Understanding ACBS Loans

ACBS loans, or Asset-Based Credit and Borrowing Solutions, represent a powerful financing option for businesses looking to leverage their assets for capital. Unlike traditional loans that rely primarily on creditworthiness, ACBS loans focus on the value of a company’s assets as collateral. This approach unlocks access to capital for businesses that might struggle to secure funding through conventional channels. Understanding the nuances of ACBS loans is crucial for businesses seeking flexible and potentially more advantageous financing solutions.

Core Features of ACBS Loans

ACBS loans are characterized by their reliance on a company’s assets as collateral. This can include inventory, accounts receivable, equipment, and real estate. Lenders assess the value of these assets to determine the loan amount, offering a level of security that can lead to more favorable interest rates and loan terms compared to unsecured loans. A key feature is the flexibility; the loan amount can often be adjusted based on fluctuating asset values, providing a dynamic financing solution that adapts to a business’s changing needs. Another significant aspect is the speed of access to funds, often faster than traditional loan applications.

Eligibility Criteria for ACBS Loans

While credit history is considered, it’s not the sole determinant of eligibility for an ACBS loan. Lenders prioritize the value and liquidity of the borrower’s assets. Factors such as the type and condition of assets, the stability of the business, and the borrower’s ability to manage cash flow are carefully evaluated. A strong track record of financial management and a demonstrable ability to repay the loan are essential. Meeting these criteria increases the likelihood of approval and potentially secures more favorable loan terms. The specific requirements will vary between lenders, emphasizing the need for thorough research and comparison shopping.

