the tools to understand the total cost of borrowing, explore different loan options, and make a truly informed decision.

Essential Features of a User-Friendly Personal Loan Calculator

The key to a successful personal loan calculator lies in its simplicity and accuracy. Users need clear inputs, easily understandable outputs, and the confidence that the calculations are correct. Overly complicated interfaces will drive users away, while inaccurate calculations can have serious financial repercussions.

- Loan Amount Input: A clear field for entering the desired loan amount, with appropriate input validation to prevent non-numeric entries.

- Interest Rate Input: A field for inputting the annual interest rate, ideally allowing users to choose between fixed and variable rates. Clear labeling is crucial to avoid confusion.

- Loan Term Input: An input field for specifying the loan term (in months or years), again with validation to ensure correct input.

- Monthly Payment Calculation: The core functionality – accurately calculating the monthly payment based on the inputs provided.

- Total Interest Paid: Displaying the total amount of interest the borrower will pay over the life of the loan.

- Amortization Schedule (Optional): A detailed breakdown of each payment, showing the principal and interest components. This feature enhances transparency and understanding.

- Multiple Scenario Comparison: The ability to save and compare different loan scenarios (e.g., varying loan terms or interest rates) side-by-side.

- Clear and Concise Output: Presenting the results in a clean, easily digestible format, avoiding jargon and technical terms.

- Responsive Design: Adapting seamlessly to different screen sizes (desktops, tablets, smartphones).

Comparison of Personal Loan Calculator Interfaces

The user experience is paramount. A confusing or clunky interface can negate the value of even the most accurate calculations. Below, we compare several hypothetical calculators to illustrate the importance of design.

| Name | Features | Pros | Cons |

|---|---|---|---|

| Calculator A | Loan Amount, Interest Rate, Loan Term, Monthly Payment, Total Interest Paid | Simple, easy to use, fast results. | Lacks an amortization schedule and scenario comparison. |

| Calculator B | Loan Amount, Interest Rate, Loan Term, Monthly Payment, Total Interest Paid, Amortization Schedule, Multiple Scenario Comparison | Comprehensive features, allows for detailed analysis. | Slightly more complex interface; may be overwhelming for novice users. |

| Calculator C | Loan Amount, Interest Rate, Loan Term, Monthly Payment, Total Interest Paid, Amortization Schedule, Multiple Scenario Comparison, Prepayment Options | Most comprehensive; includes advanced features like prepayment analysis. | Steeper learning curve; may require more time to master. |

Calculator A prioritizes simplicity, making it ideal for users who need quick, basic calculations. Calculator B offers a more comprehensive feature set, striking a balance between ease of use and functionality. Calculator C caters to more sophisticated users who require advanced features. The best choice depends on the user’s needs and technical proficiency.

Exploring Loan Options for US Citizens

Navigating the world of personal loans can feel overwhelming, especially with the sheer number of options available. Understanding the different types of loans and the factors influencing approval is crucial for securing the best financing solution for your needs. This section provides a clear overview of personal loan options for US citizens, highlighting key features and considerations.

Personal loans in the US are broadly categorized as secured and unsecured. Secured loans require collateral, such as a car or savings account, to back the loan. If you default, the lender can seize the collateral. Unsecured loans, conversely, don’t require collateral; they rely solely on your creditworthiness. The interest rates and terms offered vary significantly based on the type of loan and your individual financial profile.

Types of Personal Loans Available to US Citizens

Personal loans come in various forms, each tailored to specific needs and circumstances. Common types include:

- Unsecured Personal Loans: These are the most common type, offered by banks, credit unions, and online lenders. Approval depends heavily on credit score and income. They offer flexibility but usually come with higher interest rates than secured loans.

- Secured Personal Loans: These loans use an asset as collateral, leading to lower interest rates. Examples include auto title loans (using your car title) and home equity loans (using your home’s equity). However, defaulting can result in the loss of the collateral.

- Debt Consolidation Loans: Designed to combine multiple debts into a single loan with a potentially lower interest rate and simplified repayment schedule. This can improve financial management and potentially save money on interest.

- Payday Loans: Short-term, high-interest loans typically due on your next payday. These loans are often considered predatory due to their extremely high interest rates and should be avoided unless absolutely necessary.

Institutions Offering Personal Loans and Their Terms

Several institutions offer personal loans, each with varying interest rates and terms. It’s crucial to compare offers before committing.

