Lendly Loan Certificate

A Lendly Loan Certificate, in its simplest form, is a formal document that serves as proof of a loan agreement between a lender (Lendly, in this case) and a borrower. It Artikels the key terms and conditions of the loan, providing a legally binding record of the transaction. Think of it as a detailed receipt for a loan, but with far more significant legal weight.

Definition and Purpose of a Lendly Loan Certificate

The Lendly Loan Certificate’s primary purpose is to provide a clear and unambiguous record of the loan agreement. This minimizes the risk of disputes or misunderstandings between the lender and borrower regarding the loan’s terms. Legally, it serves as evidence of the debt and the borrower’s obligation to repay according to the specified terms. The certificate’s existence protects both parties involved. For Lendly, it provides documented proof of the loan and the borrower’s responsibility. For the borrower, it offers a clear understanding of their financial obligations. A well-drafted certificate can prevent costly legal battles down the line.

Legal Implications of a Lendly Loan Certificate

A Lendly Loan Certificate carries significant legal weight. It’s a legally binding contract, meaning that both parties are obligated to fulfill the terms Artikeld within the document. Failure to comply with the terms can result in legal action, potentially leading to court proceedings, judgments, and collection efforts. The specific legal implications depend on the jurisdiction and the specifics of the loan agreement, but the certificate itself serves as primary evidence in any legal dispute concerning the loan. The certificate’s validity hinges on proper execution, including signatures from both parties and adherence to relevant legal standards.

