Calvet Loan Limits 2022

Understanding the California Veterans’ (CalVet) home loan program is crucial for eligible veterans seeking to purchase a home. In 2022, the CalVet program offered a unique set of loan limits and benefits, making it a powerful tool for California veterans navigating the real estate market. This overview clarifies the key aspects of CalVet loan limits and eligibility criteria for that year.

CalVet Loan Limits in 2022 were not defined by a single, fixed number. Instead, the maximum loan amount varied significantly depending on several factors, including the location of the property and the type of loan being sought. These limits were adjusted frequently and were subject to change based on prevailing market conditions. Consequently, precise figures for 2022 require referencing official CalVet documentation from that specific year. It’s vital to note that CalVet loans are not FHA or VA loans, and therefore have a different structure and limitations.

Types of CalVet Loans Offered in 2022

The CalVet program offered several loan types in 2022, each designed to cater to different veteran needs and financial situations. While the specific details of each loan type might vary slightly over time, understanding the general categories is essential for determining eligibility and suitable loan options. A key distinction often lay between direct loans (where CalVet holds the mortgage) and indirect loans (where a private lender is involved). This impacted the overall loan process and the applicable loan limits. Furthermore, CalVet often offered options tailored for specific property types, such as single-family homes, condos, and manufactured homes, each with its own eligibility requirements and potential loan limit differences.

Eligibility Criteria for CalVet Loans in 2022

Eligibility for CalVet loans in 2022 was determined by a series of strict criteria. Veterans needed to meet specific service requirements, demonstrating honorable discharge or separation from the military. Furthermore, proof of California residency was a fundamental requirement. Income verification was also a crucial aspect of the application process, with CalVet evaluating applicants’ financial capacity to manage the mortgage payments. Credit history was another significant factor, impacting the likelihood of loan approval and potentially influencing the terms and conditions of the loan agreement. Finally, the property itself needed to meet CalVet’s standards for appraisal and condition. Failing to meet any of these criteria could result in loan application denial.

Loan Amount Variations

CalVet loan limits, while offering significant advantages to California veterans, aren’t a one-size-fits-all solution. The maximum loan amount you can receive depends heavily on several factors, most notably the type of property you’re purchasing and its location. Understanding these variations is crucial for effectively navigating the CalVet home loan process. This section delves into the specifics of how loan amounts fluctuate based on these key variables.

The CalVet program doesn’t publish a simple, easily accessible chart showing loan limits for every property type and location. Instead, the maximum loan amount is determined by a complex appraisal process that considers the property’s fair market value and other factors. This means that while there aren’t fixed limits for specific property types like there are for some FHA loans, we can examine real-world examples to illustrate the range of loan amounts approved in 2022.

Loan Amount Differences Based on Property Type

The type of property significantly impacts the loan amount. Single-family homes generally command higher loan amounts due to their typical value compared to multi-family dwellings or other property types. However, the location plays a critical role; a single-family home in a rural area might have a lower appraisal than a smaller multi-family unit in a high-demand urban location. The CalVet appraisal process considers factors such as property size, condition, location, and comparable sales in the area to determine the fair market value, which directly influences the maximum loan amount.

Examples of CalVet Loan Amounts Approved in 2022

The following table provides illustrative examples of CalVet loan amounts approved in 2022. Remember, these are examples only and should not be considered guarantees of loan amounts for similar properties. The actual loan amount will depend on a comprehensive appraisal conducted by a CalVet-approved appraiser.

| Property Type | Location | Property Value | Loan Amount |

|---|---|---|---|

| Single-Family Home | Sacramento, CA | $600,000 | $500,000 |

| Multi-Family Dwelling (Duplex) | Fresno, CA | $450,000 | $380,000 |

| Single-Family Home | San Diego, CA | $850,000 | $700,000 |

| Condominium | San Francisco, CA | $900,000 | $750,000 |

Factors Influencing Loan Limits

Calvet loan limits, like those of any mortgage program, aren’t static; they fluctuate based on a complex interplay of economic and financial factors. Understanding these influences is crucial for both prospective borrowers and those involved in the Calvet loan process. These factors directly impact the amount of money available to borrowers and ultimately determine their eligibility for a loan.

