Understanding Greenstone Loans: Greenstone Loan Calculator

Greenstone loans are a specialized financing option designed to support environmentally friendly projects. Unlike conventional loans, Greenstone loans often come with more favorable terms and conditions, reflecting the positive environmental impact of the funded projects. Understanding their core features and eligibility criteria is crucial for anyone considering this type of financing.

Core Features of Greenstone Loans

Greenstone loans typically offer lower interest rates compared to traditional loans. This is because lenders often view these projects as lower risk due to the potential for long-term environmental benefits and government incentives. Furthermore, repayment terms are often more flexible, allowing borrowers more time to recoup their investment. Many Greenstone loan programs also offer grants or subsidies, further reducing the overall cost of the project. The specific features will vary depending on the lender and the specific project.

Eligibility Criteria for Greenstone Loan Applicants

Eligibility for a Greenstone loan depends heavily on the project’s environmental impact. Applicants must demonstrate that their project contributes significantly to environmental sustainability. This usually involves a rigorous application process, including a detailed project proposal outlining the environmental benefits and a comprehensive financial plan. Creditworthiness is also a factor, as lenders still need to assess the borrower’s ability to repay the loan. Specific requirements vary based on the lending institution and the program.

Examples of Projects Typically Financed by Greenstone Loans

Greenstone loans are commonly used to finance a wide range of environmentally beneficial projects. For example, they can fund the installation of solar panels on residential or commercial buildings, the construction of energy-efficient homes, the development of sustainable transportation infrastructure (such as electric vehicle charging stations), and the implementation of water conservation technologies. Agricultural projects focusing on sustainable farming practices, such as organic farming or precision agriculture, are also frequently supported. Reforestation initiatives and the development of renewable energy sources like wind turbines are additional examples.

Comparison of Greenstone Loans with Conventional Financing Options

While conventional loans offer broader accessibility, Greenstone loans often provide significant advantages for environmentally focused projects. The lower interest rates and flexible repayment terms can result in substantial cost savings compared to traditional loans. However, the eligibility criteria are stricter, and the application process may be more demanding. The availability of grants or subsidies further enhances the attractiveness of Greenstone loans, making them a potentially more cost-effective option for eligible projects. The choice between Greenstone and conventional financing hinges on the specific project’s environmental impact and the borrower’s financial situation. A thorough cost-benefit analysis is essential to make an informed decision.

Greenstone Loan Calculator Functionality

Understanding how a Greenstone loan calculator works is crucial for making informed borrowing decisions. This section will break down the calculator’s functionality, from its user interface to the underlying mathematical formulas. We’ll also provide a step-by-step guide to ensure you can confidently navigate the process.

A well-designed Greenstone loan calculator empowers borrowers to quickly assess loan affordability and compare different borrowing scenarios. By inputting key loan parameters, users can instantly generate personalized payment estimates, helping them budget effectively and avoid unexpected financial burdens.