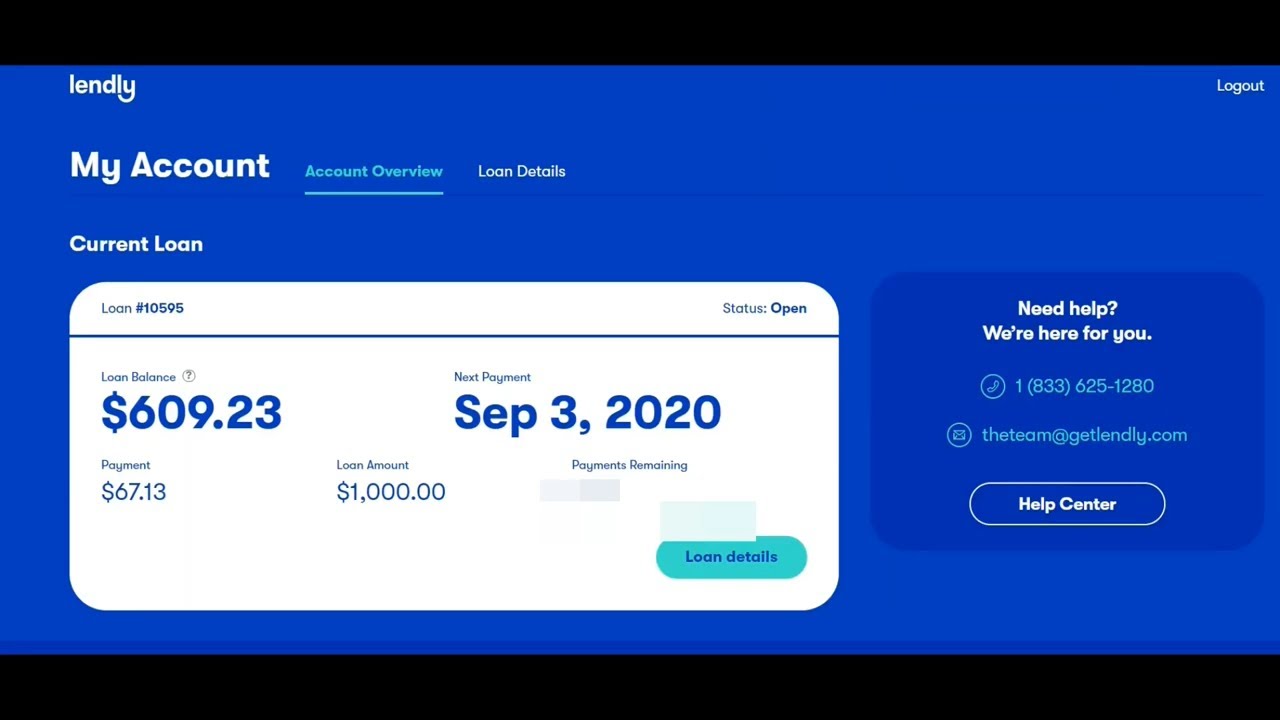

Information Included in a Lendly Loan Certificate

A typical Lendly Loan Certificate will include several crucial pieces of information. This typically includes the names and addresses of both the lender (Lendly) and the borrower, the loan amount, the interest rate (if applicable), the repayment schedule (including due dates and payment amounts), the loan term (the duration of the loan), any collateral involved (if applicable), and details about any fees or charges associated with the loan. It might also include clauses regarding default, late payment penalties, and dispute resolution mechanisms. The more detailed and comprehensive the certificate, the better it protects both parties.

Examples of Lendly Loan Certificates

While Lendly likely offers a standardized certificate format, variations may exist depending on the type of loan. For instance, a certificate for a short-term personal loan might differ from one for a business loan or a secured loan. The key variations would lie in the specifics of the repayment schedule, interest rates, and collateral details. A short-term loan might have a simpler repayment structure, while a business loan could involve more complex terms and conditions, potentially including milestones or performance-based clauses. The inclusion of collateral (e.g., a car or property) would significantly alter the certificate’s content.

Comparison of Lendly Loan Certificates to Other Loan Documentation

| Feature | Lendly Loan Certificate | Promissory Note | Loan Agreement |

|---|---|---|---|

| Legal Standing | Legally binding contract | Legally binding contract | Legally binding contract |

| Level of Detail | Moderate to high, depending on loan type | Generally concise, focusing on core terms | Comprehensive, covering all aspects of the loan |

| Use Cases | Proof of loan, evidence in disputes | Proof of debt, core terms of loan | Complete record of the loan agreement |

Issuance and Verification of Lendly Loan Certificates

Securing your Lendly Loan Certificate is paramount. Understanding the issuance process and verification methods is crucial to protecting yourself from potential fraud and ensuring the legitimacy of your loan agreement. This section details the steps involved, emphasizing best practices for security and highlighting the risks associated with fraudulent certificates.

Lendly Loan Certificate Issuance Process

The issuance of a Lendly Loan Certificate follows a rigorous, multi-step process designed to maintain integrity and prevent counterfeiting. First, upon successful loan application approval, Lendly generates a unique certificate number. This number is then encrypted and securely linked to the borrower’s profile within the Lendly system. The certificate itself is then digitally signed using robust cryptographic methods, ensuring its authenticity and tamper-proof nature. Finally, the certificate is delivered to the borrower via a secure, encrypted email, often requiring multi-factor authentication for access. This ensures only the intended recipient can view and access the certificate.

Methods for Verifying Lendly Loan Certificate Authenticity

Verifying the authenticity of a Lendly Loan Certificate involves several key steps. The primary method involves using the unique certificate number to cross-reference it with Lendly’s internal database. This database contains a complete record of all issued certificates, including their associated loan details and borrower information. Discrepancies between the information on the certificate and the database record immediately flag a potential forgery. Furthermore, Lendly employs advanced digital signature verification techniques to ensure the certificate hasn’t been tampered with. Any alteration to the certificate will invalidate the digital signature, immediately revealing its fraudulent nature. Borrowers should always compare the certificate details against their loan agreement to ensure consistency.

Best Practices for Secure Storage and Handling of Lendly Loan Certificates

Protecting your Lendly Loan Certificate is crucial. Never share your certificate number or a copy of the certificate with unauthorized individuals. Store the digital certificate securely on a password-protected device, preferably encrypted. Regularly review your loan agreement and compare it to the details on your certificate to ensure consistency. Report any suspicious activity or discrepancies to Lendly immediately. Consider printing a copy for your records, but store it securely in a locked filing cabinet or safety deposit box. Remember, maintaining the security of your certificate is your responsibility.

