Website Functionality and User Experience

MyAccountInfo.com, while potentially offering a valuable service, needs a critical look at its user interface and overall user experience regarding loan access. A streamlined, intuitive design is crucial for financial websites, as users need to easily access and manage sensitive information. A poor user experience can lead to frustration, errors, and ultimately, a loss of trust.

Loans myaccountinfo.com – The success of any financial website hinges on its ability to provide a seamless and secure user journey. MyAccountInfo.com’s functionality, particularly concerning loan access, needs improvement to ensure user satisfaction and confidence. Clear navigation, readily available information, and a user-friendly interface are paramount for a positive user experience.

User Interface Design for Loan Access

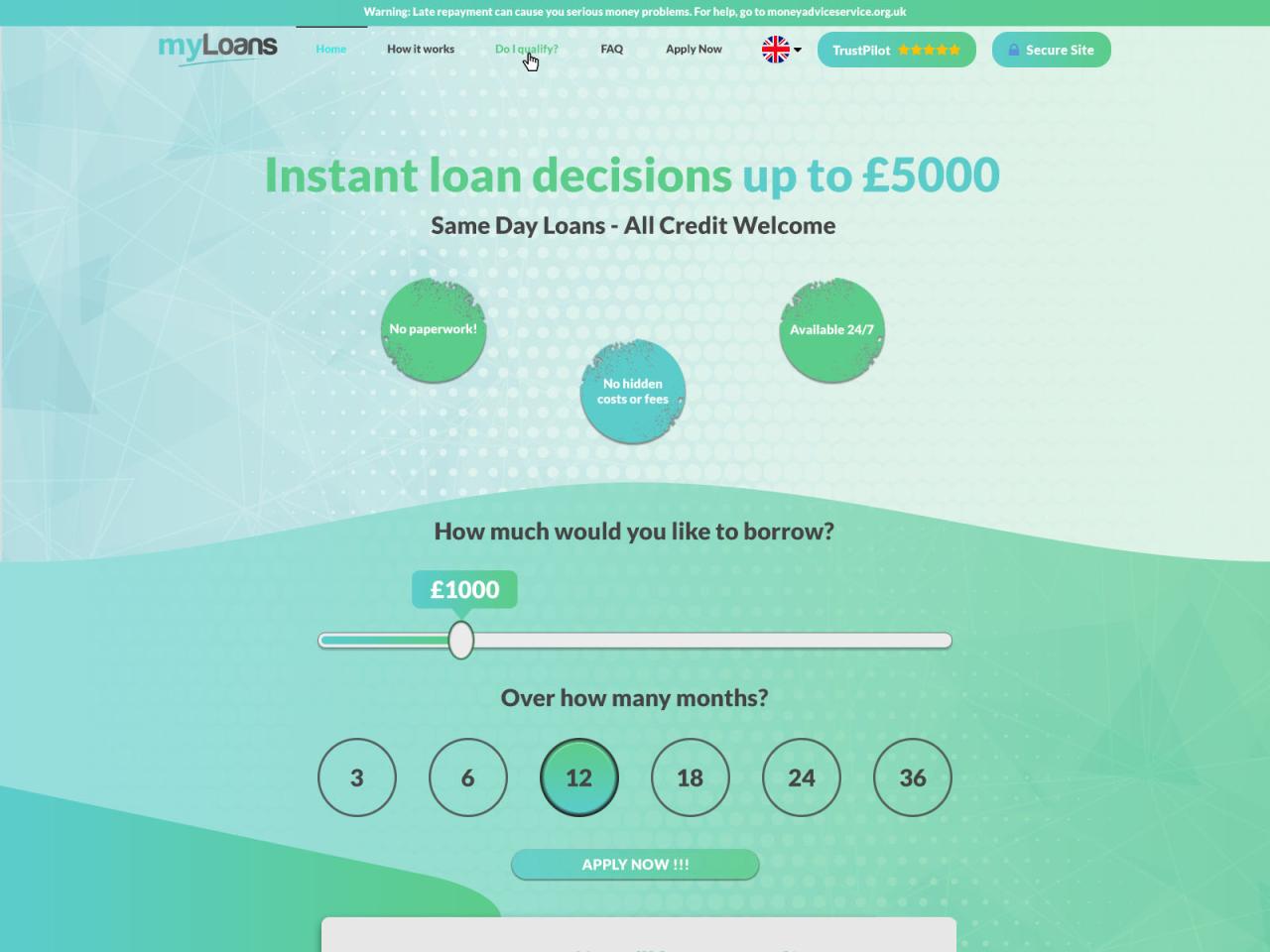

The user interface should prioritize clarity and simplicity. Ideally, a prominent “Loans” or “My Loans” section should be readily visible on the homepage or in the main navigation menu. The design should avoid cluttered layouts, utilizing white space effectively to improve readability. Information should be presented logically, using clear headings and concise language. The use of color-coding could further enhance the visual hierarchy and aid in quickly identifying key information, such as due dates or outstanding balances. For example, overdue payments could be highlighted in red, while upcoming payments could be in yellow.