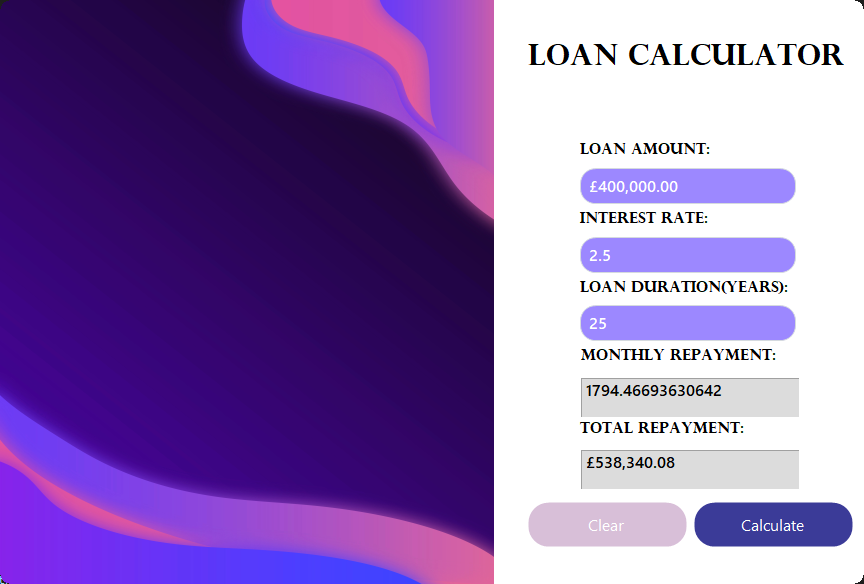

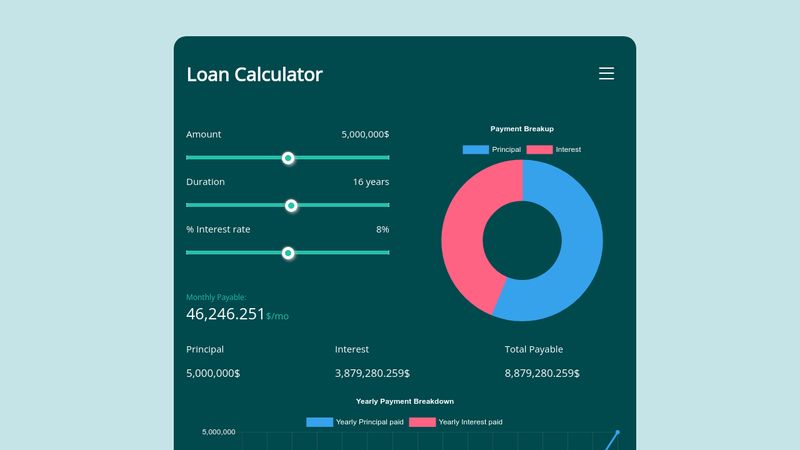

User Interface Design

The Greenstone loan calculator’s user interface should be intuitive and user-friendly, prioritizing clarity and ease of navigation. Imagine a clean, uncluttered layout with clearly labeled input fields for each key parameter. These fields should accept numerical input and ideally include validation to prevent errors (e.g., ensuring the loan amount is positive). Output displays should clearly show the calculated monthly payment, total interest paid, and potentially an amortization schedule showing the principal and interest breakdown for each payment period. A “Calculate” button initiates the computation, and a “Reset” button clears the input fields for a new calculation.

Mathematical Formulas for Monthly Payment Calculation

The core of any loan calculator lies in its mathematical engine. The Greenstone loan calculator uses standard loan amortization formulas to determine monthly payments. These formulas account for the loan amount, interest rate, and loan term. The most common formula is:

M = P [ i(1 + i)^n ] / [ (1 + i)^n – 1]

Where:

- M = Monthly Payment

- P = Principal Loan Amount

- i = Monthly Interest Rate (Annual Interest Rate / 12)

- n = Total Number of Payments (Loan Term in Years * 12)

This formula calculates the fixed monthly payment required to amortize the loan over the specified term at the given interest rate. The calculator will then use this monthly payment to generate the total interest paid and the amortization schedule.

Step-by-Step Guide to Using the Greenstone Loan Calculator

Using the Greenstone loan calculator is straightforward. Follow these steps for accurate results:

- Enter the Loan Amount: Input the total amount you wish to borrow.

- Enter the Annual Interest Rate: Input the interest rate as a percentage (e.g., 5 for 5%).

- Enter the Loan Term: Input the loan term in years.

- Click “Calculate”: The calculator will process the input and display the calculated monthly payment, total interest paid, and potentially an amortization schedule.

- Review the Results: Carefully review the results to assess the loan’s affordability and suitability to your financial situation.

Key Parameters Influencing Greenstone Loan Calculations

Several key parameters significantly impact the calculated monthly payment and total cost of a Greenstone loan. Understanding these parameters allows for effective loan comparison and financial planning.

| Parameter | Description | Impact on Monthly Payment | Impact on Total Interest |

|---|---|---|---|

| Loan Amount | The principal amount borrowed. | Directly proportional: Higher loan amount leads to higher monthly payments. | Directly proportional: Higher loan amount leads to higher total interest. |

| Interest Rate | The annual interest rate charged on the loan. | Directly proportional: Higher interest rate leads to higher monthly payments. | Directly proportional: Higher interest rate leads to higher total interest. |

| Loan Term | The length of the loan in years. | Inversely proportional: Longer loan term leads to lower monthly payments. | Directly proportional: Longer loan term leads to higher total interest. |

Factors Affecting Greenstone Loan Calculations

Understanding the true cost of a Greenstone loan requires a deep dive into the variables that significantly influence your monthly payments and overall repayment. Ignoring these factors can lead to unexpected financial burdens. This section will illuminate the key elements that shape your Greenstone loan experience.

