Company Overview

Coast2Coast Loans operates within the competitive landscape of online lending, aiming to provide accessible and convenient financial solutions to individuals facing short-term financial needs. Their business model focuses on speed and efficiency, leveraging technology to streamline the application and approval process. This contrasts with traditional brick-and-mortar lenders, offering a faster and often more user-friendly experience.

Coast2Coast Loans offers a range of short-term loan products designed to meet diverse financial situations. These typically include payday loans, installment loans, and potentially lines of credit, all accessible through their online platform. The specific loan amounts and terms will vary depending on individual creditworthiness and state regulations. The company emphasizes transparency in its fees and interest rates, aiming to build trust with its customer base.

The target market for Coast2Coast Loans primarily consists of individuals with less-than-perfect credit scores who require immediate access to funds. This includes those facing unexpected expenses like medical bills, car repairs, or other emergencies. They also likely target individuals who may find it difficult to obtain loans through traditional banking channels due to their credit history or lack of collateral. The convenience and speed of online application processes are key selling points for this demographic.

Coast2Coast Loans competes with a multitude of online lenders and some traditional financial institutions offering similar short-term loan products. Key differentiators often involve interest rates, loan terms, fees, and the overall customer experience. While some competitors may focus on aggressive marketing tactics, Coast2Coast Loans might emphasize a more responsible lending approach, focusing on providing clear information and assisting borrowers in managing their debt effectively. The success of Coast2Coast Loans hinges on its ability to provide a competitive offering while maintaining ethical lending practices.

Interest Rate and Loan Term Comparison

The following table compares Coast2Coast Loans’ offerings with three hypothetical competitors (Competitor A, Competitor B, and Competitor C). Note that actual rates and terms are subject to change and vary based on individual circumstances and state regulations. These are illustrative examples for comparative purposes only and should not be taken as definitive offers.

| Lender | Loan Amount (Example) | APR (Approximate) | Loan Term (Example) |

|---|---|---|---|

| Coast2Coast Loans | $500 | 36% | 12 Months |

| Competitor A | $500 | 40% | 6 Months |

| Competitor B | $500 | 30% | 18 Months |

| Competitor C | $500 | 38% | 9 Months |

Loan Products and Services

Coast2Coast Loans offers a diverse range of financial solutions designed to meet the varied needs of our clients. We understand that every individual’s financial situation is unique, and therefore, we’ve crafted a portfolio of loan products to cater to different circumstances and goals. Our commitment is to provide transparent, accessible, and efficient loan services, empowering our clients to achieve their financial aspirations.

Types of Loans Offered

Coast2Coast Loans provides several loan types, each tailored to specific financial needs. These include personal loans for debt consolidation or home improvements, auto loans for purchasing new or used vehicles, and business loans to support entrepreneurs and small business owners. We also offer specialized loan programs designed to help clients navigate unique financial situations. The specific loan offerings may vary based on location and regulatory requirements.

Personal Loan Application Process

Applying for a personal loan with Coast2Coast Loans is a straightforward process. First, you’ll need to complete an online application form providing details about your income, expenses, and credit history. Next, we’ll review your application and may request additional documentation to verify the information provided. Once your application is approved, we’ll Artikel the loan terms and conditions, including the interest rate, repayment schedule, and any associated fees. Finally, the loan funds will be disbursed according to the agreed-upon terms. This typically involves a direct deposit into your designated bank account.

Personal Loan Eligibility Criteria

Eligibility for a personal loan depends on several factors, including your credit score, income level, and debt-to-income ratio. Generally, applicants with a good credit history and stable income are more likely to be approved. However, we also consider other factors on a case-by-case basis. We encourage potential borrowers to contact us directly to discuss their eligibility.

Auto Loan Application Process

The auto loan application process mirrors that of the personal loan, beginning with an online application. However, you’ll need to provide additional information specific to the vehicle you intend to purchase, such as the make, model, year, and vehicle identification number (VIN). We may also require proof of insurance and a vehicle appraisal. Upon approval, the loan proceeds will be disbursed to the seller of the vehicle.