The primary drivers behind Calvet loan limit adjustments in 2022 were a combination of prevailing interest rates and broader economic conditions. These elements created a dynamic environment that significantly affected the program’s capacity to extend loans and the ability of individuals to qualify.

Interest Rate Fluctuations

Interest rates are a cornerstone of mortgage lending. Higher interest rates increase the cost of borrowing, making it more expensive for both the lender and the borrower. In 2022, we saw a notable increase in interest rates, a trend that directly impacted the Calvet loan program. As rates climbed, the risk associated with lending increased, leading to a potential recalibration of loan limits to mitigate that risk. This meant that even with the same income and creditworthiness, borrowers might have qualified for a smaller loan amount due to the increased cost of financing. For example, a borrower who might have qualified for a $300,000 loan at a 3% interest rate could find their eligibility reduced to $275,000 at a 5% rate, even with no other changes in their financial profile.

Economic Conditions and Housing Market Dynamics

The broader economic climate also plays a vital role. Factors like inflation, unemployment rates, and overall economic growth directly influence the housing market and, consequently, loan limits. High inflation, for instance, can increase the cost of construction and existing homes, potentially impacting the appraised value of properties used as collateral for Calvet loans. This, in turn, could lead to lower loan limits to maintain a healthy loan-to-value ratio. Similarly, periods of high unemployment can lead to lenders being more cautious in extending loans, potentially reducing loan limits as a risk management strategy. Conversely, robust economic growth and low unemployment can potentially lead to increased loan limits, reflecting a more optimistic outlook on borrower repayment ability. The fluctuations in the housing market, specifically regarding home prices and sales volume, also directly affect the amount lenders are willing to provide.

Consequences of Exceeding Loan Limits

Attempting to circumvent Calvet loan limits can have significant repercussions. Borrowers who attempt to secure a loan exceeding the established limits may find their applications rejected outright. This could lead to significant delays in securing financing and potentially missing out on desired properties. Furthermore, engaging in fraudulent activities to inflate income or asset values to meet higher loan amounts could result in severe legal and financial penalties, including potential criminal charges. It’s crucial to adhere to the established loan limits and work within the parameters of the Calvet loan program to ensure a smooth and compliant application process.

Comparison to Other Loan Programs

Understanding the CalVet loan program requires comparing it to other financing options available to California veterans. This allows for a more informed decision-making process, ensuring you select the program best suited to your individual financial circumstances and property goals. By examining key differences in loan limits, down payment requirements, and interest rates, you can effectively weigh the pros and cons of each program.