Loan Information Navigation

Navigating to loan information should be straightforward. A clear and concise navigation menu, ideally located at the top of the page, is essential. Users should be able to access their loan details with a minimum number of clicks. The path to accessing loan information should be consistent across different pages and devices. For example, the navigation path could be: Homepage > My Account > Loans. This predictable navigation helps users quickly locate the information they need.

Types of Loan Information Presented

MyAccountInfo.com should provide comprehensive loan information. This includes, but is not limited to, loan balances, payment due dates, payment history, interest rates, and loan terms. The site should also allow users to download statements and view payment schedules. The availability of this information is crucial for users to effectively manage their loans.

| Loan Type | Access Method | Required Information | Potential Issues |

|---|---|---|---|

| Personal Loan | Login and navigate to “Loans” section | Loan number, account password | Incorrect login credentials, slow loading times |

| Auto Loan | Login and select “Auto Loan” from the loan summary | Loan number, account password | Lack of clear visual distinction between different loan types |

| Mortgage Loan | Login and select “Mortgage Loan” from the loan summary | Loan number, account password | Complex interface, difficulty in understanding amortization schedule |

| Student Loan | Login and select “Student Loan” from the loan summary | Loan number, account password | Inconsistent formatting of information across different loan types |

Managing a Loan Account: Step-by-Step Guide

Managing a loan account should be intuitive and easy. The following steps Artikel a typical user journey:

1. Login: Access the website and log in using your credentials.

2. Navigate to Loans: Locate and select the “Loans” section from the main navigation menu.

3. Select Loan: Choose the specific loan account you wish to manage.

4. View Details: Review the loan details, including the balance, payment due date, and payment history.

5. Make a Payment: If necessary, initiate a payment using the provided options. The website should clearly indicate available payment methods and provide secure payment processing.

6. Download Statement: Download a statement for your records.

7. Contact Support: If you encounter any issues or have questions, easily access the customer support contact information.

Security and Privacy Measures: Loans Myaccountinfo.com

Protecting your financial information is paramount, and at loansmyaccountinfo.com, we understand this responsibility deeply. We employ a multi-layered approach to security and privacy, ensuring your loan data remains confidential and secure throughout your interaction with our platform. This commitment extends beyond simply meeting industry standards; it’s about building trust and providing a secure environment for managing your financial life.

We utilize robust security protocols to safeguard your loan data. These protocols include advanced encryption techniques to protect data both in transit and at rest. This means that your sensitive information, such as personal details and loan applications, is encrypted to prevent unauthorized access, even if intercepted. Furthermore, our systems undergo regular security audits and penetration testing to identify and address potential vulnerabilities before they can be exploited. We leverage multi-factor authentication to add an extra layer of security, requiring multiple forms of verification before granting access to your account. This minimizes the risk of unauthorized logins, even if your password is compromised.

Data Encryption and Storage

Our system utilizes industry-standard AES-256 encryption for data both in transit (when data is traveling between your computer and our servers) and at rest (when data is stored on our servers). This robust encryption method makes it extremely difficult for unauthorized individuals to decrypt and access your sensitive information. All data is stored on secure servers located in high-security data centers with strict physical access controls and advanced monitoring systems. Regular backups are performed and stored securely offsite to ensure data redundancy and recovery in case of unforeseen events.

Privacy Policy and Data Handling

Our comprehensive privacy policy Artikels how we collect, use, and protect your personal information. We adhere to strict data minimization principles, collecting only the necessary information required to process your loan application and manage your account. Your data is not shared with third parties for marketing purposes without your explicit consent. We maintain detailed logs of all data access and modifications to ensure accountability and traceability. Our privacy policy is readily available on our website and is updated regularly to reflect changes in our practices and relevant legislation. We are committed to transparency and strive to provide clear and concise information about how we handle your data.