Interest Rates and Loan Repayment

The interest rate is arguably the most impactful variable in determining your total loan cost. A higher interest rate translates directly into higher monthly payments and a significantly larger amount paid in interest over the life of the loan. Conversely, a lower interest rate results in lower monthly payments and substantially less interest paid. For example, a 5% interest rate on a $100,000 loan over 15 years will result in a much lower total repayment than a 7% interest rate on the same loan. The difference can amount to thousands of dollars. This highlights the importance of securing the best possible interest rate when applying for a Greenstone loan.

Loan Term Length and Monthly Payments

The length of your loan term—the time you have to repay the loan—directly impacts both your monthly payments and the total interest paid. A shorter loan term, such as 10 years, will result in higher monthly payments but significantly lower total interest compared to a longer term like 15 or 20 years. A longer term means lower monthly payments, but you’ll end up paying substantially more in interest over the loan’s lifetime. Let’s illustrate: a $100,000 loan at 6% interest will have dramatically different monthly payments and total interest costs whether you choose a 10-year, 15-year, or 20-year repayment plan. Choosing the right term involves balancing affordability with long-term cost efficiency.

Loan Amount and Total Interest Paid

The principal loan amount—the initial amount borrowed—is the foundation of your loan calculation. A larger loan amount necessitates higher monthly payments and results in a considerably higher total interest paid over the life of the loan. Conversely, a smaller loan amount reduces both monthly payments and total interest. Consider this: a $150,000 loan will have substantially higher monthly payments and total interest than a $100,000 loan, even with the same interest rate and loan term. Therefore, carefully budgeting and borrowing only what you need is crucial to minimizing long-term costs.

Illustrative Examples and Scenarios

Let’s dive into some real-world examples to illustrate how a Greenstone loan can work for you. Understanding these scenarios will help you determine if a Greenstone loan is the right financial tool for your project. We’ll explore different loan amounts, interest rates, and project types to give you a comprehensive overview.

The following examples use hypothetical data for illustrative purposes. Actual loan terms and interest rates will vary depending on your creditworthiness, the lender, and the specific details of your project.

Greenstone Loan Scenarios

Here are three diverse scenarios demonstrating Greenstone loan calculations for various project scales and interest rates. These examples highlight the flexibility and potential cost-effectiveness of Greenstone loans for different sustainability initiatives.

- Scenario 1: Small-Scale Home Energy Efficiency Upgrades: Let’s say you need a $5,000 Greenstone loan to install energy-efficient windows and LED lighting in your home. With a 5% interest rate over 5 years, your monthly payment might be approximately $90. This relatively low monthly payment makes the upgrades financially manageable. The long-term energy savings from reduced electricity bills could significantly offset the loan payments.

- Scenario 2: Mid-Sized Solar Panel Installation: Imagine you’re installing a solar panel system costing $20,000. A Greenstone loan with a 7% interest rate spread over 10 years could result in a monthly payment of around $220. While the monthly payment is higher, the long-term energy cost savings from reduced or eliminated electricity bills can significantly outweigh the loan’s cost, leading to substantial financial benefits.

- Scenario 3: Large-Scale Commercial Building Retrofit: Consider a commercial building owner investing $100,000 in energy-efficient upgrades through a Greenstone loan. With a 4% interest rate and a 15-year loan term, the monthly payment could be approximately $739. This larger investment, while demanding a higher monthly payment, could lead to significant long-term cost savings through lower energy bills and increased property value, justifying the higher initial investment.

Loan Amount vs. Monthly Payment

The relationship between the loan amount and monthly payments is directly proportional. Generally, a larger loan amount will result in higher monthly payments, all else being equal. Conversely, a smaller loan amount will translate into lower monthly payments. Interest rate and loan term also play a crucial role. A higher interest rate or longer loan term will increase the monthly payment even for the same loan amount.

