Understanding “CC Connect Total Loan Services”

CC Connect Total Loan Services represents a comprehensive suite of financial products designed to streamline the borrowing process for individuals and businesses. This service acts as a central hub, connecting borrowers with a variety of lenders and loan options, eliminating the need to navigate multiple applications and websites. The goal is to simplify access to capital, offering a more efficient and transparent experience.

CC Connect Total Loan Services aims to provide a one-stop shop for all loan needs, acting as an aggregator and facilitator rather than a direct lender. This model benefits both borrowers, who gain access to a wider range of options, and lenders, who can reach a broader customer base. The service leverages technology to automate parts of the process, such as application processing and document verification, enhancing speed and efficiency.

Target Audience for CC Connect Total Loan Services

The target audience for CC Connect Total Loan Services is broad, encompassing both individual consumers and small to medium-sized businesses (SMBs). Individuals might utilize the service for personal loans, auto loans, or debt consolidation. SMBs, on the other hand, could leverage the platform to access working capital loans, equipment financing, or commercial real estate loans. The platform’s design prioritizes user-friendliness, making it accessible to a wide range of tech-savviness levels. This inclusivity is a key differentiator in the competitive loan marketplace.

Types of Loans Offered by CC Connect Total Loan Services

CC Connect Total Loan Services typically offers a diverse range of loan products to cater to its broad target audience. This includes, but isn’t limited to, personal loans for various purposes (debt consolidation, home improvement, etc.), auto loans, business loans (including lines of credit and term loans), and potentially even mortgages or equipment financing, depending on the partnerships and agreements established with various lenders. The specific offerings may vary depending on the borrower’s creditworthiness and financial profile, as well as the available lenders within the CC Connect network.

Comparison with Competitors

Compared to competitors such as LendingTree or Bankrate, CC Connect Total Loan Services may differentiate itself through its focus on a more personalized and streamlined application process. While competitors offer loan comparisons, CC Connect might leverage advanced algorithms and data analysis to match borrowers with lenders most likely to approve their application, reducing the time and effort required for loan seekers. This focus on efficiency and personalized matching, along with potentially broader lender partnerships, could provide a competitive advantage. However, specific advantages will depend on factors like the breadth of lender partnerships, the efficiency of the platform’s technology, and the transparency of the fee structure compared to other market players. A direct comparison requires a detailed analysis of each competitor’s offerings and customer reviews.

Services Offered

CC Connect Total Loan Services provides a comprehensive suite of financial solutions designed to meet diverse borrowing needs. We understand that securing financing can be complex, so we’ve streamlined the process and offer personalized support at every stage. Our goal is to connect you with the right loan, quickly and efficiently. This section details the services we offer, the application procedures, eligibility criteria, and key financial terms.

Cc connect total loan services – Understanding the specifics of each loan type is crucial for making informed financial decisions. The following Artikels the services offered, along with the associated application processes and eligibility requirements.

Loan Services Offered

CC Connect Total Loan Services offers a range of loan products tailored to various financial situations. Each loan type is designed to provide flexible and accessible financing options.

- Personal Loans: These unsecured loans are ideal for debt consolidation, home improvements, or unexpected expenses. They offer flexible repayment terms and competitive interest rates.

- Auto Loans: Secure financing for purchasing a new or used vehicle. We offer competitive interest rates and various repayment options to suit your budget.

- Home Improvement Loans: Specifically designed for renovations, repairs, or upgrades to your home. These loans often come with longer repayment terms and potentially lower interest rates than personal loans.

- Business Loans: We offer financing solutions for small and medium-sized businesses, supporting expansion, equipment purchases, or working capital needs. Eligibility criteria are more stringent, requiring detailed financial information.

Application Process

The application process for each loan type is similar but requires specific documentation. All applications are reviewed thoroughly to ensure responsible lending practices.

- Personal Loans: Applicants typically need to provide proof of income, employment history, and credit score. The application is submitted online, and a decision is usually provided within 24-48 hours.

- Auto Loans: Applicants need to provide information about the vehicle being purchased, along with proof of income, employment, and credit history. Pre-approval is often available to simplify the car buying process.

- Home Improvement Loans: This process involves providing detailed information about the planned improvements, along with proof of homeownership, income, and creditworthiness. An appraisal of the property may be required.

- Business Loans: This process is more involved, requiring detailed financial statements, business plans, and tax returns. A thorough review of the applicant’s financial health is conducted before a decision is made. This often takes longer than other loan applications.

Eligibility Criteria

Eligibility requirements vary depending on the loan type. Generally, a good credit score and stable income are crucial factors. Specific requirements are Artikeld below.

