Understanding Centra Loan Payment Methods

Making your Centra loan payments on time and efficiently is crucial for maintaining a healthy credit score and avoiding late fees. Centra offers a variety of convenient payment options to suit your needs and preferences. Choosing the right method can significantly impact your time management and overall financial organization.

Centra Loan Payment Methods Available

Centra provides several methods for making loan payments, ensuring flexibility for its customers. These options range from convenient online and mobile methods to traditional banking and postal services. Understanding the nuances of each method will help you select the best option for your individual circumstances.

Online Portal Payment

Paying through the Centra online portal is a fast, secure, and convenient method. The process involves logging into your account using your unique username and password, navigating to the payment section, and entering the amount you wish to pay. The portal typically offers real-time transaction confirmation and provides detailed payment history for easy record-keeping. You’ll need a stable internet connection and access to your Centra account details.

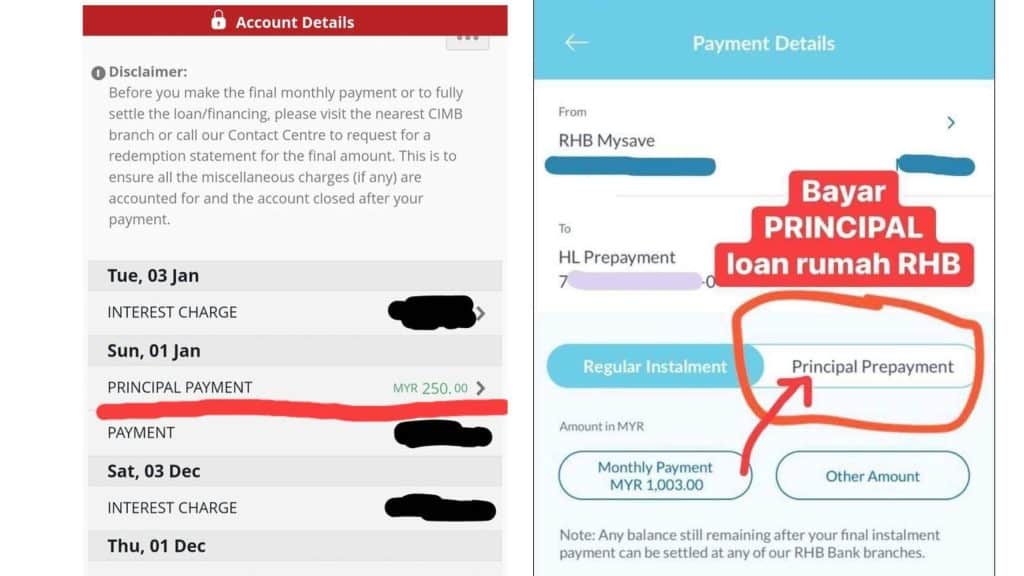

Mobile App Payment

The Centra mobile app mirrors the functionality of the online portal, offering a user-friendly interface optimized for smartphones and tablets. The payment process is similar to the online portal, allowing for quick and easy payments from anywhere with a mobile data or Wi-Fi connection. The app also provides access to your account information, including payment history and loan details.

Bank Transfer Payment

For those who prefer traditional banking methods, Centra allows for payments via bank transfer. This involves initiating a transfer from your bank account to Centra’s designated account using your bank’s online banking platform or mobile app. You will need Centra’s bank details, including account number and bank name, to complete the transfer. Remember to include your loan account number as a reference to ensure correct allocation of your payment.

Mail Payment

Centra also accepts payments sent via mail. This method requires you to send a check or money order payable to Centra, along with your loan account number and other relevant information, to their designated mailing address. This is generally the slowest payment method and requires careful handling of your payment instrument to prevent loss or damage.

Comparison of Centra Loan Payment Methods

| Payment Method | Speed | Fees | Convenience | Security |

|---|---|---|---|---|

| Online Portal | Instant | None | High | High |

| Mobile App | Instant | None | High | High |

| Bank Transfer | 1-3 Business Days | May vary depending on bank | Medium | Medium |

| 7-10 Business Days | None (but potential for loss/damage) | Low | Low |

Managing Centra Loan Payments Effectively

Successfully managing your Centra loan payments requires proactive planning and a disciplined approach. Missed payments can negatively impact your credit score and incur late fees, ultimately costing you more in the long run. By implementing effective budgeting strategies and utilizing available payment automation tools, you can streamline the repayment process and ensure timely payments. This section will provide practical strategies to help you master your Centra loan repayments.