Imagine a simple graph (x-axis representing loan amount, y-axis representing monthly payment). The line would show a positive linear relationship – as the loan amount increases, so does the monthly payment. However, the slope of this line will vary based on the interest rate and loan term. A steeper slope would indicate a higher interest rate or a longer repayment period.

Energy-Efficient Home Improvements: Cost Savings Example, Greenstone loan calculator

Let’s consider a homeowner using a Greenstone loan to finance $15,000 in energy-efficient home improvements, including insulation upgrades and high-efficiency HVAC systems. The improvements reduce their annual energy bill by $1,500. Over the 10-year loan term, the cumulative energy savings would be $15,000, potentially offsetting the entire loan cost. This illustrates how Greenstone loans can lead to a net-positive financial outcome through energy savings.

Greenstone Loan vs. Traditional Loan: A Case Study

Let’s compare a Greenstone loan to a traditional loan for a $25,000 project to install a geothermal heating and cooling system. Assume a Greenstone loan offers a 6% interest rate over 10 years, while a traditional loan has an 8% interest rate over the same period. The Greenstone loan would likely have a lower monthly payment due to the lower interest rate. Over the life of the loan, the total interest paid on the Greenstone loan would be significantly less than the traditional loan. This translates to substantial long-term cost savings, making the Greenstone loan a more financially attractive option.

Potential Limitations and Considerations

While Greenstone loan calculators offer a valuable tool for preliminary estimations, it’s crucial to understand their inherent limitations. These calculators provide a snapshot based on the data you input, but real-world lending scenarios are often more nuanced and complex. Over-reliance on calculator results without considering other factors could lead to inaccurate financial planning.

Greenstone loan calculators typically simplify a complex process. They offer a convenient way to quickly assess potential loan payments, but they might not fully capture the intricacies of your unique financial situation. Remember, these are estimations, not guarantees.

Limitations of Greenstone Loan Calculators

Several factors inherent to the design of Greenstone loan calculators can limit their accuracy. These calculators usually rely on pre-programmed algorithms and standardized interest rates, which may not reflect the specific terms offered by individual lenders. Furthermore, the calculators typically don’t account for unexpected changes in your financial circumstances or unforeseen loan modifications. For instance, a sudden change in your credit score could significantly alter the interest rate offered, a detail not readily captured by the calculator’s static model.

Factors Excluded from Greenstone Loan Calculations

Greenstone loan calculators usually omit several crucial elements that influence the final loan cost. These often include closing costs, which can add thousands of dollars to the overall expense. Similarly, private mortgage insurance (PMI), required for loans with less than 20% down payment, isn’t typically factored in. Potential prepayment penalties, if you decide to pay off the loan early, are another important factor frequently overlooked. Finally, changes in interest rates during the loan term, particularly with adjustable-rate mortgages (ARMs), can dramatically alter the total cost, a variability not always reflected in initial calculations. Consider a scenario where a borrower uses a calculator to estimate payments based on a current interest rate of 5%, but the rate increases to 7% during the loan term. This could substantially increase the total amount paid.

Interpreting Greenstone Loan Calculator Results

Interpreting the results from a Greenstone loan calculator requires a cautious and informed approach. Treat the output as an initial estimate, not a definitive financial plan. Always compare the calculator’s results with offers from multiple lenders to ensure you are getting the most competitive terms. Don’t solely focus on the monthly payment; consider the total cost of the loan over its lifetime, including all fees and interest. For example, a lower monthly payment might come with a higher total interest paid, resulting in a significantly more expensive loan in the long run.

Importance of Professional Financial Advice

Before committing to any Greenstone loan, seeking professional financial advice is paramount. A qualified financial advisor can assess your complete financial picture, considering factors beyond the scope of a simple online calculator. They can help you explore different loan options, negotiate better terms, and create a comprehensive financial plan that aligns with your long-term goals. This personalized approach ensures you make informed decisions that optimize your financial well-being and avoid potentially costly mistakes. The expertise of a financial advisor provides a crucial layer of oversight, mitigating the risks associated with relying solely on automated calculations.