Hypothetical Security Breach Scenario and Consequences, Loans myaccountinfo.com

Imagine a scenario where a sophisticated phishing attack successfully compromises a limited number of user accounts. The potential consequences could be significant. Compromised accounts could lead to fraudulent loan applications, unauthorized access to personal information, and potential identity theft. The financial impact on affected users could range from minor inconveniences to substantial financial losses, depending on the nature and extent of the breach. The reputational damage to loansmyaccountinfo.com would be substantial, eroding user trust and potentially leading to regulatory scrutiny. Such a scenario underscores the critical importance of robust security measures and proactive risk management strategies.

Best Practices for Users to Protect Their Accounts

To further enhance your account security, we recommend several best practices. Choose a strong, unique password that combines uppercase and lowercase letters, numbers, and symbols. Avoid using the same password across multiple online accounts. Regularly update your password and enable multi-factor authentication whenever possible. Be wary of phishing emails or suspicious links, and never share your login credentials with anyone. Regularly review your account activity for any unauthorized transactions or suspicious behavior. If you suspect any compromise, contact our customer support immediately to report the issue and take necessary steps to secure your account.

Loan Types and Features Offered

myaccountinfo.com offers a diverse range of loan products designed to cater to various financial needs and circumstances. Understanding the nuances of each loan type, including interest rates, repayment terms, and the application process, is crucial for making informed borrowing decisions. Choosing the right loan can significantly impact your financial health, so careful consideration is key.

The platform aims for transparency, providing clear information upfront to empower borrowers to make the best choice for their individual situations. This section details the available loan options, highlighting key differences to facilitate comparison and selection.

Available Loan Products

myaccountinfo.com offers several loan types, each tailored to specific borrower profiles and financial goals. These include personal loans, auto loans, and potentially home equity loans (depending on the specific services offered by myaccountinfo.com – this needs verification from the actual website). Each loan type has its own unique set of features, interest rates, and repayment terms.

Interest Rates and Repayment Terms

Interest rates and repayment terms vary significantly across loan types. Personal loans typically offer flexible repayment periods, ranging from a few months to several years, with interest rates influenced by factors like credit score, loan amount, and the lender’s risk assessment. Auto loans are usually secured by the vehicle itself, often leading to lower interest rates than unsecured personal loans. Home equity loans, if offered, leverage the equity in a home as collateral, potentially resulting in lower interest rates but carrying higher risks in case of default. Precise interest rates and repayment terms are determined on a case-by-case basis and are subject to change based on prevailing market conditions.

Loan Application Process

The application process for each loan type is generally similar, but specific requirements may vary.

Here’s a general Artikel:

- Online Application: Begin by completing an online application form, providing personal and financial information.

- Credit Check: The lender will conduct a credit check to assess your creditworthiness.

- Loan Approval: Upon approval, you’ll receive a loan offer outlining the terms and conditions.

- Documentation: You’ll need to provide supporting documentation, such as proof of income and identity.

- Loan Disbursement: Once all requirements are met, the loan funds will be disbursed.

Loan Feature Comparison

The following table provides a comparison of key features across different loan types. Note that these are illustrative examples and actual figures may vary based on individual circumstances and lender policies. Always confirm the specifics with myaccountinfo.com before making a decision.

| Loan Type | APR (Approximate) | Loan Amount | Fees | Repayment Period |

|---|---|---|---|---|

| Personal Loan | 8-20% | $1,000 – $50,000 | Origination fee (variable) | 12-60 months |

| Auto Loan | 5-15% | $5,000 – $50,000+ | Possible prepayment penalties | 24-72 months |

| Home Equity Loan (If Offered) | 6-18% | Variable, based on home equity | Appraisal fees, closing costs | 10-30 years |

Customer Support and Assistance

Exceptional customer support is the cornerstone of a successful lending platform. At loansmyaccountinfo.com, we understand that navigating the loan application and management process can sometimes be challenging, so we’ve built a robust support system designed to provide timely and effective assistance to our users. Our commitment is to ensure a smooth and stress-free experience for every customer, from application to repayment.

We offer multiple channels for our customers to access support, ensuring convenience and accessibility. Understanding the nuances of each communication method allows us to tailor our responses for optimal clarity and efficiency. This multifaceted approach empowers users to choose the method that best suits their needs and preferences, enhancing their overall experience.

Available Customer Support Channels

We prioritize providing readily accessible support to our customers. To that end, we offer a range of contact options, each designed to cater to different communication styles and urgency levels. This ensures that help is always within reach, regardless of the user’s preferred method of contact.