Lendly Loan Certificate Issuance and Verification Process Flowchart

Imagine a flowchart. The first box would be “Loan Application Approved.” This leads to a second box, “Unique Certificate Number Generated and Encrypted.” This connects to a third box, “Certificate Digitally Signed.” Next, a box labeled “Secure Email Delivery (Multi-Factor Authentication)” follows. The verification process begins with a box “Enter Certificate Number.” This leads to a “Cross-Reference with Lendly Database” box. If the data matches, the process flows to a “Certificate Authenticated” box. If not, it goes to a “Certificate Fraudulent” box. This simple flowchart visualizes the entire process.

Potential Risks Associated with Fraudulent Lendly Loan Certificates

Fraudulent Lendly Loan Certificates pose significant risks. They can be used for identity theft, loan fraud, and other financial crimes. A fraudulent certificate might contain altered loan terms, leading to unexpected financial burdens. Furthermore, using a fraudulent certificate could result in legal repercussions for the borrower. It’s essential to be vigilant and follow the verification procedures Artikeld above to mitigate these risks. Examples of such fraud could include attempts to obtain additional loans using a forged certificate or to manipulate existing loan terms. The consequences can range from financial losses to criminal prosecution.

Lendly Loan Certificate and Borrower Rights

Understanding your rights as a borrower is crucial for a smooth and successful loan experience. A Lendly Loan Certificate serves as a legally binding agreement, outlining the terms and conditions of your loan and safeguarding your interests throughout the borrowing process. This section details the key rights and responsibilities associated with the certificate, potential disputes, and steps to take if issues arise.

Borrower Rights and Responsibilities

The Lendly Loan Certificate clearly defines the borrower’s rights, including the right to receive the agreed-upon loan amount, the right to a clear and concise explanation of the loan terms, and the right to repayment flexibility as Artikeld in the contract. Conversely, borrowers have responsibilities, such as making timely payments according to the schedule, providing accurate information during the application process, and adhering to all the stipulations within the certificate. Failure to fulfill these responsibilities can lead to penalties or even legal action. The certificate itself acts as a legally sound record of this agreement, protecting both the lender and the borrower.

Protection of Borrower Interests

The Lendly Loan Certificate protects borrower interests in several ways. Firstly, it provides a documented record of the loan terms, preventing misunderstandings or disputes regarding the interest rate, repayment schedule, or other key aspects. Secondly, it establishes clear boundaries, preventing the lender from imposing additional fees or changing terms unilaterally without the borrower’s consent. Finally, the certificate serves as evidence in case of disputes or legal proceedings. For instance, if a lender attempts to claim a higher amount than agreed upon, the certificate provides irrefutable proof of the original terms. Consider it your shield against unfair practices.

Challenging or Disputing a Lendly Loan Certificate

A Lendly Loan Certificate, like any legal document, can be challenged or disputed under specific circumstances. This could involve situations where there’s evidence of fraud, misrepresentation, or coercion during the loan application process. For example, if a borrower can prove that the lender intentionally concealed crucial information or applied unfair pressure during the signing, the certificate’s validity could be challenged in court. Similarly, discrepancies between the certificate’s terms and the initial loan agreement could form grounds for a dispute. These disputes are usually handled through mediation or legal proceedings, requiring concrete evidence to support the claims.

Examples of Common Disputes

Common disputes related to Lendly Loan Certificates often involve disagreements over interest rates, hidden fees, inaccurate repayment schedules, or allegations of predatory lending practices. For example, a dispute might arise if the lender charges a significantly higher interest rate than initially agreed upon, or if hidden fees are added without proper disclosure. Another common issue involves disagreements over the calculation of the total repayment amount. Clear documentation, including the original loan application, the certificate itself, and any communication between the borrower and the lender, is crucial in resolving these disputes.

