Corning Credit Union’s Solar Loan Program Overview

Corning Credit Union offers a competitive solar loan program designed to help members finance the installation of solar energy systems on their homes or businesses. This program provides access to affordable financing, enabling individuals and businesses to reduce their carbon footprint and potentially lower their energy bills. The program’s key features are designed for simplicity and transparency, making the transition to solar power a straightforward process.

Key Features of the Corning Credit Union Solar Loan Program

The Corning Credit Union solar loan program boasts several key features designed to benefit borrowers. These include competitive, fixed interest rates that protect borrowers from fluctuating market conditions. The loan terms are flexible, offering various repayment schedules to accommodate different budgets and financial situations. Furthermore, the application process is streamlined and designed for efficiency, minimizing the paperwork and hassle often associated with securing financing for large projects. Pre-qualification is available, allowing potential borrowers to quickly assess their eligibility before committing to a full application. Finally, the credit union often works directly with reputable solar installers, potentially simplifying the entire project management process.

Eligibility Requirements for Borrowers

Eligibility for the Corning Credit Union solar loan hinges on several factors. Borrowers must be members in good standing with Corning Credit Union. Creditworthiness is a key consideration, with the credit union assessing applicants’ credit scores and history to determine their risk profile. The loan amount is typically tied to the cost of the solar installation project, requiring borrowers to provide detailed quotes and contracts from reputable solar installers. Finally, the property where the solar panels will be installed must meet certain requirements, such as sufficient roof space and appropriate structural integrity. Specific requirements may vary depending on the size and type of solar installation.

Step-by-Step Application Process

The application process is designed to be clear and straightforward. First, borrowers should pre-qualify for a loan to get an initial assessment of their eligibility. Next, they need to secure a detailed quote from a qualified solar installer, which will form the basis of the loan application. This quote should include all costs associated with the project, from equipment to installation. The borrower then completes the loan application, providing all necessary documentation, including proof of income, credit reports, and the installer’s quote. Corning Credit Union will review the application and, if approved, will finalize the loan terms. Finally, the funds are disbursed directly to the solar installer upon completion of the installation and verification.

Loan Amounts and Interest Rates

Loan amounts offered through Corning Credit Union’s solar loan program are tailored to the individual needs of borrowers, generally ranging from $5,000 to $50,000 or more, depending on the project scope and borrower’s creditworthiness. Interest rates are competitive and fixed, protecting borrowers from rate increases during the loan term. The specific interest rate offered will depend on several factors, including the borrower’s credit score, loan amount, and loan term. For example, a borrower with excellent credit might qualify for a rate as low as 4%, while a borrower with less-than-perfect credit might face a higher rate, potentially in the 7-9% range. It’s crucial to contact Corning Credit Union directly for the most up-to-date information on current interest rates and loan terms.

Comparison of Corning Credit Union’s Solar Loan with Other Local Institutions

The following table compares Corning Credit Union’s solar loan program with similar offerings from other local financial institutions. Note that rates and terms are subject to change and should be verified directly with each institution.

| Institution | Loan Amount | Interest Rate Range | Loan Term Options |

|---|---|---|---|

| Corning Credit Union | $5,000 – $50,000+ | 4% – 9% (Variable based on creditworthiness) | 5-15 years |

| [Local Bank A] | $10,000 – $40,000 | 5% – 10% | 7-12 years |

| [Local Bank B] | $5,000 – $30,000 | 6% – 11% | 5-10 years |

| [Local Credit Union C] | $7,500 – $60,000 | 4.5% – 9.5% | 8-15 years |

Financial Incentives and Rebates

Going solar doesn’t just benefit the planet; it can significantly boost your wallet too. Numerous financial incentives, at both the federal and state levels, are designed to make solar energy more accessible and affordable. Coupled with Corning Credit Union’s competitive loan rates, these incentives can dramatically reduce the upfront cost and accelerate your return on investment. Let’s explore the potential savings.

Federal and state governments understand the importance of transitioning to renewable energy. To encourage this shift, they offer substantial tax credits and rebates that can significantly offset the cost of installing a solar energy system. These incentives are designed to make solar power a financially viable option for homeowners and businesses alike. Understanding these incentives is crucial to maximizing your savings.