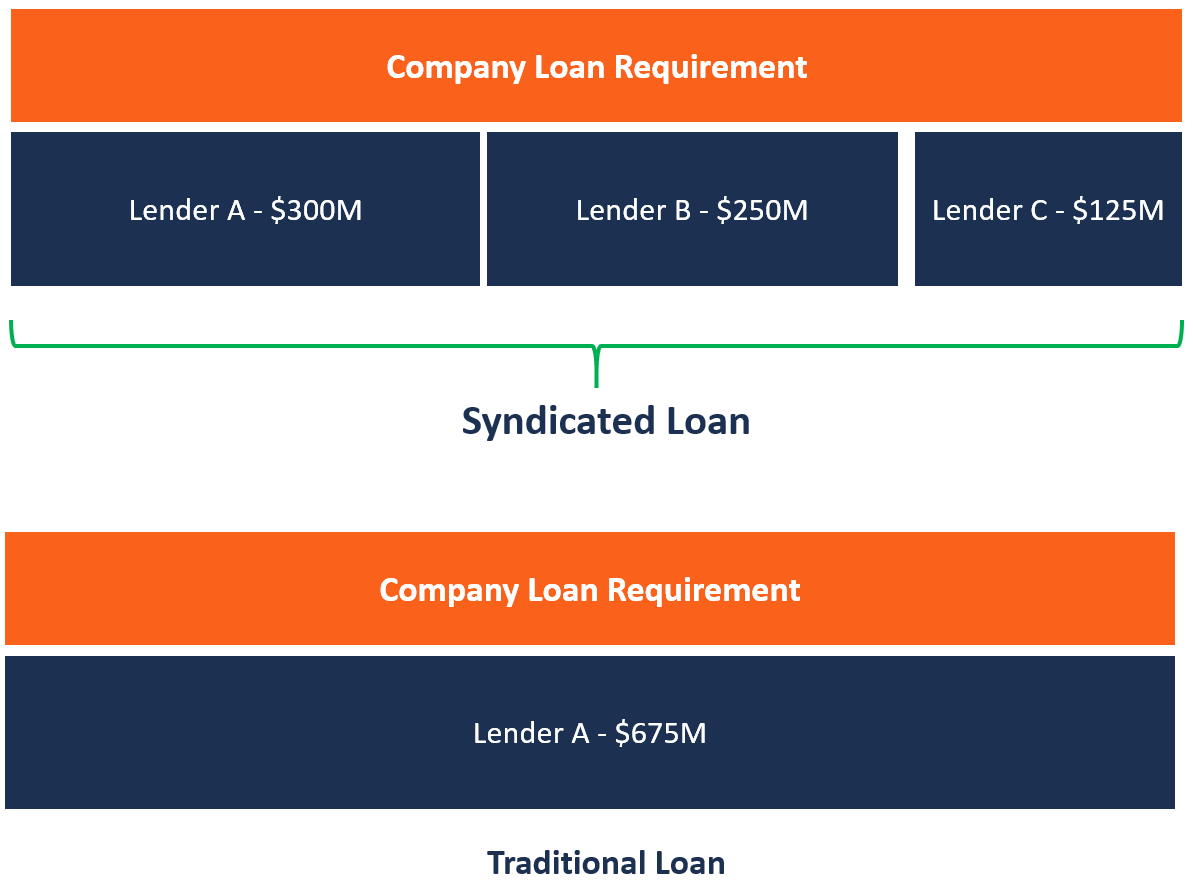

Comparison of ACBS Loans with Other Loan Products

Compared to traditional bank loans, ACBS loans often offer faster processing times and higher loan-to-value ratios due to the asset backing. They stand apart from lines of credit by providing a fixed amount of funding for a specific period, offering predictability in repayment schedules. Unlike merchant cash advances, which often carry high fees, ACBS loans typically have more transparent and competitive interest rates. The choice between these options depends on a business’s specific needs, financial situation, and risk tolerance. A detailed comparison is essential before making a decision.

Beneficial Situations for ACBS Loans

ACBS loans are particularly beneficial for businesses experiencing rapid growth, needing short-term working capital, or managing seasonal fluctuations in cash flow. Companies with significant inventory or accounts receivable can leverage these assets to secure funding for expansion, equipment upgrades, or inventory purchases. Businesses facing temporary cash flow challenges can utilize ACBS loans to bridge the gap until revenue streams stabilize. For example, a seasonal retailer might use an ACBS loan secured by inventory to manage expenses during the off-season. Similarly, a rapidly growing tech startup could leverage its intellectual property or equipment as collateral to secure funding for expansion.

Key Terms and Definitions Related to ACBS Loans

| Term | Definition | Example | Relevance to Borrower |

|---|---|---|---|

| Advance Rate | The percentage of an asset’s value that a lender will loan. | A lender might offer a 75% advance rate on inventory. | Higher advance rates mean more funding. |

| Asset-Based Lending | A type of financing where assets serve as collateral. | Using accounts receivable to secure a loan. | Provides access to capital for businesses with valuable assets. |

| Collateral | Assets pledged to secure a loan. | Inventory, equipment, real estate. | Impacts loan approval and interest rates. |

| Loan-to-Value Ratio (LTV) | The ratio of the loan amount to the value of the collateral. | An 80% LTV means the loan amount is 80% of the asset’s value. | Higher LTV ratios indicate more leverage. |

Application and Approval Process

Securing an ACBS loan involves a straightforward yet crucial process. Understanding the steps involved, the necessary documentation, and potential roadblocks will significantly increase your chances of a smooth and timely approval. This section will provide you with a clear roadmap to navigate the application and approval journey.

The application process for an ACBS loan is designed to be efficient and transparent. Lenders typically prioritize a streamlined approach, aiming to provide quick decisions while ensuring responsible lending practices. The speed of approval, however, depends on various factors, including the completeness of your application and the complexity of your financial situation.

Required Documentation

The documentation required for an ACBS loan application varies depending on the lender and the specific loan amount. However, you can generally expect to provide documents verifying your identity, income, and creditworthiness. This is crucial as it allows the lender to assess your ability to repay the loan and minimize risk. Incomplete or inaccurate documentation can significantly delay the approval process or lead to rejection.

Commonly requested documents include:

- Government-issued photo identification (passport, driver’s license).

- Proof of income (pay stubs, tax returns, bank statements).

