The 21st Century Mortgage Application Process

Securing a mortgage in the 21st century is a vastly different experience than it was even a few decades ago. The process, while still demanding, has been significantly streamlined and modernized thanks to advancements in technology and a greater emphasis on efficiency. This has resulted in a faster, more transparent, and often less stressful experience for borrowers. However, understanding the intricacies of the modern application process remains crucial for a successful outcome.

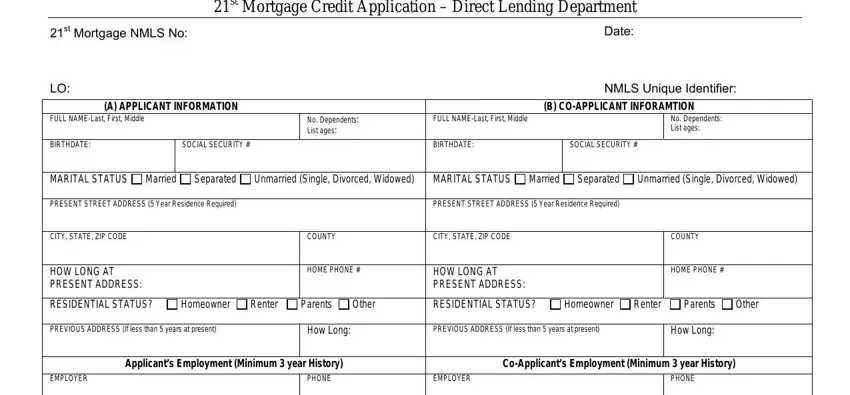

21st mortgage loan application – The typical 21st-century mortgage application involves several key steps. First, you’ll pre-qualify or pre-approve for a loan, which gives you a realistic understanding of how much you can borrow. This often involves providing basic financial information to a lender. Next comes the formal application, where you’ll submit a comprehensive set of documents. This includes details about your income, assets, debts, and the property you’re purchasing. The lender then underwrites your application, verifying the information you’ve provided and assessing your creditworthiness. If approved, you’ll proceed to closing, where the final paperwork is signed, and the funds are disbursed. Throughout this process, you’ll likely interact with loan officers, underwriters, and other professionals, often through online portals and digital communication channels.

A Comparison of Mortgage Application Processes Across Eras

The shift from traditional mortgage applications to modern digital processes is dramatic. The table below highlights the key differences:

| Application Method | Documentation Required | Processing Time | Technology Used |

|---|---|---|---|

| In-person application, paper forms | Extensive paper documentation, physical pay stubs, bank statements, tax returns. Often required multiple in-person visits to provide additional documentation. | Weeks to months; delays were frequent due to manual processing and physical mail delivery. | Limited; primarily manual processes, typewriters, and fax machines. |

| Online application, digital portals | Electronic submission of documents; digital verification of income, assets, and employment. Many documents can be uploaded directly. | Days to weeks; significantly faster due to automation and digital workflows. | Extensive use of online portals, automated underwriting systems, e-signatures, and secure data transmission. |

The Role of Technology in Streamlining the Mortgage Application Process

Technology has revolutionized the mortgage application process, offering numerous benefits. Automated underwriting systems, for instance, significantly speed up the approval process by quickly analyzing vast amounts of data. Online portals allow borrowers to track their application’s progress in real-time, fostering transparency and reducing anxiety. E-signatures eliminate the need for physical paperwork and expedite the closing process. Secure data transmission ensures the confidentiality and safety of sensitive financial information. Furthermore, the use of AI and machine learning is emerging to further improve accuracy and efficiency in risk assessment and fraud detection. For example, companies like Blend and Roostify are leveraging technology to create more efficient and user-friendly mortgage application experiences, reducing processing times and improving overall customer satisfaction. This has led to a more efficient and convenient experience for both borrowers and lenders.