Federal Tax Credits

The federal government currently offers a significant tax credit for solar panel installations. This credit is a percentage of the total cost of your system, including installation. The exact percentage can fluctuate, so it’s vital to check the latest IRS guidelines. For example, in recent years, the Investment Tax Credit (ITC) has been a significant percentage of the total cost. This credit is applied directly to your federal income tax liability, resulting in a direct reduction of the amount you owe. Claiming this credit requires careful documentation of all expenses related to your solar panel installation. This is a significant incentive that can drastically reduce the overall price of your system.

State and Local Incentives

Beyond the federal tax credit, many states and localities offer additional incentives to promote solar energy adoption. These can take various forms, including state tax credits, rebates, and accelerated depreciation schedules. Some states even have programs specifically designed to support low-to-moderate-income homeowners in installing solar panels. It’s essential to research your specific state and local government websites to identify any available incentives. For instance, New York State offers various programs to support renewable energy development, and your local utility company might also offer rebates for solar installations. These incentives can stack with the federal tax credit, further reducing the overall cost.

Corning Credit Union Incentives

Corning Credit Union may offer additional incentives specifically for members financing their solar panel installations through their loan program. These could include lower interest rates, reduced closing costs, or other financial benefits. Contact Corning Credit Union directly to inquire about any current incentives offered in conjunction with their solar loan program. They may also be able to connect you with local installers and provide guidance on navigating the process of claiming federal and state incentives.

Sample Cost Savings Calculation

Let’s illustrate how these incentives can reduce the total cost. Assume a solar panel system costs $20,000 before incentives.

| Item | Cost |

|---|---|

| Solar Panel System | $20,000 |

| Federal Tax Credit (30%) | -$6,000 |

| State Rebate (5%) | -$1,000 |

| Corning Credit Union Loan (at 3% interest) | (Loan Amount Details would be provided separately by Corning Credit Union) |

| Total Cost After Incentives | $13,000 (Example – Actual cost will vary) |

The actual savings will vary depending on the size of your system, the specific incentives available in your area, and the terms of your Corning Credit Union loan. It is crucial to consult with both Corning Credit Union and a qualified solar installer to determine your precise savings.

Solar Panel System Considerations

Choosing the right solar panel system is crucial for maximizing your return on investment and ensuring long-term energy independence. Understanding the various types of panels, their lifespans, and the factors influencing system size are key to making an informed decision. This section will provide you with the essential knowledge to navigate these critical aspects of your solar journey.

Solar Panel Types and Their Characteristics

Several types of solar panels exist, each with its own strengths and weaknesses. The most common are monocrystalline, polycrystalline, and thin-film panels. Monocrystalline panels, made from single silicon crystals, boast the highest efficiency, converting sunlight to electricity more effectively than other types. However, they tend to be more expensive. Polycrystalline panels, made from multiple silicon crystals, offer a balance between efficiency and cost-effectiveness. Thin-film panels, using a thin layer of photovoltaic material, are lightweight and flexible, ideal for unique installations but generally have lower efficiency. The optimal choice depends on your budget, energy needs, and aesthetic preferences.

Solar Panel Lifespan and Maintenance

The lifespan of a solar panel system is typically 25-30 years, though they can last longer with proper maintenance. Regular cleaning, typically once or twice a year, is essential to remove dirt, leaves, and other debris that can reduce efficiency. While panels themselves are quite durable, inverters (which convert DC power from panels to AC power for your home) may require replacement after 10-15 years. Professional maintenance checks every few years can identify and address potential issues early, ensuring optimal performance throughout the system’s lifespan. Neglecting maintenance can lead to decreased efficiency and potentially costly repairs down the line.

Factors Determining Solar Panel System Size and Capacity

The size and capacity of your solar panel system are determined by several factors. Your home’s energy consumption, roof size and orientation, shading, and your energy goals all play a significant role. A comprehensive energy audit will help determine your average daily energy usage, allowing installers to design a system that meets your needs. Roof orientation and shading affect the amount of sunlight your panels receive, impacting overall energy production. For instance, a south-facing roof in the northern hemisphere receives optimal sunlight, while significant shading from trees or buildings can significantly reduce output. Your goals, such as offsetting 100% of your electricity usage or just a portion, will further shape the system’s size. A larger system will cost more upfront but generate more energy, while a smaller system will be cheaper but may not meet all your energy needs.