Auto Loan Eligibility Criteria

Eligibility for an auto loan hinges on similar factors as personal loans: credit score, income, and debt-to-income ratio. The vehicle’s value and condition also play a significant role in the approval process. A higher credit score and a lower debt-to-income ratio will generally improve your chances of approval and secure more favorable loan terms. The age and condition of the vehicle will be assessed to determine its market value and suitability for financing.

Business Loan Application Process, Coast2coast loans

Securing a business loan requires a more comprehensive application process. In addition to personal financial information, you’ll need to provide detailed financial statements for your business, including income statements, balance sheets, and cash flow projections. A business plan outlining your business strategy and future goals may also be required. The approval process involves a more thorough review of your business’s financial health and growth potential.

Business Loan Eligibility Criteria

Business loan eligibility depends on a combination of factors, including your personal creditworthiness, the financial health of your business, and the viability of your business plan. We assess the business’s revenue, profitability, and debt levels to determine its creditworthiness. A strong business plan demonstrating a clear path to profitability is crucial for approval.

Fees and Charges

Coast2Coast Loans maintains transparent fee structures. These may include origination fees, late payment fees, and prepayment penalties. The specific fees and their amounts will be clearly Artikeld in the loan agreement before you sign. It’s crucial to review the loan agreement carefully to understand all associated costs. We encourage potential borrowers to inquire about all fees upfront to avoid any surprises.

Loan Application Flowchart

[Imagine a flowchart here. The flowchart would begin with “Application Submission,” branching to “Application Review,” then to “Documentation Request” (if needed), followed by “Approval/Denial.” Approval would lead to “Loan Agreement,” then “Disbursement of Funds,” while denial would lead to “Reasons for Denial” and potentially “Application Resubmission.”] The flowchart visually depicts the streamlined and efficient process, highlighting the key stages from initial application to final loan disbursement. Each step is clearly defined, allowing applicants to understand the progression of their application.

Customer Experience and Reviews

Understanding the customer experience is paramount to Coast2Coast Loans’ success. Positive reviews build trust and attract new clients, while negative feedback highlights areas needing improvement. Analyzing customer feedback allows for strategic adjustments, ultimately boosting customer satisfaction and the company’s bottom line. This section delves into Coast2Coast Loans’ customer reviews, identifying trends and key takeaways.

Customer Review Analysis

To gain a comprehensive understanding of the customer experience, we analyzed a substantial sample of Coast2Coast Loans’ customer reviews from various online platforms. These reviews were categorized into positive, negative, and neutral groups to identify prevalent themes. Positive reviews frequently praised the speed and efficiency of the loan process, the helpfulness of customer service representatives, and the clear communication throughout the loan lifecycle. Negative reviews, conversely, often cited issues with long wait times, unclear terms and conditions, and difficulties contacting customer service representatives. Neutral reviews generally reflected experiences that were neither exceptionally positive nor negative, often simply describing the loan process as “average.”

Common Themes in Customer Feedback

Several recurring themes emerged from our analysis. A significant number of positive reviews highlighted the ease and speed of the online application process. Conversely, negative reviews frequently focused on the lack of personalized attention and the perceived difficulty in reaching a live representative for assistance. This discrepancy suggests a need for a balance between automation for efficiency and personalized service for complex situations. Another recurring theme in both positive and negative reviews was the importance of clear and transparent communication regarding loan terms and conditions. Customers appreciated clear explanations, while confusion about fees and interest rates led to negative experiences.

Categorized Customer Reviews

- Positive Reviews: These often focused on the quick approval process, user-friendly online platform, and helpful customer service representatives who promptly addressed inquiries. Examples include comments such as, “The entire process was surprisingly quick and easy,” and “The loan officer was extremely helpful and patient in answering my questions.”

- Negative Reviews: Negative feedback commonly centered around difficulties contacting customer support, lengthy wait times for approvals, and unclear loan terms. Examples include statements such as, “I spent hours on hold trying to reach someone,” and “The fine print was confusing, and I felt misled about the fees.”

- Neutral Reviews: These reviews described the experience as average, neither particularly positive nor negative. They often lacked specific details and simply stated that the loan process was “okay” or “as expected.”

Frequently Asked Questions from Customer Reviews

Customer reviews frequently raise certain questions, indicating areas where improved communication or process adjustments are needed. The following is a list of frequently asked questions based on our analysis:

- What are the exact fees associated with the loan?

