Understanding 365/360 Loan Calculations

Choosing the right loan can significantly impact your overall financial health. A crucial aspect often overlooked is the method used to calculate interest: the 365-day method versus the 360-day method. While seemingly minor, this difference can lead to surprisingly significant variations in the total interest paid over the loan term. Understanding these nuances is critical for making informed borrowing decisions.

365/360 loan calculator – The core difference lies in the number of days used to calculate the daily interest rate. The 365-day method uses the actual number of days in a year, while the 360-day method, also known as the Banker’s year, uses 360 days for simplicity. This seemingly small difference can lead to notable variations in the final interest amount, particularly for longer loan terms.

Impact of 365-Day and 360-Day Methods on Total Interest

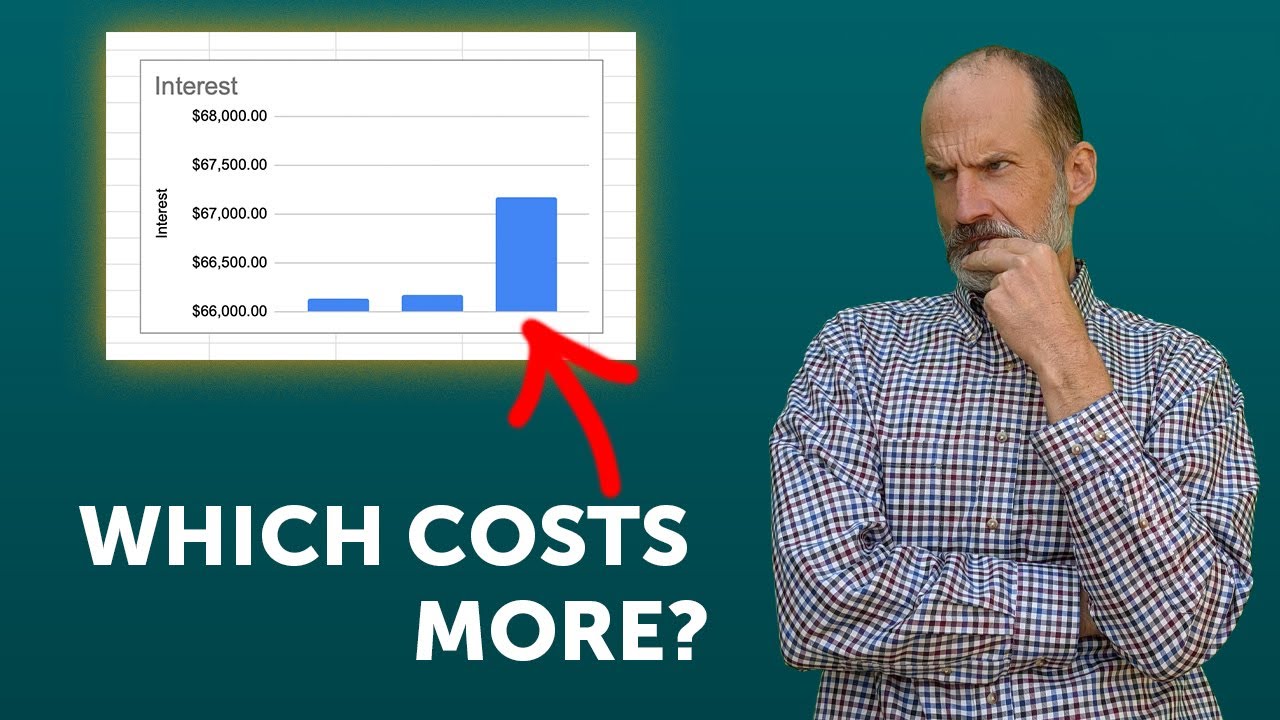

The 360-day method generally results in slightly higher interest payments compared to the 365-day method. This is because the daily interest rate is calculated by dividing the annual interest rate by 360 instead of 365. The higher daily rate, even if marginally so, accumulates over the loan’s duration, leading to a larger total interest amount. For instance, a loan with a 10% annual interest rate will have a daily rate of approximately 0.0274% (10%/365) using the 365-day method and approximately 0.0278% (10%/360) using the 360-day method. This small difference in daily rates compounds over time, resulting in a higher total interest cost with the 360-day method.

Scenarios Favoring One Method Over the Other

While the 360-day method often leads to higher interest, there are situations where it might be preferable. Historically, the 360-day method was favored for its simplicity in manual calculations. Today, with automated systems, this advantage is less significant. However, some lenders might still use the 360-day method due to established practices or internal systems. Conversely, borrowers might prefer the 365-day method to minimize the total interest paid. The choice often depends on the lender’s policies and the borrower’s priorities.