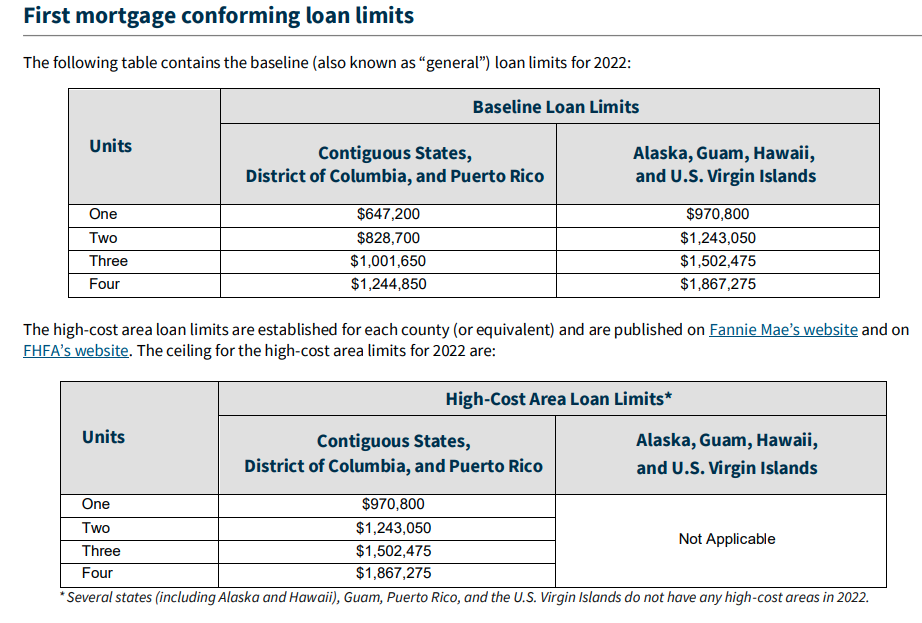

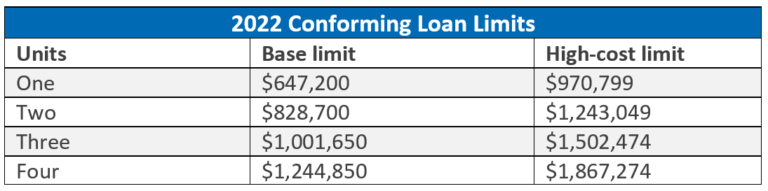

This section will directly compare CalVet loan limits in 2022 with those of similar loan programs in California, highlighting crucial distinctions to help you make a well-informed choice. We will focus on two prominent programs: conventional loans backed by Fannie Mae or Freddie Mac, and FHA loans.

Comparison of CalVet, Conventional, and FHA Loans

The following bullet points Artikel key differences between CalVet home loans and other prominent loan programs in California. Remember that specific loan amounts and interest rates can fluctuate based on market conditions and individual borrower qualifications. Always consult with a qualified lender for the most up-to-date information.

- CalVet: Offers competitive interest rates, often fixed for the life of the loan. No private mortgage insurance (PMI) is required, and down payment requirements are typically lower than conventional loans. Loan limits vary based on property location and value, but are generally higher than FHA loan limits in certain areas. However, the CalVet loan is specific to California veterans and requires meeting specific eligibility criteria.

- Conventional Loans (Fannie Mae/Freddie Mac): These loans are widely available, but typically require a higher down payment (often 20% or more) to avoid PMI. Interest rates can be competitive, depending on credit score and market conditions. Loan limits are set annually by the Federal Housing Finance Agency (FHFA) and vary by county. Eligibility is broader than CalVet but may require stricter credit qualifications.

- FHA Loans: Designed for borrowers with lower credit scores and smaller down payments (as low as 3.5%), FHA loans often come with higher interest rates compared to conventional loans. Mortgage insurance is required, adding to the overall cost of the loan. Loan limits are set by the Federal Housing Administration (FHA) and vary by county, generally lower than conventional loan limits in many areas. While more accessible than conventional loans, they may still be less flexible than CalVet for eligible veterans.

Loan Program Comparison Table

The following table provides a simplified comparison of CalVet, Conventional, and FHA loans in 2022. Remember, these are illustrative examples and actual figures can vary based on numerous factors. Consult a lender for personalized estimates.

| Feature | CalVet (Example) | Conventional (Example) | FHA (Example) |

|---|---|---|---|

| Maximum Loan Amount (Example County) | $800,000 | $726,200 | $647,200 |

| Minimum Down Payment | 0% – 10% (depending on the loan type) | 3% – 20% (depending on loan type and credit score) | 3.5% |

| Interest Rate (Example) | 5.5% (Fixed) | 6.0% (Variable) | 6.5% (Variable) |

| PMI/MIP | No | Yes (if down payment < 20%) | Yes |

Illustrative Scenarios

Understanding the CalVet loan limits is crucial for prospective borrowers. Let’s examine several scenarios to clarify how these limits impact eligibility and loan amounts. These examples illustrate the practical application of the 2022 CalVet loan limits, highlighting situations where borrowers reach the maximum, are ineligible, or successfully secure a loan.