Required Documentation for a 21st Century Mortgage Loan

Securing a mortgage in the 21st century requires a comprehensive application process, and a key component of this is providing the lender with a complete and accurate set of supporting documentation. Failing to provide the necessary paperwork can significantly delay—or even derail—your loan approval. This section Artikels the essential documents you’ll typically need to submit. Remember, specific requirements can vary slightly between lenders, so always confirm with your chosen institution.

The purpose of each document is to verify your financial stability, creditworthiness, and the value of the property you intend to purchase. Lenders use this information to assess risk and determine your eligibility for a loan. The more efficiently you provide this information, the smoother your application process will be.

Personal Identification

Providing proof of identity is a crucial first step. This ensures the lender is working with the correct individual and mitigates the risk of fraud. Typically, a government-issued photo ID, such as a driver’s license or passport, is sufficient. Some lenders may also request a Social Security card or other supporting identification documents.

Income Verification, 21st mortgage loan application

Lenders need to confirm your ability to repay the loan. This typically involves providing documentation that verifies your income and employment history. This might include pay stubs from the past two to three months, W-2 forms for the past two years, tax returns (for self-employed individuals, this is especially important), and a letter from your employer confirming your employment status, salary, and tenure. For those with multiple income streams, documentation for each source will be required.

Credit Report

Your credit report is a detailed summary of your credit history, reflecting your past borrowing and repayment behavior. Lenders will order a credit report to assess your creditworthiness and determine your credit score. A higher credit score generally indicates a lower risk to the lender, resulting in potentially more favorable loan terms.

Asset Documentation

Proof of assets demonstrates your financial capacity to manage the mortgage. This typically involves providing bank statements, investment account statements, and documentation for any other significant assets you possess. This allows the lender to verify the funds available for your down payment and closing costs. Providing at least two months of bank statements is generally recommended.

Property Information

Documentation related to the property you’re purchasing is essential. This typically includes the purchase agreement or contract, a property appraisal, and possibly homeowner’s insurance quotes. The appraisal helps determine the fair market value of the property, ensuring the loan amount doesn’t exceed the property’s worth. Homeowner’s insurance protects the lender’s investment in case of damage to the property.

Debt Information

A complete picture of your existing debts is necessary for the lender to accurately assess your debt-to-income ratio (DTI). This includes credit card statements, auto loan statements, student loan statements, and any other outstanding debts. Your DTI is a key factor in determining your eligibility for a mortgage. A lower DTI generally improves your chances of approval.

Online Mortgage Application Platforms and Their Features

The digital age has revolutionized the mortgage application process, offering convenience and efficiency previously unimaginable. Online platforms have become the primary avenue for many borrowers, streamlining the submission of applications and providing instant access to crucial information. Understanding the features and functionality of these platforms is critical for both borrowers and lenders alike. This section explores several popular platforms, comparing their key features, user experience, and security measures.

Comparison of Online Mortgage Application Platforms

Several online platforms facilitate the mortgage application process, each with its unique strengths and weaknesses. A direct comparison helps identify the best fit for individual needs and preferences. The following table highlights three popular platforms, focusing on key features, user experience, and security measures.

| Platform Name | Key Features | User Experience | Security Measures |

|---|---|---|---|

| Rocket Mortgage | Pre-qualification, personalized rate quotes, online document upload, digital closing, mobile app integration. Offers a streamlined, quick application process with instant feedback. | Generally considered user-friendly with a clean interface and intuitive navigation. However, some users report difficulties with certain features or a lack of personalized support. | Utilizes encryption and secure servers, adhering to industry best practices. Employs multi-factor authentication and robust fraud detection systems. |

| Better.com | Competitive rates, transparent pricing, online document management, personalized guidance from loan officers, fast closing times. Aims for a fast and efficient application. | Known for its streamlined and modern interface. However, the level of personalized support can vary, and some users have reported difficulties with communication. | Employs data encryption and secure servers, and adheres to industry security standards. However, past security breaches in other parts of the company highlight the ongoing need for vigilance. |

| LoanDepot | Wide range of loan products, online application, document upload, real-time application tracking, dedicated loan officer support. Focuses on a broad range of loan options. | The user interface is generally well-regarded, but the complexity of the various loan options might overwhelm some users. Access to dedicated support is a key differentiator. | Implements data encryption and secure servers, and utilizes multiple layers of security protocols. Regular security audits are conducted to ensure compliance with industry standards. |