For example, large national banks like Bank of America and Chase typically offer a range of personal loans, but their interest rates might be higher for borrowers with less-than-perfect credit. Credit unions often provide more favorable terms to their members, potentially offering lower interest rates and more flexible repayment options. Online lenders, such as LendingClub and Upstart, utilize alternative data to assess creditworthiness and may offer loans to borrowers who might be turned down by traditional banks. Interest rates and terms can vary greatly depending on the lender, your credit score, and the loan amount.

Factors Influencing Personal Loan Approval

Several key factors determine whether your personal loan application will be approved. Understanding these factors can help you improve your chances of securing favorable terms.

- Credit Score: Your credit score is a critical factor. A higher credit score generally translates to lower interest rates and better loan terms. Lenders use credit reports from agencies like Experian, Equifax, and TransUnion to assess your creditworthiness.

- Income: Lenders want assurance that you can afford the monthly payments. Your income, along with your debt-to-income ratio (DTI), plays a significant role in determining your eligibility.

- Debt-to-Income Ratio (DTI): This ratio compares your monthly debt payments to your gross monthly income. A lower DTI indicates better financial health and increases your chances of loan approval. A high DTI suggests you may struggle to manage additional debt. For example, a DTI of 40% or higher might be considered high by many lenders.

- Employment History: A stable employment history demonstrates your ability to consistently make loan payments. Lenders often require proof of employment and income.

Impact of Economic Factors on Loan Accessibility

Securing a personal loan isn’t just about your credit score; it’s deeply intertwined with the broader economic landscape. Interest rates, approval chances, and even the loan amounts offered fluctuate significantly based on prevailing economic conditions. Understanding these dynamics is crucial for both lenders and borrowers to make informed decisions. Ignoring the economic context can lead to missed opportunities or, worse, financial hardship.

Economic indicators such as inflation, unemployment rates, and the overall growth of the Gross Domestic Product (GDP) significantly influence the personal loan market. These factors impact lenders’ risk assessments, their cost of borrowing, and ultimately, the terms they offer to borrowers. Recessions, in particular, trigger a ripple effect across the financial system, making loan approval more stringent and increasing interest rates as lenders become more risk-averse.

Key Economic Indicators Affecting Personal Loan Terms

Inflation, unemployment rates, and the Federal Funds rate are key economic indicators that directly affect personal loan interest rates and approval rates. High inflation erodes purchasing power, leading to increased borrowing costs for lenders, which they pass on to borrowers in the form of higher interest rates. Simultaneously, high unemployment increases the risk of loan defaults, prompting lenders to tighten lending standards and potentially increase interest rates to compensate for this heightened risk. The Federal Funds rate, the target rate set by the Federal Reserve, influences other interest rates across the economy, including personal loan rates. A rise in the Federal Funds rate generally leads to higher personal loan interest rates.

Influence of Inflation and Recession on the US Personal Loan Market

During periods of high inflation, lenders face increased costs and are more cautious about extending credit. This results in higher interest rates for personal loans and potentially stricter approval criteria. Borrowers may find it harder to secure loans or may be offered less favorable terms. Conversely, during a recession, the risk of loan defaults increases dramatically. Lenders become more conservative, leading to tighter lending standards, higher rejection rates, and potentially higher interest rates to offset the increased risk. The 2008 financial crisis serves as a prime example, where the availability of credit plummeted, making it significantly more challenging for individuals to obtain personal loans.

Strategies for Navigating Economic Uncertainty When Seeking Personal Loans

Understanding the economic climate is paramount when applying for a personal loan. Here are some strategies to improve your chances of securing a favorable loan during periods of economic uncertainty:

- Improve your credit score: A higher credit score demonstrates creditworthiness, making you a less risky borrower. This is especially crucial during economic downturns.

- Shop around for the best rates: Comparing offers from multiple lenders is crucial to securing the most competitive interest rate. Use online comparison tools to streamline this process.

- Consider a shorter loan term: While monthly payments will be higher, a shorter loan term will reduce the overall interest paid, saving you money in the long run, especially if interest rates are high.

- Build a strong financial foundation: Maintain a healthy savings account and demonstrate responsible financial habits to increase your approval odds. A consistent income stream also significantly helps.

- Explore alternative financing options: If securing a traditional personal loan proves difficult, explore alternative options like peer-to-peer lending or credit unions, which might offer more flexible terms.