- Proof of address (utility bills, bank statements).

- Credit report and score.

- Details of existing debts and financial obligations.

- Loan application form, completely filled out and signed.

Application Timeframe

The typical timeframe for ACBS loan approval can range from a few days to several weeks. Faster approvals are often associated with complete applications and straightforward financial situations. More complex applications, requiring additional verification or involving larger loan amounts, may take longer. For instance, a loan application with readily available documentation and a strong credit history might be approved within a week, whereas an application involving self-employment income or a less-than-perfect credit score could take several weeks for thorough review.

Reasons for Loan Application Rejection

While lenders strive to approve as many applications as possible, several factors can lead to rejection. Understanding these potential pitfalls can help you prepare a stronger application and increase your chances of success.

Common reasons for rejection include:

- Insufficient income to meet repayment obligations.

- Poor credit history indicating a high risk of default.

- Incomplete or inaccurate application information.

- Lack of sufficient collateral or security for the loan.

- Negative information on your credit report, such as bankruptcies or judgments.

Step-by-Step Application Procedure

Following a structured approach significantly improves the efficiency of the application process. A clear, step-by-step guide ensures you don’t miss any crucial steps, potentially leading to delays or rejection.

Here’s a recommended step-by-step guide:

- Gather necessary documentation: Compile all required documents before starting the application.

- Complete the application form: Ensure all information is accurate and complete.

- Submit the application: Submit your application online or in person, depending on the lender’s preferences.

- Await verification: The lender will verify the information you provided.

- Receive approval or denial notification: You will be notified of the lender’s decision.

- Loan disbursement (if approved): Once approved, the loan will be disbursed according to the agreed-upon terms.