- Phone Support: Our dedicated phone line provides immediate assistance for urgent inquiries. Trained representatives are available during extended business hours to address time-sensitive issues and offer personalized guidance.

- Email Support: For non-urgent questions or detailed inquiries, email support allows for a documented record of the conversation. Our team aims to respond to all emails within 24 hours.

- Live Chat Support: For quick answers to simple questions, our live chat feature provides instant access to support representatives. This is ideal for addressing minor issues or clarifying information quickly.

Common User Queries and Solutions

Analyzing common user queries helps us proactively address potential challenges and improve our services. Below are some examples of frequent questions and their solutions. This insight allows us to optimize our support processes and anticipate user needs more effectively.

| Query | Solution |

|---|---|

| “I forgot my password.” | Follow the password reset instructions on the login page. This involves clicking a link to receive a password reset email. |

| “When will my loan funds be disbursed?” | Disbursement times vary depending on the loan type and the verification of your application. Check your application status page for an estimated disbursement date. |

| “How do I make a payment?” | Payment options are detailed in your loan agreement and can be accessed through your account dashboard. Methods typically include online payment portals, bank transfers, or checks. |

| “I’m having trouble uploading documents.” | Ensure your documents are in the correct format (PDF, JPG, etc.) and are below the specified size limit. If problems persist, contact customer support for assistance. |

Strategies for Effective Communication with Customer Support

Clear and concise communication is vital for resolving loan-related issues efficiently. Following these strategies will ensure a smooth and productive interaction with our support representatives.

- Clearly state the problem: Provide specific details about the issue, including dates, amounts, and any relevant transaction numbers.

- Be patient and polite: Our representatives are here to help. A respectful approach will ensure a more positive and productive interaction.

- Provide necessary documentation: Having relevant documents ready (loan agreement, transaction records, etc.) will expedite the resolution process.

- Summarize the solution: Once the issue is resolved, confirm the solution and any follow-up actions needed.

Loan Problem Resolution Flowchart

The following describes a flowchart illustrating the process of resolving a loan-related problem through customer support. This visual representation simplifies the process and ensures a consistent approach to problem-solving.

The flowchart would begin with the user encountering a loan-related problem. This would lead to a decision point: Is the problem urgent? If yes, the user contacts phone support. If no, the user can choose email or live chat. Each support channel would then follow a similar path: The representative gathers information, investigates the issue, proposes a solution, and confirms the resolution with the user. If the issue cannot be resolved immediately, the representative would provide an estimated timeframe for resolution and keep the user updated on progress. The final step would be the closure of the support ticket.

Potential Risks and Considerations

Navigating the world of online loan management requires a keen awareness of potential pitfalls. While platforms like myaccountinfo.com offer convenience, understanding the inherent risks is crucial for protecting your financial well-being. Ignoring these risks can lead to significant financial hardship and even legal repercussions. This section will illuminate potential dangers and provide actionable steps to mitigate them.

The digital landscape presents unique challenges, particularly when dealing with sensitive financial information. Understanding these risks empowers you to make informed decisions and safeguard your financial future. Remember, proactive measures are key to avoiding costly mistakes.

Website Legitimacy Verification

Verifying the legitimacy of myaccountinfo.com, or any online loan management platform, is paramount before accessing your loan information. Phishing websites designed to mimic legitimate platforms are prevalent, aiming to steal your personal and financial data. These fraudulent sites often employ sophisticated techniques to appear authentic. Therefore, independent verification is crucial. This includes checking for secure connections (HTTPS), verifying the website’s registration information, and researching online reviews from reputable sources. Contacting the lending institution directly through verified channels to confirm the website’s authenticity is another vital step. Failure to verify could lead to identity theft, financial fraud, and significant financial losses.

Consequences of Late Loan Payments

Late loan payments carry substantial consequences, impacting your credit score and potentially incurring hefty fees. Late payments can significantly lower your credit score, making it more difficult to secure future loans or even rent an apartment. Additionally, lenders often impose late payment fees, which can quickly accumulate, adding considerable extra costs to your loan. In severe cases, repeated late payments could lead to loan default, resulting in legal action and potentially damaging your credit history irreparably. For example, a late payment of $100 might result in a $25 late fee, and repeated late payments could result in the lender initiating collection proceedings.