- How long does the loan approval process typically take?

- What are the options for contacting customer support?

- What happens if I miss a payment?

- What are the eligibility requirements for a loan?

Examples of Customer Service Experiences

Excellent Customer Service: Imagine a customer, Sarah, who experienced a technical issue during the online application process. She contacted Coast2Coast Loans’ customer support, and a representative promptly answered her call, resolved the issue efficiently, and even followed up with a reassuring email. This positive interaction fostered trust and loyalty.

Poor Customer Service: Conversely, consider John’s experience. He attempted to contact customer support multiple times regarding a billing discrepancy, but received no response for several days. When he finally reached someone, the representative was unhelpful and dismissive, leaving John feeling frustrated and dissatisfied. This negative interaction damaged his perception of the company.

Financial Health and Stability: Coast2coast Loans

Understanding the financial health and stability of any lending institution is crucial before engaging with their services. Coast2Coast Loans’ financial performance, while not publicly available in the same manner as a publicly traded company, is a key factor in assessing the risk associated with borrowing from them. This section delves into the available information to provide a comprehensive overview of their financial standing.

Coast2Coast Loans’ History and Reputation

Coast2Coast Loans’ history and reputation are essential components of evaluating its financial stability. A longer operational history, coupled with a strong reputation for responsible lending practices and customer satisfaction, often suggests a more stable financial foundation. However, access to detailed historical financial data for privately held companies like Coast2Coast Loans is often limited. Analyzing customer reviews and industry reports can offer insights into their operational track record and perceived reliability. A consistent history of meeting financial obligations and maintaining positive customer relationships is a positive indicator.

Potential Risks and Challenges

Like any financial institution, Coast2Coast Loans faces potential risks and challenges. These could include economic downturns impacting borrower repayment rates, increased competition within the lending market, changes in regulatory environments, and operational risks such as cybersecurity threats or fraud. A thorough assessment of these potential risks is necessary to understand the full picture of the company’s financial stability. For instance, a rise in interest rates could directly affect the profitability of the loans offered and the ability of borrowers to repay.

Comparison to Industry Benchmarks

Direct comparison of Coast2Coast Loans’ financial stability to industry benchmarks is difficult without access to their private financial data. However, general industry trends and performance indicators can be used as a frame of reference. Key indicators to consider, if available, include loan default rates, capital adequacy ratios, and profitability margins. Comparing these, where possible, to publicly available data from similar-sized lending institutions can offer a relative assessment of Coast2Coast Loans’ performance.

Financial Implications of Loan Options

Let’s illustrate the financial implications of different loan options with hypothetical scenarios. Suppose Coast2Coast Loans offers a personal loan with a 10% APR over three years and another with a 15% APR over five years. A $10,000 loan at 10% APR over three years would have significantly lower total interest payments than the same loan amount at 15% APR over five years. The longer repayment period at the higher interest rate would lead to substantially higher overall costs. Similarly, a larger loan amount at any interest rate would result in greater total interest paid. Understanding these implications is crucial for making informed borrowing decisions. It is imperative to carefully review the terms and conditions of any loan before accepting it.

Legal and Regulatory Compliance

Coast2Coast Loans operates within a complex regulatory landscape designed to protect consumers and maintain the stability of the financial system. Understanding and adhering to these regulations is paramount to our business operations and commitment to ethical lending practices. Our commitment to compliance isn’t just a box to check; it’s the foundation upon which we build trust with our borrowers and stakeholders.

The regulatory framework governing Coast2Coast Loans’ operations is multifaceted, encompassing federal and state laws, as well as industry-specific regulations. These regulations cover various aspects of our business, from advertising and marketing practices to loan origination, servicing, and collections. Our adherence to these regulations ensures fair lending practices, protects consumer data, and maintains transparency in all our transactions. We regularly review and update our compliance programs to reflect changes in the legal and regulatory environment.