- Personal Loans: Minimum credit score requirements vary, but generally, a score above 650 is preferred. Applicants need to demonstrate a stable income and ability to repay the loan.

- Auto Loans: Similar to personal loans, a good credit score is advantageous. The applicant’s income and debt-to-income ratio are carefully evaluated. The vehicle being financed acts as collateral.

- Home Improvement Loans: A strong credit score is essential, along with proof of homeownership and sufficient equity in the property. The value of the home and the scope of the improvements are key considerations.

- Business Loans: Stricter eligibility criteria apply. Applicants need to demonstrate a strong business track record, stable revenue, and a well-defined business plan. Detailed financial statements are required for assessment.

Loan Type Comparison

The following table summarizes the key features of each loan type. Interest rates and repayment terms are subject to change and are based on individual creditworthiness and market conditions.

| Loan Type | Interest Rate | Repayment Terms | Eligibility Requirements |

|---|---|---|---|

| Personal Loan | Variable, based on credit score (e.g., 5% – 20%) | 12-60 months | Good credit score, stable income, proof of identity |

| Auto Loan | Variable, based on credit score and vehicle (e.g., 4% – 18%) | 24-72 months | Good credit score, stable income, vehicle information |

| Home Improvement Loan | Variable, based on credit score and property value (e.g., 6% – 15%) | 36-180 months | Good credit score, homeownership, sufficient equity |

| Business Loan | Variable, based on financial health and risk assessment (e.g., 8% – 25%) | 12-84 months | Strong business track record, stable revenue, detailed financial statements |

Customer Experience and Support: Cc Connect Total Loan Services

At CC Connect Total Loan Services, we understand that a seamless and supportive customer experience is paramount. Our goal is to make the loan process as straightforward and stress-free as possible, from initial application to final repayment. We achieve this through a multi-faceted approach encompassing intuitive online tools, readily available support channels, and a dedicated team committed to exceeding customer expectations. This commitment translates to higher customer satisfaction and loyalty, ultimately driving business growth.

The typical customer journey begins with exploring our online resources to understand our loan offerings and eligibility criteria. This often involves using our online loan calculator and reviewing frequently asked questions. Following this initial research, customers typically submit an application online, providing necessary documentation. The application is then processed, and customers are kept informed of its progress through email and/or phone calls. Once approved, loan disbursement occurs, and ongoing support is provided throughout the repayment period. This journey, while seemingly simple, hinges on the quality of support provided at each stage.

Positive and Negative Customer Experience Examples, Cc connect total loan services

Positive and negative customer experiences significantly impact brand reputation and customer loyalty. Analyzing these scenarios helps refine processes and improve service delivery.

For instance, consider Sarah, a small business owner who used our online application portal. The process was intuitive, and she received prompt updates via email. Upon approval, the funds were transferred swiftly, exceeding her expectations. This positive experience led to a strong recommendation to her network. Conversely, consider Mark, whose application was delayed due to a minor documentation issue. Lack of clear communication regarding the delay led to frustration and a negative perception of our services. This highlights the importance of proactive communication and efficient issue resolution.

Customer Support Flowchart

A well-defined customer support flowchart streamlines issue resolution and improves efficiency.

Our flowchart begins with the customer contacting support through any available channel (phone, email, or online chat). The initial interaction involves gathering information about the issue. If the issue is simple (e.g., password reset), the support agent resolves it directly. More complex issues (e.g., loan modification requests) are escalated to a specialist. The specialist investigates the issue, communicates the findings to the customer, and implements the necessary solution. Throughout the process, updates are provided to the customer, and the issue’s resolution is documented. Finally, customer satisfaction is assessed through a follow-up survey.

Customer Support Channels

We offer multiple channels to ensure convenient and accessible support.

Customers can contact us via phone during our extended business hours. Our dedicated phone lines ensure immediate assistance for urgent matters. For non-urgent inquiries or detailed questions, email support provides a written record of the interaction. For immediate assistance with common issues, our online chat feature offers real-time support. Each channel is staffed by trained professionals equipped to handle a wide range of inquiries.

Financial Aspects and Regulations

Understanding the financial implications and regulatory landscape of CC Connect Total Loan Services is crucial for borrowers seeking to leverage their offerings. This section will delve into the associated costs, the legal framework governing their operations, and potential risks involved. Transparency in these areas is paramount for making informed financial decisions.