Steps to Take if a Problem is Suspected

If a borrower suspects a problem with their Lendly Loan Certificate, several steps should be taken immediately. First, carefully review the certificate and compare it to the initial loan agreement and any related documents. Then, attempt to resolve the issue directly with the lender through formal communication, keeping records of all correspondence. If direct communication fails, seek advice from a legal professional or a consumer protection agency. Gathering and preserving all relevant documentation is vital throughout this process. Finally, if necessary, consider initiating legal action to protect your rights. Proactive action is key to a positive outcome.

Lendly Loan Certificate and Lender Responsibilities

Lenders play a crucial role in the Lendly loan ecosystem, and their responsibilities extend beyond simply issuing certificates. Understanding these responsibilities is vital for maintaining the integrity of the system and protecting both lenders and borrowers. Failure to meet these obligations can have significant legal and financial consequences.

Lender responsibilities encompass a wide range of activities, from the initial issuance of the certificate to its ongoing management and eventual retirement. This includes adhering to strict legal and regulatory frameworks, ensuring transparency, and maintaining accurate records. The complexities involved highlight the importance of robust internal controls and compliance programs.

Lender Responsibilities in Issuing Lendly Loan Certificates

Issuing a Lendly Loan Certificate requires meticulous attention to detail and strict adherence to established procedures. Lenders must verify the borrower’s identity and eligibility, ensuring all necessary documentation is accurate and complete before issuing the certificate. This includes confirming the loan terms, interest rates, and repayment schedule are clearly stated and understood by both parties. Any discrepancies or inconsistencies can lead to disputes and legal challenges. A robust verification system, incorporating both manual and automated checks, is essential to mitigate risk. For instance, a lender might use a third-party verification service to confirm the borrower’s income and credit history, adding an extra layer of security and reducing the chance of fraudulent activities.

Legal Obligations of Lenders Related to Lendly Loan Certificates

Lenders are legally obligated to comply with all relevant laws and regulations governing lending practices and financial instruments. These regulations vary across jurisdictions and may include requirements for licensing, disclosure, and reporting. Failure to comply can result in significant penalties, including fines, legal action, and reputational damage. For example, lenders must ensure they are complying with anti-money laundering (AML) regulations, which may require them to perform due diligence on borrowers and report suspicious activity to the relevant authorities. They must also ensure that the terms of the loan are fair and transparent, and that they do not engage in predatory lending practices.

Comparison of Lender Responsibilities Across Jurisdictions

The specific responsibilities of lenders regarding Lendly Loan Certificates can vary significantly depending on the jurisdiction. For instance, some countries may have stricter regulations on interest rates or require lenders to provide specific disclosures to borrowers. Others may have different requirements for record-keeping and reporting. Lenders operating in multiple jurisdictions must understand and comply with the specific regulations in each location. A failure to do so could lead to significant legal and financial ramifications. For example, a lender operating in both the US and the EU would need to comply with different data privacy regulations (such as GDPR in the EU and CCPA in California) and potentially different lending regulations.

Consequences of Non-Compliance with Regulations

Non-compliance with regulations related to Lendly Loan Certificates can have severe consequences for lenders. These consequences can range from financial penalties and legal action to reputational damage and loss of business. Regulatory bodies may impose significant fines, and borrowers may initiate legal proceedings for damages if they suffer losses due to the lender’s non-compliance. In severe cases, lenders may face criminal charges. The reputational damage resulting from non-compliance can be significant, making it difficult to attract new business and maintain existing relationships. For instance, a lender found guilty of predatory lending practices could face substantial fines and a tarnished reputation, making it difficult to secure funding or attract new clients.

Ensuring Compliance with Laws and Regulations

To ensure compliance with all relevant laws and regulations, lenders should implement a robust compliance program. This program should include regular reviews of applicable laws and regulations, internal controls to prevent and detect non-compliance, and a system for reporting and addressing any identified issues. Lenders should also provide regular training to their employees on compliance matters. Furthermore, engaging external legal and compliance experts can provide valuable insights and guidance in navigating the complexities of regulatory compliance. A proactive approach to compliance is essential to minimize risks and protect the lender’s interests.