Maximum CalVet Loan Limit Reached

Imagine Sarah, a veteran with a strong credit history and sufficient income, is looking to purchase a home in a highly competitive market. After careful consideration, she finds her dream home, priced at $800,000. Assuming the 2022 CalVet loan limits in her area were, for example, $800,000, Sarah would be able to utilize the maximum loan amount offered by the program to purchase her property. This scenario showcases a successful application of the program up to its maximum capacity, demonstrating a best-case scenario for eligible borrowers. She would need to meet all other eligibility requirements, of course, but the loan amount itself would not be a barrier.

Ineligibility Due to Exceeding Loan Limit

Consider Mark, a veteran seeking to purchase a luxury home valued at $1.2 million in a high-demand coastal region. Even with excellent credit and financial stability, Mark would be ineligible for a CalVet loan in 2022 if the county limit in his area was, say, $800,000. The property’s value significantly exceeds the maximum loan amount permitted under the CalVet program, rendering him ineligible regardless of his financial qualifications. This highlights the importance of understanding regional loan limits and aligning property searches with the program’s financial capabilities.

Successful CalVet Loan Acquisition

Let’s look at David, a veteran seeking a more modest home priced at $500,000. David has a stable income, good credit, and meets all other CalVet eligibility requirements. Assuming the maximum loan limit in his area was $800,000, he would comfortably fall within the program’s limits. He would likely secure a CalVet loan, receiving financing for his home purchase. This scenario illustrates a common and successful application of the CalVet program, demonstrating how it can help veterans purchase homes within their financial reach and within the established program parameters.

Impact of Regulations: Calvet Loan Limits 2022

The Calvet loan program, designed to assist California veterans with homeownership, operates within a complex regulatory framework. These regulations significantly influence the loan limits, impacting both the accessibility and affordability of the program for eligible borrowers. Understanding these regulations is crucial for navigating the Calvet loan process and predicting future changes.

Governmental oversight and budgetary constraints play a major role in shaping Calvet loan limits. Annual adjustments often reflect changes in housing costs, economic conditions, and the overall availability of funds allocated to the program. These adjustments are not arbitrary; they are driven by data analysis and projections aiming to balance the program’s objectives with fiscal responsibility. For instance, a period of high inflation might lead to increased loan limits to maintain the program’s effectiveness in helping veterans purchase homes, while a budget deficit might necessitate a more conservative approach.

Regulatory Changes and Their Effects on Loan Limits, Calvet loan limits 2022

Changes in federal or state regulations directly impact Calvet loan limits. For example, stricter lending standards introduced to mitigate risk could lead to lower loan amounts to reduce the program’s exposure to potential defaults. Conversely, initiatives aimed at boosting homeownership, particularly for veterans, might lead to increased loan limits or more flexible lending criteria. The interplay between these factors is constantly evolving, creating a dynamic environment for Calvet loan applicants. Consider a scenario where new regulations require stricter appraisals, leading to lower valuations of properties. This could, in turn, force a reduction in the maximum loan amount offered under the Calvet program to ensure responsible lending practices are maintained.

Regulatory Impact on Borrower Access to Funds

Variations in loan limits, driven by regulatory changes, directly influence the number of veterans who can access Calvet loans. Higher loan limits broaden the range of properties eligible for purchase, making homeownership more attainable for veterans with higher-priced housing needs. Conversely, reduced loan limits could restrict access, particularly in high-cost housing markets, potentially excluding veterans from the program entirely. For example, if loan limits remain stagnant while housing prices significantly increase, the program becomes less effective for veterans seeking homes in expensive urban areas. This could lead to a disproportionate impact on veterans in these regions, limiting their opportunities for homeownership compared to those in more affordable areas. The program’s efficacy hinges on a balance between maintaining fiscal responsibility and providing accessible homeownership opportunities for eligible veterans.