Borrowers should carefully consider the total cost of borrowing when using CC Connect Total Loan Services. This includes not only the principal loan amount but also interest charges, fees, and any other applicable costs. Interest rates, often expressed as an Annual Percentage Rate (APR), significantly impact the overall repayment amount. Higher APRs lead to substantially higher total repayment costs over the loan term. It’s essential to compare APRs from different lenders and loan products to secure the most favorable terms. Additionally, late payment fees, prepayment penalties, and other charges can add unexpected costs, potentially derailing your budget if not accounted for. Thorough review of the loan agreement is essential before signing.

Regulatory Compliance of CC Connect Total Loan Services

CC Connect Total Loan Services, like all lending institutions, operates within a defined regulatory framework designed to protect consumers and ensure fair lending practices. This framework varies depending on the jurisdiction, but generally includes adherence to laws concerning interest rates, advertising, debt collection, and consumer protection. Compliance with regulations such as the Truth in Lending Act (TILA) in the United States, or equivalent legislation in other countries, is mandatory. These regulations dictate transparency in disclosing all loan terms and conditions, preventing predatory lending practices, and providing recourse for borrowers facing unfair treatment. Non-compliance can result in significant penalties for the lender.

Potential Risks Associated with CC Connect Total Loan Services

While CC Connect Total Loan Services aims to provide convenient and accessible loan options, borrowers should be aware of potential risks. One significant risk is the potential for accumulating substantial debt if loan repayments are not managed effectively. Failure to make timely payments can lead to late fees, increased interest charges, and ultimately, damage to credit scores. Another risk involves the possibility of hidden fees or unfavorable loan terms that may not be immediately apparent. Borrowers should carefully review all loan documents and understand all associated costs before committing to a loan. Finally, there’s always a risk of the lender’s financial stability. Choosing a reputable and financially sound lender can mitigate this risk, but it remains a factor to consider.

Comparison of APRs for Different Loan Types

The following table provides a sample comparison of APRs for different loan types offered by CC Connect Total Loan Services. Note that these are illustrative examples and actual APRs may vary based on individual creditworthiness, loan amount, and term. Always check the current rates offered directly with CC Connect Total Loan Services.

| Loan Type | APR Range (%) | Loan Term (Months) | Example Monthly Payment (for $10,000 loan) |

|---|---|---|---|

| Personal Loan | 8-18 | 12-60 | $180 – $250 |

| Debt Consolidation Loan | 9-20 | 24-72 | $150 – $300 |

| Home Improvement Loan | 7-15 | 36-84 | $120 – $200 |

| Auto Loan | 6-14 | 24-72 | $150 – $250 |

Technological Aspects

CC Connect Total Loan Services leverages a robust and secure technological infrastructure to deliver a seamless and efficient loan experience. The platform is built on a scalable architecture designed to handle high volumes of transactions while maintaining optimal performance and availability. This ensures a responsive and reliable service for all users, regardless of the time of day or the volume of requests.

The platform utilizes a combination of cutting-edge technologies, including cloud computing, advanced encryption protocols, and sophisticated data analytics tools. This blend allows for efficient processing of loan applications, enhanced security measures, and data-driven insights to continuously improve the service and personalize the user experience.

Platform Technology

The core of the CC Connect Total Loan Services platform is built upon a microservices architecture hosted on a secure cloud infrastructure. This allows for independent scaling of individual components, ensuring optimal performance even during peak demand. The system employs a variety of programming languages and frameworks optimized for security, scalability, and maintainability. For example, the application layer might utilize Java or Python, while the database might be managed using a robust solution like PostgreSQL or MySQL. The use of containerization technologies, such as Docker and Kubernetes, further enhances the platform’s flexibility and deployment speed.

Data Security Measures

Protecting customer data is paramount. CC Connect Total Loan Services employs multiple layers of security to safeguard sensitive information. This includes robust encryption protocols, such as TLS/SSL, to protect data transmitted between the user’s device and the platform. Data at rest is encrypted using industry-standard encryption algorithms. Furthermore, the platform incorporates multi-factor authentication (MFA) to verify user identities, significantly reducing the risk of unauthorized access. Regular security audits and penetration testing are conducted to identify and address potential vulnerabilities proactively. Compliance with relevant data privacy regulations, such as GDPR and CCPA, is strictly adhered to.