Hypothetical Solar Panel Installation: System Components and Functions

Let’s consider a hypothetical installation for a typical suburban home. The system might include 20 monocrystalline solar panels, each with a capacity of 350 watts, totaling 7 kW. These panels would be mounted on the south-facing roof using a racking system. The DC power generated by the panels would then be fed into an inverter, converting it to AC power compatible with your home’s electrical system. A monitoring system would track energy production and consumption, providing valuable data for optimization. The system would also include a disconnect switch for safety and a net metering system to allow excess energy to be fed back into the grid.

“This hypothetical system would provide enough energy to offset a significant portion of the homeowner’s electricity consumption, reducing their reliance on the grid and lowering their monthly energy bills. The system’s performance would be further enhanced by regular maintenance and cleaning, ensuring optimal energy production throughout its lifespan.”

Environmental Impact and Energy Savings: Corning Credit Union Solar Loan

Switching to solar energy offers significant environmental and economic advantages. By harnessing the sun’s power, you drastically reduce your reliance on fossil fuels, minimizing your carbon footprint and contributing to a cleaner, healthier planet. This section details the quantifiable benefits of solar panel installation, showcasing the positive impact on both your energy bills and the environment.

Going solar dramatically reduces your reliance on fossil fuels, the primary drivers of climate change. Traditional energy sources like coal and natural gas release substantial greenhouse gases during their extraction, processing, and combustion. Solar energy, on the other hand, produces virtually no greenhouse gas emissions during operation. This shift significantly lowers your carbon footprint and contributes to a healthier environment for everyone.

Greenhouse Gas Emission Reduction

A typical residential solar panel installation can significantly reduce greenhouse gas emissions. Consider a home using 10,000 kWh of electricity annually. If this energy were generated by a coal-fired power plant, it would result in approximately 9,000 kg of CO2 emissions per year. By installing a solar panel system that generates the same amount of energy, this CO2 emission would be almost entirely eliminated.

The visual representation would depict two bar graphs side-by-side. The first bar, labeled “Traditional Energy,” would be significantly taller, representing the substantial CO2 emissions from fossil fuels. The second bar, labeled “Solar Energy,” would be considerably shorter, almost negligible, visually illustrating the dramatic reduction in greenhouse gas emissions achieved through solar power. The specific numerical values (e.g., 9,000 kg vs. negligible) would be clearly labeled on each bar for easy comparison.

Quantifiable Energy Savings and Environmental Benefits

The environmental benefits of solar energy extend beyond greenhouse gas reduction. Switching to solar power contributes to cleaner air and water, as the process eliminates pollutants associated with fossil fuel combustion. This cleaner environment leads to improved public health and reduced environmental damage.

- Reduced Carbon Footprint: Significantly lower greenhouse gas emissions compared to traditional energy sources.

- Improved Air Quality: Elimination of air pollutants associated with fossil fuel combustion.

- Water Conservation: Solar energy requires significantly less water than traditional energy generation methods.

- Reduced Land Degradation: While solar farms require land, their impact is generally less extensive than that of fossil fuel extraction.

- Renewable Energy Source: The sun’s energy is constantly replenished, ensuring a sustainable energy supply.

Switching to solar energy is not just about saving money; it’s about investing in a cleaner, healthier future.