Comparison of 365-Day and 360-Day Loan Calculations

The following table summarizes the key differences between the two methods. Note that the “Total Interest Paid Example” is a simplified illustration and will vary significantly based on loan amount, interest rate, and loan term.

| Loan Type | Interest Calculation Method | Daily Interest Rate Formula | Total Interest Paid Example (Loan Amount: $10,000, Annual Interest Rate: 10%, Loan Term: 1 Year) |

|---|---|---|---|

| Standard Loan | 365-Day Method | Annual Interest Rate / 365 |

Approximately $986.30 |

| Standard Loan | 360-Day Method | Annual Interest Rate / 360 |

Approximately $1000.00 |

Factors Affecting Loan Calculations

Understanding the nuances of 365/360 loan calculations requires a deep dive into the variables that significantly impact the final repayment amount. These calculations, while seemingly straightforward, are sensitive to even small changes in key inputs, leading to potentially substantial differences in your overall cost of borrowing. Let’s dissect these crucial factors.

Interest Rate’s Influence on Total Repayment

The interest rate is the cornerstone of any loan calculation. A higher interest rate directly translates to a larger total repayment amount. This is because you’re paying interest not only on the principal loan amount but also on the accumulated interest over the loan’s lifespan. For example, a 1% increase in the interest rate on a $100,000 loan could easily add thousands of dollars to your total repayment over the loan term. Conversely, a lower interest rate will result in significantly lower overall costs. The effect is compounded by longer loan terms, as explained below. Accurate interest rate calculation is crucial for both 365 and 360-day methods, impacting the daily interest accrued.

Loan Term Length’s Impact on Calculation Methods

The length of the loan term (the time you have to repay the loan) significantly impacts the total repayment amount under both the 365-day and 360-day methods. A longer loan term means you’ll pay less per month, but you’ll pay significantly more in total interest over the life of the loan. This is because you’re accruing interest over a longer period. The difference between the 365 and 360-day methods becomes more pronounced with longer loan terms, as the slight difference in the daily interest calculation accumulates over time. A 30-year mortgage, for instance, will show a more noticeable difference compared to a 5-year loan.

Manual Loan Payment Calculation: A Step-by-Step Guide

Let’s illustrate how to manually calculate loan payments using both methods. While loan calculators simplify this process, understanding the underlying math is crucial. We’ll use the following formula:

M = P [ i(1 + i)^n ] / [ (1 + i)^n – 1]

Where:

* M = Monthly Payment

* P = Principal Loan Amount

* i = Monthly Interest Rate (Annual Interest Rate / 12)

* n = Number of Months (Loan Term in Years * 12)

365-Day Method

1. Determine the annual interest rate: Let’s assume an annual interest rate of 6%.

2. Calculate the monthly interest rate: Divide the annual interest rate by 12: 6% / 12 = 0.5% or 0.005.

3. Determine the loan term in months: For a 5-year loan, this would be 5 years * 12 months/year = 60 months.

4. Calculate the monthly payment: Substitute the values into the formula above. For example, with a principal loan amount (P) of $20,000, the monthly payment (M) would be approximately $386.66. Note that this calculation uses a 365-day year for the interest calculation, subtly influencing the monthly interest rate.

360-Day Method

The process is identical, except that the slight difference lies in how the annual interest rate is converted to a daily rate and then back to a monthly rate. The 360-day method assumes a year has 360 days, simplifying calculations but slightly altering the final outcome compared to the 365-day method. Using the same example as above, but applying the 360-day method, the monthly payment might be slightly different, reflecting the change in the underlying daily interest calculation. The difference will be small for shorter-term loans but can become more noticeable with longer-term loans.

Practical Applications of 365/360 Calculators

Understanding the nuances of 365/360 day calculations is crucial for accurate financial modeling, particularly in the lending industry. These calculations directly impact interest accrual and ultimately, the total cost of borrowing. The choice between a 360-day or a 365-day year significantly affects the final numbers, especially over longer loan terms. Let’s delve into how these calculations are applied in real-world scenarios.

Loan Types Utilizing 365/360 Day Calculations, 365/360 loan calculator

The 365/360 day count convention is prevalent across various loan types. Its application isn’t arbitrary; it’s deeply embedded in the financial instruments themselves and the regulatory frameworks governing them. The choice between 360 and 365 often depends on the specific loan agreement and industry standards.

- Mortgages: Many mortgage loans utilize 360-day calculations for simplicity and historical reasons. This simplifies calculations for monthly payments.