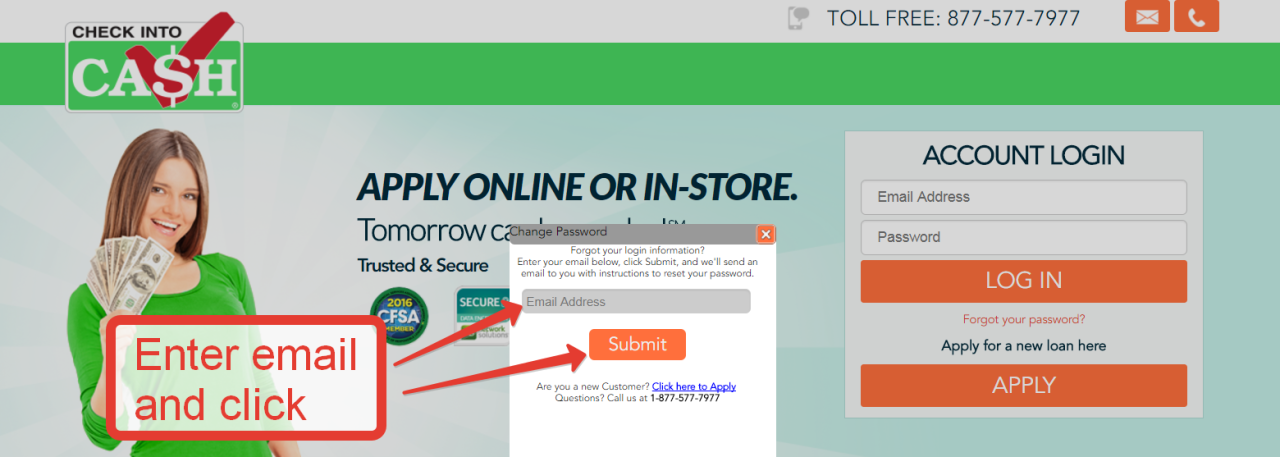

Loan Application and Management

The platform streamlines the entire loan application and management process. Users can apply for loans online, submitting all necessary documentation electronically. The system automatically validates the information provided, flags any inconsistencies, and guides users through the process. Real-time tracking of application status is available, allowing users to monitor the progress of their application at any time. Once approved, loan management features allow users to make payments, view statements, and access other relevant information securely through a dedicated portal. The platform also utilizes automated workflows to expedite the approval process, minimizing manual intervention and reducing processing times.

Accessibility Features

CC Connect Total Loan Services is designed to be accessible to all users, including those with disabilities. The platform adheres to WCAG (Web Content Accessibility Guidelines) standards, ensuring compatibility with assistive technologies such as screen readers and keyboard navigation. Features such as adjustable font sizes, high contrast modes, and alternative text for images are incorporated to enhance usability for users with visual impairments. Furthermore, the platform provides keyboard navigation for all interactive elements, catering to users with motor impairments. The platform’s design emphasizes intuitive navigation and clear labeling, making it user-friendly for all individuals.

Future of “CC Connect Total Loan Services”

CC Connect Total Loan Services stands at a pivotal point, poised for significant growth and evolution. The future hinges on adapting to technological advancements, evolving customer expectations, and expanding service offerings to maintain a competitive edge in the dynamic lending landscape. Strategic foresight and proactive implementation are key to realizing the full potential of this platform.

Expansion of Service Offerings

The current suite of services can be significantly expanded to encompass a wider range of financial needs. This could involve integrating services like budgeting tools, financial literacy resources, and personalized investment advice. Partnerships with insurance providers to offer bundled loan protection products could also increase revenue streams and customer loyalty. For example, partnering with a reputable insurance company to offer credit life insurance directly through the platform could provide a significant value-add for borrowers. Another area of expansion could be offering services tailored to specific demographics, such as specialized loan products for small businesses or green initiatives.

Enhancements to Customer Experience

Elevating the customer experience is paramount for long-term success. This involves streamlining the application process, making it more intuitive and user-friendly, reducing processing times, and offering personalized support through multiple channels. Proactive communication, regular updates, and easily accessible FAQs are vital. Implementing a robust customer relationship management (CRM) system will enable CC Connect to track customer interactions, personalize communications, and proactively address potential issues. Imagine a system that automatically sends personalized reminders about upcoming payments or offers tailored financial advice based on individual customer profiles. This level of personalization can dramatically improve customer satisfaction.

Impact of Technological Advancements

Technological advancements will play a crucial role in shaping the future of CC Connect. The integration of AI-powered chatbots for instant customer support, automated loan underwriting processes using machine learning algorithms, and the implementation of robust cybersecurity measures are essential. Blockchain technology could potentially enhance transparency and security in loan transactions. For example, utilizing AI to analyze borrower data can significantly improve the accuracy and speed of loan approvals, reducing processing time and improving efficiency. Similarly, implementing advanced fraud detection systems based on machine learning can minimize risk and protect the platform from fraudulent activities. These technological enhancements not only improve efficiency but also enhance the overall security and reliability of the service.