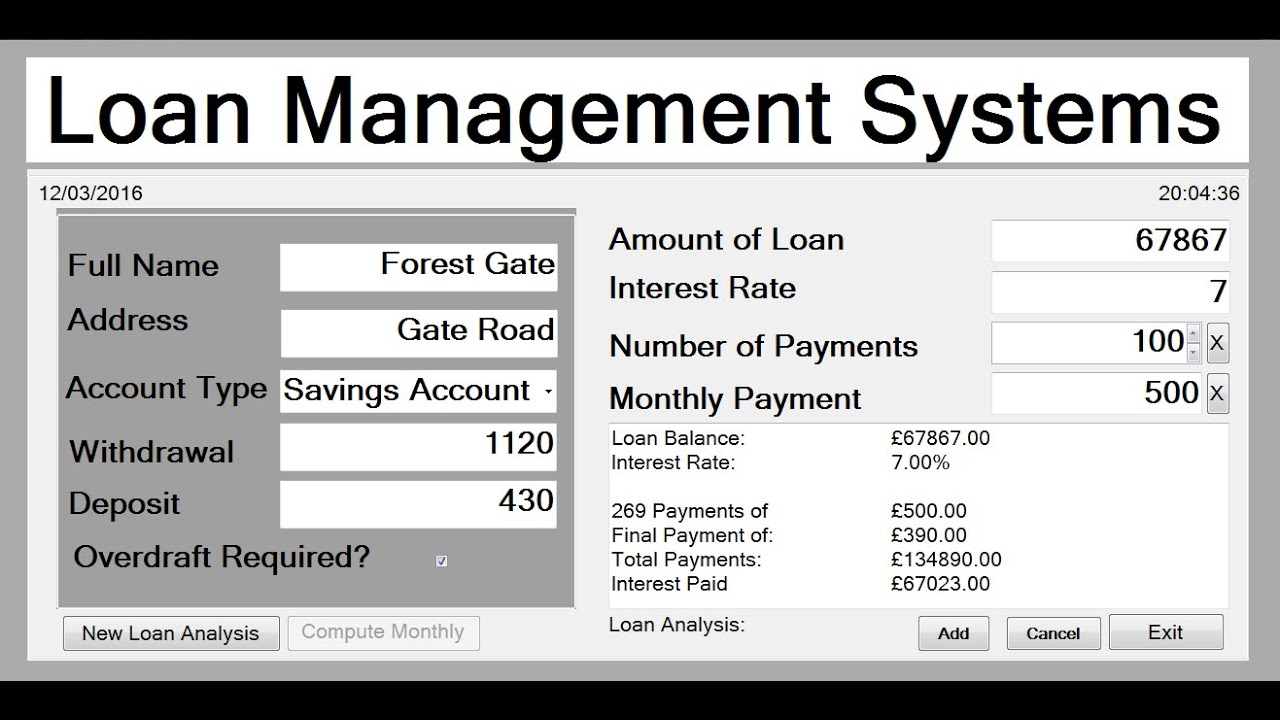

Interest Rates and Repayment Terms

Understanding the interest rates and repayment terms of an ACBS loan is crucial for making an informed borrowing decision. These factors directly impact the overall cost and affordability of your loan. Let’s break down the key elements to help you navigate this process effectively.

ACBS loan interest rates aren’t set in stone; they’re dynamic and influenced by several interconnected factors. The primary driver is the prevailing market interest rates. Think of it like this: if the overall cost of borrowing money increases in the economy, lenders will adjust their ACBS loan rates accordingly to reflect that increased risk. Additionally, your individual creditworthiness plays a significant role. A strong credit history, indicating a lower risk of default, typically translates to a lower interest rate. Conversely, a weaker credit profile might result in a higher rate to compensate for the increased risk the lender assumes.

ACBS Loan Interest Rate Determination

Several factors contribute to the final interest rate offered on an ACBS loan. These include the prevailing market interest rates, the borrower’s credit score and history, the loan amount, and the loan term. A higher credit score generally leads to a lower interest rate, while a larger loan amount or longer repayment term may result in a higher rate. The lender also considers the specific terms of the loan agreement and any collateral involved. Essentially, the interest rate reflects the lender’s assessment of the risk associated with lending to you. This is a complex calculation, but understanding the underlying factors is key to negotiating the best possible terms.

Repayment Schedules for ACBS Loans

ACBS loans offer various repayment schedules to suit different financial situations. Common options include monthly installments spread over a fixed term (e.g., 12, 24, 36, or 60 months), allowing for predictable budgeting. Some lenders may also offer bi-weekly or quarterly payment options, although these are less common. The repayment schedule is agreed upon at the time of loan approval and Artikeld in the loan agreement. Choosing a shorter repayment term generally results in higher monthly payments but lower overall interest paid, while a longer term means lower monthly payments but higher overall interest costs.

Factors Influencing the Total Cost of an ACBS Loan

The total cost of an ACBS loan is more than just the principal amount borrowed. Several factors significantly impact the final amount you repay. These include the interest rate, the loan term, any associated fees (such as origination fees or late payment penalties), and the repayment schedule. For example, a lower interest rate and shorter loan term will reduce the overall cost, while a higher interest rate and longer loan term will significantly increase it. It’s crucial to understand all associated costs before committing to a loan to avoid unexpected expenses. Careful comparison shopping and understanding the terms of the loan agreement are essential.

Comparison of ACBS Loan Interest Rates with Other Loan Types

ACBS loan interest rates are generally competitive with other types of personal loans, but the precise comparison depends on various factors, including your creditworthiness and the lender. Compared to credit cards, ACBS loans often offer lower interest rates, especially for larger loan amounts. However, secured loans, such as those backed by collateral, may offer even lower rates than unsecured ACBS loans. Conversely, payday loans typically carry significantly higher interest rates and shorter repayment terms, making them considerably more expensive in the long run. It’s always wise to compare interest rates and terms from multiple lenders before making a decision.