Effective budgeting is crucial for consistent loan repayments. It involves creating a realistic monthly budget that accurately reflects your income and expenses, ensuring sufficient funds are allocated for your Centra loan payment. Failing to account for unexpected expenses can lead to missed payments, so building a buffer is key. Careful tracking of your spending habits can illuminate areas where you might reduce expenses to free up more money for your loan.

Budgeting and Planning Loan Repayments

A well-structured budget ensures your loan payments are prioritized. This involves listing all your monthly income sources and then meticulously detailing all your expenses. Categorizing expenses helps identify areas where you can potentially cut back to free up funds for loan repayments. Remember to include unexpected expenses, like car repairs or medical bills, in your budget to avoid any surprises.

Here’s a sample monthly budget demonstrating how to incorporate Centra loan payments:

- Income: $4,000 (Net Monthly Salary)

- Expenses:

- Housing: $1,200

- Utilities: $300

- Groceries: $500

- Transportation: $200

- Entertainment: $200

- Centra Loan Payment: $500

- Savings: $100

- Total Expenses: $3,000

- Remaining Funds: $1,000 (This can be used for emergencies or additional savings)

This is just a sample budget; your specific numbers will vary depending on your income and expenses. The key is to create a realistic budget that works for your individual circumstances and prioritizes your Centra loan payment.

Setting Up Automatic Loan Payments

Automating your Centra loan payments is a highly effective strategy to prevent missed payments. This method ensures that your payment is processed on time, every time, eliminating the risk of human error or forgetfulness. Most lenders offer various methods for automating payments, providing convenience and peace of mind.

- Log in to your Centra Loan Account: Access your online account through the Centra website or mobile app.

- Navigate to Payment Settings: Look for a section labeled “Payments,” “Payment Options,” or something similar.

- Select Automatic Payment: Choose the option to set up automatic payments. You’ll typically be prompted to provide your banking information.

- Verify Payment Details: Double-check all the information you’ve entered to ensure accuracy.

- Confirm Setup: Once you’ve verified everything, confirm the setup of your automatic payments.

- Monitor Your Account: Regularly monitor your account to ensure payments are being processed correctly.

By following these steps, you can effortlessly ensure timely payments and avoid any late payment fees or negative impacts on your credit score. Remember to review your account statements regularly to verify the accuracy of your payments.

Troubleshooting Centra Loan Payment Issues

Navigating the world of loan payments can sometimes feel like traversing a minefield. Even with a seemingly straightforward process like paying off your Centra loan, unexpected hiccups can occur. Understanding common problems and their solutions is crucial for maintaining a healthy financial standing and avoiding late payment penalties. This section will equip you with the knowledge to troubleshoot any payment issues you might encounter.

Knowing what to expect and how to respond proactively is key to avoiding unnecessary stress and financial complications. Let’s dive into some common problems and their effective solutions.

Declined Payments

A declined payment can stem from several sources, ranging from insufficient funds in your account to issues with your payment method information. It’s crucial to act quickly to rectify the situation and prevent late payment fees. First, verify that sufficient funds are available in the account linked to your Centra loan payment. Then, double-check that all the payment information—account number, routing number (if applicable), card details—is accurate and up-to-date. Contact your bank or financial institution if you suspect a problem with your account. If the issue persists after these checks, contacting Centra’s customer support is your next step. They can investigate the reason for the decline and guide you through the necessary corrections.

Technical Glitches

Occasionally, technical glitches on either the Centra platform or your end can disrupt the payment process. These issues might manifest as error messages, website unavailability, or payment processing delays. If you encounter a technical problem, the first step is to try again after a short period. Often, temporary glitches resolve themselves. If the problem persists, check Centra’s website or social media channels for service announcements or known issues. Contacting Centra’s customer support directly, providing details of the error message and the time of the attempted payment, is vital for a swift resolution.

Understanding Error Messages

Error messages are often cryptic, but they provide valuable clues to resolving payment problems. For example, a message indicating “Insufficient Funds” clearly points to a lack of money in the designated account. An error like “Invalid Account Number” signifies incorrect payment information. A message stating “Payment Processing Error” suggests a technical problem requiring further investigation by Centra’s support team. Keep a record of any error messages you receive, including the exact wording and the timestamp, as this information is invaluable when contacting customer support. Providing this information streamlines the troubleshooting process and helps Centra’s support team quickly identify and address the root cause of the problem.