Hypothetical Improved Online Mortgage Application Platform

An ideal online mortgage application platform would combine the best features of existing platforms while addressing common user pain points. This hypothetical platform, which we’ll call “MortgageFlow,” would focus on seamless integration, personalized guidance, and proactive communication.

Imagine a user interface with a clean, intuitive design, incorporating gamification elements to make the process less daunting. The platform would utilize artificial intelligence (AI) to pre-qualify applicants quickly and accurately, providing personalized rate quotes and loan options based on individual financial profiles. A built-in financial advisor chatbot would answer common questions, providing instant support and guidance. MortgageFlow would integrate seamlessly with various financial institutions, enabling automatic data retrieval and verification, significantly reducing the time and effort required for document upload and verification. The platform would also feature a robust security system with multi-factor authentication, real-time fraud detection, and end-to-end encryption to protect sensitive user data. Finally, proactive communication features would keep users informed of their application’s progress, providing regular updates and addressing any potential issues promptly. This system, based on the successful models of platforms like Rocket Mortgage and Better.com but addressing their shortcomings, aims to create a more efficient and user-friendly experience. For example, imagine a progress bar that dynamically updates as the user completes each step, providing a visual representation of their progress and fostering a sense of accomplishment. The AI-powered assistant could also proactively identify any missing documentation or inconsistencies in the application, alerting the user and providing guidance on how to rectify the issue. This would significantly reduce delays and frustrations.

Financial Data Analysis in 21st Century Mortgage Applications

The 21st-century mortgage application process relies heavily on sophisticated financial data analysis to assess risk and make informed lending decisions. Lenders leverage a combination of traditional credit scoring methods and advanced analytical techniques, incorporating vast datasets to paint a comprehensive picture of an applicant’s financial health and repayment capacity. This data-driven approach allows for faster processing, more accurate risk assessment, and ultimately, a more efficient and transparent lending process.

The analysis goes far beyond simply checking credit scores. Modern systems utilize algorithms and machine learning to identify patterns and correlations within applicant data that might not be apparent through traditional methods. This allows for a more nuanced understanding of an applicant’s financial situation, leading to more informed decisions and potentially opening up lending opportunities to individuals who might have been overlooked in the past.

Automated Creditworthiness Assessment

Algorithms and automated systems are integral to the modern mortgage application process. These systems analyze a wide range of data points, including credit history, income verification, debt-to-income ratio (DTI), and asset information. Sophisticated algorithms assess the probability of default based on historical data and predictive modeling. For example, a machine learning model might identify subtle correlations between seemingly unrelated data points, like the frequency of online banking transactions and the likelihood of timely mortgage payments. This enables lenders to make quicker, more accurate assessments of creditworthiness, streamlining the application process significantly. The use of automation reduces manual processing time, allowing lenders to handle a higher volume of applications more efficiently.

Data Analytics in Lending Decisions

Lenders use data analytics to make lending decisions in several key ways. One crucial application is in risk stratification. By analyzing vast datasets, lenders can segment applicants into different risk categories, allowing them to tailor loan terms and interest rates accordingly. For example, an applicant with a high credit score and stable income might qualify for a lower interest rate than an applicant with a lower credit score and fluctuating income. Another critical use of data analytics is in fraud detection. Algorithms can identify suspicious patterns and anomalies in application data, flagging potentially fraudulent applications for further review. This helps protect lenders from financial losses and ensures the integrity of the lending process. Finally, data analytics can be used to optimize lending strategies. By analyzing historical data on loan performance, lenders can identify trends and patterns that inform their lending policies and improve their overall risk management. For instance, a lender might adjust its underwriting criteria based on observed correlations between specific demographic factors and loan default rates.