Impact of Lendly Loan Certificates on the Lending Process

Lendly Loan Certificates fundamentally reshape the lending landscape, offering a streamlined, secure, and transparent alternative to traditional methods. Their impact is multifaceted, affecting efficiency, risk mitigation, and accountability across the entire lending process, ultimately benefiting both lenders and borrowers. This section will explore the key ways Lendly Loan Certificates achieve these improvements.

Streamlining the Lending Process Through Lendly Loan Certificates

Lendly Loan Certificates significantly reduce the administrative burden associated with loan origination and management. The digital nature of the certificate allows for automated verification and tracking, eliminating the need for extensive paperwork and manual processes. This automation accelerates loan processing times, allowing lenders to approve and disburse funds more quickly and efficiently. Imagine the time saved by eliminating the need for manual checks of collateral or the tedious process of verifying borrower information – a streamlined system allows for faster loan disbursement, freeing up resources and improving lender productivity. This speed translates directly into a better borrower experience and improved lender profitability.

Reduction of Fraud and Risk Using Lendly Loan Certificates

The inherent security features of Lendly Loan Certificates play a crucial role in mitigating fraud and reducing overall risk. The use of blockchain technology, for instance, provides an immutable record of the loan, making it extremely difficult to tamper with or forge. This significantly reduces the risk of loan fraud and identity theft, protecting both lenders and borrowers. Furthermore, the transparent nature of the certificate allows for easy verification of loan details, minimizing the potential for errors and discrepancies. This enhanced security fosters trust and confidence in the lending process, leading to more secure transactions. Consider the potential savings from reduced fraud losses – a substantial benefit for lenders and a safer environment for borrowers.

Improved Transparency and Accountability with Lendly Loan Certificates

Lendly Loan Certificates promote transparency and accountability by providing all stakeholders with a clear and readily accessible record of the loan. The certificate’s digital nature allows for easy sharing and verification of information, ensuring all parties are informed and up-to-date. This transparency fosters trust and accountability, reducing the likelihood of disputes and disagreements. For example, both lenders and borrowers can easily access information regarding loan terms, repayment schedules, and outstanding balances. This enhanced transparency streamlines communication and minimizes potential conflicts.

Benefits of Lendly Loan Certificates for Lenders and Borrowers

The advantages of Lendly Loan Certificates extend to both lenders and borrowers. Lenders benefit from reduced operational costs, faster loan processing times, and lower risk of fraud. Borrowers benefit from quicker access to funds, improved transparency, and a more secure borrowing experience. The increased efficiency and reduced risk lead to potentially lower interest rates for borrowers and higher profitability for lenders. This creates a win-win situation, fostering a more sustainable and efficient lending ecosystem.

Advantages and Disadvantages of Lendly Loan Certificates in Different Lending Scenarios

The suitability of Lendly Loan Certificates varies depending on the specific lending scenario. Before implementing this technology, it’s crucial to weigh the advantages and disadvantages carefully.

- Advantage: Reduced processing time and costs. This is particularly beneficial for high-volume lenders processing numerous loans daily. The automation capabilities significantly improve efficiency.

- Advantage: Enhanced security and fraud prevention. This is especially important in scenarios with higher fraud risk, such as peer-to-peer lending or unsecured loans.

- Advantage: Increased transparency and accountability. This benefit is significant in situations where multiple parties are involved in the lending process, such as syndicated loans or loans involving multiple intermediaries.

- Disadvantage: Initial implementation costs. Setting up the necessary infrastructure and training personnel can be expensive, potentially hindering smaller lenders.

- Disadvantage: Technological dependence. The system relies on technology, and any technical glitches or outages can disrupt the lending process. Robust backup systems are necessary.

- Disadvantage: Regulatory uncertainty. The regulatory landscape surrounding blockchain and digital certificates is still evolving, creating potential compliance challenges for lenders.