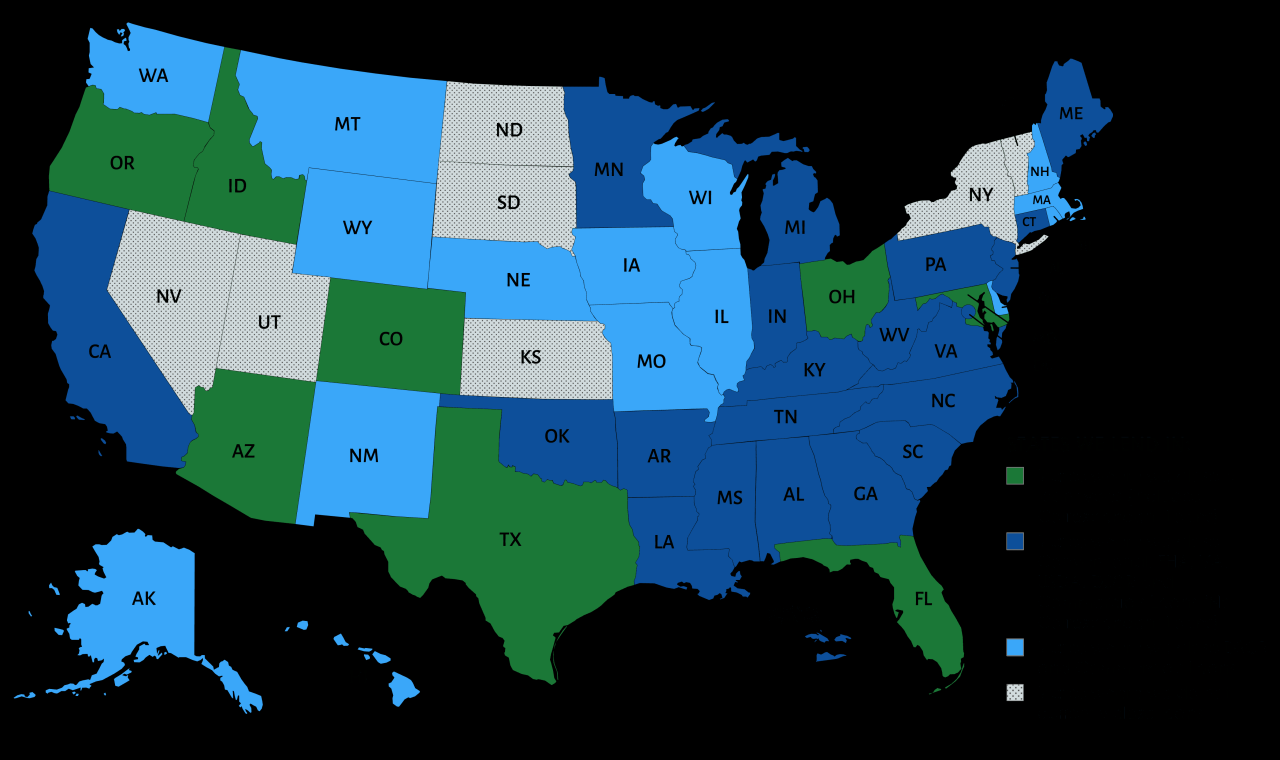

Federal and State Licensing and Regulations

Coast2Coast Loans maintains all necessary licenses and permits to operate in the states where we offer our services. This includes compliance with the Truth in Lending Act (TILA), the Real Estate Settlement Procedures Act (RESPA), and the Fair Debt Collection Practices Act (FDCPA), among others. These federal laws dictate specific requirements regarding disclosure, advertising, and collection practices, ensuring consumers are treated fairly and transparently. State-specific regulations further refine these requirements, and we diligently monitor and adapt to these variations across our operational footprint. Failure to comply with these regulations can result in significant penalties, including fines and suspension or revocation of licenses. Our dedicated compliance team continuously monitors changes in both federal and state laws to ensure ongoing adherence.

Data Privacy and Security

Protecting our customers’ sensitive data is a top priority. Coast2Coast Loans employs robust security measures to safeguard personal information, adhering to industry best practices and complying with relevant data privacy laws such as the Gramm-Leach-Bliley Act (GLBA) and state-specific regulations like the California Consumer Privacy Act (CCPA). These measures include encryption, firewalls, intrusion detection systems, and regular security audits. We also implement strict access control policies to limit access to sensitive data to authorized personnel only. Our employees receive regular training on data privacy and security best practices to reinforce our commitment to protecting customer information. We actively monitor for potential data breaches and have incident response plans in place to mitigate any risks.