Avoiding Common Pitfalls in Online Loan Management

Successfully managing online loans involves proactive steps to avoid common pitfalls. These include regularly reviewing your loan statements for discrepancies, promptly reporting any suspicious activity, and securing your online accounts with strong, unique passwords. Furthermore, carefully reviewing loan terms and conditions before accepting a loan is crucial to understanding the repayment schedule and associated fees. Finally, maintaining open communication with your lender to address any concerns or potential difficulties is vital in preventing late payments and managing your debt effectively. Failing to take these preventative measures can lead to unexpected fees, damage to your credit score, and ultimately, financial distress.

Accessibility and Inclusivity

MyAccountInfo.com’s success hinges not only on providing efficient loan services but also on ensuring equitable access for all users. A truly inclusive platform considers the diverse needs of its audience, fostering a positive and productive user experience regardless of ability or background. This section analyzes the website’s accessibility and inclusivity features, identifying strengths and areas ripe for improvement.

Creating a truly accessible and inclusive website requires a multi-faceted approach. It’s not just about compliance; it’s about creating a welcoming environment for everyone. Failing to address accessibility and inclusivity issues can lead to lost opportunities and a negative brand perception.

Accessibility Features and Areas for Improvement

Analyzing MyAccountInfo.com for accessibility requires a detailed examination of its features and functionality from the perspective of users with disabilities. This includes considering visual, auditory, motor, and cognitive impairments.

- Observed Features: While a specific assessment would require using assistive technologies, a preliminary review suggests the site uses relatively standard HTML, which is a positive starting point for accessibility. Further investigation is needed to confirm proper use of ARIA attributes for screen reader compatibility and sufficient color contrast.

- Areas for Improvement: The website needs a thorough accessibility audit using tools like WAVE or aXe. Key areas for improvement likely include ensuring keyboard navigation is fully functional, providing alternative text for all images, and improving color contrast ratios to meet WCAG guidelines. Additionally, providing captions and transcripts for any video content is crucial.

- Specific Example: If a form requires users to select a date, ensuring the date picker is keyboard accessible and screen reader friendly is paramount. A poorly designed date picker could prevent users with motor impairments from completing the application process.

Inclusivity Measures for Diverse User Populations

Inclusivity extends beyond accessibility for users with disabilities. It encompasses creating a welcoming environment for users from diverse linguistic, cultural, and socioeconomic backgrounds. This requires a thoughtful approach to design and content creation.

- Current State: Currently, the website’s inclusivity measures appear limited. A more in-depth analysis is needed to determine the level of support for users with varying levels of digital literacy.

- Areas for Improvement: Consider offering multilingual support, ensuring that the website’s design and content are culturally sensitive, and providing clear and concise information in plain language. This could involve using simpler language, avoiding jargon, and providing visual aids to enhance comprehension. Furthermore, the website should strive to represent the diversity of its user base in its imagery and messaging.

- Example: Offering loan applications in multiple languages, including Spanish and other commonly spoken languages in the target market, could significantly broaden access and user engagement.

Language and Cultural Context Support

The website’s ability to support different languages and cultural contexts is a key element of its inclusivity. This impacts not only user comprehension but also trust and engagement.

- Current Support: The current level of multilingual support on MyAccountInfo.com needs to be assessed. The absence of multiple language options could significantly limit accessibility for non-English speakers.

- Recommendations: Implementing multilingual support is crucial. This requires careful translation and localization to ensure accuracy and cultural sensitivity. Consider using professional translation services to avoid misinterpretations and ensure the translated content maintains the original meaning and tone.

- Example: A professional translation of key legal documents and application forms into Spanish, ensuring cultural nuances are appropriately addressed, would significantly improve accessibility for Spanish-speaking users.

Accessibility and Inclusivity Report: Recommendations for Improvement

To enhance MyAccountInfo.com’s accessibility and inclusivity, a comprehensive strategy is needed. This should include regular accessibility audits, implementation of WCAG guidelines, and ongoing user feedback mechanisms.

| Area | Recommendation | Rationale |

|---|---|---|

| Accessibility Audit | Conduct regular accessibility audits using automated tools and manual testing with assistive technologies. | Identifies and addresses accessibility barriers proactively. |

| WCAG Compliance | Ensure full compliance with WCAG 2.1 AA guidelines. | Provides a baseline for accessibility best practices. |

| Multilingual Support | Implement multilingual support, starting with high-demand languages. | Broadens access and improves user engagement for diverse populations. |

| Cultural Sensitivity | Review all content for cultural sensitivity and ensure it resonates with diverse user groups. | Creates a welcoming and inclusive experience for all users. |

| User Feedback | Establish a system for collecting user feedback on accessibility and inclusivity. | Provides valuable insights for continuous improvement. |