Security and Privacy Concerns in Online Mortgage Applications

The digital age has revolutionized the mortgage application process, offering convenience and speed. However, this shift to online platforms introduces significant security and privacy risks for both lenders and applicants. Understanding these risks and implementing robust protective measures is crucial for a smooth and secure mortgage experience. The sensitive nature of the data involved – financial details, personal identification information, and property details – makes online mortgage applications a prime target for cybercriminals.

The potential for data breaches and identity theft is a major concern. Malicious actors could exploit vulnerabilities in online platforms to gain access to this sensitive information, potentially leading to financial losses and reputational damage for both the lender and the applicant. Furthermore, the ease of online application can also make it easier for fraudulent applications to be submitted.

Lender Security Measures

Lenders employ a multi-layered approach to protect applicant data. This typically involves robust encryption protocols to safeguard data transmitted between the applicant’s computer and the lender’s servers. Multi-factor authentication adds an extra layer of security, requiring applicants to verify their identity through multiple methods beyond just a password. Regular security audits and penetration testing help identify and address potential vulnerabilities in the system before they can be exploited. Furthermore, many lenders invest heavily in firewalls and intrusion detection systems to monitor network traffic and prevent unauthorized access. Data is often stored in encrypted databases, further protecting it from unauthorized access even if a breach occurs. Compliance with industry standards like PCI DSS (Payment Card Industry Data Security Standard) and other relevant regulations is paramount for demonstrating a commitment to data security.

Applicant Best Practices for Secure Online Mortgage Applications

It’s equally important for applicants to take proactive steps to protect their own information. Failing to do so can negate the security measures put in place by lenders.

Here’s a list of best practices:

- Use strong, unique passwords: Avoid easily guessable passwords and use a password manager to generate and securely store complex passwords for different accounts.

- Verify the website’s security: Look for “https” in the URL and a padlock icon in the browser’s address bar, indicating a secure connection.

- Be wary of phishing attempts: Don’t click on suspicious links or open attachments from unknown senders, as these may be attempts to steal your information.

- Use a secure network: Avoid applying for a mortgage loan on public Wi-Fi networks, as these are more vulnerable to attacks.

- Monitor your accounts: Regularly check your bank statements and credit reports for any unauthorized activity.

- Shred sensitive documents: After submitting your application, destroy any paper documents containing sensitive personal or financial information.

- Understand the lender’s privacy policy: Carefully review the lender’s privacy policy to understand how they collect, use, and protect your data.

The Impact of Fintech on the 21st Century Mortgage Application: 21st Mortgage Loan Application

The rise of fintech has dramatically reshaped the mortgage application process, moving it from a traditionally slow, paper-heavy system to a more streamlined, digital experience. This transformation is driven by innovative technologies and business models that are improving efficiency, transparency, and accessibility for both lenders and borrowers. The impact is profound, affecting every stage of the application, from initial pre-qualification to final loan closing.

Fintech companies are leveraging technology to automate many aspects of the mortgage process, significantly reducing processing times and administrative overhead. This automation isn’t just about speed; it’s about creating a more accurate and consistent experience, minimizing human error and improving overall customer satisfaction. The integration of various data sources and advanced analytical tools allows for faster underwriting decisions and a more efficient allocation of resources.

AI and Machine Learning in Mortgage Automation

Artificial intelligence and machine learning are playing increasingly crucial roles in automating various stages of the mortgage application process. AI-powered systems can analyze vast amounts of data – including credit scores, income verification documents, and property valuations – to assess risk more accurately and efficiently than traditional methods. Machine learning algorithms can identify patterns and anomalies in data, flagging potentially fraudulent applications or highlighting areas needing further scrutiny. For example, AI can automatically verify employment information by cross-referencing data from multiple sources, eliminating the need for manual verification. This automation not only speeds up the process but also reduces the risk of human error in data entry and interpretation. Furthermore, predictive modeling powered by machine learning can help lenders assess the likelihood of loan defaults, allowing for better risk management and more informed lending decisions. Companies like Blend and Roostify are prime examples of firms successfully deploying AI and machine learning in their mortgage platforms.