Illustrating Loan Repayment Scenarios

Understanding the financial implications of different repayment schedules is crucial for responsible borrowing. Choosing a shorter loan term might seem daunting initially, but it can significantly reduce the overall cost of borrowing. Conversely, opting for a longer term might offer lower monthly payments, but it often leads to paying substantially more in interest over the life of the loan. Let’s explore this with concrete examples.

Loan Repayment Schedules and Interest Costs

The following table illustrates the impact of different loan terms on the total interest paid. We’ll consider two hypothetical scenarios: a $10,000 loan at 8% interest and a $20,000 loan at 10% interest, both with varying repayment periods. Remember, these are simplified examples and actual interest rates and fees can vary depending on the lender and your creditworthiness.

| Loan Amount | Interest Rate | Loan Term (Years) | Monthly Payment (approx.) | Total Interest Paid (approx.) |

|---|---|---|---|---|

| $10,000 | 8% | 3 | $313 | $1,476 |

| $10,000 | 8% | 5 | $203 | $2,158 |

| $20,000 | 10% | 3 | $650 | $4,620 |

| $20,000 | 10% | 5 | $426 | $7,560 |

Consequences of Defaulting on a Personal Loan

Defaulting on a personal loan can have severe consequences, significantly impacting your financial well-being. Failure to make timely payments can result in a sharp decline in your credit score, making it harder to secure future loans, credit cards, or even rent an apartment. Lenders may also pursue legal action, potentially leading to wage garnishment, lawsuits, and even the seizure of assets. In short, responsible repayment is paramount.

Sample Amortization Schedule

Imagine a $5,000 personal loan at a 7% annual interest rate, repaid over 24 months. A sample amortization schedule would visually represent the breakdown of each monthly payment into principal and interest. Initially, a larger portion of the payment goes towards interest, while as the loan progresses, more of the payment is applied towards the principal. For instance, the first month’s payment might be $220, with $29 going towards principal and $191 towards interest. By month 12, the principal payment would have increased to around $170, while the interest payment would have decreased to around $50. This trend continues until the final payment, at which point the principal is fully repaid. This visual representation clearly shows how your payments are allocated over time and how the loan balance gradually decreases.

Addressing Potential Biases in Lending Practices

Fair and equitable access to personal loans is crucial for economic health, yet biases in lending practices can create significant hurdles for certain groups. Understanding these biases and implementing strategies to mitigate them is paramount for a truly inclusive financial system. This section will delve into the potential sources of bias, effective strategies for promoting fairness, and the crucial role of regulatory oversight.

Potential biases in lending algorithms and human decision-making can disproportionately impact borrowers based on factors like race, ethnicity, gender, age, and geographic location. For example, historical lending data might reflect past discriminatory practices, leading to algorithms that inadvertently perpetuate these biases. Similarly, unconscious biases held by loan officers can influence their assessment of applicants, resulting in unequal treatment. This isn’t about intentional discrimination; it’s about recognizing systemic issues embedded in data and processes.

Strategies to Promote Fair and Equitable Access to Personal Loans

Promoting fair lending requires a multifaceted approach. Transparency in lending criteria is essential, allowing borrowers to understand how decisions are made and identify potential areas of bias. The use of alternative data, such as bank transaction history or utility payment records, can help create a more comprehensive picture of a borrower’s creditworthiness, reducing reliance on traditional credit scores that may reflect past discriminatory practices. Furthermore, robust training programs for loan officers on unconscious bias and fair lending regulations are crucial to fostering a more equitable environment. Finally, actively targeting underserved communities with financial literacy programs can empower borrowers to navigate the loan application process more effectively.

The Role of Regulatory Bodies in Ensuring Fair Lending Practices

Regulatory bodies like the Consumer Financial Protection Bureau (CFPB) play a vital role in preventing discriminatory lending practices and protecting consumers. They establish and enforce regulations designed to ensure fair access to credit for all eligible borrowers. These regulations often include requirements for lenders to disclose their lending criteria, regularly assess their lending practices for bias, and take corrective action if discriminatory patterns are identified. The CFPB actively monitors lenders for compliance and investigates complaints of discriminatory lending. Strong regulatory oversight and enforcement are key to maintaining a level playing field in the personal loan market and ensuring that all borrowers are treated fairly.