Repayment Scenarios

The following table illustrates various repayment scenarios for ACBS loans with different interest rates, loan amounts, and repayment terms. Remember, these are examples and actual rates and terms may vary depending on the lender and your individual circumstances.

| Loan Amount | Interest Rate | Loan Term (Months) | Approximate Monthly Payment |

|---|---|---|---|

| $5,000 | 8% | 12 | $438 |

| $10,000 | 10% | 24 | $471 |

| $15,000 | 12% | 36 | $527 |

| $20,000 | 14% | 60 | $442 |

Risks and Considerations

Securing an ACBS loan can be a powerful financial tool, but like any financial instrument, it carries inherent risks. Understanding these risks and implementing proactive mitigation strategies is crucial for ensuring a positive outcome. Failing to do so can lead to significant financial distress. Let’s delve into the potential pitfalls and how to navigate them effectively.

The primary risk associated with ACBS loans stems from the potential for default. This happens when you’re unable to meet your repayment obligations, leading to a cascade of negative consequences. The severity of these consequences is directly proportional to the size of the loan and your overall financial situation. Furthermore, the specific terms of your loan agreement, including interest rates and penalties for late payments, will significantly influence the ultimate impact of a default.

Potential Risks of ACBS Loans

Several factors can contribute to the risk profile of an ACBS loan. These include fluctuating interest rates, unexpected changes in personal income, and unforeseen expenses. High debt-to-income ratios, coupled with insufficient emergency funds, can further amplify the risk of default. Proper financial planning and a realistic assessment of your financial capacity are vital to mitigating these risks.

Strategies for Managing Financial Risks

Effective risk management begins with a comprehensive budget. This allows you to clearly see your income and expenses, identifying areas where you can potentially cut back to free up funds for loan repayments. Building an emergency fund is also crucial; this acts as a buffer against unforeseen circumstances that could otherwise jeopardize your ability to repay your loan. Consider exploring options like debt consolidation or refinancing if you anticipate difficulty in managing multiple debts.

Consequences of Defaulting on an ACBS Loan

Defaulting on an ACBS loan can have severe repercussions. These can include damage to your credit score, which makes it harder to secure future loans or even rent an apartment. Furthermore, late payment fees and penalties can quickly escalate the amount you owe. In extreme cases, the lender may initiate legal action to recover the outstanding debt, potentially leading to wage garnishment or even the seizure of assets. The impact of default extends beyond the financial realm, impacting your creditworthiness and overall financial stability for years to come.

Importance of Understanding the Loan Agreement

Before signing any loan agreement, carefully review every clause. Pay close attention to the interest rate, repayment schedule, fees, and penalties for late or missed payments. If anything is unclear, seek clarification from the lender before proceeding. Understanding the terms of your agreement empowers you to make informed decisions and avoid potential misunderstandings that could lead to financial hardship. A clear understanding of the agreement protects your interests and minimizes future complications.

Potential Problems and Their Solutions

Proactive planning can significantly reduce the likelihood of encountering problems with your ACBS loan. Addressing potential issues early can prevent them from escalating into major financial setbacks. The following list illustrates some common challenges and their corresponding solutions.

- Problem: Unexpected job loss. Solution: Immediately contact the lender to explore options like forbearance or a temporary modification of your repayment plan. Actively search for new employment and consider utilizing emergency funds if available.

- Problem: Unforeseen medical expenses. Solution: Similar to job loss, contact your lender to discuss potential payment adjustments. Explore options for financial assistance programs or medical payment plans.

- Problem: Overspending and budget mismanagement. Solution: Create a detailed budget, identify areas for cost reduction, and consider seeking financial counseling to improve budgeting and spending habits.

ACBS Loan Providers

Choosing the right ACBS (Asset-Based Commercial Business) loan provider is crucial for securing the best terms and ensuring a smooth borrowing experience. Understanding the nuances of different providers is key to maximizing your return on investment and minimizing financial risk. This section will illuminate the landscape of ACBS loan providers, helping you make an informed decision.