Advantages of Fintech Solutions for Mortgage Applications

The advantages of using fintech solutions for mortgage applications are numerous. Firstly, the process becomes significantly faster. Automated verification and streamlined workflows lead to quicker approvals and closings, saving borrowers valuable time and reducing stress. Secondly, transparency is enhanced. Online portals provide borrowers with real-time updates on the status of their application, promoting better communication and reducing uncertainty. Thirdly, accessibility improves. Fintech platforms often offer a more user-friendly experience, making the application process easier to navigate for borrowers who may not be technologically savvy. Finally, cost savings can be achieved. Automation reduces the need for manual labor, potentially lowering processing fees for both lenders and borrowers.

Disadvantages of Fintech Solutions for Mortgage Applications

While fintech offers many advantages, some disadvantages exist. One concern is the potential for bias in algorithms. If the data used to train AI models contains biases, the resulting decisions may perpetuate or even amplify those biases. Furthermore, reliance on technology can create vulnerabilities to cyberattacks and data breaches, compromising sensitive borrower information. Finally, the digital divide could exclude some borrowers who lack access to technology or the digital literacy required to navigate online platforms. This necessitates a careful consideration of equitable access and robust security measures to mitigate these potential drawbacks.

Illustrative Example of a 21st Century Mortgage Application Workflow

The 21st-century mortgage application process, while seemingly complex, is streamlined by technology and designed for efficiency. Understanding this workflow can significantly reduce stress and improve your chances of a successful loan application. This detailed breakdown will walk you through each stage, highlighting key players and critical considerations.

A typical 21st-century mortgage application unfolds in a series of interconnected steps, beginning with the initial inquiry and culminating in loan approval. The entire process leverages online platforms, automated systems, and digital communication, significantly reducing the time and paperwork involved in traditional methods.

Initial Inquiry and Pre-Approval

This stage involves the prospective borrower’s initial contact with a lender, either directly through their website or via a mortgage broker. The borrower provides basic information, such as desired loan amount, property type, and credit score range. The lender then performs a preliminary assessment of creditworthiness, offering a pre-approval letter contingent upon verification of the provided information. This letter strengthens the borrower’s negotiating position when making an offer on a property.

Formal Application and Document Submission

Once a property is identified, the borrower submits a formal application, typically online, providing comprehensive financial details, including income statements, tax returns, bank statements, and employment verification. The lender utilizes automated systems to verify this information, expediting the process.

Loan Underwriting and Appraisal

The lender’s underwriters meticulously review the borrower’s application and supporting documentation, assessing their creditworthiness and ability to repay the loan. Simultaneously, an independent appraiser evaluates the property’s market value to ensure it aligns with the loan amount. This stage is crucial for determining loan eligibility and terms.

Loan Closing and Funding

Upon successful underwriting and appraisal, the loan enters the closing phase. This involves reviewing and signing final loan documents, ensuring all conditions are met. After the closing process, the lender disburses the loan funds, completing the transaction. The borrower now officially owns the property, having successfully navigated the 21st-century mortgage application workflow.

Workflow Flowchart

Imagine a flowchart beginning with a box labeled “Initial Inquiry.” An arrow points to a box labeled “Pre-Approval,” which then branches to either “Property Found” or “Property Search Continues.” “Property Found” leads to “Formal Application & Document Submission,” which then splits into two parallel paths: “Loan Underwriting” and “Appraisal.” Both paths converge at “Loan Closing & Funding,” signifying the successful completion of the process. A “Loan Denied” box would branch off from both “Loan Underwriting” and “Appraisal,” illustrating potential points of failure in the process. The flowchart visually represents the sequential and conditional nature of the application.