- Commercial Loans: Commercial loans, particularly those with shorter terms, often employ 360-day calculations. This can be due to industry conventions or specific contractual agreements.

- Auto Loans: Auto loans frequently use 365-day calculations for greater accuracy in interest calculations, though 360-day methods are also common.

- Corporate Bonds: The calculation of interest payments on corporate bonds often involves 360-day year conventions, aligning with standard accounting practices.

Mortgage Calculation Scenario: 365-Day Method

Let’s consider a $300,000 mortgage with a 30-year term and a 6% annual interest rate. Using a 365-day year calculator, we would input these values. The calculator would then compute the daily interest rate (6%/365), and using this rate, calculate the interest accrued each day and accumulate it over the loan term to arrive at the total interest paid. The monthly payment would be calculated based on the total interest and principal to be repaid over the 360 monthly payments (30 years x 12 months). While the precise numbers would depend on the specific calculator used, the process is consistent.

Comparison of 365-Day and 360-Day Methods in Mortgage Calculation

Applying both 365-day and 360-day methods to our $300,000 mortgage example will reveal a difference in the total interest paid over the loan’s lifetime. The 360-day method, due to its slightly larger daily interest rate (6%/360), will result in a higher total interest paid compared to the 365-day method. This difference might seem small on a daily basis, but it compounds over 30 years. While the difference might not be enormous in this example, it highlights the importance of understanding the calculation method used, particularly for larger loans or longer terms. For example, a difference of even 0.5% annually can amount to thousands of dollars over the life of a loan.

Interpreting 365/360 Loan Calculator Output

A typical 365/360 loan calculator will provide several key outputs. These include:

- Monthly Payment: The fixed amount paid each month to cover both principal and interest.

- Total Interest Paid: The cumulative amount of interest paid over the loan’s lifetime.

- Amortization Schedule: A detailed breakdown of each payment, showing the allocation between principal and interest over time. This allows you to visualize how much of your payment is going towards paying down the loan principal versus interest.

- Total Payment: The sum of all monthly payments, representing the total cost of the loan.

Understanding these outputs is crucial for making informed borrowing decisions. By comparing the results from different day-count conventions, you can assess the potential financial implications and choose the loan option that best aligns with your financial goals.

Potential Errors and Misinterpretations

Using 365/360 loan calculators, while seemingly straightforward, presents several opportunities for errors and misinterpretations. Understanding these potential pitfalls is crucial for ensuring accurate loan calculations and avoiding costly mistakes. Accurate input and careful interpretation of the results are key to leveraging these tools effectively.

While these calculators streamline the process, they are only as good as the data you input. Inaccurate data leads to inaccurate results, potentially impacting your financial decisions significantly. Furthermore, subtle differences in how the 365/360 method is implemented can lead to variations in calculated values between different calculators. This highlights the need for careful selection and understanding of the specific calculator you’re using.

Incorrect Data Input

Entering incorrect loan terms—the principal amount, interest rate, or loan term—is a primary source of error. A simple typo, like entering 100,000 instead of 10,000 for the principal amount, will dramatically alter the calculated payments and total interest. Similarly, a misinterpretation of the interest rate (e.g., confusing an annual rate with a monthly rate) will yield significantly different results. Double-checking all inputs before initiating the calculation is paramount.

Rounding Errors

Rounding errors can accumulate throughout the calculation process, particularly when dealing with decimal values for interest rates or daily payments. For example, rounding the daily interest to two decimal places might seem insignificant, but over the course of a multi-year loan, this minor rounding can lead to a noticeable difference in the final amount owed. While many calculators handle this internally, understanding this potential for inaccuracy is important. Consider comparing results from multiple calculators to mitigate this risk.

Misinterpretation of Results

Understanding the output of a 365/360 loan calculator requires careful attention. The calculator provides several key figures, such as monthly payments, total interest paid, and the total amount repaid. Misinterpreting these figures, such as mistaking the monthly payment for the total payment, is a common mistake. It’s crucial to understand what each value represents and how they relate to the overall loan structure. For instance, a small change in the interest rate can lead to a substantial difference in the total interest paid over the life of the loan. This underscores the importance of carefully reviewing all output values.

Common Mistakes to Avoid

Before using any 365/360 loan calculator, it’s vital to understand the potential for errors. Here’s a list of common mistakes to avoid:

- Entering incorrect loan amounts (principal, interest rate, loan term).

- Confusing annual and monthly interest rates.

- Failing to double-check all input values before calculation.

- Misinterpreting the results provided by the calculator.

- Ignoring the potential impact of rounding errors.

- Relying on a single calculator without comparing results from other sources.

- Not understanding the nuances of the 365/360 day-count convention.