Centra Loan Payment Security and Protection

Protecting your financial information is paramount, and at Centra, we understand this. We employ multiple layers of security to safeguard your payment details throughout the loan repayment process. This commitment ensures a secure and trustworthy experience for all our borrowers.

Centra utilizes robust security measures to protect customer payment information. These measures are designed to prevent unauthorized access, use, disclosure, alteration, or destruction of your data. We employ advanced encryption technologies to protect data both in transit and at rest. Our systems are regularly monitored for vulnerabilities and updated with the latest security patches to stay ahead of evolving threats. Furthermore, we adhere to strict industry best practices and comply with relevant data privacy regulations to maintain the highest levels of security.

Data Encryption and Security Protocols

Centra uses industry-standard encryption protocols, such as TLS (Transport Layer Security) and HTTPS, to protect data transmitted between your device and our servers. This ensures that your payment information remains confidential during the transmission process. At rest, your data is further protected through robust encryption techniques, making it inaccessible to unauthorized individuals even if our systems were compromised. Regular security audits and penetration testing are conducted to identify and address any potential vulnerabilities. We also employ multi-factor authentication (MFA) where applicable, adding an extra layer of security to your account.

Reporting Suspicious Activity

If you suspect any unauthorized activity related to your Centra loan payments, it’s crucial to report it immediately. You can contact Centra’s dedicated customer support team via phone, email, or through the secure messaging system within your online account. Provide them with as much detail as possible, including any unusual transactions, dates, and amounts. Prompt reporting allows Centra to investigate the matter swiftly and take necessary steps to protect your account. A dedicated fraud prevention team analyzes reported incidents, investigates potential breaches, and works to prevent future occurrences.

Responding to Suspected Fraudulent Activity

If you suspect fraudulent activity on your Centra loan account, such as unauthorized withdrawals or changes to your account details, take immediate action. First, contact Centra’s customer support immediately to report the suspicious activity. Next, review your account statements meticulously to identify any unauthorized transactions. Change your Centra account password immediately and consider enabling MFA if it’s not already activated. Finally, report the incident to your local law enforcement authorities if necessary, providing them with all relevant information to support their investigation. Centra will cooperate fully with law enforcement to resolve any fraudulent activity and protect your interests.

Centra Loan Payment Customer Support

Navigating loan payments can sometimes feel overwhelming, but having reliable customer support readily available can significantly ease the process. Centra understands this, offering multiple channels to ensure you receive timely and efficient assistance with your loan payments. Understanding these options and how to best utilize them is crucial for a smooth loan management experience.

Centra’s commitment to customer service extends to providing various avenues for support. This allows you to choose the method most convenient for you, whether you prefer a quick phone call, a detailed email, or the immediacy of online chat. Effective communication is key when addressing payment-related issues, ensuring a swift resolution and maintaining a positive relationship with your lender.

Contacting Centra Customer Support

Accessing Centra’s customer support is straightforward. They offer a range of communication channels designed to cater to diverse preferences and needs. Choosing the right channel depends on the urgency of your issue and your preferred communication style.

Phone: 1-800-CENTRA-1 (1-800-236-8721) Available Monday-Friday, 8 AM – 8 PM EST.

Email: [email protected] Allow 24-48 hours for a response. Include your loan number and a concise description of your issue.

Online Chat: Available on the Centra website during business hours. This option provides immediate assistance for less complex queries.

Effective Communication with Centra Support

When contacting Centra regarding payment issues, clear and concise communication is essential for a quick resolution. Before contacting support, gather all relevant information, such as your loan number, account details, and a detailed description of the problem. This will streamline the process and prevent unnecessary delays. For example, if you’re experiencing a payment processing error, include the error message, the date and time of the attempted payment, and any relevant screenshots. If you’re requesting a payment extension, clearly state your reasons and propose a revised payment schedule.

Impact of Late Centra Loan Payments

Missing a Centra loan payment, even by a single day, can trigger a cascade of negative consequences, significantly impacting your financial well-being and credit score. Understanding the ramifications is crucial for responsible loan management. This section details the potential repercussions and resources available to help you avoid late payments.