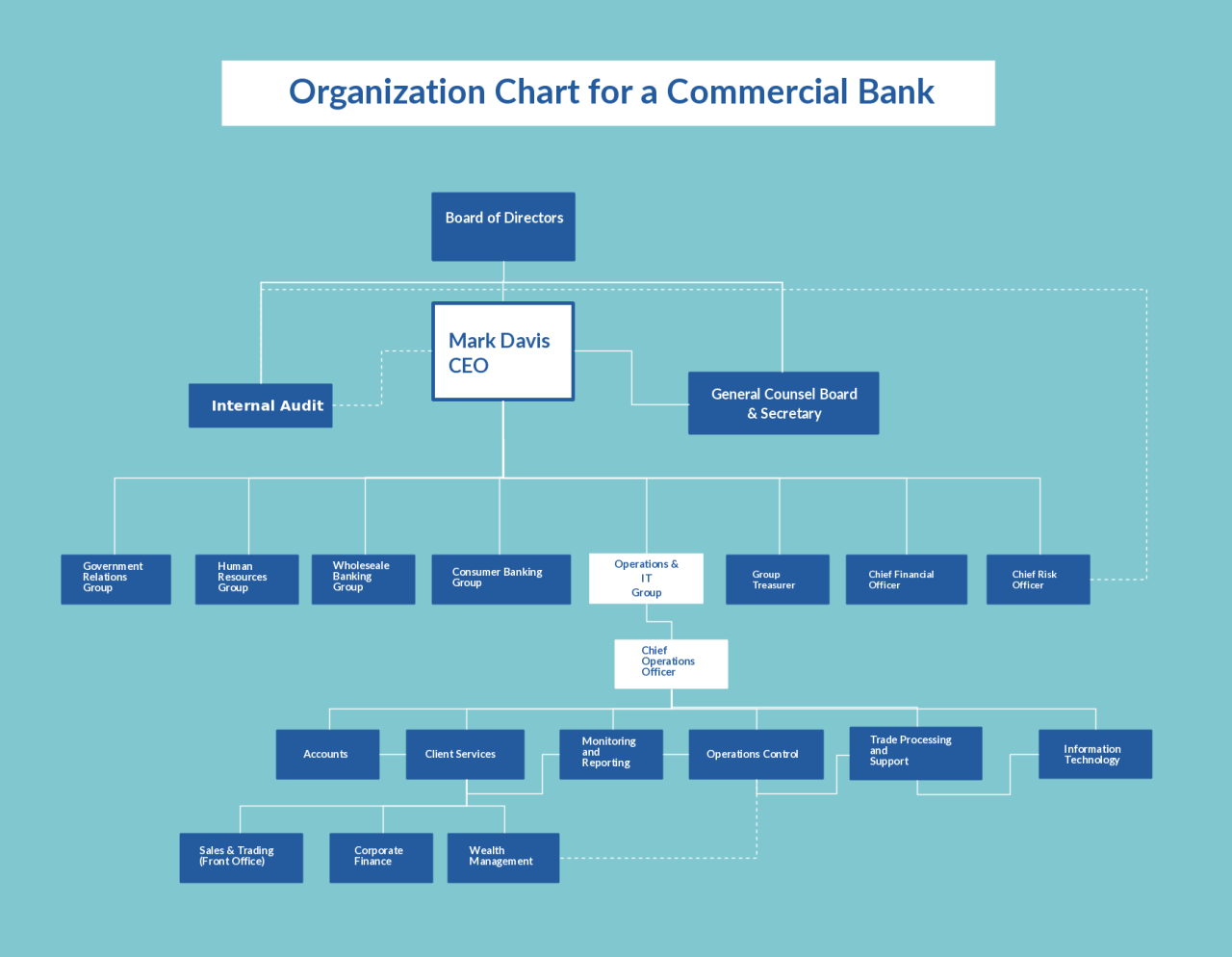

Types of ACBS Loan Providers

Several financial institutions offer ACBS loans, each with its own strengths and weaknesses. These include traditional banks, credit unions, online lenders, and specialized finance companies. Traditional banks often provide larger loan amounts but may have stricter requirements and a more complex application process. Credit unions typically offer more personalized service and potentially better rates for members, while online lenders provide a convenient and often faster application process, albeit sometimes with higher interest rates. Specialized finance companies cater to specific industries or business types, offering tailored loan products.