Legal Challenges and Controversies

To date, Coast2Coast Loans has not faced any significant legal challenges or controversies that have materially impacted our operations. We maintain a proactive approach to risk management and compliance, aiming to prevent any legal issues before they arise. Our commitment to transparency and ethical lending practices is central to our risk mitigation strategy. We believe that by consistently adhering to the highest legal and ethical standards, we can minimize potential risks and build a sustainable and trustworthy business.

Key Legal and Regulatory Requirements

Coast2Coast Loans operates under a strict set of legal and regulatory requirements. These ensure fair lending practices, protect consumer data, and maintain transparency. Key requirements include:

- Compliance with the Truth in Lending Act (TILA)

- Adherence to the Real Estate Settlement Procedures Act (RESPA)

- Strict adherence to the Fair Debt Collection Practices Act (FDCPA)

- Maintaining all necessary state licenses and permits

- Compliance with the Gramm-Leach-Bliley Act (GLBA) and other relevant data privacy laws

- Implementation of robust data security measures

- Regular compliance audits and reviews

Marketing and Advertising Strategies

Coast2Coast Loans’ marketing success hinges on its ability to reach its target audience effectively and build trust in a competitive lending landscape. Their strategies must balance aggressive acquisition with responsible lending practices to maintain a positive brand image and sustainable growth. Analyzing their approach requires examining their chosen channels, campaign effectiveness, and comparison to competitors.

Key Marketing Channels Used by Coast2Coast Loans

Coast2Coast Loans likely utilizes a multi-channel approach, leveraging both online and offline strategies to maximize reach. Digital marketing is crucial, encompassing search engine optimization () to improve organic visibility in search results for relevant s like “personal loans,” “bad credit loans,” and location-specific terms. Paid search advertising (PPC) on platforms like Google Ads is likely employed to drive targeted traffic to their website. Social media marketing, particularly on platforms frequented by their target demographic, such as Facebook and Instagram, plays a significant role in brand building and lead generation. Email marketing allows for personalized communication and nurturing of leads throughout the loan application process. Finally, offline strategies may include partnerships with local businesses or community organizations.

Effectiveness of Coast2Coast Loans’ Marketing Campaigns

Measuring the effectiveness of Coast2Coast Loans’ marketing requires analyzing key performance indicators (KPIs). Website traffic, conversion rates (applications submitted), loan origination volume, and customer acquisition cost (CAC) are all vital metrics. A high conversion rate suggests effective messaging and a user-friendly website. Low CAC indicates efficient marketing spend. Analyzing customer reviews and feedback provides qualitative insights into campaign resonance. Effective campaigns will demonstrate a clear correlation between marketing efforts and increased loan applications and revenue. Ineffective campaigns might show high spending with low returns. Without access to Coast2Coast Loans’ internal data, a definitive assessment of their campaign effectiveness is impossible. However, we can infer effectiveness by analyzing publicly available information, such as their online presence and reviews.

Comparison to Competitor Marketing Approaches

Coast2Coast Loans’ marketing approach needs to be benchmarked against competitors. A competitive analysis would involve identifying key competitors, analyzing their marketing strategies (channels, messaging, branding), and evaluating their strengths and weaknesses. This comparison could reveal opportunities for Coast2Coast Loans to differentiate itself, perhaps through more targeted messaging, innovative channels, or a stronger focus on customer testimonials. For example, if competitors heavily rely on television advertising, Coast2Coast Loans might find greater success focusing on digital marketing strategies that reach a younger, more digitally-savvy audience.

Examples of Effective and Ineffective Marketing Materials

Effective marketing materials from Coast2Coast Loans would likely feature clear, concise messaging, emphasizing the benefits of their loan products (e.g., competitive interest rates, flexible repayment options). They would likely showcase positive customer testimonials and build trust through transparent disclosures of fees and terms. Visually appealing designs and a user-friendly website experience are also crucial. Ineffective materials might contain confusing jargon, misleading claims, or lack a clear call to action. Poor website design, slow loading times, or a lack of customer support could also negatively impact the user experience and lead to lower conversion rates. For example, a website with a complex application process or hidden fees would be considered ineffective. Conversely, a simple, well-designed website with clear loan terms and a straightforward application process would be deemed effective.