Late payments on your Centra loan can lead to a variety of serious financial setbacks. The most immediate consequence is typically the imposition of late fees. These fees can be substantial, adding considerably to your overall loan cost and quickly snowballing if payments remain consistently late. Beyond financial penalties, late payments have a lasting impact on your credit report, potentially affecting your ability to secure loans, credit cards, or even rent an apartment in the future. A consistently poor payment history can severely damage your credit score, limiting your financial options for years to come.

Centra’s Late Payment Policy

Centra’s late payment policy is designed to encourage timely repayments. While the specifics may vary depending on your loan agreement, it generally involves a grace period after the due date, during which a late payment may be accepted without immediate penalty. However, once this grace period expires, late fees are typically applied. The amount of the late fee is usually stipulated in your loan contract. Continued late payments can escalate the penalties, potentially leading to further fees and, ultimately, the loan being sent to collections. This can result in significant damage to your credit score and even legal action. It is critical to review your loan agreement thoroughly to understand the precise terms of Centra’s late payment policy applicable to your specific loan. Contacting Centra directly if you anticipate difficulty making a payment is also highly recommended.

Resources for Customers Facing Financial Difficulties

Experiencing unexpected financial hardship? Centra recognizes that unforeseen circumstances can impact repayment ability. They often offer several avenues of support for borrowers facing financial difficulties. These resources can include:

- Deferment or Forbearance Programs: These programs may temporarily postpone or reduce your loan payments, providing breathing room during a challenging period. Eligibility criteria usually involve demonstrating genuine financial hardship, such as job loss or medical emergency. The specifics of these programs, including application procedures and required documentation, are Artikeld in your loan agreement or can be obtained by contacting Centra’s customer support.

- Financial Counseling: Centra may provide access to or recommend reputable financial counseling services. These services can help you create a budget, explore debt management options, and develop a plan to get back on track with your loan repayments.

- Loan Modification: In some cases, Centra may be willing to modify your loan terms, such as extending the repayment period or adjusting the interest rate, to make payments more manageable. This option is usually considered after exploring other avenues of support.

Proactive communication with Centra is essential. Don’t wait until you’re significantly behind on payments to seek assistance. Contacting them early allows for a collaborative approach to finding a solution that works for both parties. Remember, ignoring the problem only exacerbates the situation. Taking advantage of the available resources can prevent serious damage to your credit and overall financial health.

Illustrative Scenarios of Centra Loan Payments

Understanding how Centra loan payments work in practice is crucial. Let’s examine two scenarios – one showcasing a successful payment and another detailing a failed payment and its resolution. These examples highlight the importance of careful attention to detail and proactive problem-solving.

Successful Online Centra Loan Payment

This scenario depicts a straightforward online payment through the Centra portal. Imagine Sarah, a Centra loan customer, logging into her account on the Centra website. She navigates to the “Make a Payment” section, which is clearly labeled and easily accessible from the main dashboard. The interface is user-friendly, presenting a clear overview of her outstanding balance, due date, and available payment methods. Sarah selects “Online Payment” and enters her payment amount, verifying it matches her current balance. She then chooses her preferred payment method, her linked bank account, and confirms the transaction. A confirmation page appears, displaying a transaction ID and a summary of the payment details. This confirmation page also contains a timestamp indicating the successful processing of the payment. A digital receipt is instantly generated and emailed to her registered email address for her records. This entire process is quick, secure, and provides immediate feedback to the user. The confirmation screen would likely include a visually appealing checkmark icon alongside the confirmation message to reinforce the success of the transaction. The email receipt would mirror the information displayed on the confirmation screen, adding an extra layer of security and confirmation for the user.

Failed Centra Loan Payment and Resolution

Now, let’s consider a different scenario. John, another Centra loan customer, attempts to make a payment via the online portal, but encounters an error. He enters his payment information, but the system displays an error message indicating insufficient funds in his linked bank account. A screenshot of this error message might show a red banner at the top of the screen with the words “Payment Failed” in bold, red font. Below, a more detailed explanation would indicate the reason for failure, “Insufficient Funds.” John checks his bank account balance and realizes he made a mistake in his budgeting. He immediately transfers sufficient funds to his linked account. He then returns to the Centra portal, logs back into his account, and attempts the payment again. This time, the transaction is successful. He receives the confirmation page and email receipt, identical to Sarah’s experience. The system’s clear error messaging and John’s prompt action prevented a late payment. The ease of retrying the payment after addressing the initial error underscores the user-friendliness and resilience of the Centra payment system.