Visual Representation of Calculations: 365/360 Loan Calculator

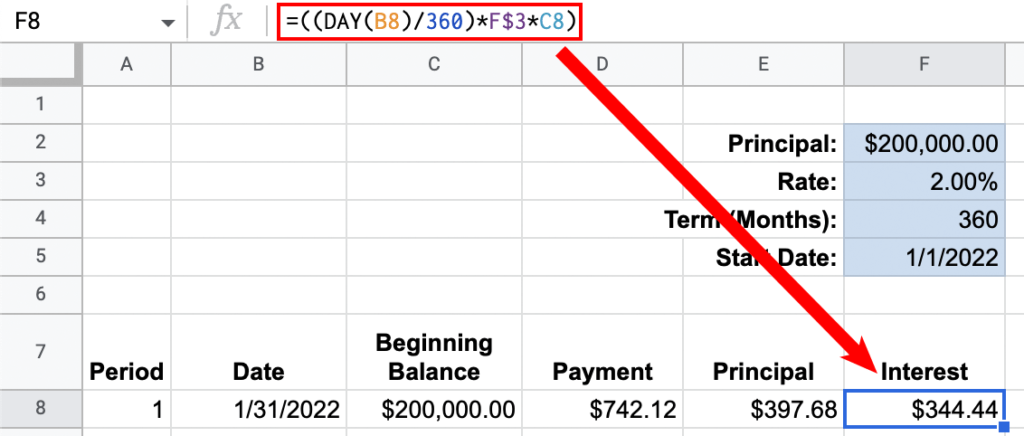

Understanding loan amortization is crucial for effective financial planning. A visual representation, specifically an amortization schedule, simplifies the complex process of loan repayment by clearly outlining each payment’s breakdown over the loan’s lifespan. This allows borrowers to easily track their progress and anticipate future payments.

A 365/360 loan calculator generates an amortization schedule that provides a detailed breakdown of each periodic payment. This visual representation makes understanding the nuances of interest calculation and principal reduction much easier, especially when comparing the 365-day and 360-day year methods.

Amortization Schedule Details

An amortization schedule typically includes several key data points for each payment period. These details are essential for comprehending the loan’s repayment structure and its overall financial impact. This detailed information allows borrowers to effectively manage their finances and make informed decisions.

| Period | Payment Date | Beginning Balance | Payment | Interest | Principal | Ending Balance |

|---|

Sample Amortization Schedule: 365-Day Year Method

Let’s imagine a $10,000 loan at 5% annual interest, repaid over 12 months using the 365-day year method. The following table illustrates a simplified representation of the amortization schedule. Note that actual figures would involve more precise calculations using a loan amortization formula.

| Period | Payment Date | Beginning Balance | Payment | Interest | Principal | Ending Balance |

|---|---|---|---|---|---|---|

| 1 | Jan 31 | $10,000.00 | $856.07 | $41.67 | $814.40 | $9185.60 |

| 2 | Feb 28 | $9185.60 | $856.07 | $38.27 | $817.80 | $8367.80 |

| 3 | Mar 31 | $8367.80 | $856.07 | $34.87 | $821.20 | $7546.60 |

| … | … | … | … | … | … | … |

| 12 | Dec 31 | $814.40 | $856.07 | $3.40 | $852.67 | $0.00 |

Sample Amortization Schedule: 360-Day Year Method

Using the same loan parameters but applying the 360-day year method, the schedule would differ slightly, primarily in the interest calculation for each period. The following is a simplified representation, again, precise figures require a dedicated calculation.

| Period | Payment Date | Beginning Balance | Payment | Interest | Principal | Ending Balance |

|---|---|---|---|---|---|---|

| 1 | Jan 31 | $10,000.00 | $856.07 | $41.67 | $814.40 | $9185.60 |

| 2 | Feb 28 | $9185.60 | $856.07 | $38.27 | $817.80 | $8367.80 |

| 3 | Mar 31 | $8367.80 | $856.07 | $34.87 | $821.20 | $7546.60 |

| … | … | … | … | … | … | … |

| 12 | Dec 31 | $814.40 | $856.07 | $3.40 | $852.67 | $0.00 |

Understanding Loan Repayment Through Visual Representation

The visual representation of an amortization schedule dramatically improves understanding of the loan repayment process. By clearly showing the allocation of each payment between principal and interest, borrowers can readily grasp how their debt is reduced over time. The comparison of schedules generated using the 365-day and 360-day methods highlights the subtle yet potentially significant differences in total interest paid, impacting the overall cost of borrowing. This visual clarity empowers borrowers to make informed decisions regarding their loan terms.