Long-Term Financial Implications

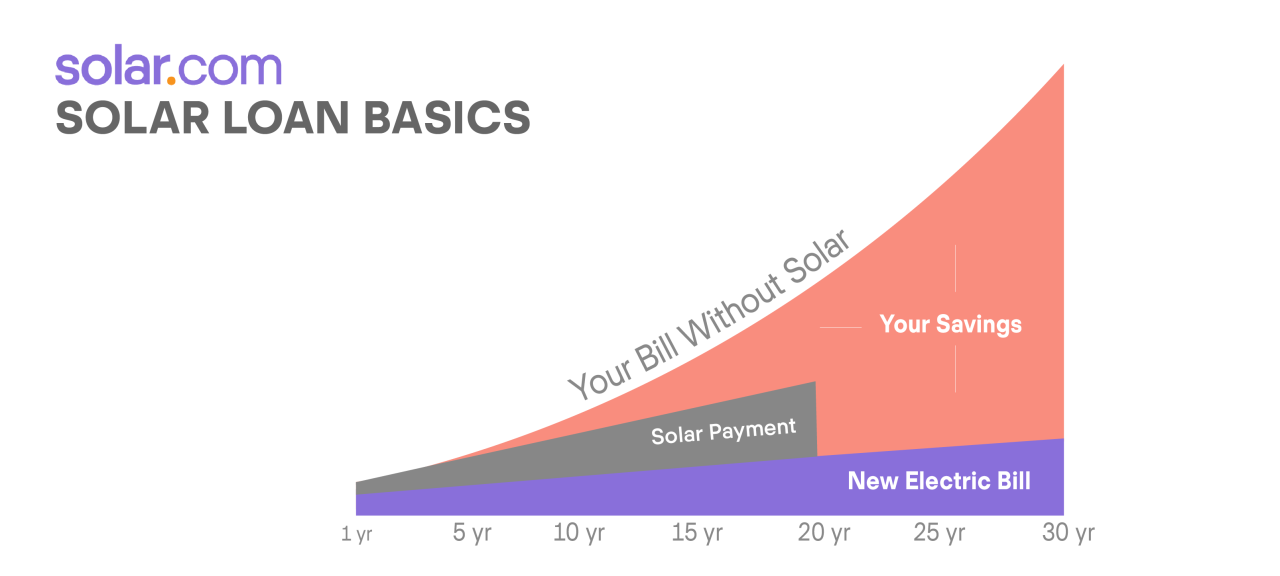

Investing in a solar energy system through Corning Credit Union’s loan offers significant long-term financial benefits that extend far beyond immediate energy cost savings. This section analyzes the total cost of ownership, potential resale value increases, and various repayment scenarios to illustrate the long-term financial impact of this investment. Understanding these factors is crucial for making an informed decision about your home’s energy future.

Total Cost of Ownership: Loan vs. Outright Purchase

A key consideration is comparing the total cost of ownership when financing a solar system through a loan versus paying outright. While an outright purchase eliminates loan interest, it requires a substantial upfront capital investment. A loan, however, allows you to spread the cost over time, potentially making a larger system financially feasible. Let’s consider a hypothetical example: A $20,000 solar panel system. If purchased outright, the immediate expense is $20,000. However, with a Corning Credit Union loan at a 5% interest rate over 15 years, the total cost, including interest, might be approximately $28,000. While this appears higher, the monthly payments might be significantly more manageable than the initial $20,000 outlay. The actual figures will depend on the loan terms and the specific system cost. This highlights the importance of carefully evaluating your financial situation and comparing different financing options.

Resale Value Appreciation

Homes equipped with solar panel installations often command higher resale values. Potential buyers are increasingly attracted to energy-efficient properties, recognizing the long-term cost savings and environmental benefits. Studies have shown that homes with solar panels can sell for a premium, often offsetting, or even exceeding, the initial investment cost. For instance, a recent study by the National Renewable Energy Laboratory (NREL) indicated that homes with solar panels sold for an average of 4.1% more than comparable homes without solar panels. This premium can vary based on factors like location, system size, and market conditions, but it represents a significant potential return on investment at the time of resale.

Illustrative Repayment Scenarios, Corning credit union solar loan

Different repayment plans can significantly impact your long-term finances. Consider these scenarios: A 10-year loan will result in higher monthly payments but lower overall interest paid compared to a 20-year loan. A 20-year loan offers lower monthly payments but results in higher overall interest costs. Choosing the right repayment plan depends on your individual financial comfort level and long-term financial goals. For example, a homeowner with a higher disposable income might opt for a shorter loan term to minimize interest payments and own the system outright sooner. Conversely, a homeowner with tighter budget constraints might prefer a longer loan term to reduce monthly expenses, even if it means paying more interest over the life of the loan. Corning Credit Union’s loan officers can help you determine the best repayment plan to suit your specific circumstances. It’s crucial to meticulously analyze the amortization schedule provided by the credit union to understand the precise impact of different loan terms on your overall financial picture.