Comparison of ACBS Loan Provider Services

The services offered by various ACBS loan providers vary significantly. Key differences lie in loan amounts, interest rates, repayment terms, application processes, and customer support. Some providers may offer flexible repayment options, while others might have stricter terms. The speed of the application process and the level of customer service also differ considerably. Some providers prioritize a quick turnaround time, while others focus on building long-term relationships with clients. It’s crucial to weigh these factors based on your specific business needs and preferences.

Examples of Reputable ACBS Loan Providers

While providing specific names could be construed as an endorsement, it’s important to understand that reputable providers generally have a long history of providing financing, strong customer reviews, and transparent lending practices. Conduct thorough research and check the Better Business Bureau or similar organizations for ratings and complaints before selecting a provider. Look for providers with clear fee schedules and readily available contact information.

Factors to Consider When Choosing an ACBS Loan Provider

Selecting the right ACBS loan provider requires careful consideration of several key factors. These include: interest rates, loan amounts, repayment terms, fees, application process, customer service, and the provider’s reputation. Comparing interest rates across multiple providers is vital. Ensure you understand all associated fees, including origination fees, prepayment penalties, and late payment fees. The application process should be straightforward and efficient, and the customer service team should be responsive and helpful. Checking online reviews and ratings can offer valuable insights into the provider’s reliability and customer satisfaction.

ACBS Loan Provider Comparison Table

| Provider Name | Interest Rate Range | Loan Amounts | Customer Reviews Summary |

|---|---|---|---|

| Example Provider A | 6% – 12% | $50,000 – $500,000 | Generally positive, with some complaints about slow processing times. |

| Example Provider B | 7% – 15% | $25,000 – $250,000 | Mixed reviews, with some praising the quick application process and others citing high fees. |

| Example Provider C | 8% – 18% | $10,000 – $100,000 | Mostly negative reviews, citing poor customer service and confusing terms. |

| Example Provider D | 5% – 10% | $100,000 – $1,000,000 | Excellent reviews, highlighting exceptional customer support and competitive rates. |

Illustrative Example of an ACBS Loan Scenario

Let’s examine a practical example to solidify your understanding of ACBS loans. This hypothetical scenario will walk you through the application, approval, repayment, and overall experience of a borrower. Remember, specific terms and conditions will vary depending on the lender and individual circumstances.

Sarah, a small business owner, needed a capital injection to expand her online store. She decided to explore ACBS loans as a potential financing solution. She possessed strong credit history and a proven track record of business success, making her a desirable candidate.

Sarah’s ACBS Loan Application

Sarah applied for a $50,000 ACBS loan from a reputable lender specializing in small business financing. The lender assessed her application based on her credit score, business financials, and the proposed use of funds. The process was straightforward and involved submitting necessary documentation online. The lender’s staff provided excellent support throughout the application process, answering Sarah’s questions promptly and efficiently.

Loan Approval and Terms

After a thorough review, Sarah was approved for the $50,000 loan with a fixed interest rate of 8% per annum. The loan had a repayment term of 5 years, requiring monthly payments of approximately $1,000. This repayment schedule was carefully crafted to align with Sarah’s projected cash flow, ensuring manageable monthly obligations. The loan agreement clearly Artikeld all terms and conditions, including late payment penalties and prepayment options.

Loan Repayment and Experience

Sarah diligently tracked her monthly payments using a dedicated spreadsheet. She ensured timely payments, avoiding any late payment fees. The consistent repayments built her creditworthiness and allowed her to manage her cash flow effectively. Her business flourished thanks to the capital injection, resulting in increased sales and profits. Sarah found the entire experience positive and the lender’s customer service to be responsive and professional. The clear communication and structured repayment plan allowed her to focus on growing her business without undue financial stress. She felt confident in her ability to manage the loan and appreciated the transparency of the process.